Researching energy and defence. Physics and data science background. Happy getting into the weeds.

2 subscribers

How to get URL link on X (Twitter) App

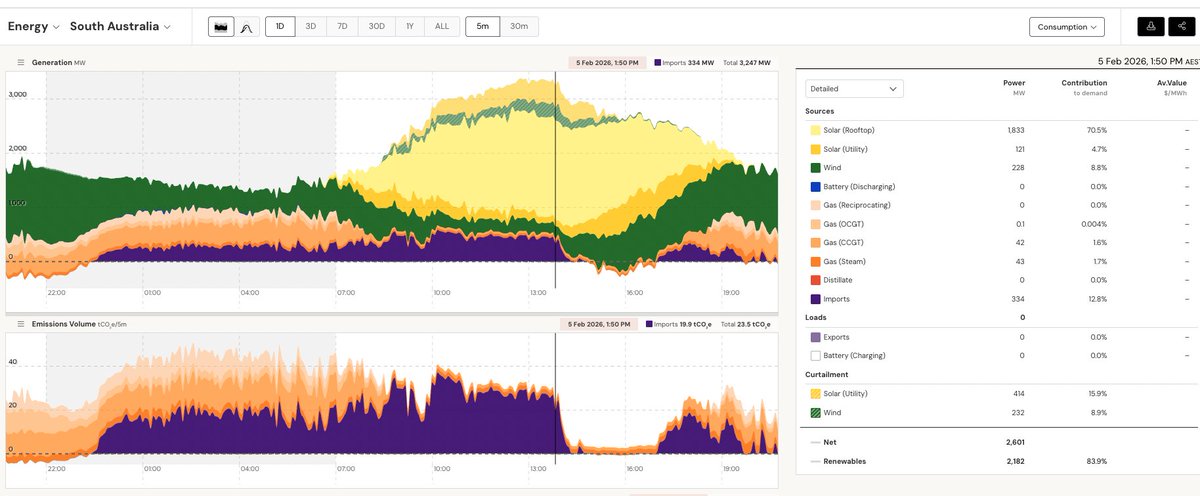

At 1:50pm, SA is soaked in rooftop solar. They're curtailing excess wind and grid solar. Prices are consistently negative, and dip here to -$200. They run a slither of gas for system security, but weirdly, they're importing nearly 400MW throughout from Victoria. 2/

At 1:50pm, SA is soaked in rooftop solar. They're curtailing excess wind and grid solar. Prices are consistently negative, and dip here to -$200. They run a slither of gas for system security, but weirdly, they're importing nearly 400MW throughout from Victoria. 2/

This story was briefly mentioned in today's Australian. But it requires a little more.

This story was briefly mentioned in today's Australian. But it requires a little more.

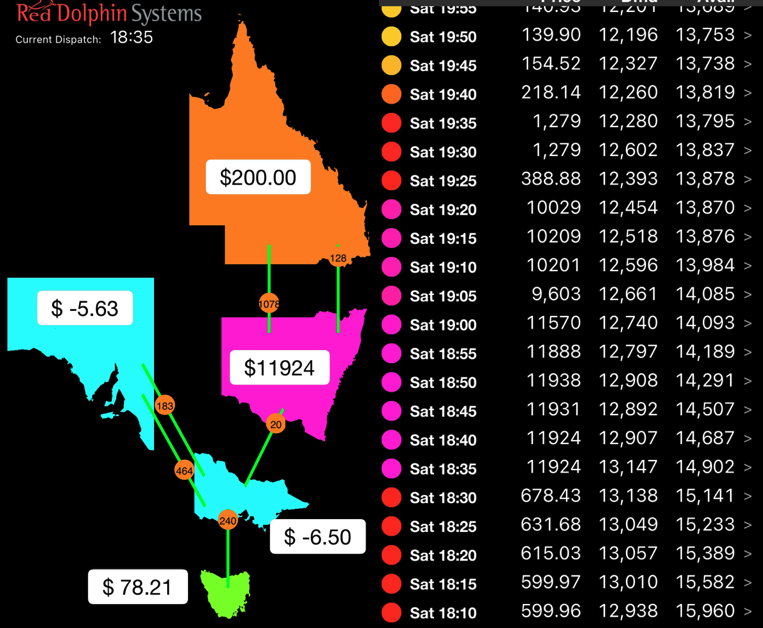

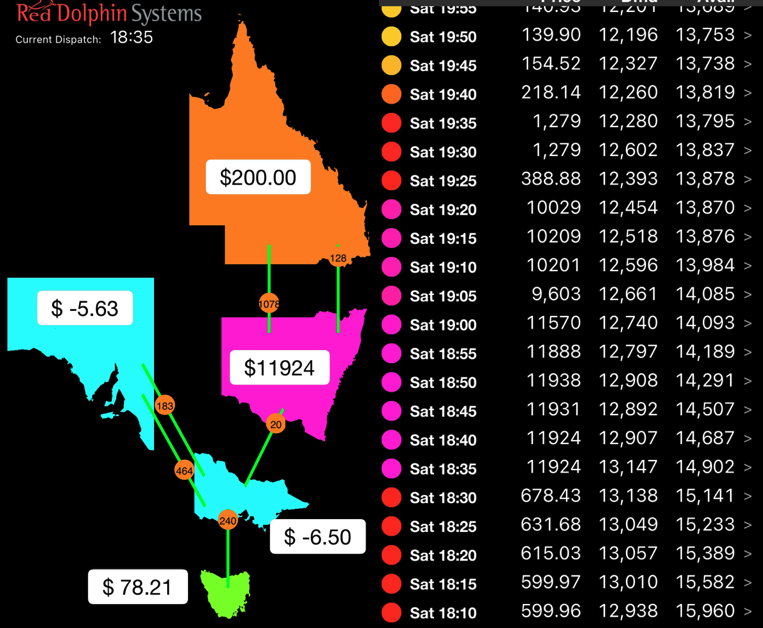

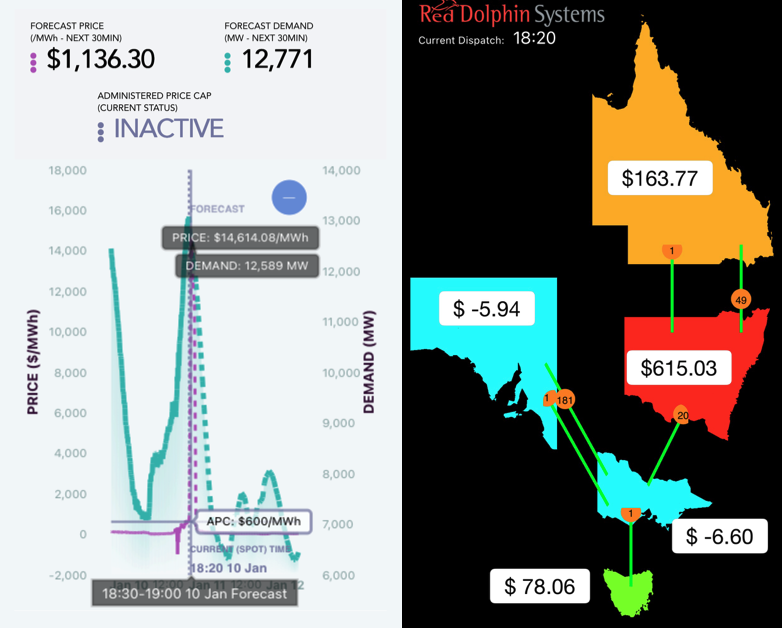

Now it's worth noting that at 6:20pm, this spike was still forecast. But it wasn't forecast to endure for 10 price intervals. As it happened, the peak grid demand was slowly falling (middle column in post above), but not as fast as that available (right column) was. 2/

Now it's worth noting that at 6:20pm, this spike was still forecast. But it wasn't forecast to endure for 10 price intervals. As it happened, the peak grid demand was slowly falling (middle column in post above), but not as fast as that available (right column) was. 2/

https://twitter.com/FootnotesGuy/status/1991492689955561981

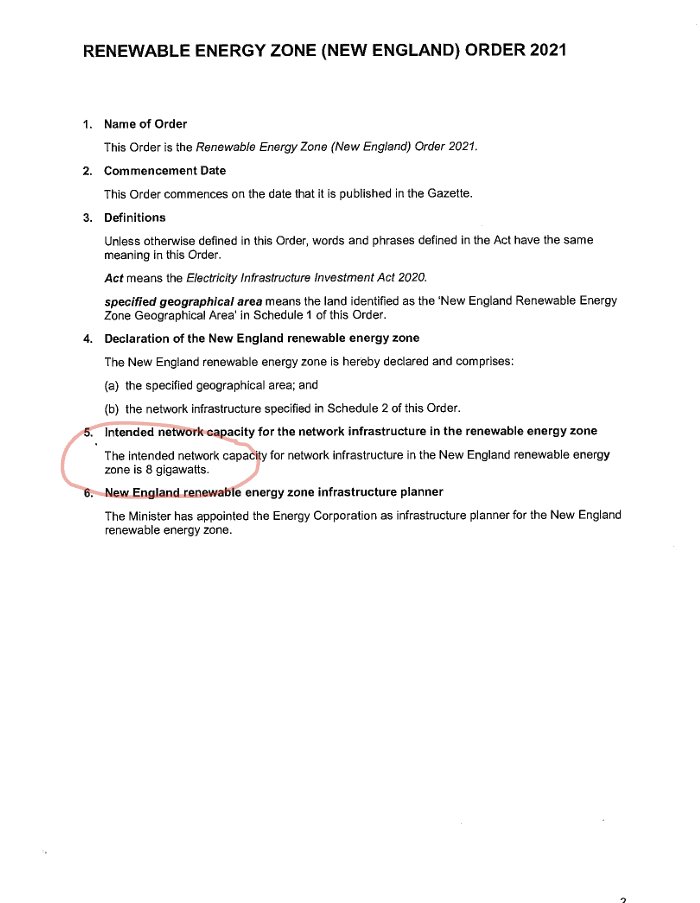

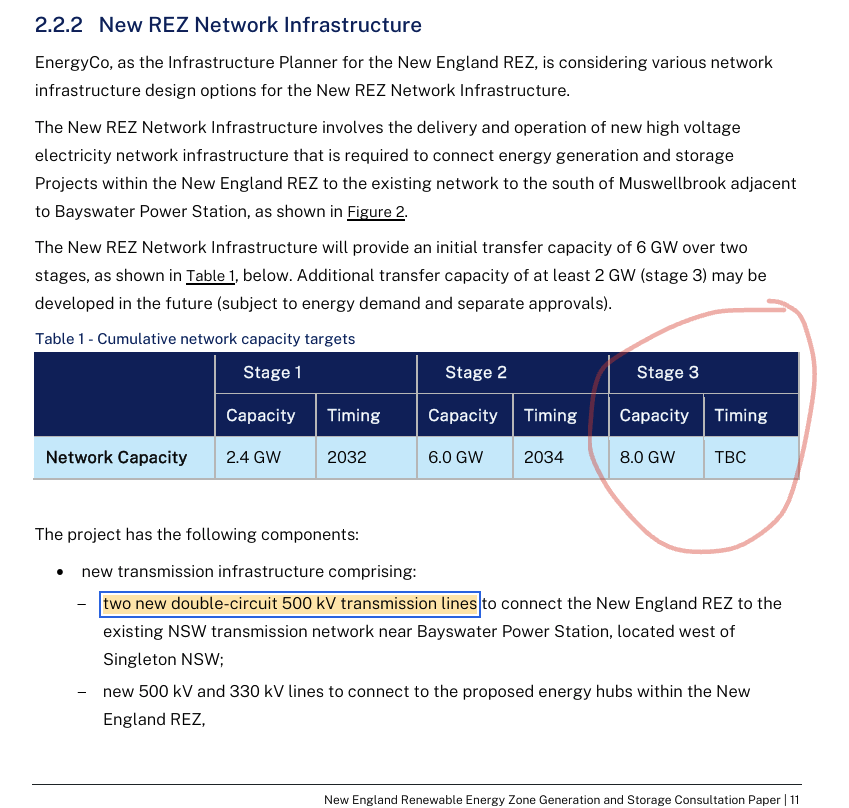

But a consultation paper that was released just in August, on the generation and storage, outlines reaching 8GW in three separated stages.

But a consultation paper that was released just in August, on the generation and storage, outlines reaching 8GW in three separated stages.

https://twitter.com/FootnotesGuy/status/1990450132840788199

This is bad, because Transgrid has said, plain as day, that they're not happy with AEMO's models.

This is bad, because Transgrid has said, plain as day, that they're not happy with AEMO's models.

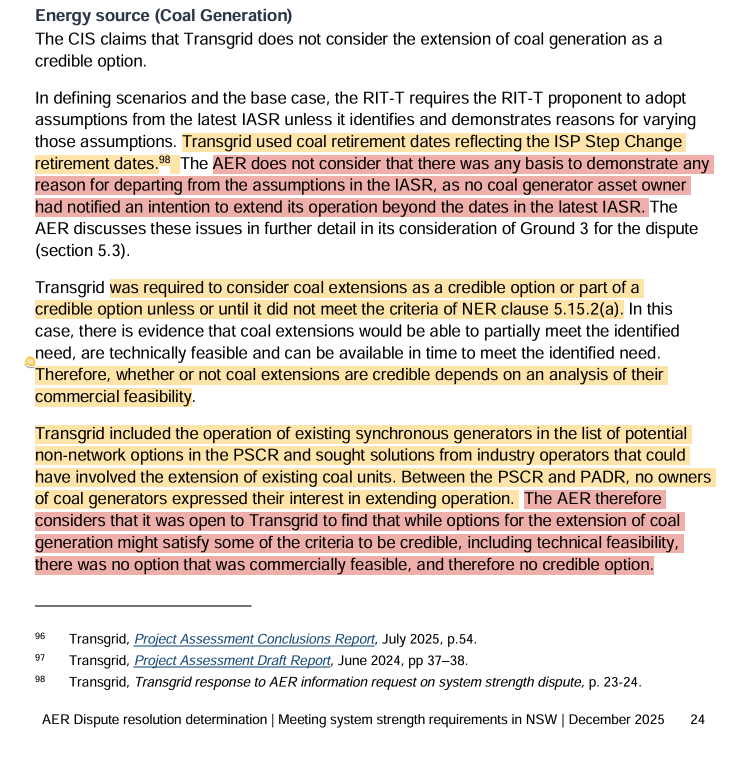

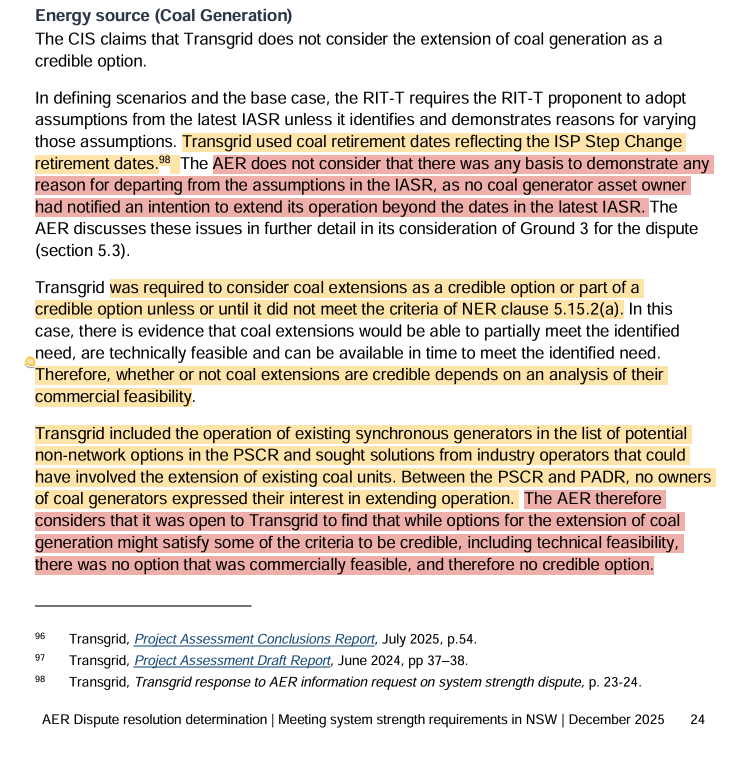

Let's start with the conclusion.

Let's start with the conclusion.

First, here's an excerpt from the latest published terms of reference. Which say, explicitly, that it should be a forecast. Despite that being difficult, their instruction is to try, for 3 years, using the last final year as an anchor. 2/

First, here's an excerpt from the latest published terms of reference. Which say, explicitly, that it should be a forecast. Despite that being difficult, their instruction is to try, for 3 years, using the last final year as an anchor. 2/

Basically, it was un-buildable. Or rather, the scale of civil works required, on "non-conventional" construction required, like lifting tower segments in place with helicopters, made the cost/complexity/safety too.... whatever. Un-buildable.

Basically, it was un-buildable. Or rather, the scale of civil works required, on "non-conventional" construction required, like lifting tower segments in place with helicopters, made the cost/complexity/safety too.... whatever. Un-buildable.

https://twitter.com/FootnotesGuy/status/1990450132840788199

Now this isn't the exact same line as is proposed for the Sydney Ring South upgrade. It's actually just upstream, kinda in the thick of the wind pocket.

Now this isn't the exact same line as is proposed for the Sydney Ring South upgrade. It's actually just upstream, kinda in the thick of the wind pocket.

https://twitter.com/FootnotesGuy/status/1990450132840788199

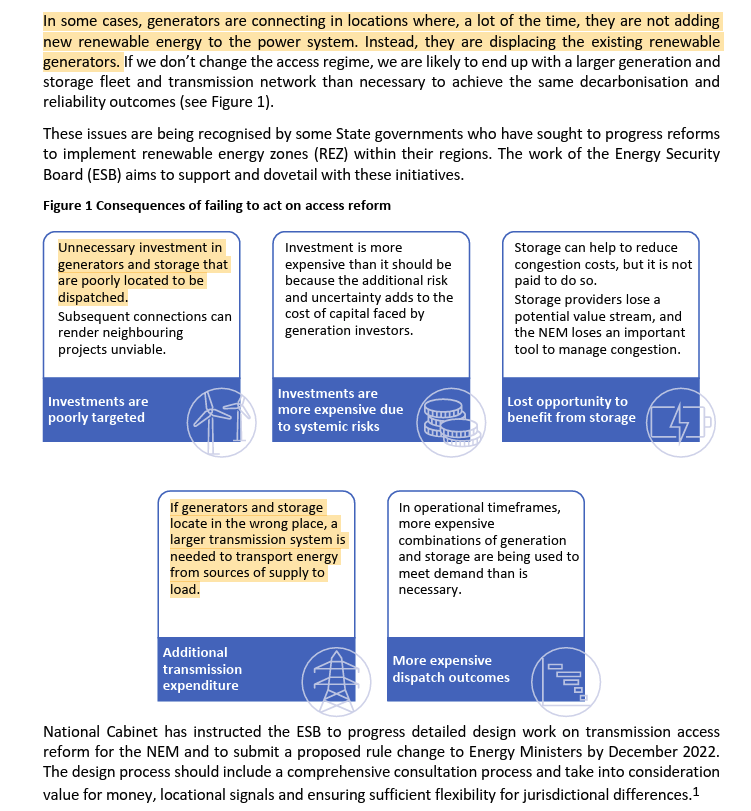

They wrote a major paper about these problems.

They wrote a major paper about these problems.

Where to start... How about where I started. The point of intrigue.

Where to start... How about where I started. The point of intrigue. https://x.com/FootnotesGuy/status/1980769974580088920?s=20

https://twitter.com/JesseJenkins/status/1986233040788398096First, millions of Australian's won't get free power at all.

This is a massive problem for AEMO, because 'coordinated' (ie VPP) battery storage is the largest part of storage by capacity in their electricity transition blueprint, the Integrated System Plan. Hundreds of billions worth. 2/

This is a massive problem for AEMO, because 'coordinated' (ie VPP) battery storage is the largest part of storage by capacity in their electricity transition blueprint, the Integrated System Plan. Hundreds of billions worth. 2/

Who could be behind this deft manoeuvre? The Sunrise Project.

Who could be behind this deft manoeuvre? The Sunrise Project.

Take this SMH headline "Like a Mad Max Movie"...

Take this SMH headline "Like a Mad Max Movie"...

https://twitter.com/GrattanInst/status/1977313663426916695Firstly, what are they arguing for?

https://twitter.com/DavidOsmond8/status/1970438479504121909

And on page 80 of the 2022-23 report we have CSIRO's explanation.

And on page 80 of the 2022-23 report we have CSIRO's explanation.

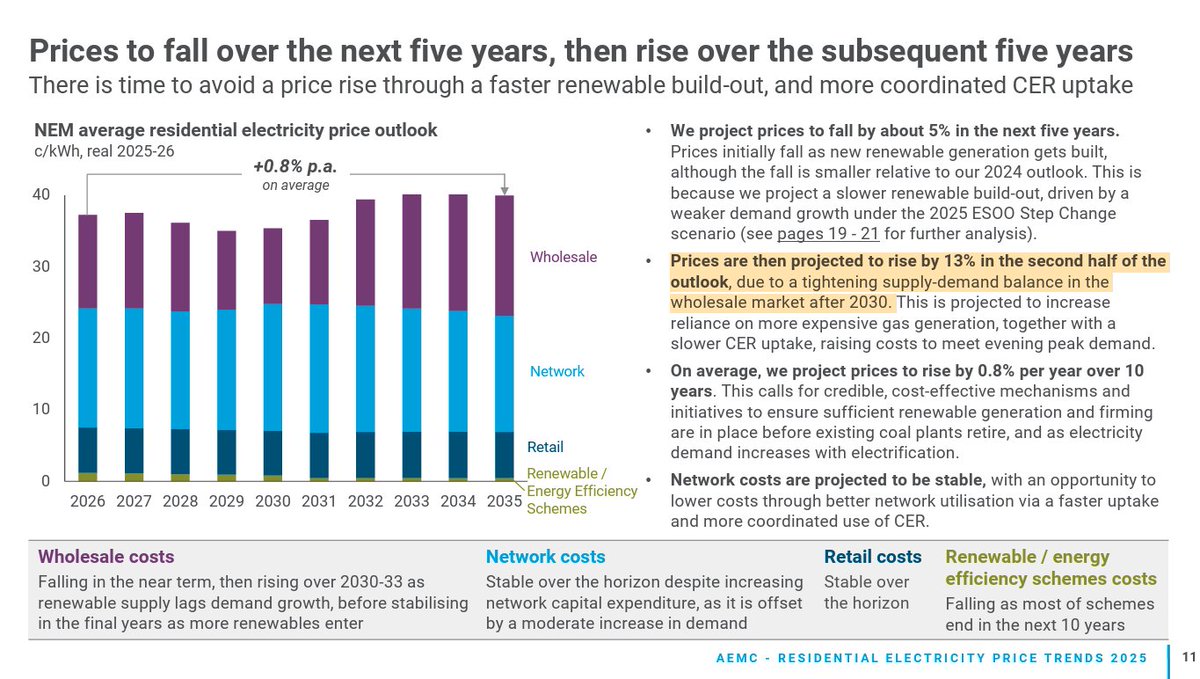

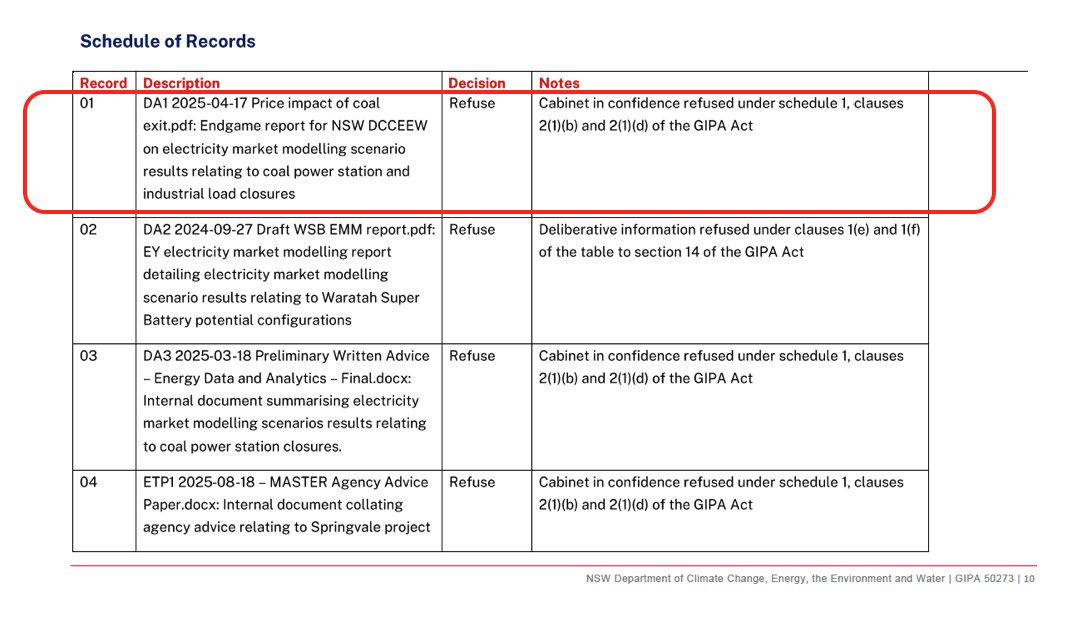

This is a recent document... from a serious consultancy, all about "Price impact of coal exit". And some industrial loads.

This is a recent document... from a serious consultancy, all about "Price impact of coal exit". And some industrial loads.

https://twitter.com/DavidOsmond8/status/1971101643275108765Let's start with capacity factor.

https://x.com/DavidOsmond8/status/1971101658240409761