It's pretty to easy to see how utterly debased the @CSIRO modelling underpinnning the economic claims regarding the 2035 targets is.

They assume the whole world is committed to Paris targets, ie. Net Zero. They don't have any baseline where that doesn't happen. 1/

They assume the whole world is committed to Paris targets, ie. Net Zero. They don't have any baseline where that doesn't happen. 1/

That's right, they derive a "global carbon price" commensurate with the world hitting net-zero targets. And apply it to Australia.

(Without saying anywhere in the document what that price is!)

2/

(Without saying anywhere in the document what that price is!)

2/

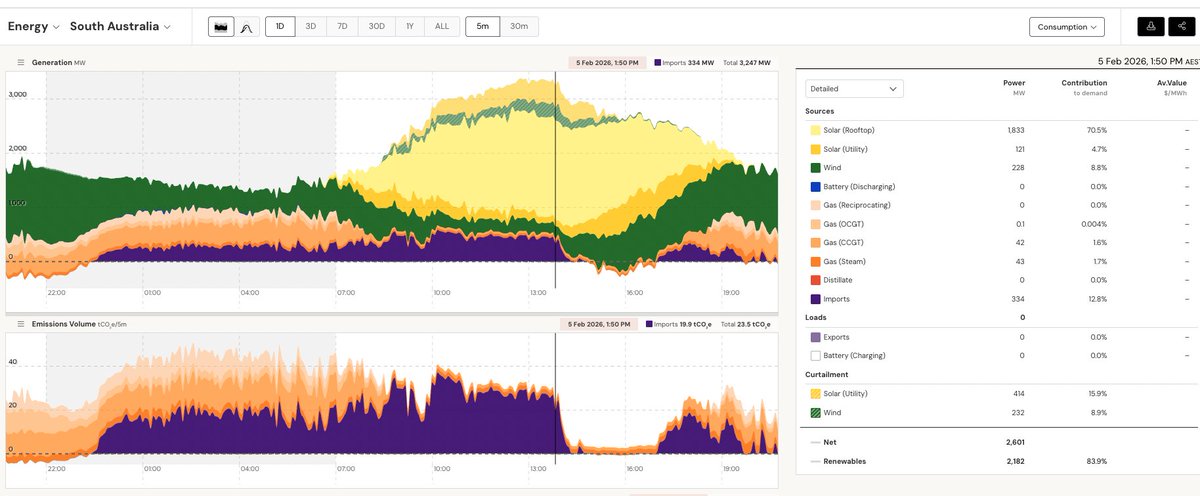

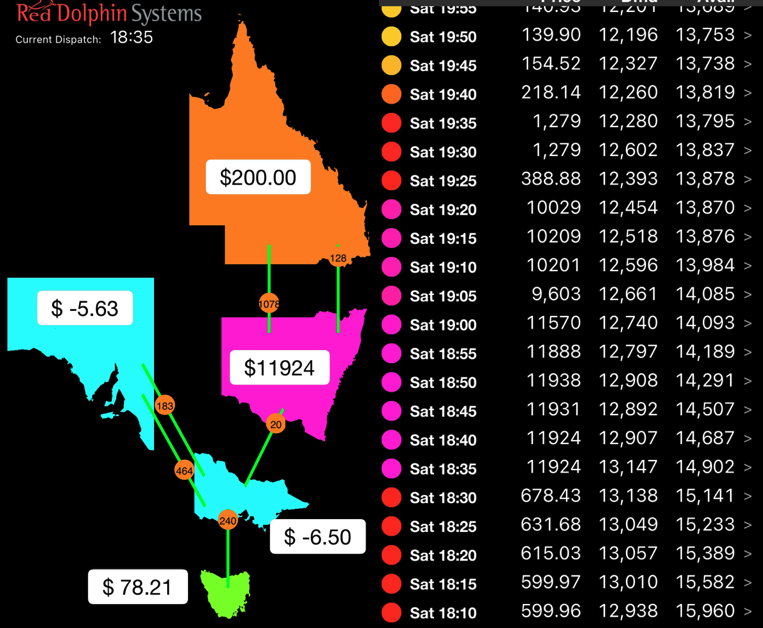

And that price seems to be enough for us to OVERSHOOT the 2030 targets! The Labor plan says we need 82% renewable energy by 2030. Not even Ross Garnaut thinks that's possible.

But CSIRO models us beating that, in all scenarios!

This is absurd. 3/

But CSIRO models us beating that, in all scenarios!

This is absurd. 3/

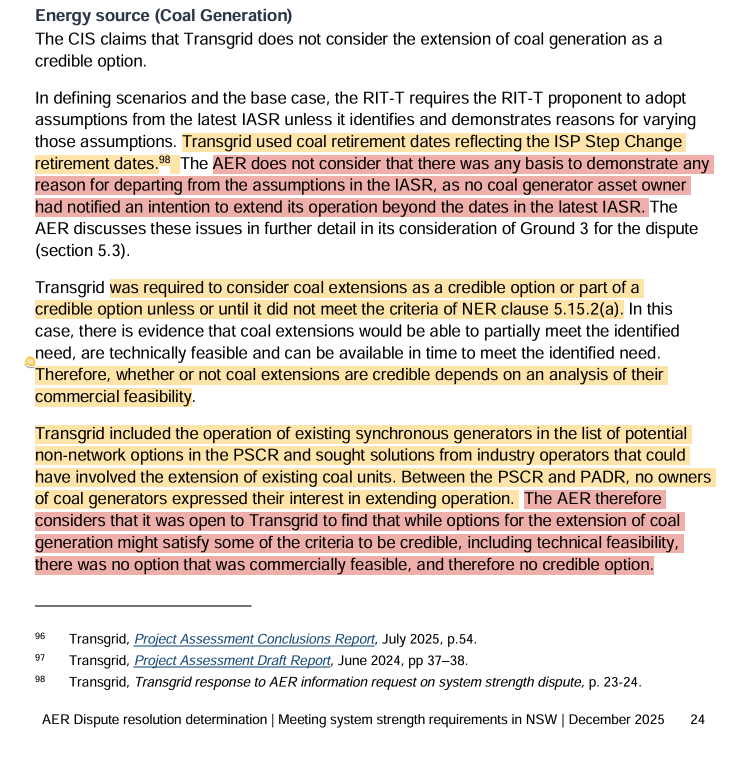

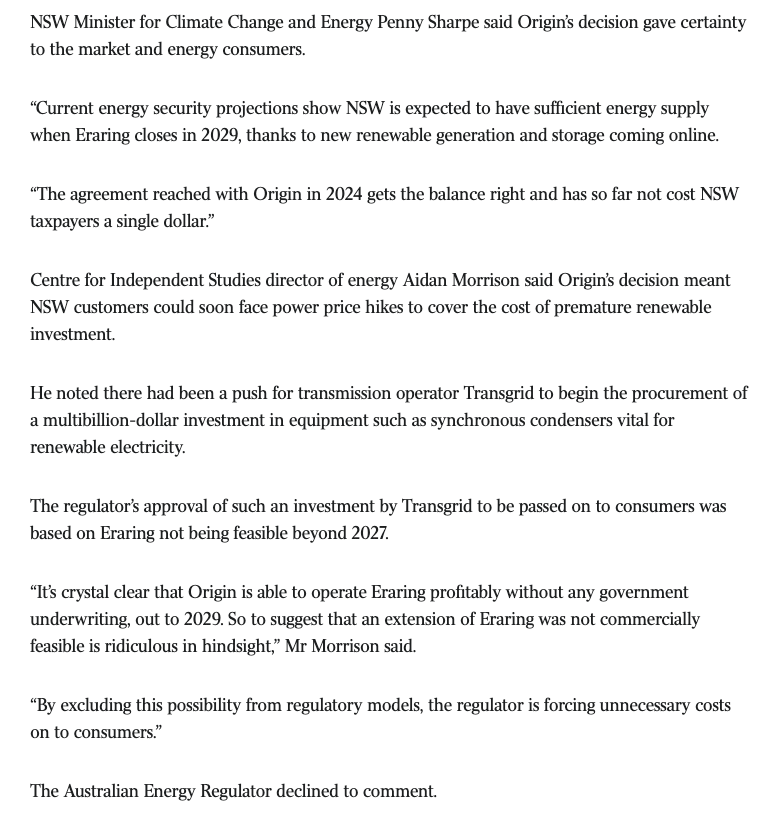

Yep, this document pays hommage to the utterly implausible state and federal targets... And the nonsense about coal being gone in 2035, despite the coal plant owners not indicating/intending that at all. 4/

And then... off with the fairies.

"one third of emissions reductions come from technologies that are currently in early demonstration or prototype phases."

Including all the ones that that have been stuck there for decades, like green hydrogen and carbon capture!! 5/

"one third of emissions reductions come from technologies that are currently in early demonstration or prototype phases."

Including all the ones that that have been stuck there for decades, like green hydrogen and carbon capture!! 5/

No, they weren't typos.

We're going to almost halve cement emissions whilst almost doubling the amount we produce.

What did Darryl Kerrigan say? "Tell 'im he's dreaming."

Steel and aluminium are all green too. 6/

We're going to almost halve cement emissions whilst almost doubling the amount we produce.

What did Darryl Kerrigan say? "Tell 'im he's dreaming."

Steel and aluminium are all green too. 6/

This is galling stuff... the most shameless "assume a can-opener" type assumptions that would make economists blush, adopted by our leading scientific institution.

Withheld from the day of announcements. 7/7

Withheld from the day of announcements. 7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh