As we progress into the end of September, there are several critical things to reflect on and look forward to in order to understand WHERE we are in the macro regime

The credit cycle is causing equities to melt up, but risks are building

Let's dig in 🧵👇

The credit cycle is causing equities to melt up, but risks are building

Let's dig in 🧵👇

First, as we came into the month of September, everyone was predicting a lower stock market because of the arbitrary seasonality. As I laid out in this video, this was HIGHLY unlikely given the macro flows.

If you don't know why a seasonality effect is taking place, you have no edge in monetizing it.

If you don't know why a seasonality effect is taking place, you have no edge in monetizing it.

https://x.com/Globalflows/status/1962885876880711805

Second, the credit cycle remains in full force and will ALWAYS outweigh seasonality if the macro catalysts are aligned for positioning to readjust. We saw this exact thing from FOMC this past week. The most important video I've recorded this month showed that the Fed is clearly cutting into resilient growth and inflation above 2%. This inherently increases the probability of inflation as opposed to recession.

x.com/Globalflows/st…

x.com/Globalflows/st…

Third, the credit cycle is so strong right now that even as interest rates are at a higher level, the Russell is about to hit an all time high. When capital moves out the risk curve like this, it shows we are beginning to approach the mid cycle/late cycle dynamics where you need to watch for WHEN liquidity flows become unsustainable. I laid out the 3 signals to watch for that will indicate WHEN the bear market is likely to begin.

x.com/Globalflows/st…

x.com/Globalflows/st…

Fourth, people like Cathie Wood are making money which primarily happens when excess liquidity exists in the system.. This isnt a top signal but an important piece of data to take into account. Just think 2021 as the parallel.

https://x.com/Globalflows/status/1968500919277891875

Fifth, real rates continue to fall which is one of the primary froces pushing capital out the risk curve. If these begin to reverse, it will be a key signal for going to cash.

https://x.com/Globalflows/status/1968368393809182991

This is bring everything to the end game where the Fed is operating between two tensions and the probability of them making a policy error is increasing!

https://x.com/Globalflows/status/1968732134350127356

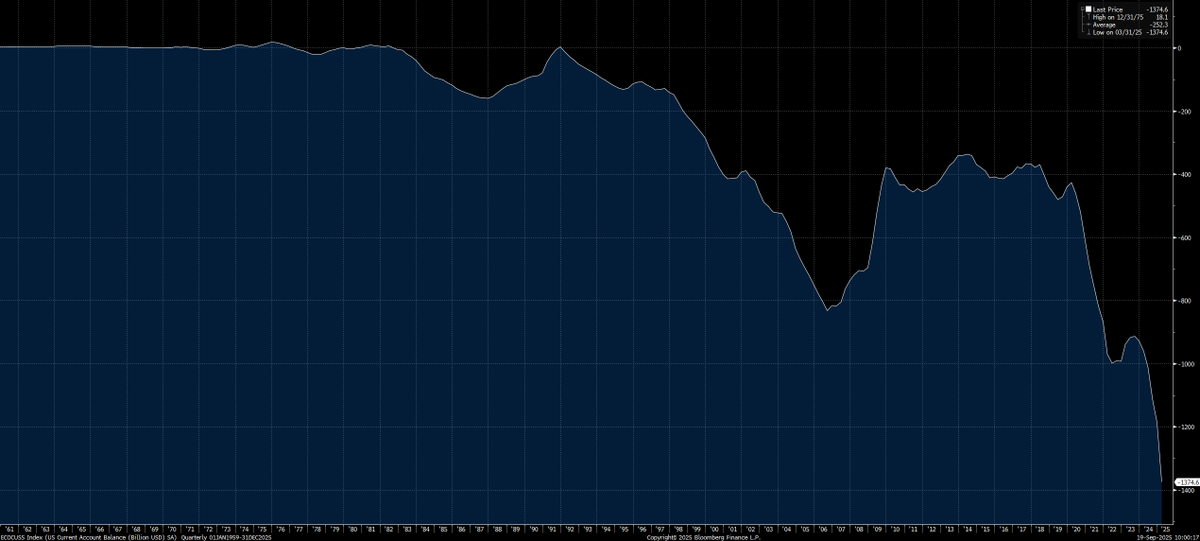

This is why there is greater risk of problems in long end rates or the currency. This is directly linked with crossborder flows. If foreigners begin to sell, the Fed can't do anything about it.

https://x.com/Globalflows/status/1968737324168052990

This is why the next actions of the Fed will be so important, because if they continue to cut AND indicate more dovishness for 2026, this is what creates massive risks for inflation and long end rates.

https://x.com/Globalflows/status/1968738116014891113

I have laid out all of the research and credit cycle playbooks in the most recent video/report here: capitalflowsresearch.com/p/the-largest-…

All the educational primers are here: capitalflowsresearch.com/p/research-syn…

Bottom line, we remain skewed to the upside in equities and I remain long. However, risks are building and there will be a time soon when going to cash and then shorting the market will come.

For now, we melt up

For now, we melt up

When my strategy flips neutral or short equities, I will immediately publish a report on the website

• • •

Missing some Tweet in this thread? You can try to

force a refresh