1/25 The GraphCall Credit quality vs spread metric

Watching the consumer delinquencies rise is worrying but it is not per se at a very high record (although some adjustments in those calculations are coming and BNPL have data silo issues)....

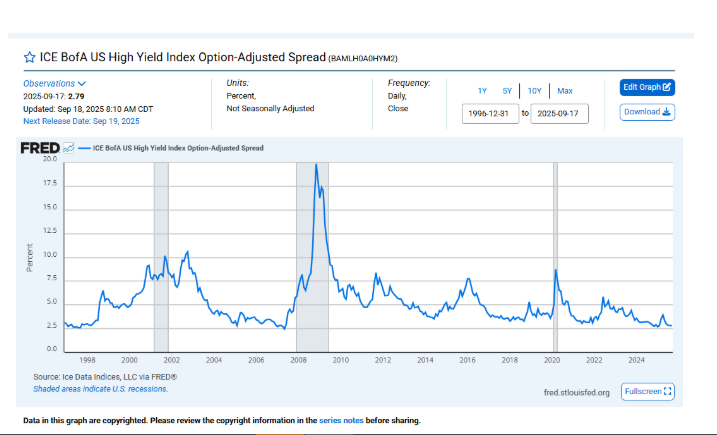

Are the credit spreads reflecting that properly?

Watching the consumer delinquencies rise is worrying but it is not per se at a very high record (although some adjustments in those calculations are coming and BNPL have data silo issues)....

Are the credit spreads reflecting that properly?

3/25

RATIONALE:

In other words if the consumer delinquencies are low but the credit spreads are low it sounds rather rational.

If the delinquencies are high but the credit spreads are ALSO high then there it also sounds rather rational

RATIONALE:

In other words if the consumer delinquencies are low but the credit spreads are low it sounds rather rational.

If the delinquencies are high but the credit spreads are ALSO high then there it also sounds rather rational

4/25

OVERSHOOTING HIGH:

If the delinquencies (a) are high but the credit spreads are tight (b), then it gives a high number.

It means irrationally bidding for garbage.

and that is a sell.

Because the (credit spreads are too tight vs credit quality)

OVERSHOOTING HIGH:

If the delinquencies (a) are high but the credit spreads are tight (b), then it gives a high number.

It means irrationally bidding for garbage.

and that is a sell.

Because the (credit spreads are too tight vs credit quality)

5/25

OVERSHOOTING LOW:

If the delinquencies (a) are low but the credit spreads are very high (b);

It gives a low number and that’s a buy (spreads too wide vs credit quality)

OVERSHOOTING LOW:

If the delinquencies (a) are low but the credit spreads are very high (b);

It gives a low number and that’s a buy (spreads too wide vs credit quality)

7/25

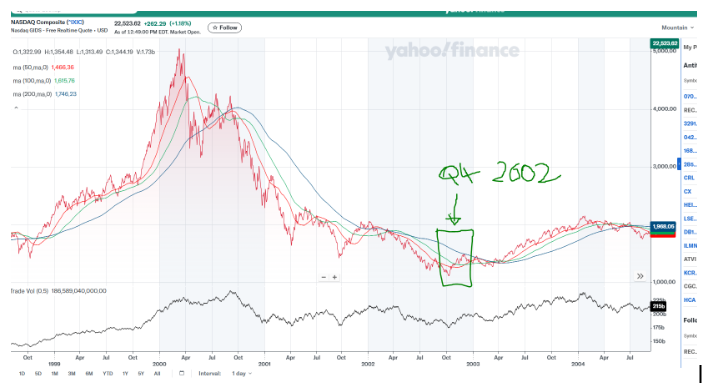

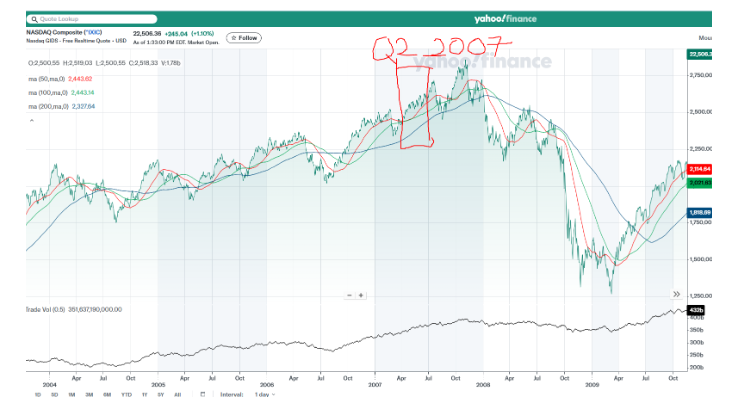

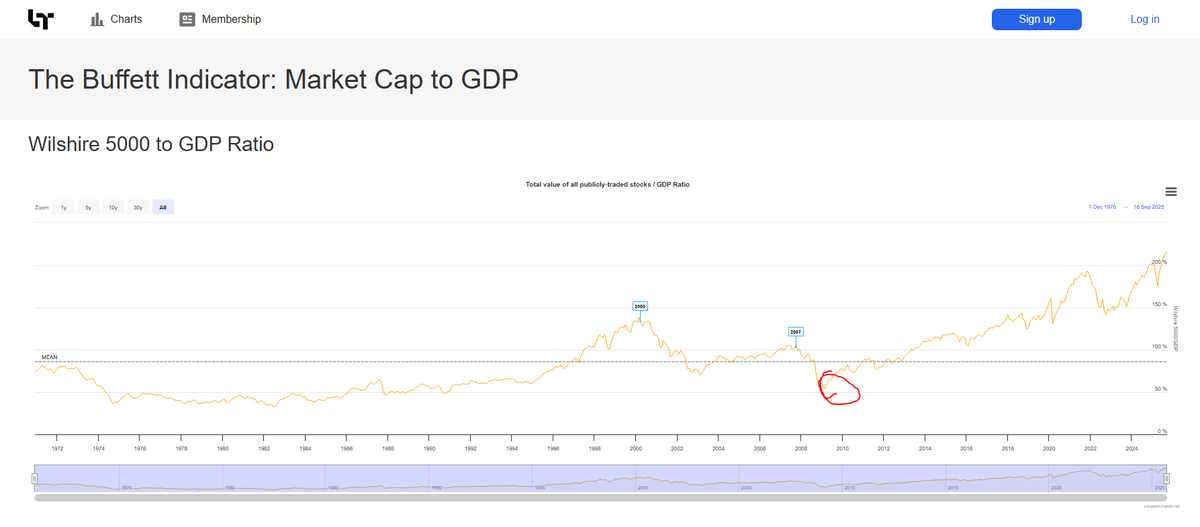

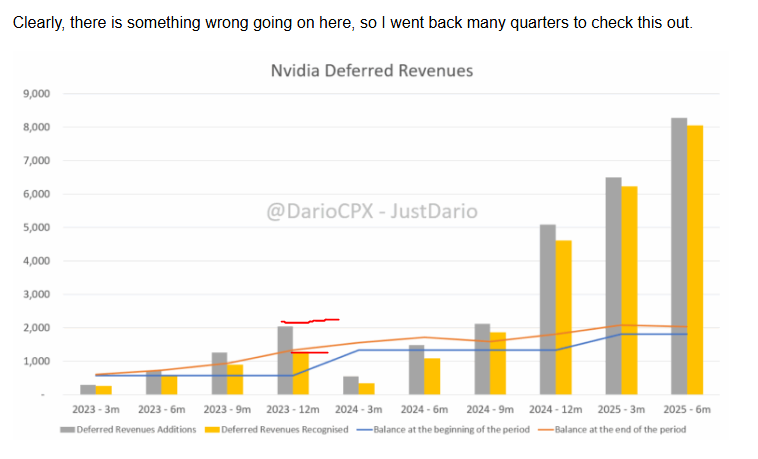

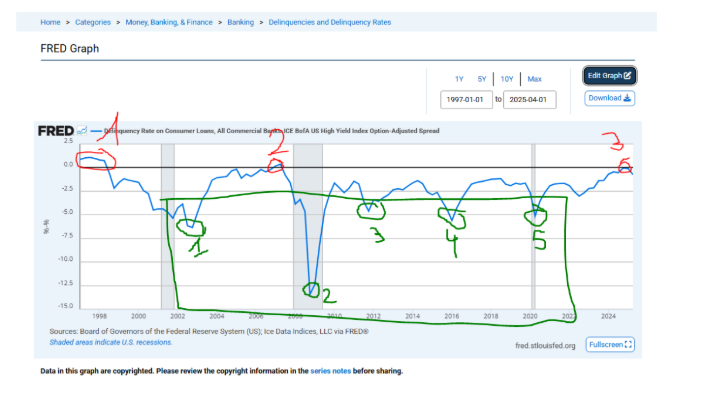

ACTUAL RESULTS:

Alright so let’s see if this simple logical approach has any echo in past situations so we take the consumer delinquencies and we subtract the credit spread.

It worked 6 times out of 7.

ACTUAL RESULTS:

Alright so let’s see if this simple logical approach has any echo in past situations so we take the consumer delinquencies and we subtract the credit spread.

It worked 6 times out of 7.

8/25

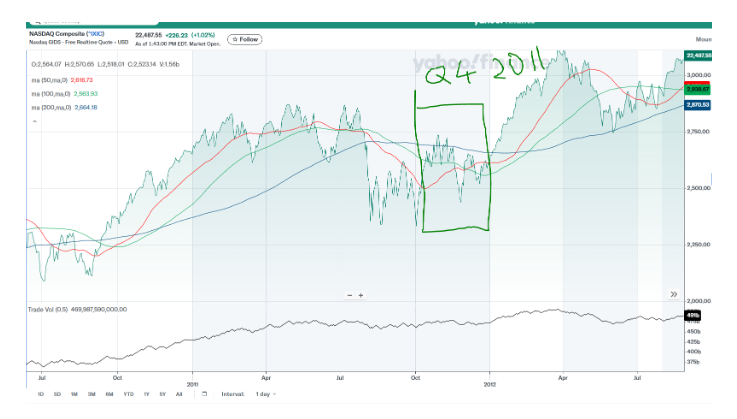

The first instance (one red) fails miserably it indicates a high in Q3 1997, maybe that's why Druck got short too early?

The first instance (one red) fails miserably it indicates a high in Q3 1997, maybe that's why Druck got short too early?

21/25

Interpretation:

The high points mean this: The credit quality is not great (relatively high deliquency) yet the markets overshoot in overbidding bad credit, mispricing bad credit.

Interpretation:

The high points mean this: The credit quality is not great (relatively high deliquency) yet the markets overshoot in overbidding bad credit, mispricing bad credit.

23/25

As the losses materialize people ask for more spread in relation to delinquencies which makes matter worse actually, they continue until they overshoot asking too much spread vs credit quality and then that’s your bottom . Green part

As the losses materialize people ask for more spread in relation to delinquencies which makes matter worse actually, they continue until they overshoot asking too much spread vs credit quality and then that’s your bottom . Green part

24/25

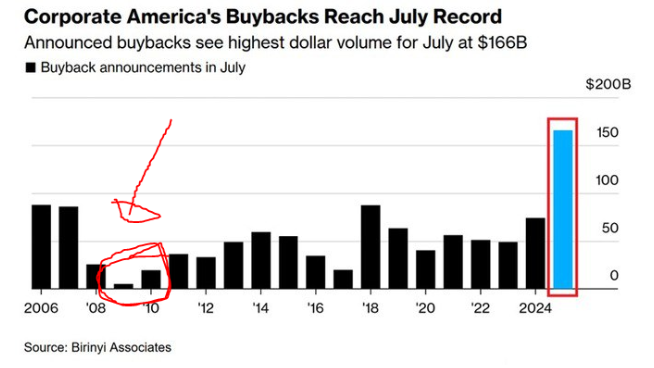

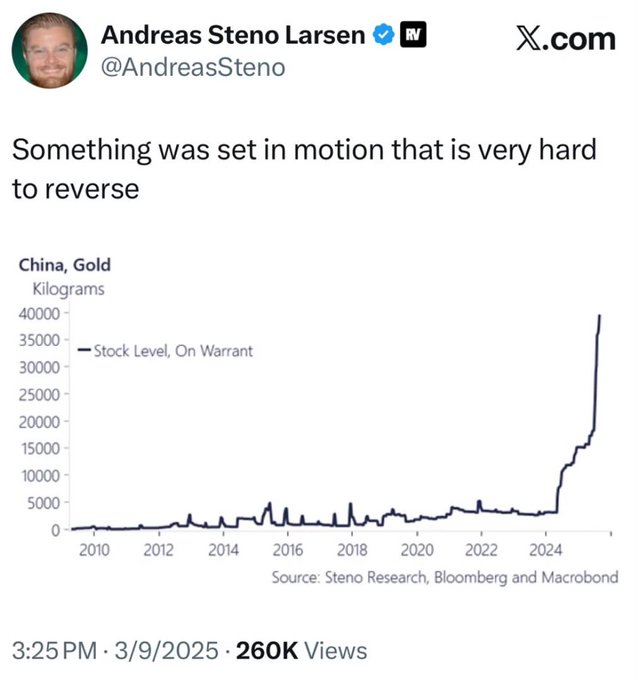

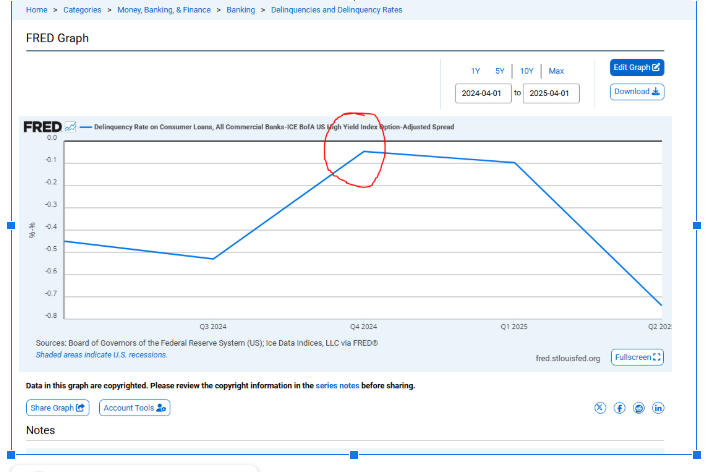

And we note that some bank like WFC reducing exposure on consumer lending, PNC reducing, USB selling and JPM freezing at telling you. They talking about spread compression at WFC to explain why they reduced the balances.

And we note that some bank like WFC reducing exposure on consumer lending, PNC reducing, USB selling and JPM freezing at telling you. They talking about spread compression at WFC to explain why they reduced the balances.

25/25

They simply say what is on the chart in red. We are not compensated for the quality. (what Gundlach also said). We have peaked in Q4 2024

Jamie Dimon sold his shares in Feb 2025. He knows one or two things about banking.

They simply say what is on the chart in red. We are not compensated for the quality. (what Gundlach also said). We have peaked in Q4 2024

Jamie Dimon sold his shares in Feb 2025. He knows one or two things about banking.

• • •

Missing some Tweet in this thread? You can try to

force a refresh