The stats for my boring business portfolio:

> 7 businesses

> 20 hours/week

> $800,000+/year

I started 6 years ago with 0 experience…

Follow these 10 steps to do the same:

> 7 businesses

> 20 hours/week

> $800,000+/year

I started 6 years ago with 0 experience…

Follow these 10 steps to do the same:

Step 1: Market Research.

Start your search with SMBmarket(.)com.

You'll see terms like:

• Price (how much it is)

• Revenue (incoming cash)

• Cashflow (profit - expenses)

Adjust the filters to your liking.

Start your search with SMBmarket(.)com.

You'll see terms like:

• Price (how much it is)

• Revenue (incoming cash)

• Cashflow (profit - expenses)

Adjust the filters to your liking.

Step 2: Discover Your Type.

There are 1,000s of businesses to choose from.

Ask yourself:

• What businesses do I visit often?

• Which industries do I like?

• What has longevity?

And you aren't limited to one type either.

There are 1,000s of businesses to choose from.

Ask yourself:

• What businesses do I visit often?

• Which industries do I like?

• What has longevity?

And you aren't limited to one type either.

Step 3: Determine Your Goal.

Every investor is different.

If you want a more "hands-on" experience, something like a parking lot might not be for you.

Determine what you're looking for.

Then get after it.

Every investor is different.

If you want a more "hands-on" experience, something like a parking lot might not be for you.

Determine what you're looking for.

Then get after it.

Step 4: Set Your Financing.

Let's figure out your acquisition strategy.

These questions will help:

• Are you buying outright?

• Do you need a bank to finance?

• Are you bringing an investor with you?

I like to work with investors so I can do the deal with $0 out of pocket.

Let's figure out your acquisition strategy.

These questions will help:

• Are you buying outright?

• Do you need a bank to finance?

• Are you bringing an investor with you?

I like to work with investors so I can do the deal with $0 out of pocket.

Step 5: Start Making Calls.

The more calls the merrier.

Steal these tips:

• Jot down as many notes as you can

• Know that you have the power

• Forget about the emotions

The more calls the merrier.

Steal these tips:

• Jot down as many notes as you can

• Know that you have the power

• Forget about the emotions

Step 6: Make an Offer.

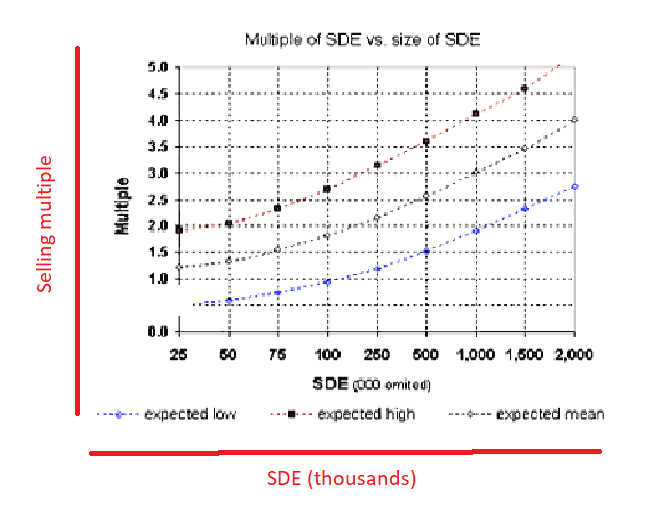

Now, you MUST look at the last 3 years of "owner's total profit" (SDE).

Multiply the average by 2x-4x (deal dependent).

• Round down

• Make your offer

• Negotiate and wait

Practice expectation management.

Now, you MUST look at the last 3 years of "owner's total profit" (SDE).

Multiply the average by 2x-4x (deal dependent).

• Round down

• Make your offer

• Negotiate and wait

Practice expectation management.

Step 7: Structure The Purchase.

So I just mentioned that I like to do these deals with $0 out of my own pocket.

(Yes, it is possible).

Find an investor willing to put up the downpayment and give them more equity in return.

The extra cash flow will cover you.

So I just mentioned that I like to do these deals with $0 out of my own pocket.

(Yes, it is possible).

Find an investor willing to put up the downpayment and give them more equity in return.

The extra cash flow will cover you.

Step 8: Do Your Due Diligence.

This is actually the most important part because you haven't closed yet.

Make sure you:

• Hire an accountant

• Talk to the employees

• Find a like-minded owner

• Check out their social media

Do NOT get lazy here, this is vital.

This is actually the most important part because you haven't closed yet.

Make sure you:

• Hire an accountant

• Talk to the employees

• Find a like-minded owner

• Check out their social media

Do NOT get lazy here, this is vital.

Step 9: Create a Post-Close Plan.

The first 3 months of ownership will set the tone for your success (this is huge).

You'll need:

• Insurance

• Email access

• Website control

• Employee contracts

• Social media accounts

Just to name a few things...

The first 3 months of ownership will set the tone for your success (this is huge).

You'll need:

• Insurance

• Email access

• Website control

• Employee contracts

• Social media accounts

Just to name a few things...

Step 10: Exhale and Close.

It's time to put the pen to the paper!

Congratulations.

You've done the due diligence.

You've done the research.

You've done the work.

Your generational wealth journey has begun...

It's time to put the pen to the paper!

Congratulations.

You've done the due diligence.

You've done the research.

You've done the work.

Your generational wealth journey has begun...

I own 7 boring businesses that generate $7M+ per year.

If you want to learn how I've found and structured these deals so that you can buy one for yourself...

📲 DM me "Biz" and I'll show you how

🤝 Follow me → @benkellyone for more

If you want to learn how I've found and structured these deals so that you can buy one for yourself...

📲 DM me "Biz" and I'll show you how

🤝 Follow me → @benkellyone for more

• • •

Missing some Tweet in this thread? You can try to

force a refresh