Europe is the Goldmine?

Europe looks like a nightmare for investors: dozens of countries, languages, and laws.

That mess is a moat

Thread on CVC’s report

Europe looks like a nightmare for investors: dozens of countries, languages, and laws.

That mess is a moat

Thread on CVC’s report

Fragmentation = Opportunity.

Europe’s fragmentation keeps deals bilateral, local, and less competitive.

That means:

•More proprietary deals

•Lower entry multiples

The market is massive.

•$20T+ GDP

•500M+ consumers

•12,000+ companies with >$300M turnover

The 2nd largest buyout market globally, but still underpenetrated by international players.

Europe’s fragmentation keeps deals bilateral, local, and less competitive.

That means:

•More proprietary deals

•Lower entry multiples

The market is massive.

•$20T+ GDP

•500M+ consumers

•12,000+ companies with >$300M turnover

The 2nd largest buyout market globally, but still underpenetrated by international players.

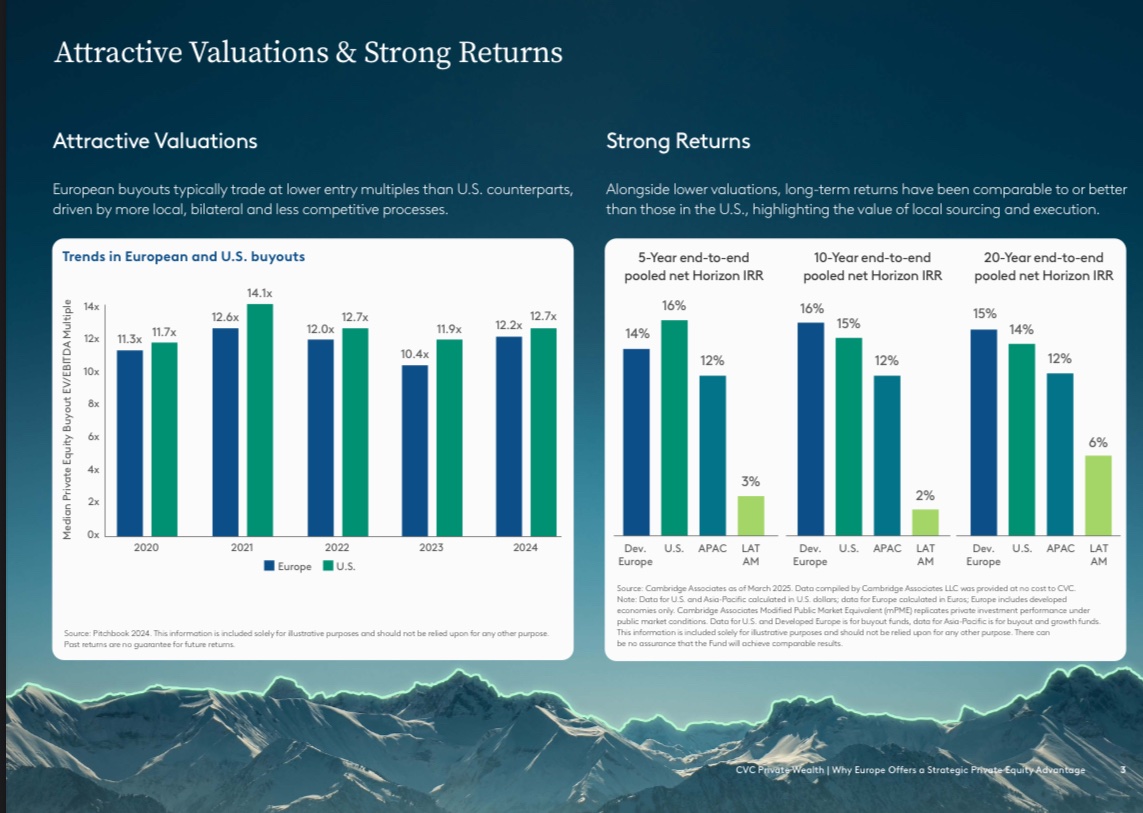

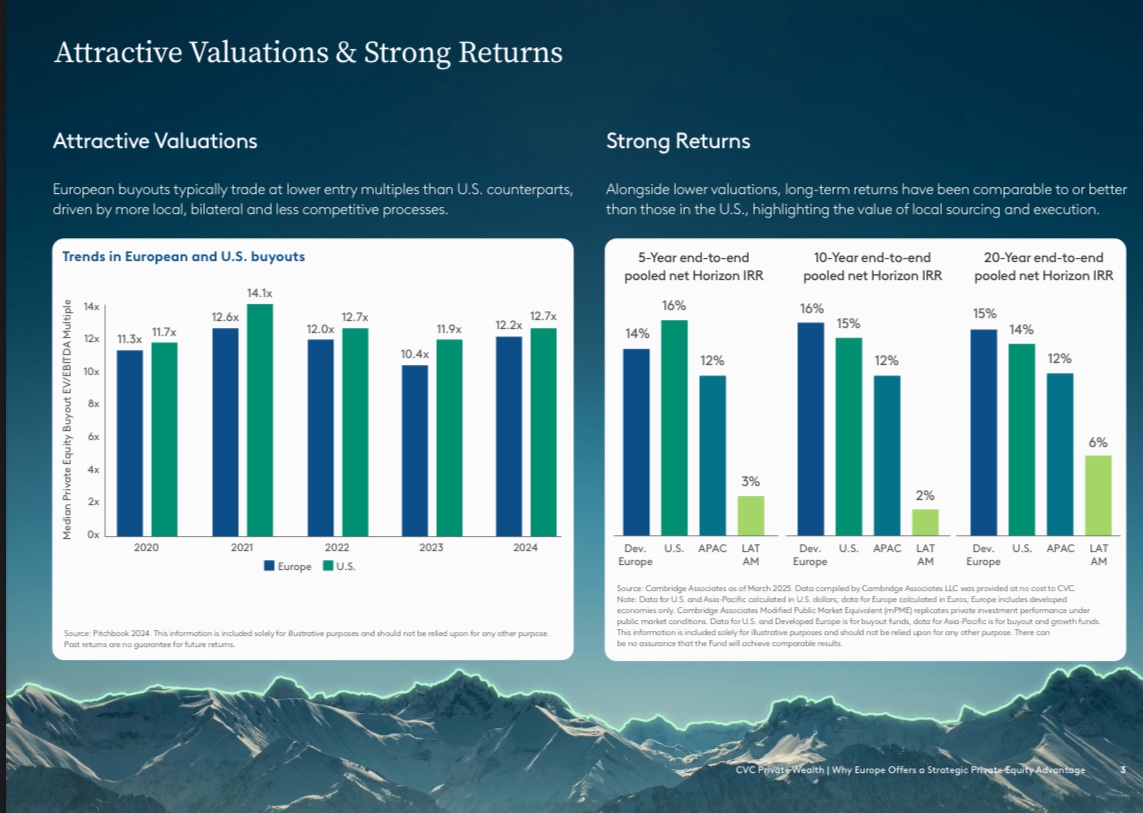

Valuations are cheaper.

Median Buyout EV/EBITDA multiples:

U.S. (2024): 12.7x

Europe (2024): 12.2x

Over time, European deals consistently price lower,

Median Buyout EV/EBITDA multiples:

U.S. (2024): 12.7x

Europe (2024): 12.2x

Over time, European deals consistently price lower,

Returns hold up.

Despite cheaper entry points, European buyout returns are comparable to or better than the U.S. over 5, 10, and 20 years.

Fragmentation creates inefficiencies → inefficiencies create alpha

Despite cheaper entry points, European buyout returns are comparable to or better than the U.S. over 5, 10, and 20 years.

Fragmentation creates inefficiencies → inefficiencies create alpha

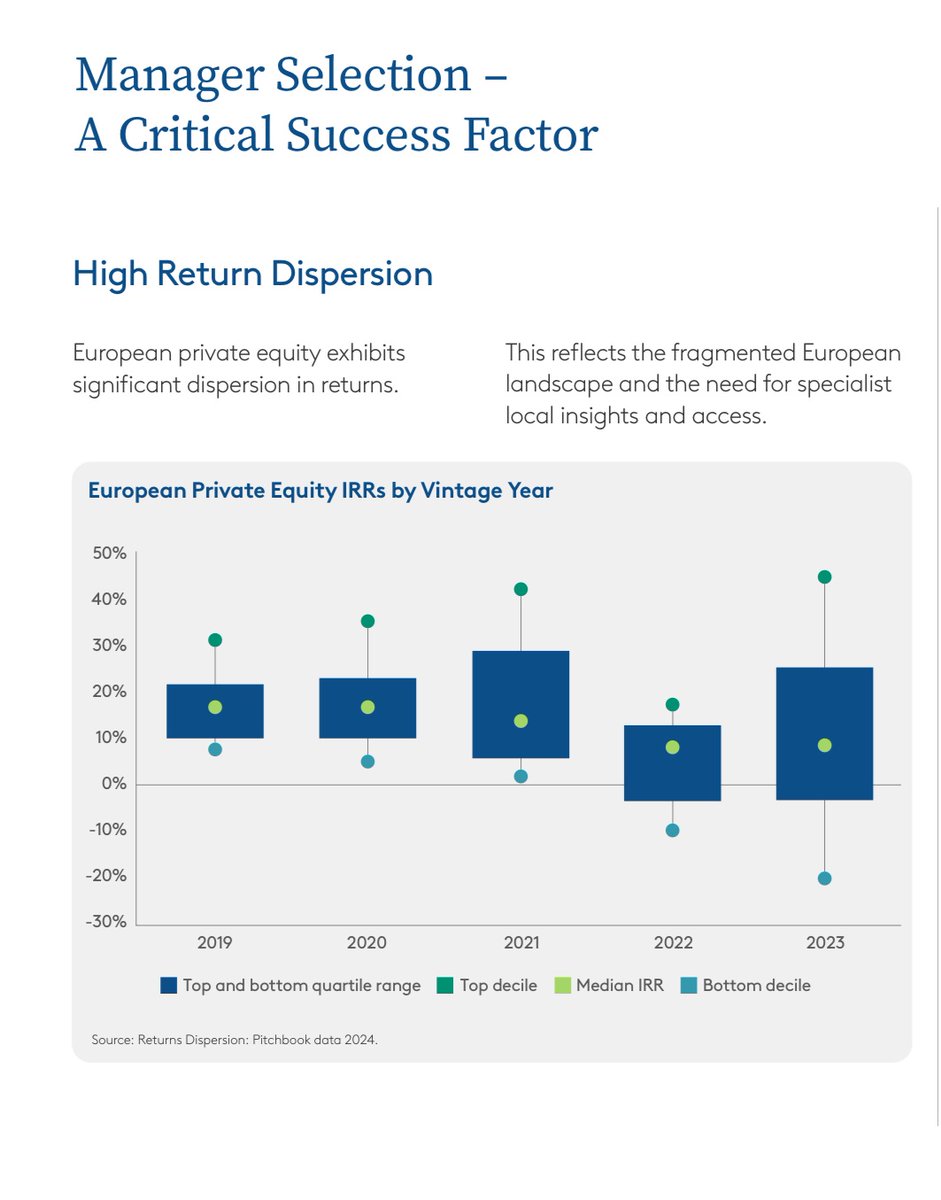

But not everyone wins.

Europe has huge return dispersion.

The difference between top and bottom quartile managers is wide.

Picking the right manager is everything.

Europe has huge return dispersion.

The difference between top and bottom quartile managers is wide.

Picking the right manager is everything.

What separates winners from losers?

Top-performing European PE funds share 3 traits:

Strong local networks → proprietary deal flow

Rigorous investment discipline → no style drift

Operational firepower → post-deal value creation

Top-performing European PE funds share 3 traits:

Strong local networks → proprietary deal flow

Rigorous investment discipline → no style drift

Operational firepower → post-deal value creation

The takeaway:

Europe is messy by design.

But for investors with local expertise, that complexity becomes a competitive edge.

Cheaper deals

Europe is messy by design.

But for investors with local expertise, that complexity becomes a competitive edge.

Cheaper deals

• • •

Missing some Tweet in this thread? You can try to

force a refresh