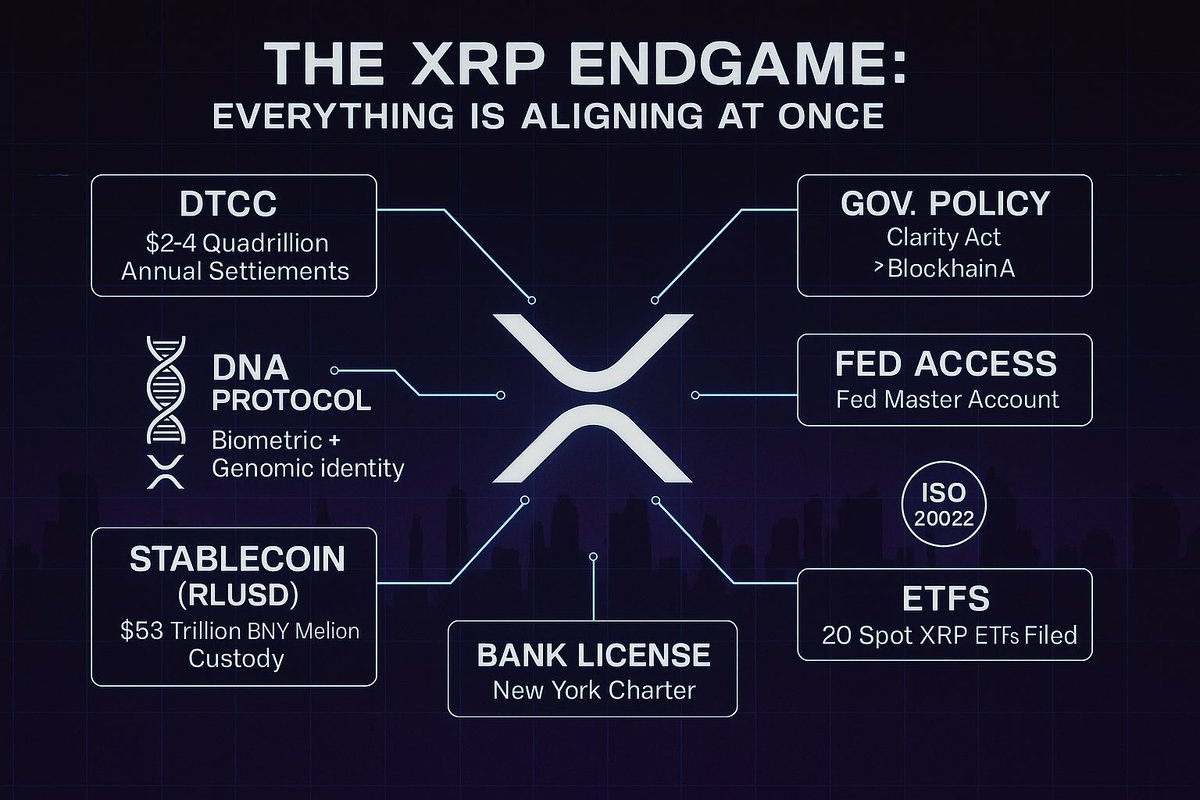

🚨 The XRP Endgame: Everything Is Aligning at Once

What I’m about to lay out isn’t hype, it’s a map of tectonic shifts converging around Ripple & $XRP.

If you don’t see the magnitude after this thread, you’re not paying attention. 🧵👇

What I’m about to lay out isn’t hype, it’s a map of tectonic shifts converging around Ripple & $XRP.

If you don’t see the magnitude after this thread, you’re not paying attention. 🧵👇

1/ 🏛️ DTCC Patent

The world’s largest settlement utility ($2-4 QUADRILLION annual settlements) explicitly references XRP in its liquidity tokenization design. That’s not a typo. Quadrillions. Ripple’s rails are the blueprint.

The world’s largest settlement utility ($2-4 QUADRILLION annual settlements) explicitly references XRP in its liquidity tokenization design. That’s not a typo. Quadrillions. Ripple’s rails are the blueprint.

2/ ⚖️ Legal Clarity

After a 5-year war with the SEC, Ripple didn’t just win, it gave XRP the strongest legal clarity of any crypto in the U.S.. While others drown in lawsuits, XRP stands as the only institutional-safe bet.

After a 5-year war with the SEC, Ripple didn’t just win, it gave XRP the strongest legal clarity of any crypto in the U.S.. While others drown in lawsuits, XRP stands as the only institutional-safe bet.

3/ 💵 Stablecoin (RLUSD)

Ripple’s enterprise-grade stablecoin RLUSD launched with reserves held at BNY Mellon, custodian of $53 TRILLION in assets. That’s the same custodian used by BlackRock and the U.S. Treasury. XRP rails just got a stable reserve army.

Ripple’s enterprise-grade stablecoin RLUSD launched with reserves held at BNY Mellon, custodian of $53 TRILLION in assets. That’s the same custodian used by BlackRock and the U.S. Treasury. XRP rails just got a stable reserve army.

4/ 🏦 Banking License

Ripple applied for a New York banking charter, the hardest license on earth to get. Only the most serious players even attempt this. Combine this with their existing MSB + EMI licenses, and you have a global bank in stealth mode.

Ripple applied for a New York banking charter, the hardest license on earth to get. Only the most serious players even attempt this. Combine this with their existing MSB + EMI licenses, and you have a global bank in stealth mode.

5/ 🏛️ Federal Reserve Access

Ripple has applied for a Fed Master Account, direct access to the U.S. settlement system. That’s the highest banking privilege in the country. If approved, XRP isn’t competing with banks… it becomes the bank.

Ripple has applied for a Fed Master Account, direct access to the U.S. settlement system. That’s the highest banking privilege in the country. If approved, XRP isn’t competing with banks… it becomes the bank.

6/ 📈 ETFs Incoming

Nearly 20 Spot XRP ETFs are filed. Approval would open the floodgates to trillions in institutional capital. XRP would go from “undervalued altcoin” to a Wall Street-grade asset class overnight.

Nearly 20 Spot XRP ETFs are filed. Approval would open the floodgates to trillions in institutional capital. XRP would go from “undervalued altcoin” to a Wall Street-grade asset class overnight.

7/ 🌍 ISO 20022 Migration

By this November, every major bank in the world must comply with ISO 20022. XRP has been compliant for years. When the switch flips, legacy rails and RippleNet rails will speak the same language.

By this November, every major bank in the world must comply with ISO 20022. XRP has been compliant for years. When the switch flips, legacy rails and RippleNet rails will speak the same language.

8/ 🇺🇸 Pro-Crypto Policy

A pro-crypto administration is in power. The Clarity Act, Genius Act, Blockchain Act, all moving forward. For the first time in U.S. history, the regulators are aligning with Ripple’s playbook.

A pro-crypto administration is in power. The Clarity Act, Genius Act, Blockchain Act, all moving forward. For the first time in U.S. history, the regulators are aligning with Ripple’s playbook.

9/ 🧬 Hidden Layer – DNA Protocol (@DNAOnChain)

While this unfolds, DNA Protocol is anchoring biometric + genomic identity on the XRPL. This solves KYC at the molecular level, making XRP the only ledger positioned for finance + identity fusion in the digital age. ()xdna.dnaprotocol.org

While this unfolds, DNA Protocol is anchoring biometric + genomic identity on the XRPL. This solves KYC at the molecular level, making XRP the only ledger positioned for finance + identity fusion in the digital age. ()xdna.dnaprotocol.org

10/ ⚔️ The Convergence

Legal clarity. Banking license. Stablecoin. ETFs. ISO. Fed Access. DTCC. Pro-Crypto policy. DNA Protocol.

👉 Follow me on Telegram for the drops I can’t post here.t.me/alexanderthewh…

Legal clarity. Banking license. Stablecoin. ETFs. ISO. Fed Access. DTCC. Pro-Crypto policy. DNA Protocol.

👉 Follow me on Telegram for the drops I can’t post here.t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh