A federal lawsuit just exposed the biggest 401(k) scam in history.

$62 million was stolen from workers through hidden fees.

They are destroying your nest egg, and you don't even know it's happening.

Here's how employers legally rob your retirement:🧵

$62 million was stolen from workers through hidden fees.

They are destroying your nest egg, and you don't even know it's happening.

Here's how employers legally rob your retirement:🧵

It began when employees noticed something suspicious:

Their 401(k) recordkeeping fees were nearly TRIPLE the market rate.

While other companies paid 0.05% for administration, Lockheed employees paid 0.15%+.

On a $100,000 balance, that's an extra $1,000 annually. Pure theft.

Their 401(k) recordkeeping fees were nearly TRIPLE the market rate.

While other companies paid 0.05% for administration, Lockheed employees paid 0.15%+.

On a $100,000 balance, that's an extra $1,000 annually. Pure theft.

2006-2015: Nine years of legal discovery revealed the systematic exploitation:

Lockheed Martin was:

- Allowing excessive investment fees

- Keeping retirement assets in low-yield State Street accounts

- Choosing providers based on business relationships

The evidence?

Lockheed Martin was:

- Allowing excessive investment fees

- Keeping retirement assets in low-yield State Street accounts

- Choosing providers based on business relationships

The evidence?

Attorney Jerry Schlichter's team uncovered the smoking gun:

State Street Bank wasn't just managing 401(k) assets.

They had multiple business dealings with Lockheed Martin worth millions.

Your employer was getting kickbacks while your retirement got pillaged.

State Street Bank wasn't just managing 401(k) assets.

They had multiple business dealings with Lockheed Martin worth millions.

Your employer was getting kickbacks while your retirement got pillaged.

The math revealed the true scale of theft:

- Over 150,000 Lockheed employees and retirees affected.

- $30 million+ lost to excessive recordkeeping fees alone.

- Revenue-sharing agreements that benefited everyone except employees.

The aftermath?

- Over 150,000 Lockheed employees and retirees affected.

- $30 million+ lost to excessive recordkeeping fees alone.

- Revenue-sharing agreements that benefited everyone except employees.

The aftermath?

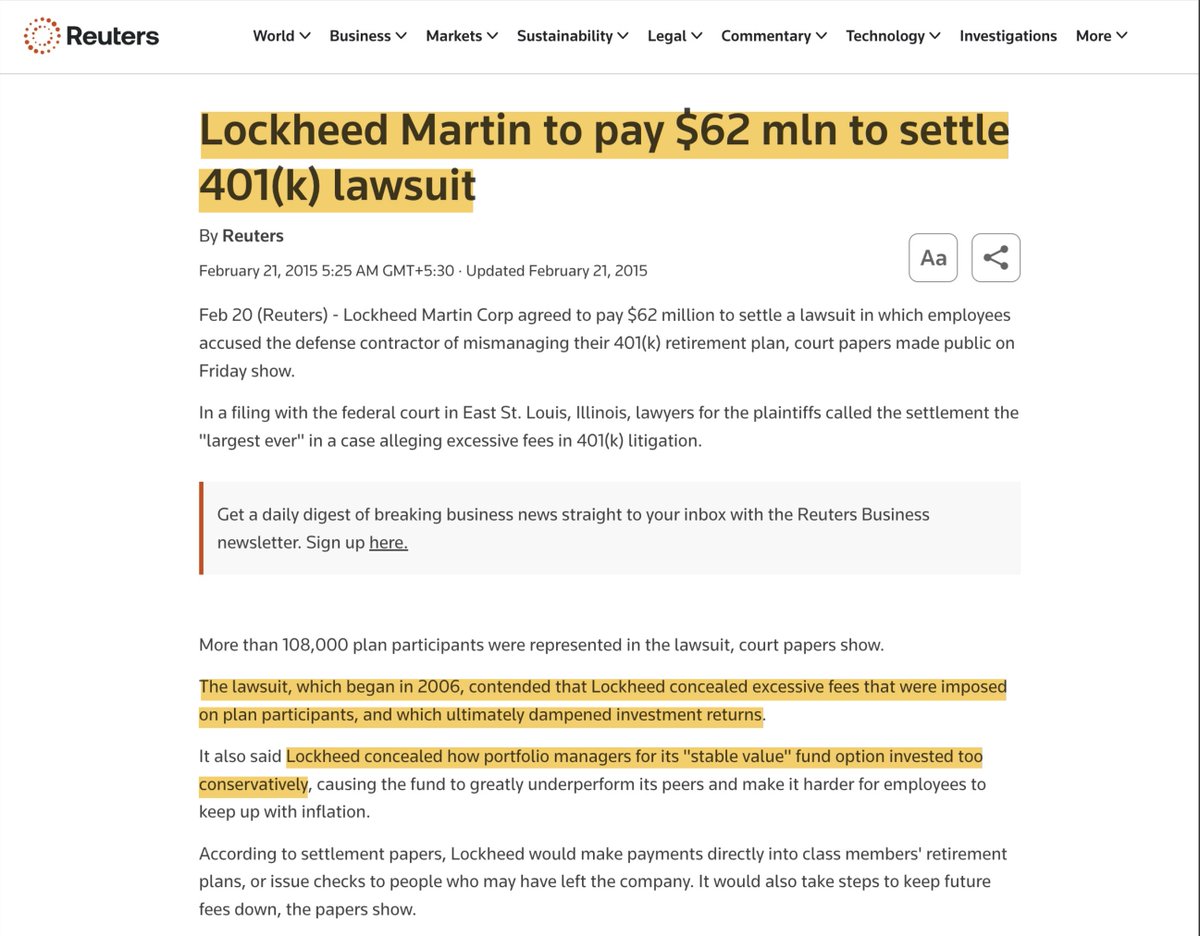

February 2015: Lockheed Martin agreed to pay $62 million.

The largest single-employer 401(k) fee settlement in US history.

But here's the terrifying part: This wasn't unique to Lockheed.

It was standard practice across corporate America.

The largest single-employer 401(k) fee settlement in US history.

But here's the terrifying part: This wasn't unique to Lockheed.

It was standard practice across corporate America.

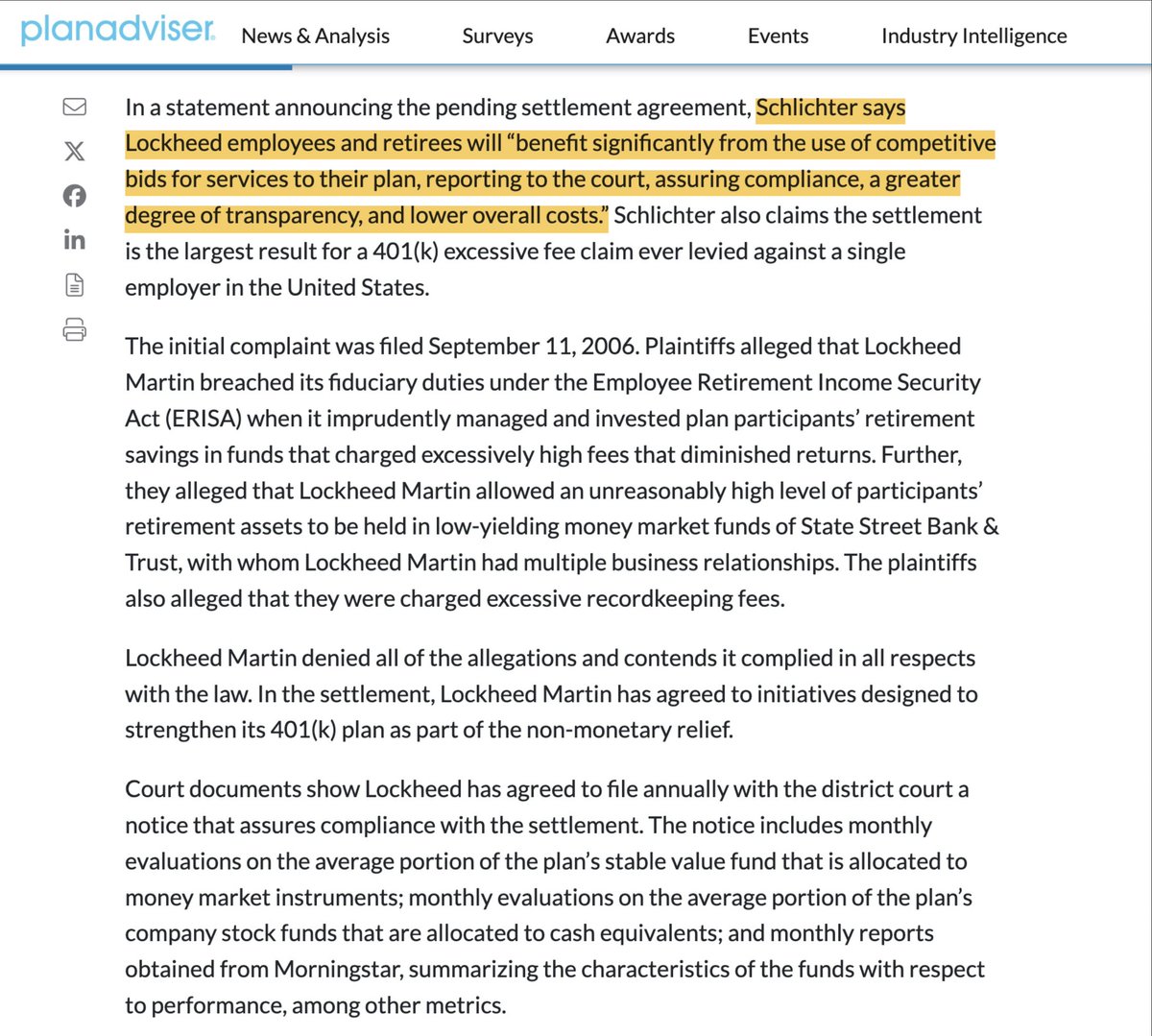

The settlement required Lockheed to implement:

- Competitive bidding for all 401(k) services

- Fee transparency reports for participants

- Lower-cost investment options

Changes that should have existed from day one.

But the damage was already done...

- Competitive bidding for all 401(k) services

- Fee transparency reports for participants

- Lower-cost investment options

Changes that should have existed from day one.

But the damage was already done...

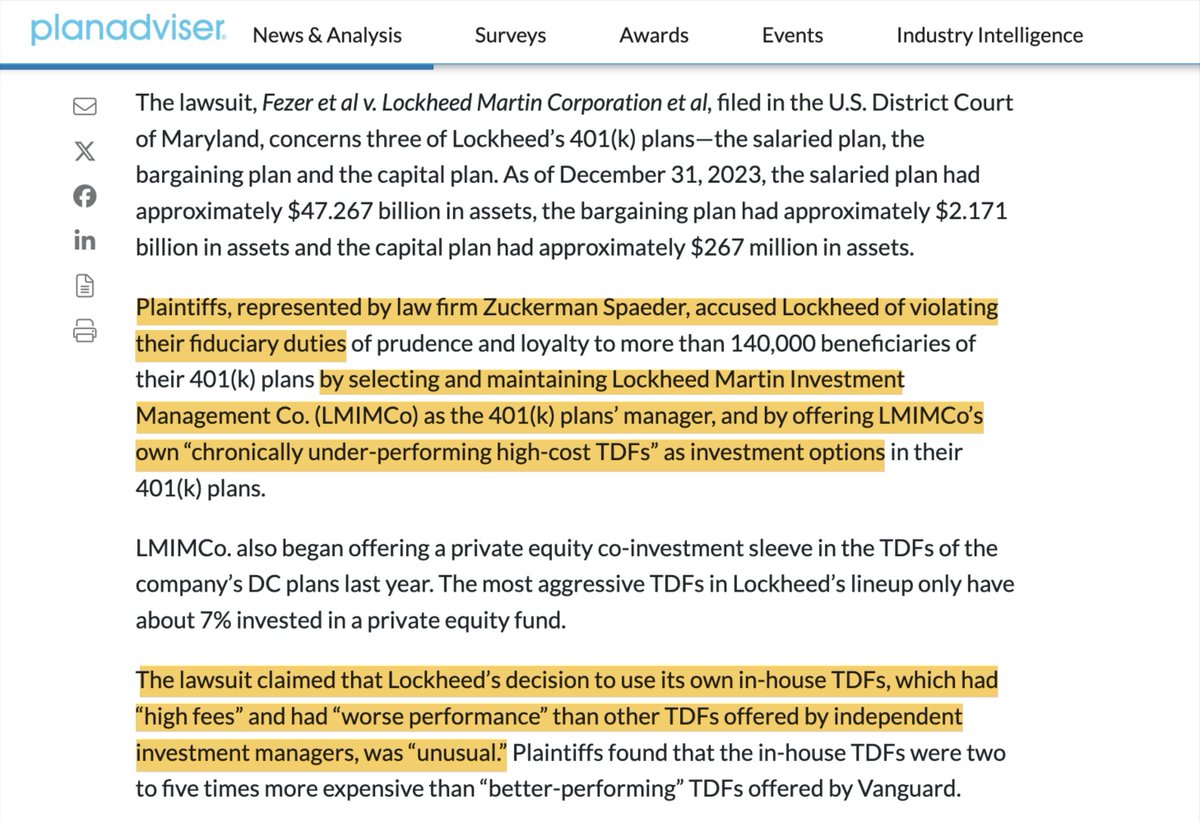

The Lockheed case triggered an avalanche of similar lawsuits:

IBM, Boeing, Caterpillar, and dozens of major employers were caught in identical schemes.

Between 2021 and 2023 alone, over 200 401(k) excessive fee lawsuits were filed.

But why is this important to you?

IBM, Boeing, Caterpillar, and dozens of major employers were caught in identical schemes.

Between 2021 and 2023 alone, over 200 401(k) excessive fee lawsuits were filed.

But why is this important to you?

If it happened at Lockheed Martin, it's happening at your company too.

Your 401(k) provider is using the same fee structure that stole $62 million from Lockheed employees.

The systematic exploitation continues unchecked across corporate America.

Let's do the math:

Your 401(k) provider is using the same fee structure that stole $62 million from Lockheed employees.

The systematic exploitation continues unchecked across corporate America.

Let's do the math:

$75,000 salary contributing 6% annually ($4,500)

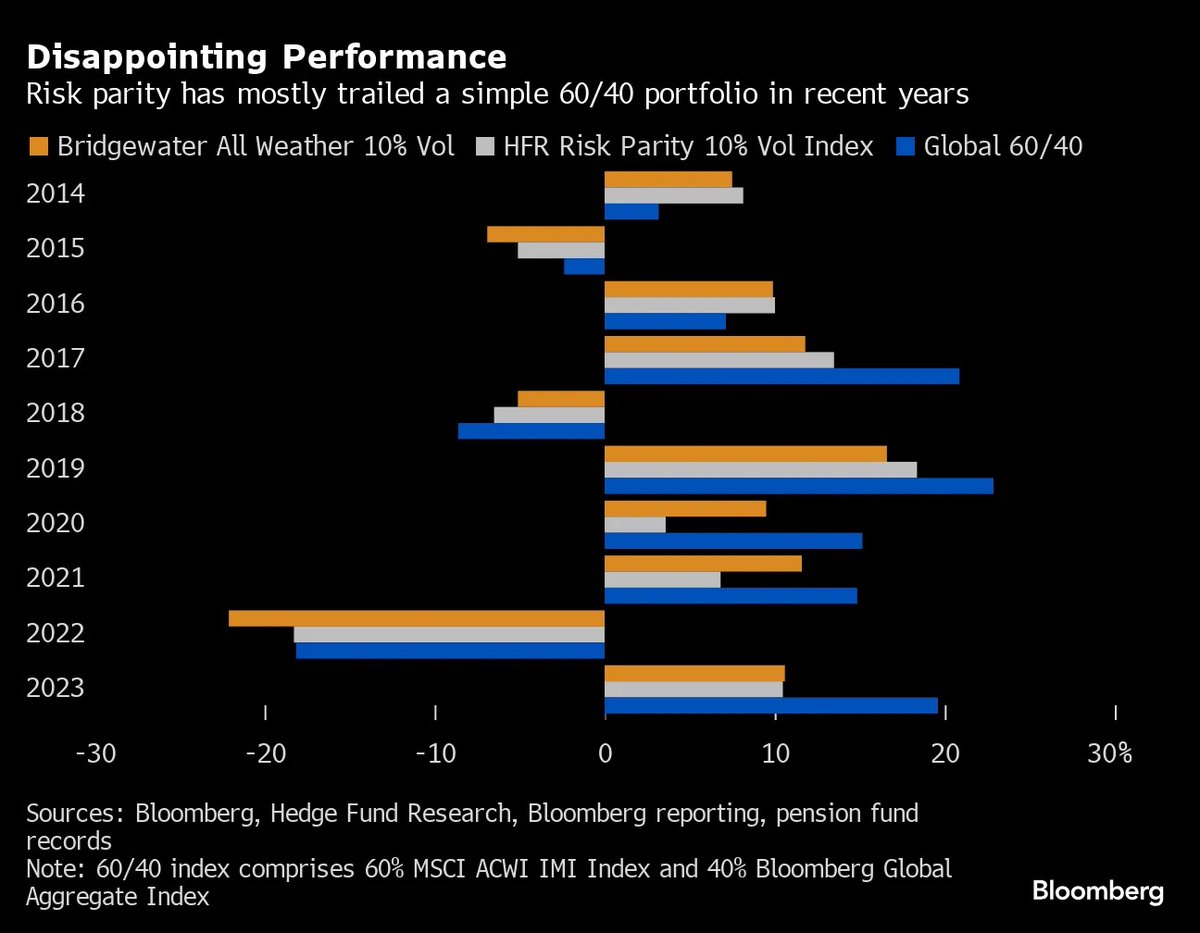

High-fee 401(k) with 2% total costs vs. 0.5% self-directed approach

Over 30 years: You lose $108,000+ to excessive fees.

That's not a market loss. That's theft disguised as "administration."

Here's how to spot the scam:

High-fee 401(k) with 2% total costs vs. 0.5% self-directed approach

Over 30 years: You lose $108,000+ to excessive fees.

That's not a market loss. That's theft disguised as "administration."

Here's how to spot the scam:

1. Check your 401(k) statement for total expense ratios above 1%.

2. Look for 'revenue sharing' or 'administrative fees' buried in fine print

3. See if your plan offers only expensive actively managed funds

4. Notice if cheaper index fund options are mysteriously absent

2. Look for 'revenue sharing' or 'administrative fees' buried in fine print

3. See if your plan offers only expensive actively managed funds

4. Notice if cheaper index fund options are mysteriously absent

Smart investors learned the lesson from Lockheed Martin:

Your employer's 401(k) is designed to extract wealth, not build it.

Self-directed IRAs eliminate the conflicts of interest and hidden fees.

But most employees never discover that this option exists:

Your employer's 401(k) is designed to extract wealth, not build it.

Self-directed IRAs eliminate the conflicts of interest and hidden fees.

But most employees never discover that this option exists:

Tired of high-fee advisors who underdeliver?

Our FREE weekly newsletter teaches:

- How to spot hidden portfolio fees

- Macro trends Wall Street hides

- Independent investing strategies

Subscribe here for FREE: dalyam.beehiiv.com

Our FREE weekly newsletter teaches:

- How to spot hidden portfolio fees

- Macro trends Wall Street hides

- Independent investing strategies

Subscribe here for FREE: dalyam.beehiiv.com

If you found this helpful consider:

- RTing the tweet below

- Following me @DalyAManagement

Thanks for reading.

- RTing the tweet below

- Following me @DalyAManagement

Thanks for reading.

https://twitter.com/1897772264696799232/status/1969038833896559010

• • •

Missing some Tweet in this thread? You can try to

force a refresh