$JD just published a case study with the UC Berkeley and HKU researchers in the INFORMS Journal on Applied Analytics.

This case study shows how $JD is using AI + optimization to squeeze real cash out of its supply chain.

Breaking it down on this thread: 🧵

TLDR: Bullish

This case study shows how $JD is using AI + optimization to squeeze real cash out of its supply chain.

Breaking it down on this thread: 🧵

TLDR: Bullish

1) $JD runs a two tier network:

RDCs aka Regional Distribution Centers: giant hubs with all SKUs.

FDCs aka Front Distribution Centers: smaller, closer to customers.

Their goal is to fulfill as many orders locally at FDCs as possible, with faster delivery, lower costs and happier customers.

RDCs aka Regional Distribution Centers: giant hubs with all SKUs.

FDCs aka Front Distribution Centers: smaller, closer to customers.

Their goal is to fulfill as many orders locally at FDCs as possible, with faster delivery, lower costs and happier customers.

2) The problem though? FDCs are small..

Which SKUs do you stock?

How much inventory do you ship daily from RDC to FDC?

This is a massive optimization problem with millions of SKUs, volatile demand, and strict space and capacity limits.

Which SKUs do you stock?

How much inventory do you ship daily from RDC to FDC?

This is a massive optimization problem with millions of SKUs, volatile demand, and strict space and capacity limits.

3) To solve the assortment challenge, $JD developed three algorithms:

1. The first is ML-Top-K, which uses machine learning forecasts to stock the most demanded items.

2. The second is Reverse-Exclude, which removes low-frequency products iteratively.

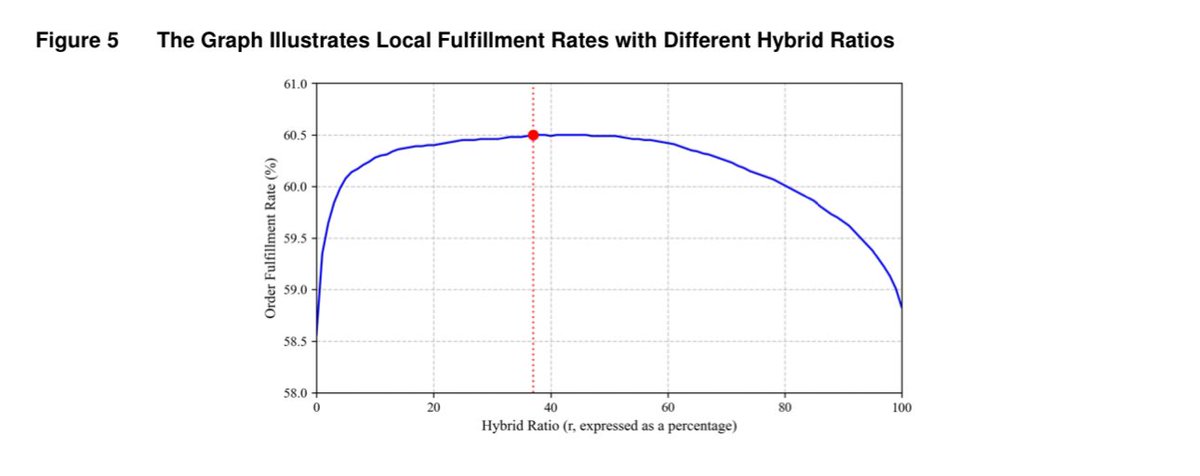

3. The third is a Hybrid approach that blends the two. The Hybrid method performed best, raising local fulfillment rates by about 2.2%. That sounds small, but in $JDs scale it translates into hundreds of thousands of additional orders filled locally.

1. The first is ML-Top-K, which uses machine learning forecasts to stock the most demanded items.

2. The second is Reverse-Exclude, which removes low-frequency products iteratively.

3. The third is a Hybrid approach that blends the two. The Hybrid method performed best, raising local fulfillment rates by about 2.2%. That sounds small, but in $JDs scale it translates into hundreds of thousands of additional orders filled locally.

4) For inventory allocation now:

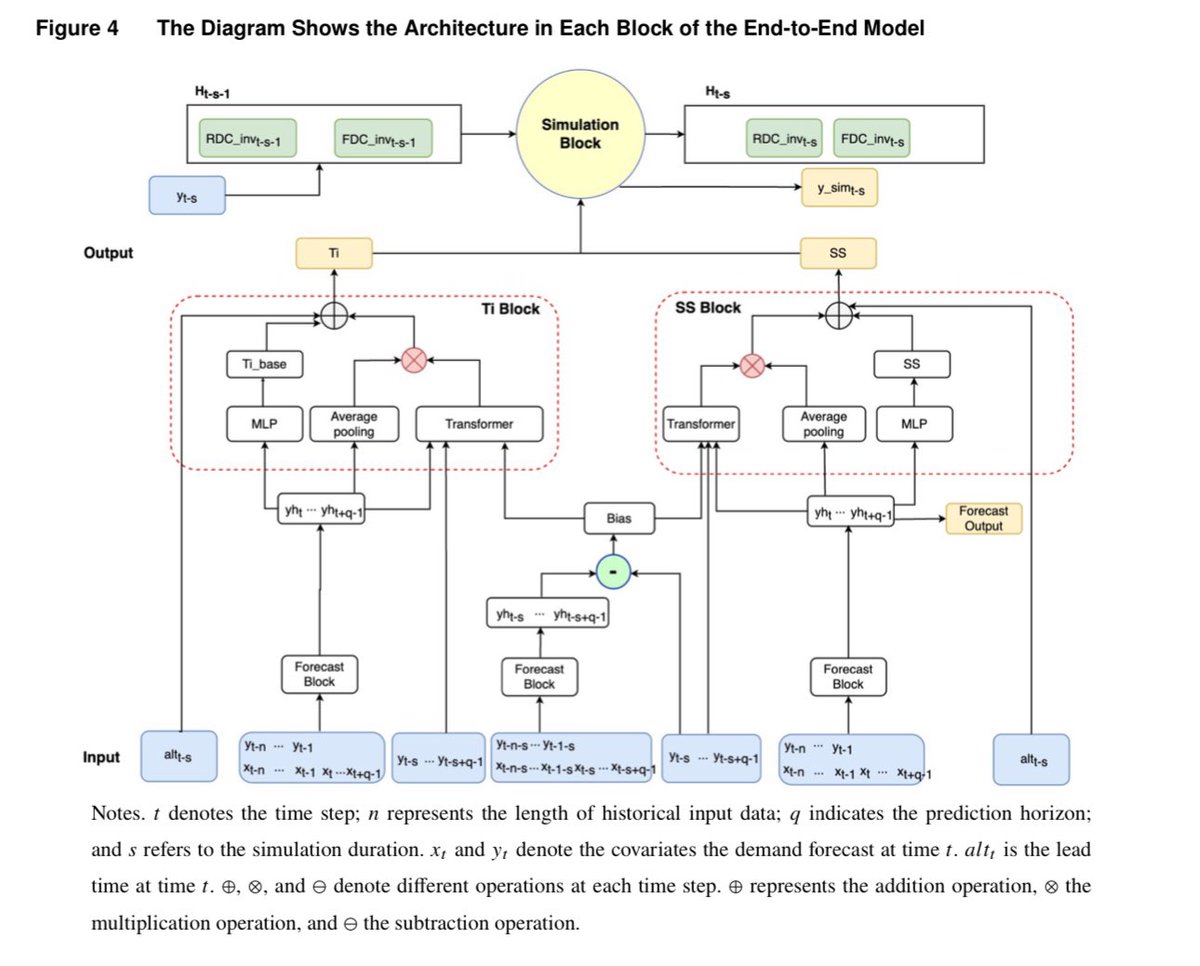

$JD built a new end-to-end AI model using recurrent neural networks. This model forecasts demand, sets safety stock and target inventory levels, and then runs simulations to adapt the allocation in real time.

Compared with previous methods, it increased fulfillment from FDCs by about 1.05 percentage points.

$JD built a new end-to-end AI model using recurrent neural networks. This model forecasts demand, sets safety stock and target inventory levels, and then runs simulations to adapt the allocation in real time.

Compared with previous methods, it increased fulfillment from FDCs by about 1.05 percentage points.

5) The most important thing now:

These improvements are not just theoretical. They delivered real financial results. $JD reduced holding costs by around $6.1 million annually and cut transfer costs by about $22.3 million.

Stock availability improved by almost 1%, and roughly 18.6 million orders per year are now fulfilled more efficiently. JD’s “211” program, which guarantees same day or next day delivery, saw 1.44% more orders delivered within the promise window.

These improvements are not just theoretical. They delivered real financial results. $JD reduced holding costs by around $6.1 million annually and cut transfer costs by about $22.3 million.

Stock availability improved by almost 1%, and roughly 18.6 million orders per year are now fulfilled more efficiently. JD’s “211” program, which guarantees same day or next day delivery, saw 1.44% more orders delivered within the promise window.

6) For the $JD investors, this is important because it shows $JD is creating operating leverage through technology.

Even small percentage improvements, when applied across JD’s vast network, generate tens of millions of dollars in annual savings.

This strengthens JD’s moat against competitors like $BABA and $PDD, who do not operate the same level of vertically integrated logistics.

Even small percentage improvements, when applied across JD’s vast network, generate tens of millions of dollars in annual savings.

This strengthens JD’s moat against competitors like $BABA and $PDD, who do not operate the same level of vertically integrated logistics.

7) The bottom line is pretty much clear as $JD is rapidly growing revenue and improving its margins and cash flow by making its supply chain smarter.

This research shows $JD executing on efficiency rather than relying only on price competition. And for the long term investors, that matters a lot.

With $JD having cut $28.5M in annual costs & having driven boosted fulfillment up with their AI driven logistics, seems like the stock market hasn’t yet priced JD correctly.

Recommendation: Long ✍🏻

This research shows $JD executing on efficiency rather than relying only on price competition. And for the long term investors, that matters a lot.

With $JD having cut $28.5M in annual costs & having driven boosted fulfillment up with their AI driven logistics, seems like the stock market hasn’t yet priced JD correctly.

Recommendation: Long ✍🏻

• • •

Missing some Tweet in this thread? You can try to

force a refresh