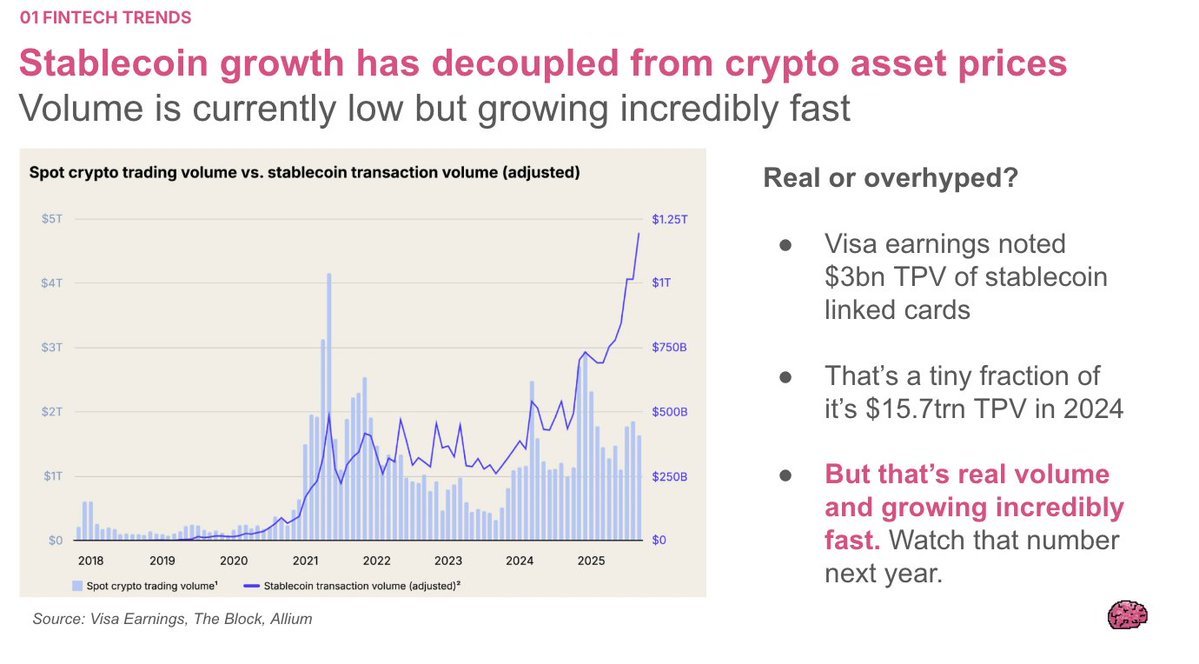

Visa Stablecoin settlement up 4x to $1bn run rate since the year started.

Great growth rate. How far can it go?

Visa 2024 settled $15.7trn

So there's a long way to go before stables are more than a rounding error.

If it grows at this rate for 5 years it would hit a trillion.

Great growth rate. How far can it go?

Visa 2024 settled $15.7trn

So there's a long way to go before stables are more than a rounding error.

If it grows at this rate for 5 years it would hit a trillion.

https://twitter.com/TheOneandOmsy/status/1968096693255106904

• • •

Missing some Tweet in this thread? You can try to

force a refresh