1/

The Fed cut rates by 25 bps yesterday. But the bond market hit back. Instead of falling, yields spiked in a bear steepening move:

30Y 4.73% (+4.3 bps), 10Y 4.12% (+3.3 bps), 2Y 3.58% (+0.6 bps).

👉 The long end doesn’t buy it.

The Fed cut rates by 25 bps yesterday. But the bond market hit back. Instead of falling, yields spiked in a bear steepening move:

30Y 4.73% (+4.3 bps), 10Y 4.12% (+3.3 bps), 2Y 3.58% (+0.6 bps).

👉 The long end doesn’t buy it.

2/

Why?

– A cut with sticky inflation = risk of higher long-term inflation.

– Massive Treasury issuance = more supply, lower bond prices, higher yields.

– Investors demanding a bigger term premium for holding long debt.

Why?

– A cut with sticky inflation = risk of higher long-term inflation.

– Massive Treasury issuance = more supply, lower bond prices, higher yields.

– Investors demanding a bigger term premium for holding long debt.

3/

The key: long maturities jumped more than short. That’s the market’s way of saying:

“Fed, you’re easing too soon. We want more yield for lending over 10–30 years.”

The key: long maturities jumped more than short. That’s the market’s way of saying:

“Fed, you’re easing too soon. We want more yield for lending over 10–30 years.”

4/

Consequences:

– Mortgages & long-term corporate loans face pressure.

– Banks with HTM portfolios = more unrealized losses.

– U.S. budget: higher interest costs, deficits worse.

Consequences:

– Mortgages & long-term corporate loans face pressure.

– Banks with HTM portfolios = more unrealized losses.

– U.S. budget: higher interest costs, deficits worse.

5/

Market impact:

– Growth equities (sensitive to discount rates) = valuations at risk.

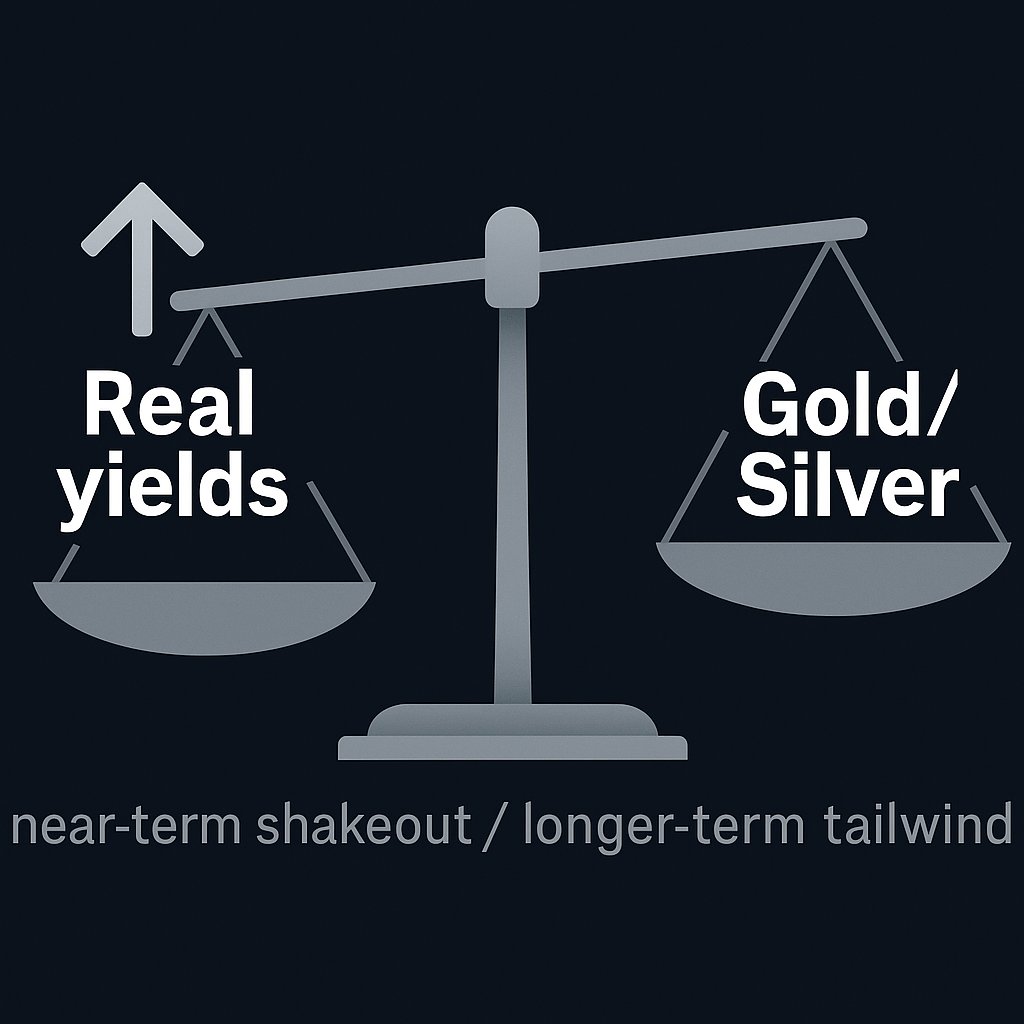

– Gold & silver: near-term FOMC shakeouts are typical, but loss of policy credibility = long-term tailwind.

Market impact:

– Growth equities (sensitive to discount rates) = valuations at risk.

– Gold & silver: near-term FOMC shakeouts are typical, but loss of policy credibility = long-term tailwind.

6/

What to watch:

– Treasury auctions (bid-to-cover).

– Breakevens & real yields.

– 2s10s spread: less inverted → cycle shift warning.

– Credit spreads (IG/HY).

– DXY vs. commodities.

What to watch:

– Treasury auctions (bid-to-cover).

– Breakevens & real yields.

– 2s10s spread: less inverted → cycle shift warning.

– Credit spreads (IG/HY).

– DXY vs. commodities.

7/

Bottom line:

The Fed wanted to ease, but the long end said NO. When policy rates drop but long yields rise, that’s not a pivot — it’s a loss of trust.

Bottom line:

The Fed wanted to ease, but the long end said NO. When policy rates drop but long yields rise, that’s not a pivot — it’s a loss of trust.

8/

I’m on team:

fewer narratives, more hard assets. Short-term swings are just noise — fundamentals speak loud and clear.

#bonds #USTreasuries #FOMC #macro #inflation #gold #silver #markets

I’m on team:

fewer narratives, more hard assets. Short-term swings are just noise — fundamentals speak loud and clear.

#bonds #USTreasuries #FOMC #macro #inflation #gold #silver #markets

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh