“Consumption-led growth is a mirage.”

"Reforms by Modi Govt is just for rich".

It has been published in an article in a major "Express" news paper last week.

Do facts tell the same story? Read this thread till the end.

Under Modi Govt's GST reforms...

"Reforms by Modi Govt is just for rich".

It has been published in an article in a major "Express" news paper last week.

Do facts tell the same story? Read this thread till the end.

Under Modi Govt's GST reforms...

India has turned taxation from chaos into a unified system.

Compliance has risen, leakages plugged, and collections hit a record ₹2.1 lakh crore in April 2024.

Inflation has been managed, ensuring food and essentials remain affordable.

The poor are supported with free food for 80 crore people under PM Garib Kalyan Anna Yojana.

The middle class benefits from lower GST slabs on daily goods.

This is not a mirage—it’s smart policy converting every rupee spent into inclusive growth.

Compliance has risen, leakages plugged, and collections hit a record ₹2.1 lakh crore in April 2024.

Inflation has been managed, ensuring food and essentials remain affordable.

The poor are supported with free food for 80 crore people under PM Garib Kalyan Anna Yojana.

The middle class benefits from lower GST slabs on daily goods.

This is not a mirage—it’s smart policy converting every rupee spent into inclusive growth.

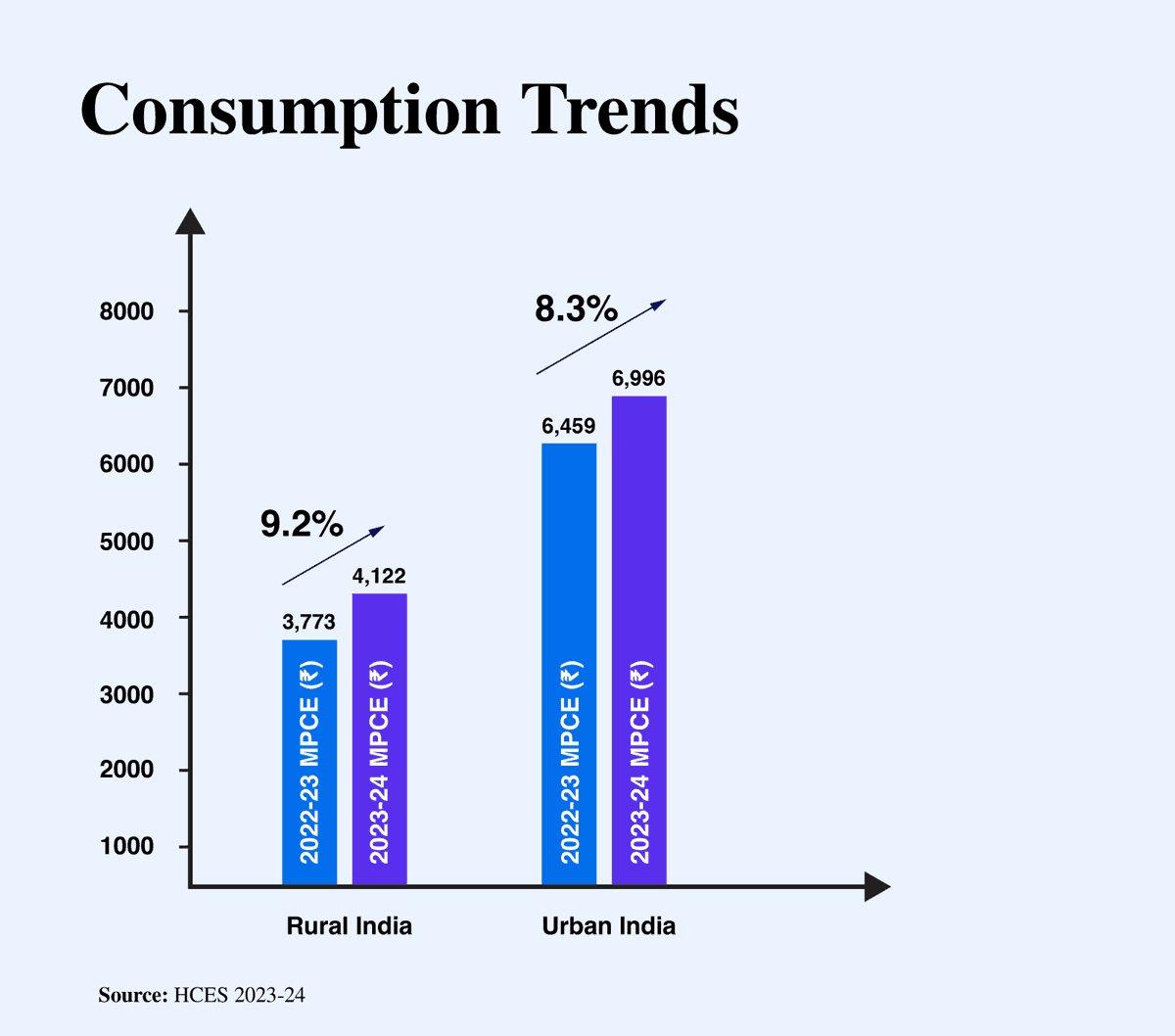

The article says consumption is unequal, but misses the larger truth: absolute consumption has risen for everyone.

HCES 2023-24 shows the bottom 5% in rural India consumes ~₹1,677/month, up nearly 3x from 20 years ago.

Rural electrification, LPG under Ujjwala, and free ration schemes mean households now spend less on survival and more on improving quality of life.

When poor families no longer worry about hunger, they can buy soap, clothes, or mobiles fueling new demand. Inequality is a challenge, but the growth of consumption across all income groups proves India’s story is genuine, not illusory.

HCES 2023-24 shows the bottom 5% in rural India consumes ~₹1,677/month, up nearly 3x from 20 years ago.

Rural electrification, LPG under Ujjwala, and free ration schemes mean households now spend less on survival and more on improving quality of life.

When poor families no longer worry about hunger, they can buy soap, clothes, or mobiles fueling new demand. Inequality is a challenge, but the growth of consumption across all income groups proves India’s story is genuine, not illusory.

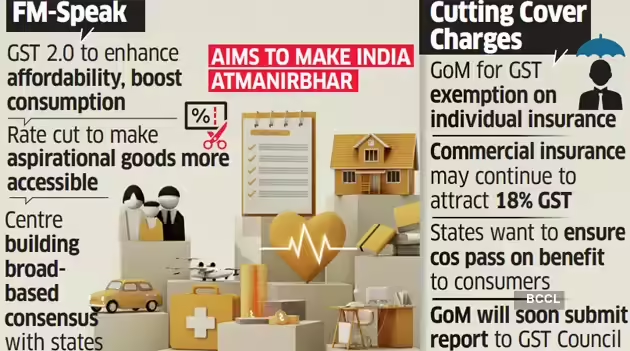

Critics say GST 2.0 helps only the rich. In reality, the poor benefit the most when essentials are taxed less or not at all.

Under Sitharaman's new reform, GST on food grains, milk, salt, handloom products, sanitary pads, footwear under ₹1,000, and basic utensils is zero or 5%.

That saves thousands of rupees annually for ordinary households. Middle-class families benefit from lower GST on appliances, mixers, and two-wheelers—items central to their daily lives.

By rationalising slabs, the government has reduced tax burden on essentials and aspirational goods. This is not just about the top 5%, it’s relief for the masses.

Under Sitharaman's new reform, GST on food grains, milk, salt, handloom products, sanitary pads, footwear under ₹1,000, and basic utensils is zero or 5%.

That saves thousands of rupees annually for ordinary households. Middle-class families benefit from lower GST on appliances, mixers, and two-wheelers—items central to their daily lives.

By rationalising slabs, the government has reduced tax burden on essentials and aspirational goods. This is not just about the top 5%, it’s relief for the masses.

The article argues “income is the constraint, not price.”

But the Modi government has tackled both sides: it raised incomes and reduced prices. PM-Kisan puts ₹6,000/year directly into the accounts of 11 crore farmers.

MGNREGA guarantees rural jobs.

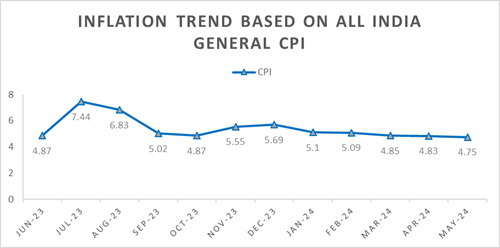

DBT reforms saved ₹2.7 lakh crore in leakages. At the same time, inflation is under control: CPI fell from 7.4% in 2022 to ~5% in 2024.

Lower inflation means every rupee buys more.

The combination of cash in hand and stable prices has boosted consumption capacity. Demand today is not weak—it’s stronger, broader, and more resilient than critics suggest.

But the Modi government has tackled both sides: it raised incomes and reduced prices. PM-Kisan puts ₹6,000/year directly into the accounts of 11 crore farmers.

MGNREGA guarantees rural jobs.

DBT reforms saved ₹2.7 lakh crore in leakages. At the same time, inflation is under control: CPI fell from 7.4% in 2022 to ~5% in 2024.

Lower inflation means every rupee buys more.

The combination of cash in hand and stable prices has boosted consumption capacity. Demand today is not weak—it’s stronger, broader, and more resilient than critics suggest.

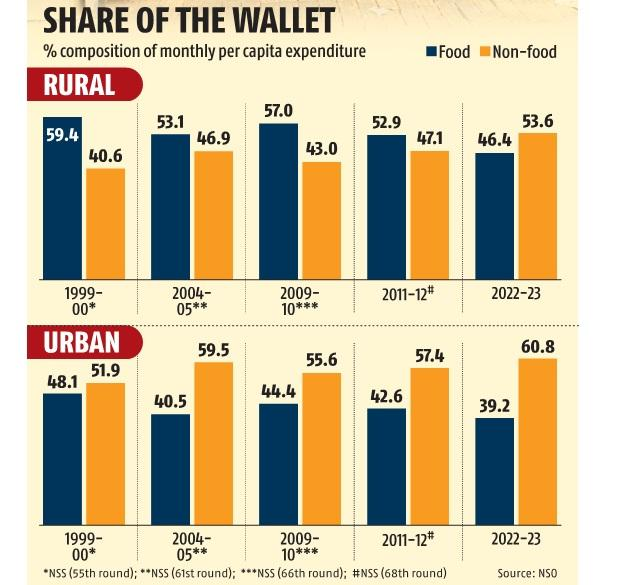

The Article claimed “the poor don’t benefit since essentials are already exempt.”

That misses the point keeping essentials tax-free is the benefit.

Imagine if GST applied heavily on food or fuel the poor would suffer the most.

By exempting basics and rationalising mid-range goods, GST ensures both survival and aspiration are affordable.

Data proves it: rural households now spend 53+% of their monthly budget on non-food items (vs 45% in 2011-12) & two-wheeler sales hit 1.75 crore units in FY24, up 9% YoY. This is inclusive growth, not elitist growth.

When aspirational consumption grows in villages ie TVs, phones, farm tools it proves India’s model is not exclusionary but inclusive, ensuring benefits reach well beyond the metro elite.

That misses the point keeping essentials tax-free is the benefit.

Imagine if GST applied heavily on food or fuel the poor would suffer the most.

By exempting basics and rationalising mid-range goods, GST ensures both survival and aspiration are affordable.

Data proves it: rural households now spend 53+% of their monthly budget on non-food items (vs 45% in 2011-12) & two-wheeler sales hit 1.75 crore units in FY24, up 9% YoY. This is inclusive growth, not elitist growth.

When aspirational consumption grows in villages ie TVs, phones, farm tools it proves India’s model is not exclusionary but inclusive, ensuring benefits reach well beyond the metro elite.

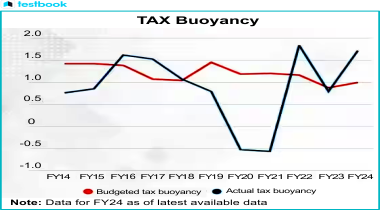

Another claim: GST cuts may cause revenue loss without boosting demand.

But tax buoyancy tells the opposite story.

GST cuts have been done previously as well but

tax collections have grown consistently, averaging ₹1.7 lakh crore/month in FY24.

The Laffer effect is real ie lower rates expanded the tax base, and compliance improved thanks to e-invoicing and UPI-linked systems. Small businesses, once in the shadow economy, are now contributing.

The fact that indirect tax revenues are rising faster than nominal GDP proves that lower GST has not hurt revenue but it has widened the pie.

Modi govt's balancing act ensures fiscal stability and growth simultaneously. That’s sound reform, not wishful thinking.

But tax buoyancy tells the opposite story.

GST cuts have been done previously as well but

tax collections have grown consistently, averaging ₹1.7 lakh crore/month in FY24.

The Laffer effect is real ie lower rates expanded the tax base, and compliance improved thanks to e-invoicing and UPI-linked systems. Small businesses, once in the shadow economy, are now contributing.

The fact that indirect tax revenues are rising faster than nominal GDP proves that lower GST has not hurt revenue but it has widened the pie.

Modi govt's balancing act ensures fiscal stability and growth simultaneously. That’s sound reform, not wishful thinking.

The article suggests India should focus only on rural wages & welfare, not GST reforms.

But the government already does both. PMAY has built 4 crore rural houses, Ayushman Bharat covers 50 crore people with health insurance, and MGNREGA provides jobs in villages.

These welfare schemes protect the poor. At the same time, record capital expenditure of ₹11.11 lakh crore in

FY25 is building highways, airports, and logistics parks, creating millions of jobs.

Employment in India is estimated to have increased by 4.67 crore (46.7 million) in the fiscal year 2023-24, reaching a total of 64.33 crore (643.3 million) individuals employed.

Jobs create income, income drives consumption. The dual push of welfare + growth ensures people don’t just survive they progress.

That’s sustainable, inclusive development.

But the government already does both. PMAY has built 4 crore rural houses, Ayushman Bharat covers 50 crore people with health insurance, and MGNREGA provides jobs in villages.

These welfare schemes protect the poor. At the same time, record capital expenditure of ₹11.11 lakh crore in

FY25 is building highways, airports, and logistics parks, creating millions of jobs.

Employment in India is estimated to have increased by 4.67 crore (46.7 million) in the fiscal year 2023-24, reaching a total of 64.33 crore (643.3 million) individuals employed.

Jobs create income, income drives consumption. The dual push of welfare + growth ensures people don’t just survive they progress.

That’s sustainable, inclusive development.

Another worry: companies won’t pass on GST cuts.

But Finance Ministry has proactively started working on it and it has started to enforce anti-profiteering rules under GST, ensuring lower taxes reach consumers.

State GST officers have been asked to submit report once GST 2.0 rolls out.

We saw this when detergents, biscuits, and FMCG items dropped MRPs after GST cuts last time.

Add cutthroat competition in e-commerce and retail, and no company can hoard the benefit for long. Inflation data confirms this core inflation fell below 4% in 2025 despite global commodity shocks.

That’s proof consumers see the benefits. The Modi govt’s mix of policy pressure + market competition ensures every GST cut translates into real savings in people’s pockets.

But Finance Ministry has proactively started working on it and it has started to enforce anti-profiteering rules under GST, ensuring lower taxes reach consumers.

State GST officers have been asked to submit report once GST 2.0 rolls out.

We saw this when detergents, biscuits, and FMCG items dropped MRPs after GST cuts last time.

Add cutthroat competition in e-commerce and retail, and no company can hoard the benefit for long. Inflation data confirms this core inflation fell below 4% in 2025 despite global commodity shocks.

That’s proof consumers see the benefits. The Modi govt’s mix of policy pressure + market competition ensures every GST cut translates into real savings in people’s pockets.

The article says a “consumption boom is wishful thinking.” Yet data tells another story.

Passenger vehicle sales hit 4.2 million in FY24, the highest ever.

Smartphone shipments crossed 152 million in 2023.

UPI transactions exploded to 13 billion in Aug 2024 from 2 billion in 2020.

E-commerce crossed $100 billion in 2023, projected to double by 2026.

These numbers show ordinary Indians from villages to metros are spending more, and digitally. This isn’t a mirage; it’s a consumption revolution.

Critics may theorise, but market realities prove Indian demand is real, strong, and globally unmatched.

Passenger vehicle sales hit 4.2 million in FY24, the highest ever.

Smartphone shipments crossed 152 million in 2023.

UPI transactions exploded to 13 billion in Aug 2024 from 2 billion in 2020.

E-commerce crossed $100 billion in 2023, projected to double by 2026.

These numbers show ordinary Indians from villages to metros are spending more, and digitally. This isn’t a mirage; it’s a consumption revolution.

Critics may theorise, but market realities prove Indian demand is real, strong, and globally unmatched.

Bottom line:

The Indian Express article calls India’s consumption story a “mirage.” But numbers, policies, and lived reality say otherwise. Consumption is 60%+ of GDP, rising across income groups, powered by GST rationalisation, welfare transfers, digital inclusion, and record capex.

FM Nirmala Sitharaman has crafted a balanced model: protect the poor with subsidies, empower the middle class with lower taxes, and fuel investment with capex.

This synergy makes India the world’s fastest-growing major economy. Far from a mirage, India’s growth story is a beacon of resilience and reform. 🇮🇳 #IndiaGrowthStory

The Indian Express article calls India’s consumption story a “mirage.” But numbers, policies, and lived reality say otherwise. Consumption is 60%+ of GDP, rising across income groups, powered by GST rationalisation, welfare transfers, digital inclusion, and record capex.

FM Nirmala Sitharaman has crafted a balanced model: protect the poor with subsidies, empower the middle class with lower taxes, and fuel investment with capex.

This synergy makes India the world’s fastest-growing major economy. Far from a mirage, India’s growth story is a beacon of resilience and reform. 🇮🇳 #IndiaGrowthStory

• • •

Missing some Tweet in this thread? You can try to

force a refresh