How to get URL link on X (Twitter) App

1) $JD runs a two tier network:

1) $JD runs a two tier network:

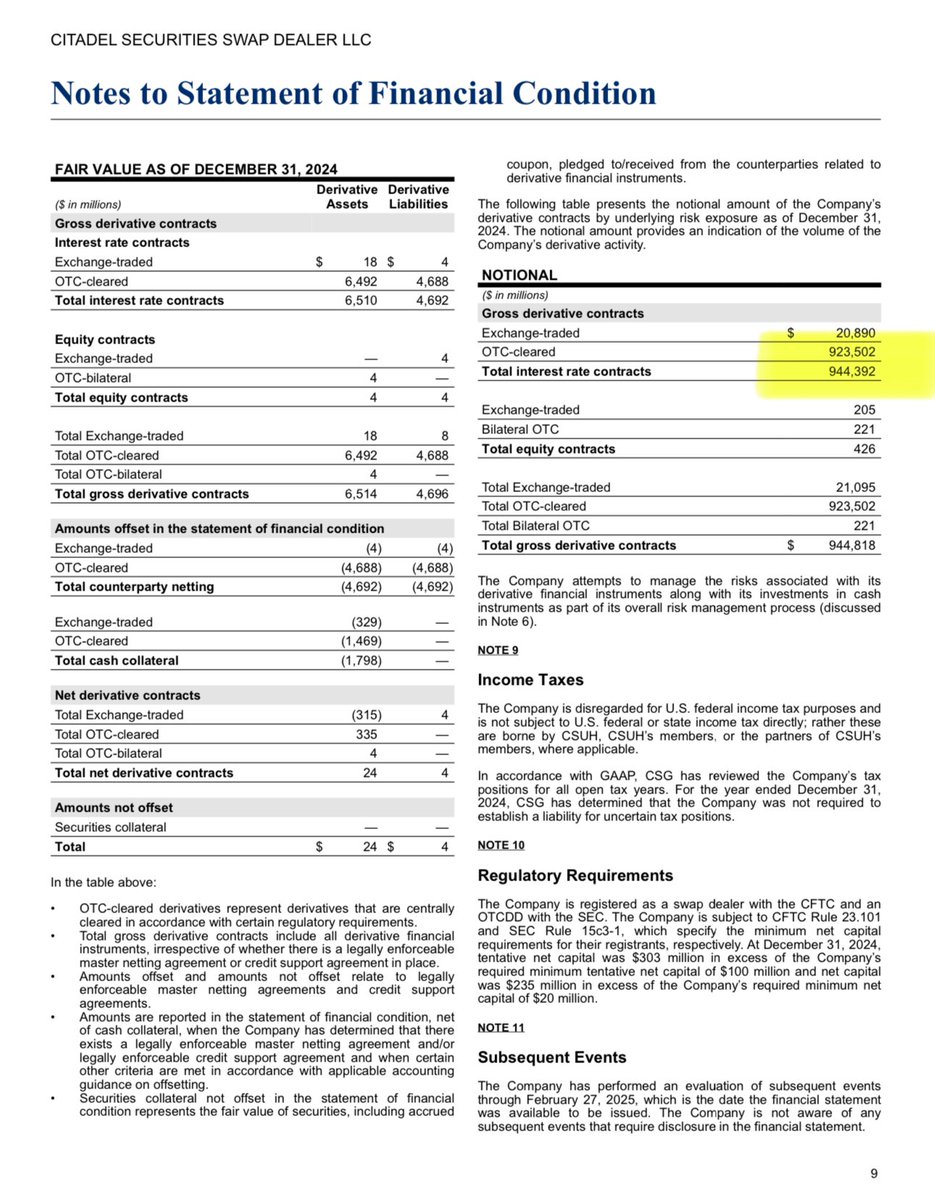

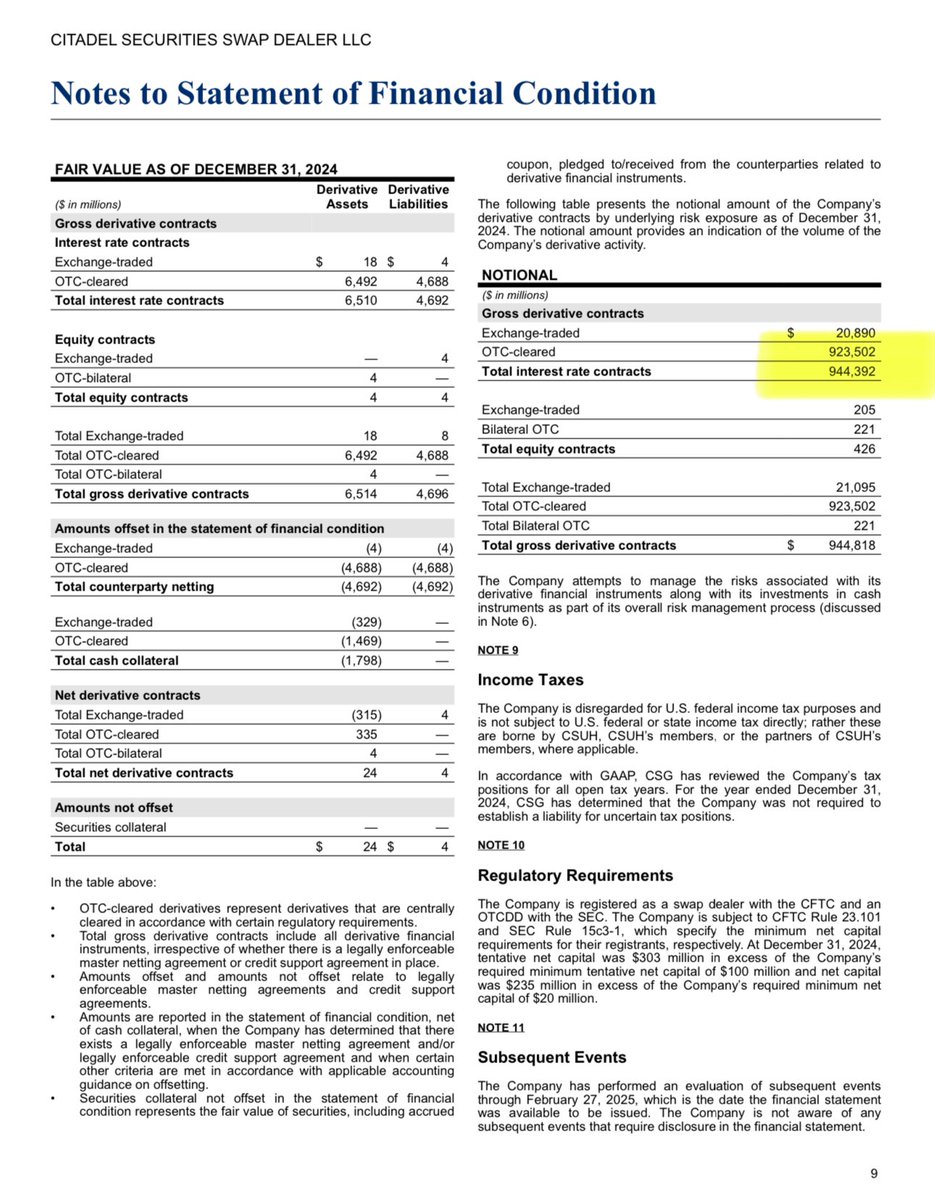

1: First of all, what’s Notional Value?

1: First of all, what’s Notional Value?

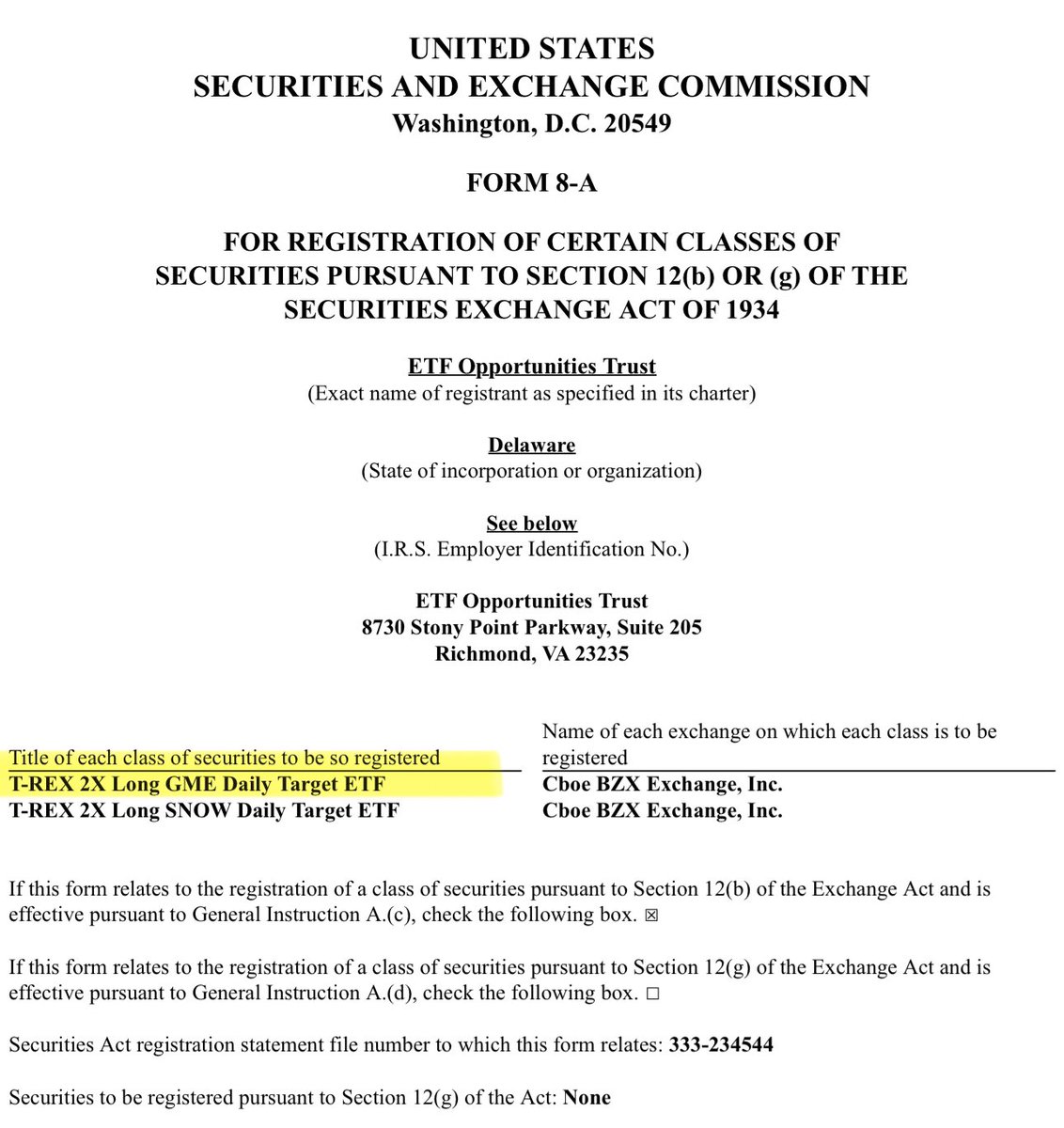

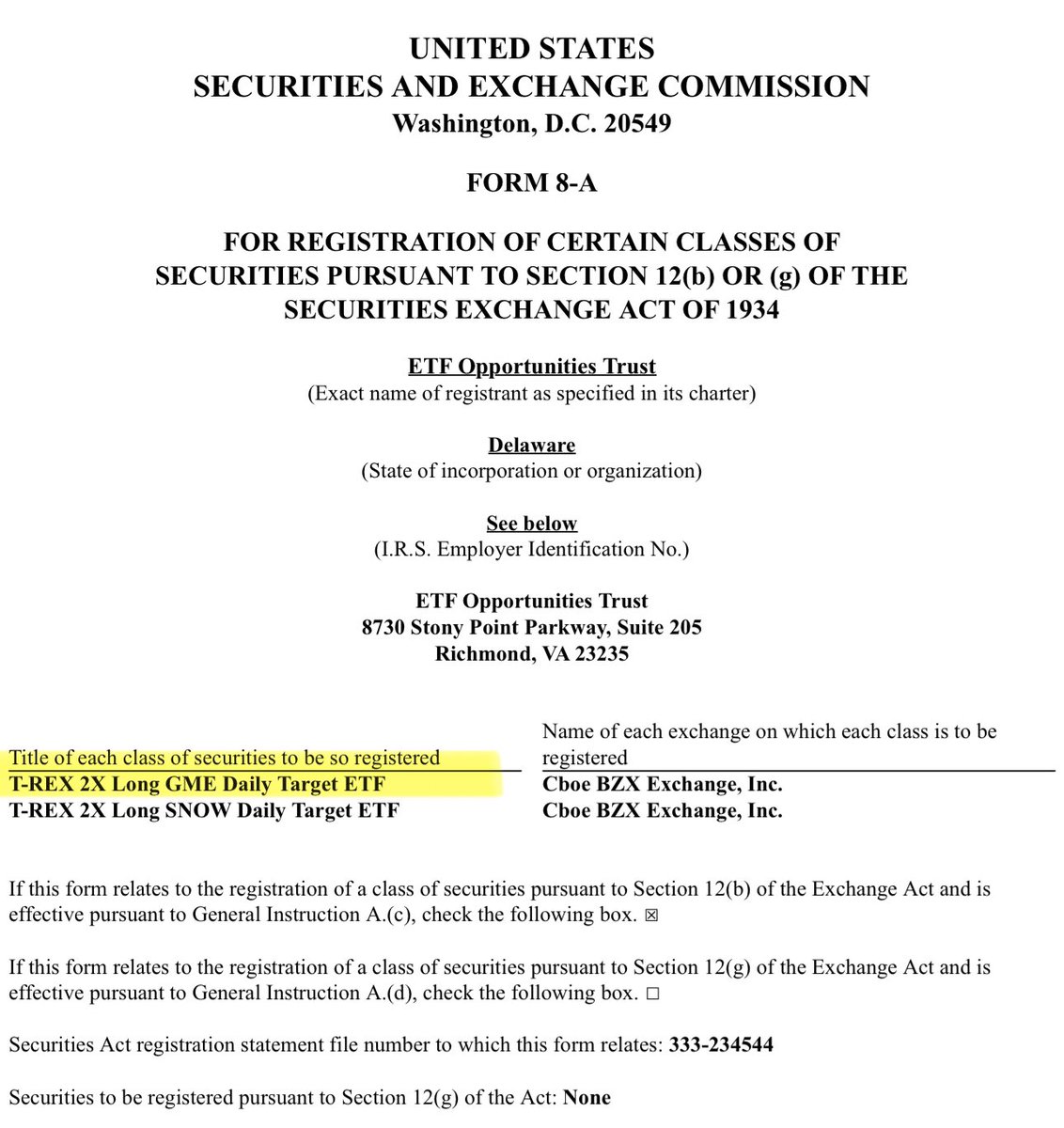

1. This ETF aims to deliver 2x the daily return of the GameStop stock $GME.

1. This ETF aims to deliver 2x the daily return of the GameStop stock $GME.

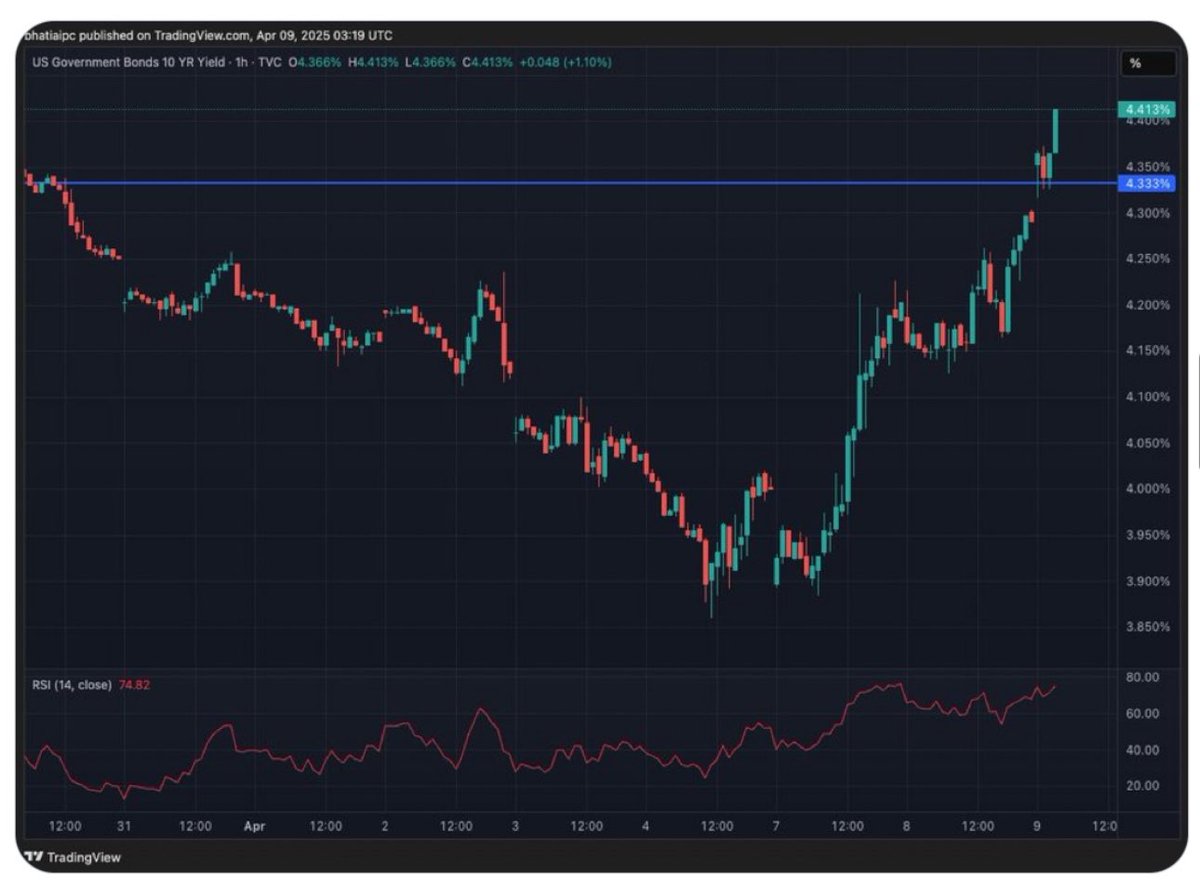

1. Bond Yields are spiking..

1. Bond Yields are spiking..

1. Only a liquidity event or a massive systemic drawdown would trigger real forced margin calls.

1. Only a liquidity event or a massive systemic drawdown would trigger real forced margin calls.

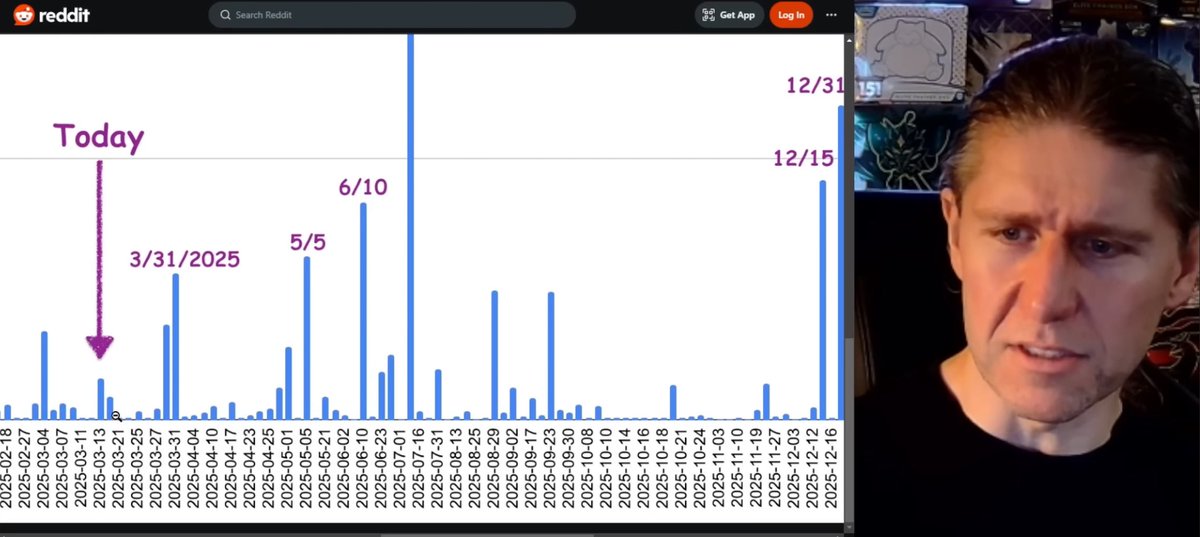

1. Let’s start unpacking what could be one of the most significant moments in $GME history:

1. Let’s start unpacking what could be one of the most significant moments in $GME history:

Michael Dell owned shares of Dell Technologies through MSD Capital, his private investment firm.

Michael Dell owned shares of Dell Technologies through MSD Capital, his private investment firm.

1) Max pain at $23 reflects the price where most call and put options would expire worthless, minimizing payouts for option sellers.

1) Max pain at $23 reflects the price where most call and put options would expire worthless, minimizing payouts for option sellers.

1) AI-Powered Robotaxis:

1) AI-Powered Robotaxis:

1) What’s QS’s Revolutionary Technology? :

1) What’s QS’s Revolutionary Technology? :