🚨Specialized Investment Fund(SIF)-Mutual funds with short positions!

Quant Mutual Fund has just launched India's first long-short SIF

What are SIFs?

Should u invest in an SIF?

A thread🧵on SIFs and should u invest in them?👇

Quant Mutual Fund has just launched India's first long-short SIF

What are SIFs?

Should u invest in an SIF?

A thread🧵on SIFs and should u invest in them?👇

What are Mutual funds?

A mutual fund is an investment fund that pools money from many investors to purchase securities.

Mutual funds in India are not allowed to take short positions.

They are mostly long-only products,

So SEBI created a new asset class

A mutual fund is an investment fund that pools money from many investors to purchase securities.

Mutual funds in India are not allowed to take short positions.

They are mostly long-only products,

So SEBI created a new asset class

What is Specialised Investment Fund(SIF)?

The Specialized Investment Fund (SIF) is a new category of investment product introduced by SEBI to bridge the gap between Mutual Funds (MFs) and Portfolio Management Services (PMS).

SIFs aim to provide a middle ground, offering portfolio flexibility while ensuring regulatory compliance and investor protection.

The Specialized Investment Fund (SIF) is a new category of investment product introduced by SEBI to bridge the gap between Mutual Funds (MFs) and Portfolio Management Services (PMS).

SIFs aim to provide a middle ground, offering portfolio flexibility while ensuring regulatory compliance and investor protection.

How will SIFs operate?

SEBI allows SIFs to offer three categories of investment strategies:

1. Equity-Oriented Strategies such as Equity Long-Short Funds and Sector Rotation Funds.

2. Debt-Oriented Strategies like Debt Long-Short Funds and Sectoral Debt Funds.

3. Hybrid Strategies including Active Asset Allocator Funds and Hybrid Long-Short Funds

SEBI allows SIFs to offer three categories of investment strategies:

1. Equity-Oriented Strategies such as Equity Long-Short Funds and Sector Rotation Funds.

2. Debt-Oriented Strategies like Debt Long-Short Funds and Sectoral Debt Funds.

3. Hybrid Strategies including Active Asset Allocator Funds and Hybrid Long-Short Funds

Equity-Oriented Strategies focus on equity and derivatives, allowing limited short exposure.

The Equity Long-Short Fund invests at least 80% in equities with a 25% short limit.

The Equity Long-Short Fund invests at least 80% in equities with a 25% short limit.

Debt-Oriented Strategies invest in fixed-income securities.

The Debt Long-Short Fund allows exposure across durations, while the Sectoral Debt Long-Short Fund focuses on two or more sectors, limiting exposure to 75% per sector.

The Debt Long-Short Fund allows exposure across durations, while the Sectoral Debt Long-Short Fund focuses on two or more sectors, limiting exposure to 75% per sector.

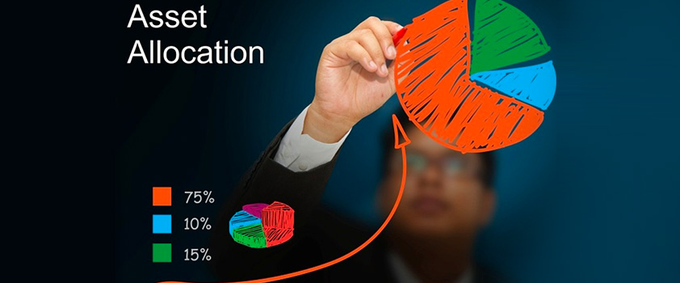

Hybrid Strategies combine multiple asset classes.

The Active Asset Allocator Long-Short Fund dynamically allocates investments across equity, debt, REITs, and commodities.

The Hybrid Long-Short Fund requires a minimum 25% investment in both equity and debt.

The Active Asset Allocator Long-Short Fund dynamically allocates investments across equity, debt, REITs, and commodities.

The Hybrid Long-Short Fund requires a minimum 25% investment in both equity and debt.

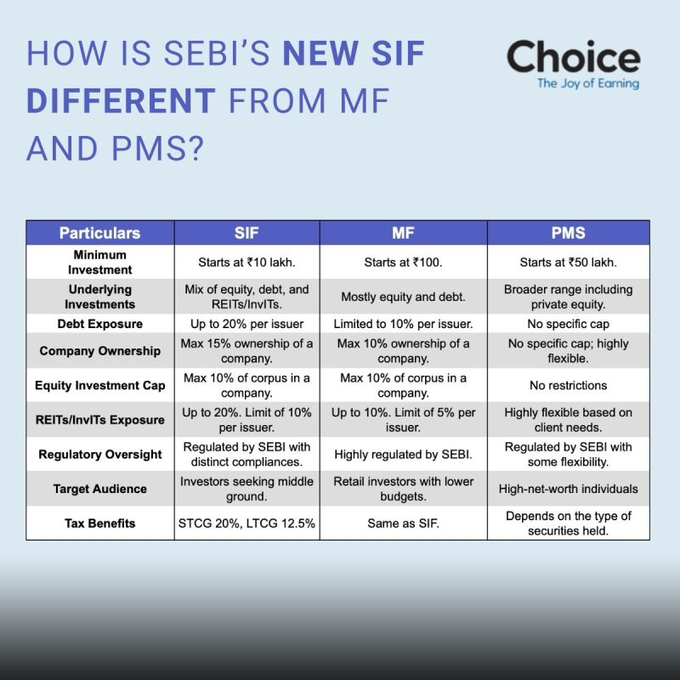

How does SIF differ from other asset class?

Here is a comparison b/w SIFs vs MFs vs PMS

Credit-Linkedin

Here is a comparison b/w SIFs vs MFs vs PMS

Credit-Linkedin

What is the minimum investment in SIFs?

The minimum investment requirement is Rs 10 lakh per investor across all investment strategies (except for accredited investors) and if an investor’s total investment falls below Rs 10 lakh due to redemption, they must redeem the entire remaining investment.

SIPs,STPs are all allowed in the SIFs

The minimum investment requirement is Rs 10 lakh per investor across all investment strategies (except for accredited investors) and if an investor’s total investment falls below Rs 10 lakh due to redemption, they must redeem the entire remaining investment.

SIPs,STPs are all allowed in the SIFs

Who can create an SIF?

Mutual fund companies of AMCs can create SIFs

If the AMC has been operational for at least three years, it must have average Assets Under Management (AUM) of Rs 10,000 crore or more over the last three years

The alternate route is that the AMC must appoint a Chief Investment Officer (CIO) with at least 10 years of experience managing an AUM of Rs 5,000 crore or more.

Mutual fund companies of AMCs can create SIFs

If the AMC has been operational for at least three years, it must have average Assets Under Management (AUM) of Rs 10,000 crore or more over the last three years

The alternate route is that the AMC must appoint a Chief Investment Officer (CIO) with at least 10 years of experience managing an AUM of Rs 5,000 crore or more.

Redemption of money from SIFs:-

The redemption process may include a notice period of up to 15 working days, allowing fund managers to manage liquidity effectively.

The circular adds that for closed-ended and interval investment strategies, SEBI mandates that all such SIFs be listed on a recognized stock exchange to provide an additional liquidity option for investors.

The redemption process may include a notice period of up to 15 working days, allowing fund managers to manage liquidity effectively.

The circular adds that for closed-ended and interval investment strategies, SEBI mandates that all such SIFs be listed on a recognized stock exchange to provide an additional liquidity option for investors.

Should investors invest in SIFs?

Investors must risk profile themselves,

SIFs will carry higher risks due to use of derivatives,

Therefore investors will high risk profile must only invest in these products

Investors must risk profile themselves,

SIFs will carry higher risks due to use of derivatives,

Therefore investors will high risk profile must only invest in these products

Conclusion:-

SEBI has got this good tool for Specialised Investment funds,

These long short funds will create a good asset class,

AMCs must now work on creating and simplify these products,

But overall this is good for the development of the markets

SEBI has got this good tool for Specialised Investment funds,

These long short funds will create a good asset class,

AMCs must now work on creating and simplify these products,

But overall this is good for the development of the markets

• • •

Missing some Tweet in this thread? You can try to

force a refresh