🧵The Prices Are Too Damn High:

Trump's Tariffs are Hitting Americans Hard

Donald Trump loved to promise that other people would pay for his schemes. Mexico would pay for the wall. China would pay for the tariffs. Cute. Here’s the correction: other people don’t pay. You do.

Trump's Tariffs are Hitting Americans Hard

Donald Trump loved to promise that other people would pay for his schemes. Mexico would pay for the wall. China would pay for the tariffs. Cute. Here’s the correction: other people don’t pay. You do.

Your kid. Your neighbor who works nights. The person at the hamburger joint sliding fries across the counter. Tariffs are a stealth sales tax — invisible, regressive, and perfectly designed to hurt people who can’t afford it.

This is Tax Scam 2.0. He calls it “tough on trade.” You call it “where did my paycheck go?”

This is Tax Scam 2.0. He calls it “tough on trade.” You call it “where did my paycheck go?”

How the Con Works (No Econ Class Required)

A retailer imports a $100 pair of work boots. The administration slaps a 20% tariff on them. The importer now owes $20. Who pays? Not the factory overseas. Not the CEO of the importing firm. You do — the price on the shelf goes up. That $100 pair becomes $120. Then your state charges sales tax on that $120. You just paid a tax on a tax. Congratulations. You’re in the art of the deal.

A retailer imports a $100 pair of work boots. The administration slaps a 20% tariff on them. The importer now owes $20. Who pays? Not the factory overseas. Not the CEO of the importing firm. You do — the price on the shelf goes up. That $100 pair becomes $120. Then your state charges sales tax on that $120. You just paid a tax on a tax. Congratulations. You’re in the art of the deal.

Tariffs don’t just hit things labeled “imported.” They hit supply chains: screws, bolts, steel for equipment, the fabric for jeans, the oil used to fry fries. When the inputs get more expensive, everything downstream becomes more expensive. It’s sneaky. It’s stupid. And it’s working exactly how the people selling the idea want it to.

September Reality: Kitchen-Table Examples

This is not some theory for policy nerds. This is what people are seeing in their carts and paychecks.

Lunch got pricier: Tariffs on inputs like cooking oil, packaging, and beef push up the price of a burger and fries. That $8 lunch now stings more because restaurants either raise prices or cut staff. Fewer workers, smaller portions, more salt — something’s gotta give.

This is not some theory for policy nerds. This is what people are seeing in their carts and paychecks.

Lunch got pricier: Tariffs on inputs like cooking oil, packaging, and beef push up the price of a burger and fries. That $8 lunch now stings more because restaurants either raise prices or cut staff. Fewer workers, smaller portions, more salt — something’s gotta give.

Diapers and formula: These aren’t luxuries. Tariffs on inputs and on finished baby goods make diapers and formula more expensive. That’s not a talking point; it’s a credit-card bill at the end of the month for parents who can’t afford round two.

Work boots and jeans: Stuff blue-collar people actually need to keep working — clothing, boots, gloves — costs more when tariffs raise the price of imported fabric and finished goods. A man who fixes roofs doesn’t care about Swiss watch tariffs; he cares that his boots don’t fall apart.

Work boots and jeans: Stuff blue-collar people actually need to keep working — clothing, boots, gloves — costs more when tariffs raise the price of imported fabric and finished goods. A man who fixes roofs doesn’t care about Swiss watch tariffs; he cares that his boots don’t fall apart.

Hardware and home basics: Tariffs on steel, lumber components, or imported tools drive up the price of nails, drills, hammers — the stuff you buy at the hardware store to fix the leaky roof yourself. Suddenly the DIY job becomes “pay the contractor or go hungry.”

Small shops getting crushed: Local shops that import an outsized share of their inventory burn through savings to keep prices stable — until they can’t. That’s when they either close or raise prices and lose customers. Both outcomes are bad.

Those are the things people actually worry about: dinner, diapers, boots, fixing the house.

Small shops getting crushed: Local shops that import an outsized share of their inventory burn through savings to keep prices stable — until they can’t. That’s when they either close or raise prices and lose customers. Both outcomes are bad.

Those are the things people actually worry about: dinner, diapers, boots, fixing the house.

Why This Is Worse Than a Regular Sales Tax

It’s invisible — you don’t see “tariff” on the receipt. You just see “new price.” That makes political outrage harder to marshal.

It’s regressive — poorer households spend a larger share of income on goods, so an across-the-board price increase eats them up first. A millionaire sees a $50 price hike on a jacket and keeps streaming; a single parent chooses between formula and electricity.

It’s invisible — you don’t see “tariff” on the receipt. You just see “new price.” That makes political outrage harder to marshal.

It’s regressive — poorer households spend a larger share of income on goods, so an across-the-board price increase eats them up first. A millionaire sees a $50 price hike on a jacket and keeps streaming; a single parent chooses between formula and electricity.

It’s taxed twice — state sales taxes are percentage-based. So when your diaper pack becomes 15% more expensive, the state taxes that inflated price. You just paid tax on the tax.

It hits jobs and hours — small restaurants and shops either pass along costs or cut labor. Both reduce worker income and spike local hardship. The policy’s “protecting jobs” talking point rings hollow if the people who actually work in the protected industries are laid off because their supply chain costs ballooned.

It hits jobs and hours — small restaurants and shops either pass along costs or cut labor. Both reduce worker income and spike local hardship. The policy’s “protecting jobs” talking point rings hollow if the people who actually work in the protected industries are laid off because their supply chain costs ballooned.

Trump’s Gaslighting, Simplified

“The Chinese will pay,” Trump insists. Same line he used about other fantasy payers. It’s performative. The receipts don’t lie. When companies publicly say they’re raising prices because of tariffs, when a neighborhood kid’s soccer cleats cost two grocery trips, when a diner shrinks its portions — that’s the truth.

You don’t need econ modeling to hate this. You need a grocery list and a paycheck.

“The Chinese will pay,” Trump insists. Same line he used about other fantasy payers. It’s performative. The receipts don’t lie. When companies publicly say they’re raising prices because of tariffs, when a neighborhood kid’s soccer cleats cost two grocery trips, when a diner shrinks its portions — that’s the truth.

You don’t need econ modeling to hate this. You need a grocery list and a paycheck.

The Political Angle (and the One-Liner That Slaps)

Here’s the simple swing: once people understand who’s actually paying, this policy loses. It’s political kryptonite — but only if you tell the story right.

One-liners to use on ads, social posts, or rallies:

Trump promised to lower prices day 1. Instead he raised them with his crazy tariffs.

He said China would pay for the tariffs but its you paying them on everything you buy.

Trump calls his tariff scheme ‘winning.’ We call that theft.”

Here’s the simple swing: once people understand who’s actually paying, this policy loses. It’s political kryptonite — but only if you tell the story right.

One-liners to use on ads, social posts, or rallies:

Trump promised to lower prices day 1. Instead he raised them with his crazy tariffs.

He said China would pay for the tariffs but its you paying them on everything you buy.

Trump calls his tariff scheme ‘winning.’ We call that theft.”

Make the enemy visceral. Don’t talk about “macro effects.” Talk about the mom choosing between formula and rent. Talk about the guy who has to choose work boots or gas for the truck. That’s how you win hearts and votes.

How to Beat the Scam (Tactical Stuff)

Name it: Call tariffs what they are—a hidden sales tax. Repeat it.

Show receipts: Use before/after prices for a handful of household staples — diapers, a burger, a pair of work boots, a pack of screws. Real numbers, real pain.

Humanize: One quote from a parent, a restaurant worker, a small-store owner hits harder than a paragraph of modeling.

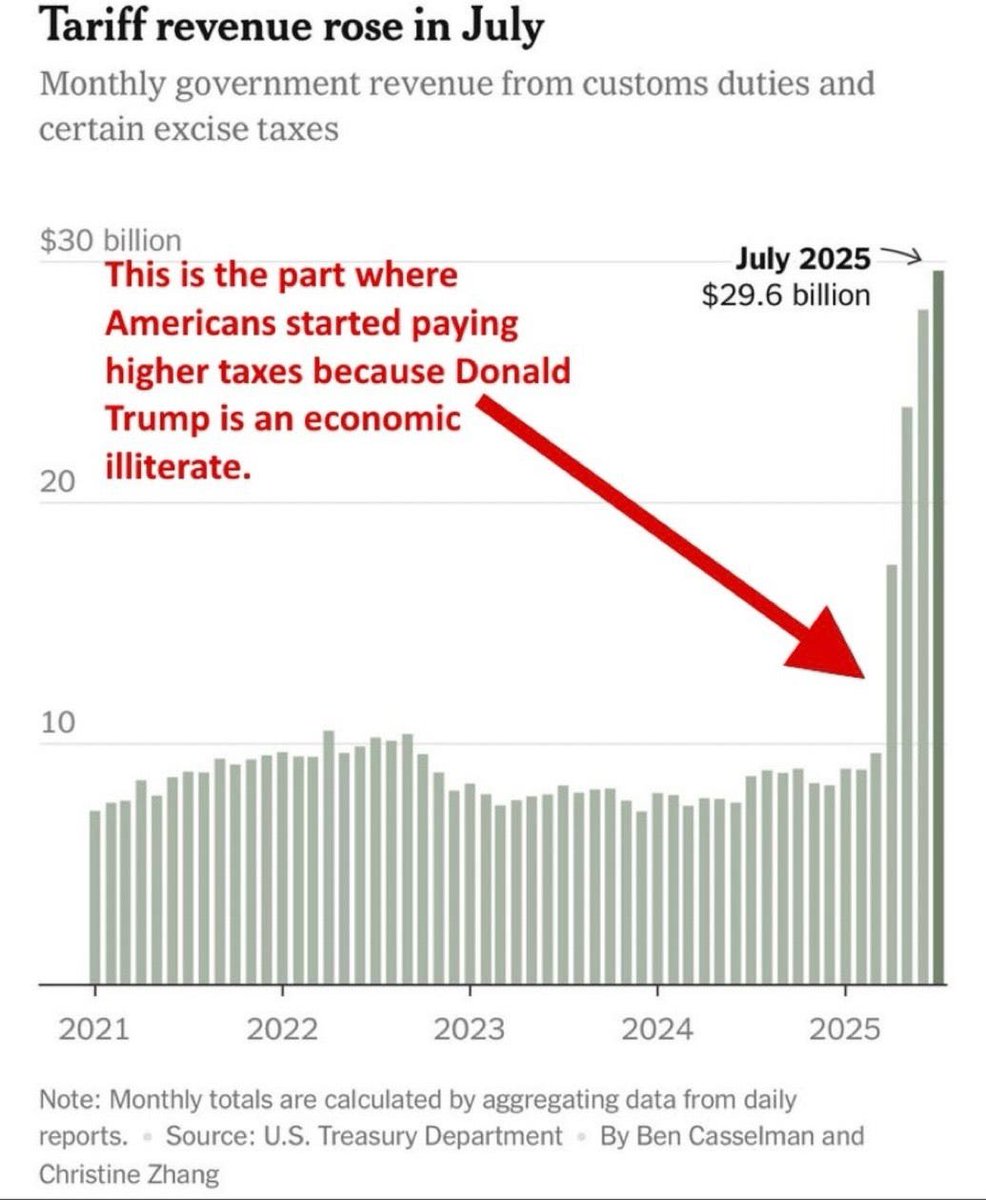

Flip the script: If Trump brags about “tariff revenue,” reply: “That’s your money. He’s bragging about stealing from your groceries.”

Name it: Call tariffs what they are—a hidden sales tax. Repeat it.

Show receipts: Use before/after prices for a handful of household staples — diapers, a burger, a pair of work boots, a pack of screws. Real numbers, real pain.

Humanize: One quote from a parent, a restaurant worker, a small-store owner hits harder than a paragraph of modeling.

Flip the script: If Trump brags about “tariff revenue,” reply: “That’s your money. He’s bragging about stealing from your groceries.”

Closing — Short and Mean

Trump’s tariffs are the perfect grift: it looks like toughness, acts like patriotism, and works like a tax on poor people. He sells you the drama of a trade war and punches your household budget. If you want to see who paid for the wall, look at your receipts. If you want to see who’s paying for the tariffs, look at your groceries.

Trump’s tariffs are the perfect grift: it looks like toughness, acts like patriotism, and works like a tax on poor people. He sells you the drama of a trade war and punches your household budget. If you want to see who paid for the wall, look at your receipts. If you want to see who’s paying for the tariffs, look at your groceries.

Did you learn something from this 🧵? RT and share it!

Sub to The Cycle 👇 Even free subscribers get most of the content bc I'm terrible at capitalism.

thecycle.substack.com/p/the-prices-a…

Sub to The Cycle 👇 Even free subscribers get most of the content bc I'm terrible at capitalism.

thecycle.substack.com/p/the-prices-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh