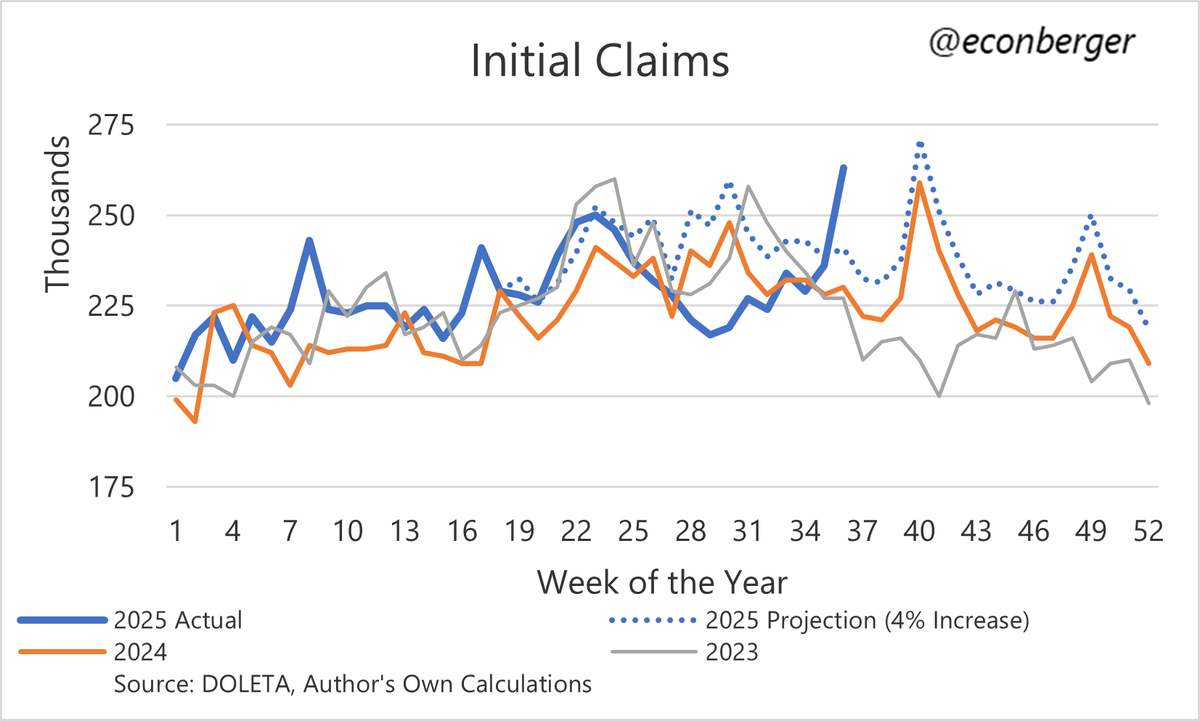

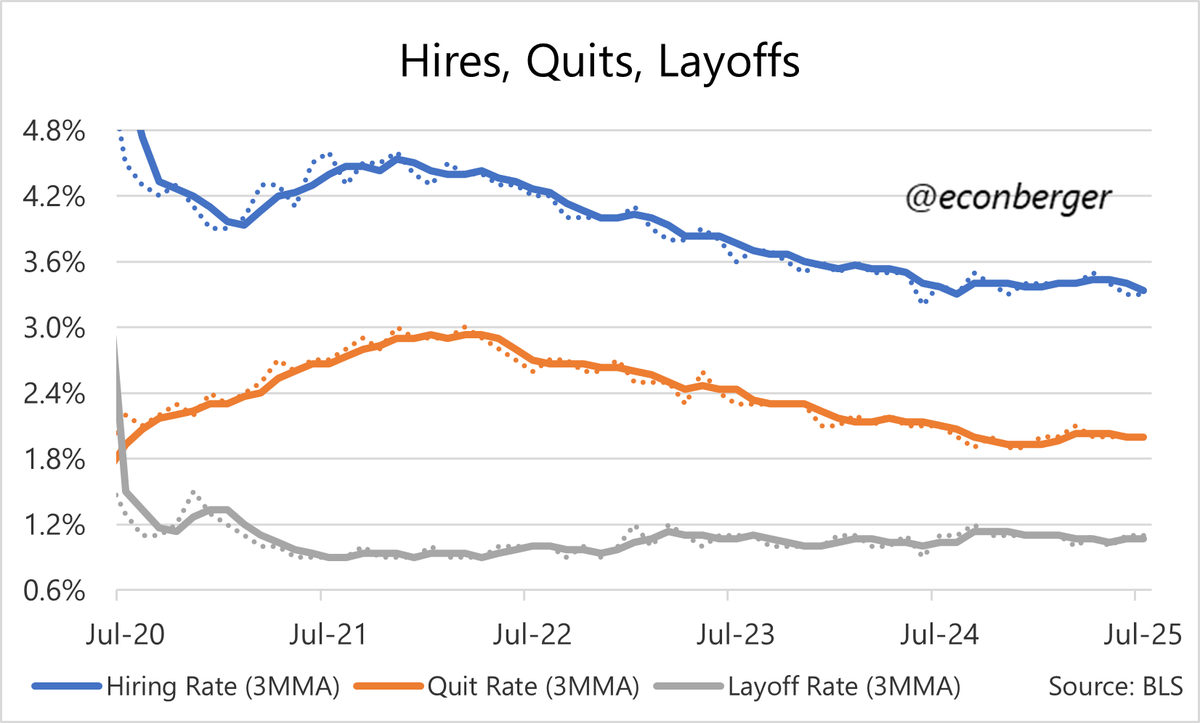

1/ I've been curious how to reconcile the relatively upbeat "flows" from the CPS (hiring & quits rising modestly; layoffs falling modestly) with the downbeat stocks (esp upward-creeping unemployment rate)

https://twitter.com/EconBerger/status/1968709253654573229

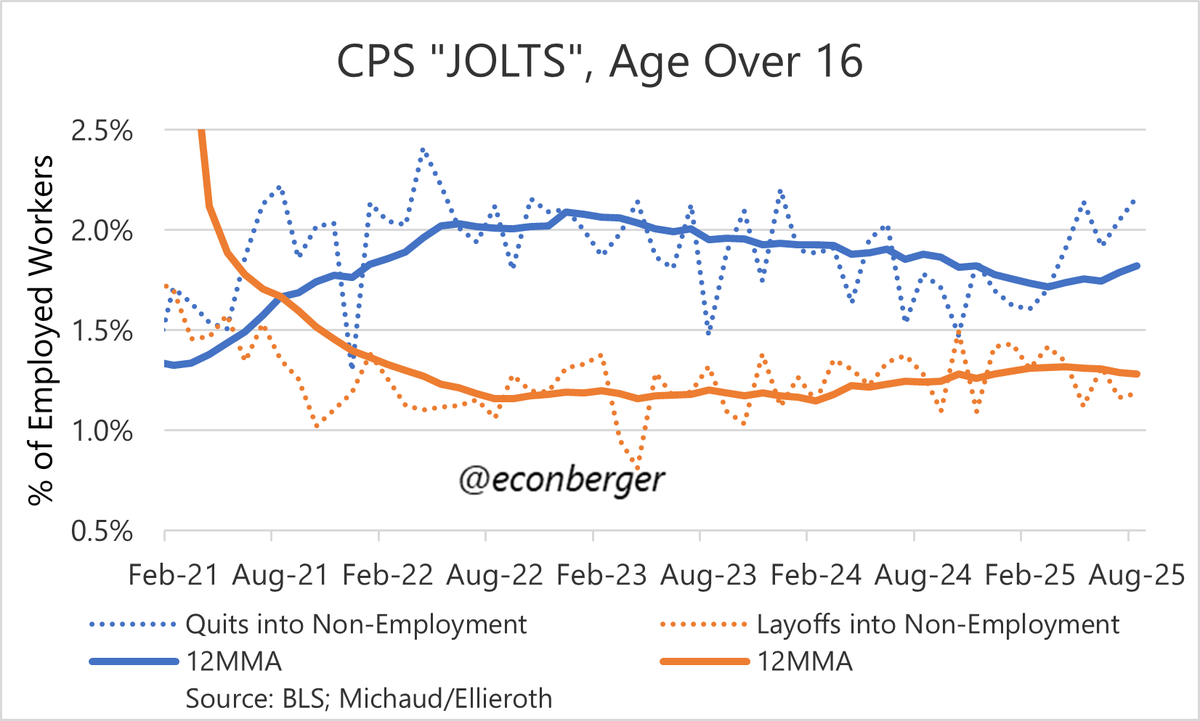

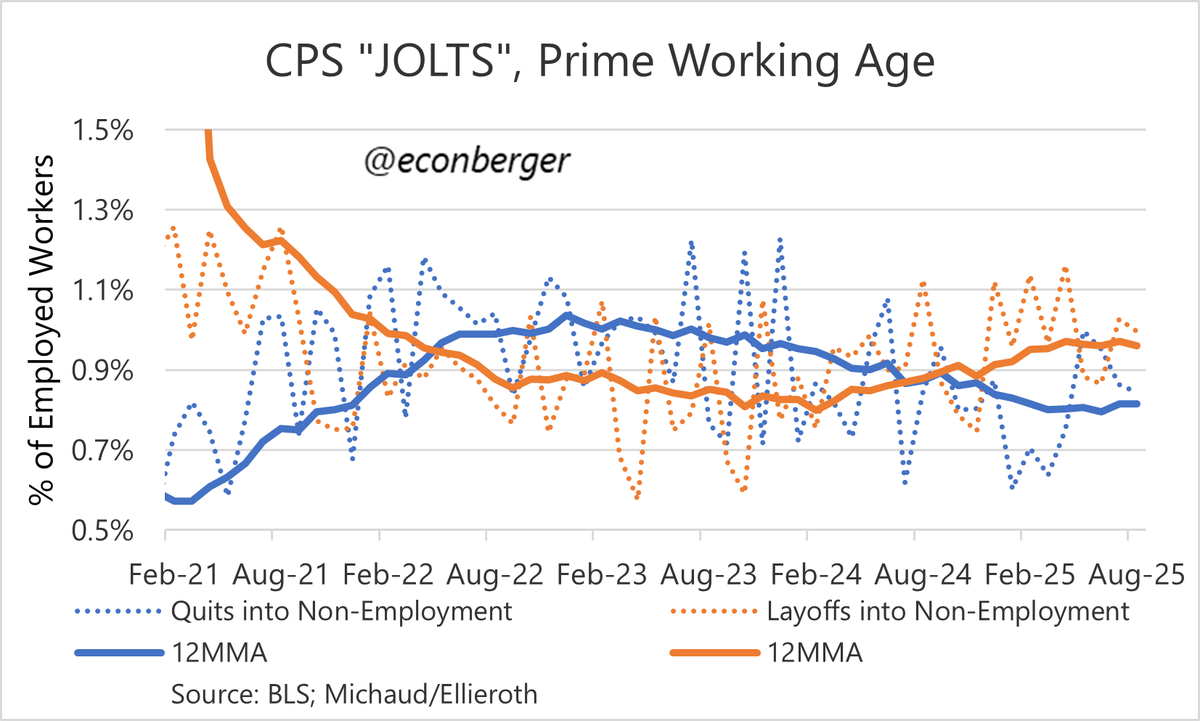

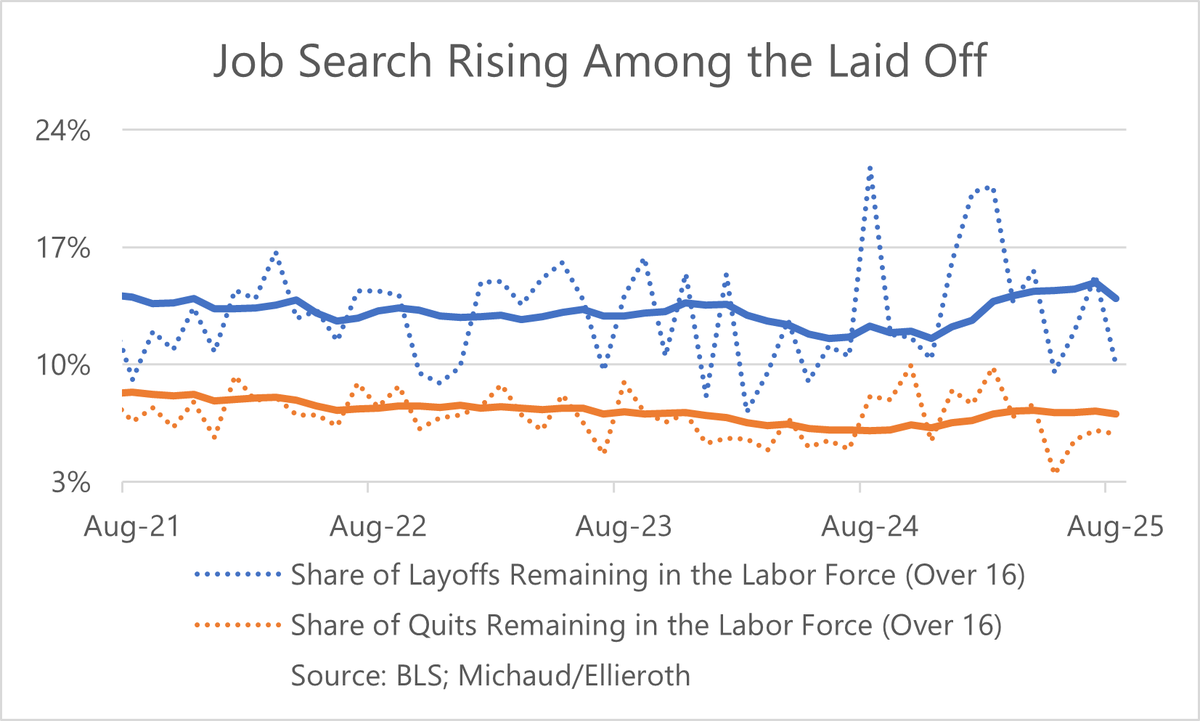

2/ Out of the @mander_michaud / @KathrinPhD data, we see that job search after layoff has gone up non-trivially over the past year, but job search after quits has increased by less.

Still digesting, but my instinct is to think this is (on net) a positive development?

Still digesting, but my instinct is to think this is (on net) a positive development?

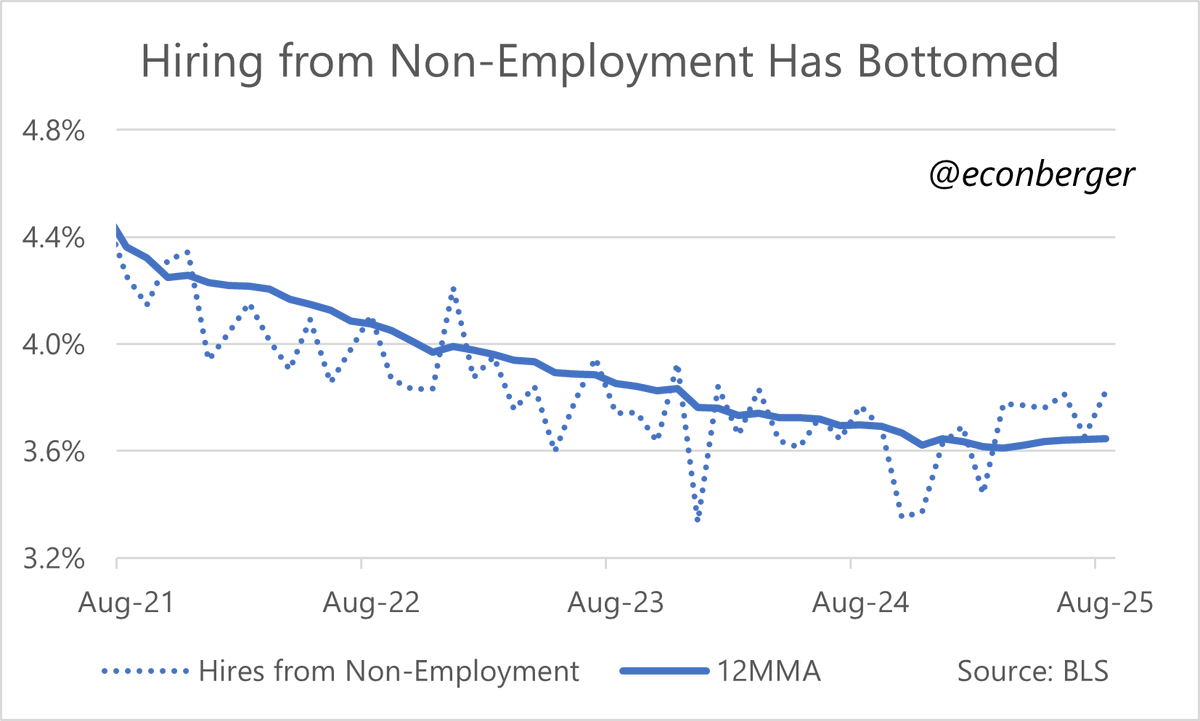

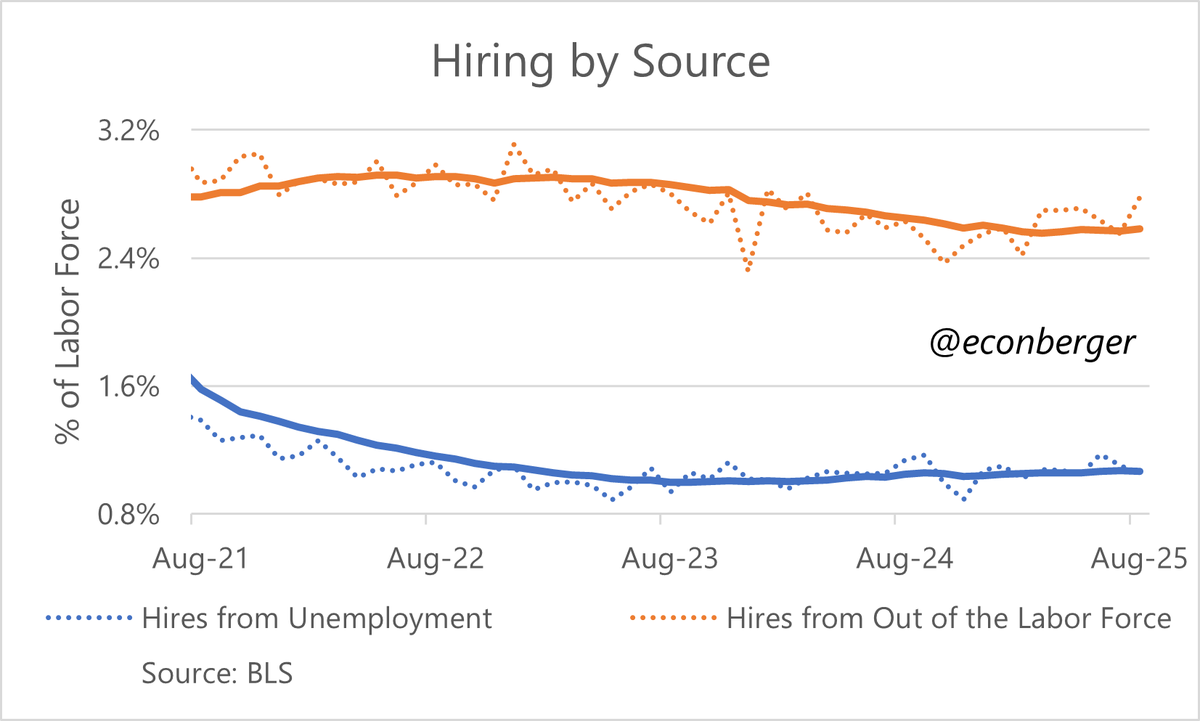

@mander_michaud @KathrinPhD 3/ And if you look at hiring out of non-employment, most of the recent fluctuation (including the small recent) is due to hiring from non-employment.

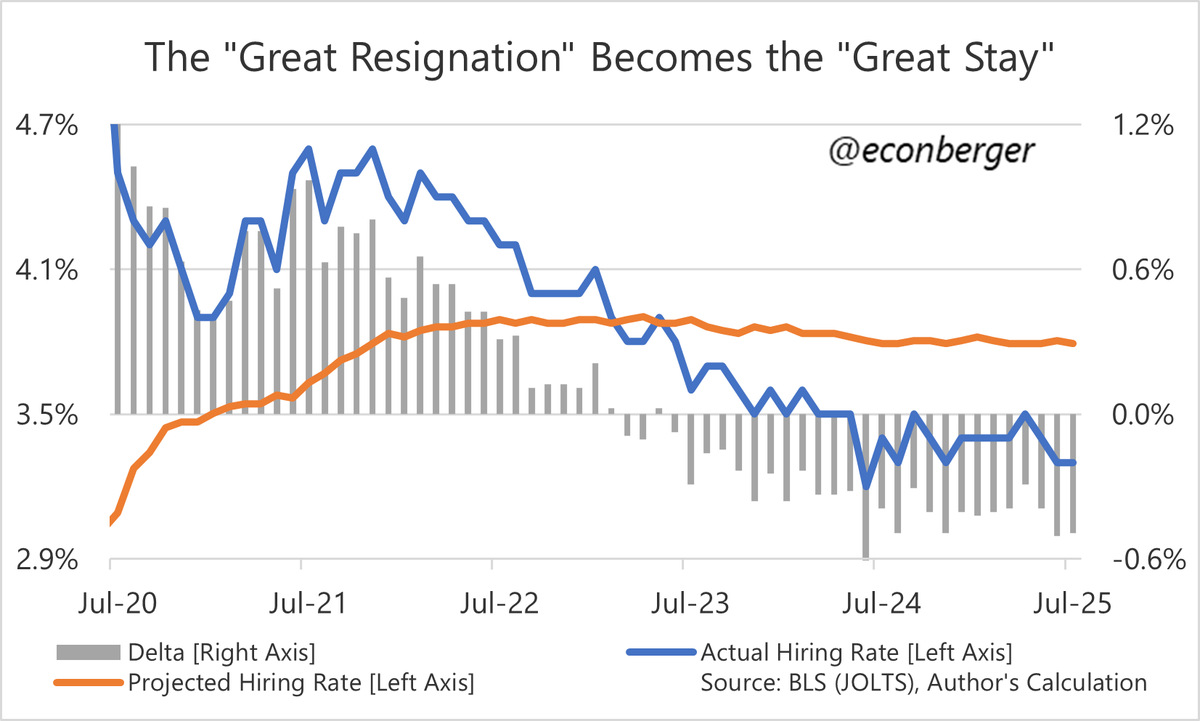

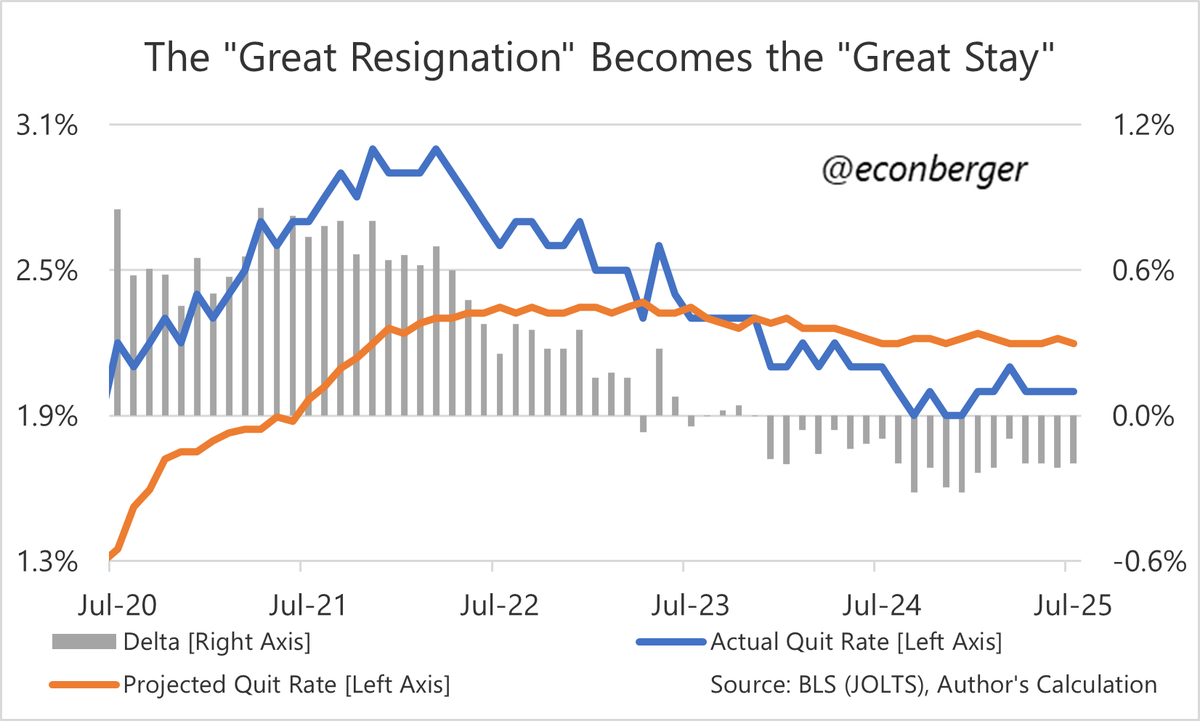

@mander_michaud @KathrinPhD 4/ So tying it all together:

* We're seeing slightly fewer layoffs, but more of them staying in the labor force

* Slightly more quits, but barely a change in the share staying more in the labor force

* No change in the share of hires coming from the ranks of the unemployed

* We're seeing slightly fewer layoffs, but more of them staying in the labor force

* Slightly more quits, but barely a change in the share staying more in the labor force

* No change in the share of hires coming from the ranks of the unemployed

@mander_michaud @KathrinPhD 5/ This puts a less negative gloss on the slight rise in the unemployment rate we've seen

@mander_michaud @KathrinPhD 6/ I don't know how much I want to commit to this line of argument. But worth thinking about, especially if JOLTS follows in the CPS's tracks

• • •

Missing some Tweet in this thread? You can try to

force a refresh