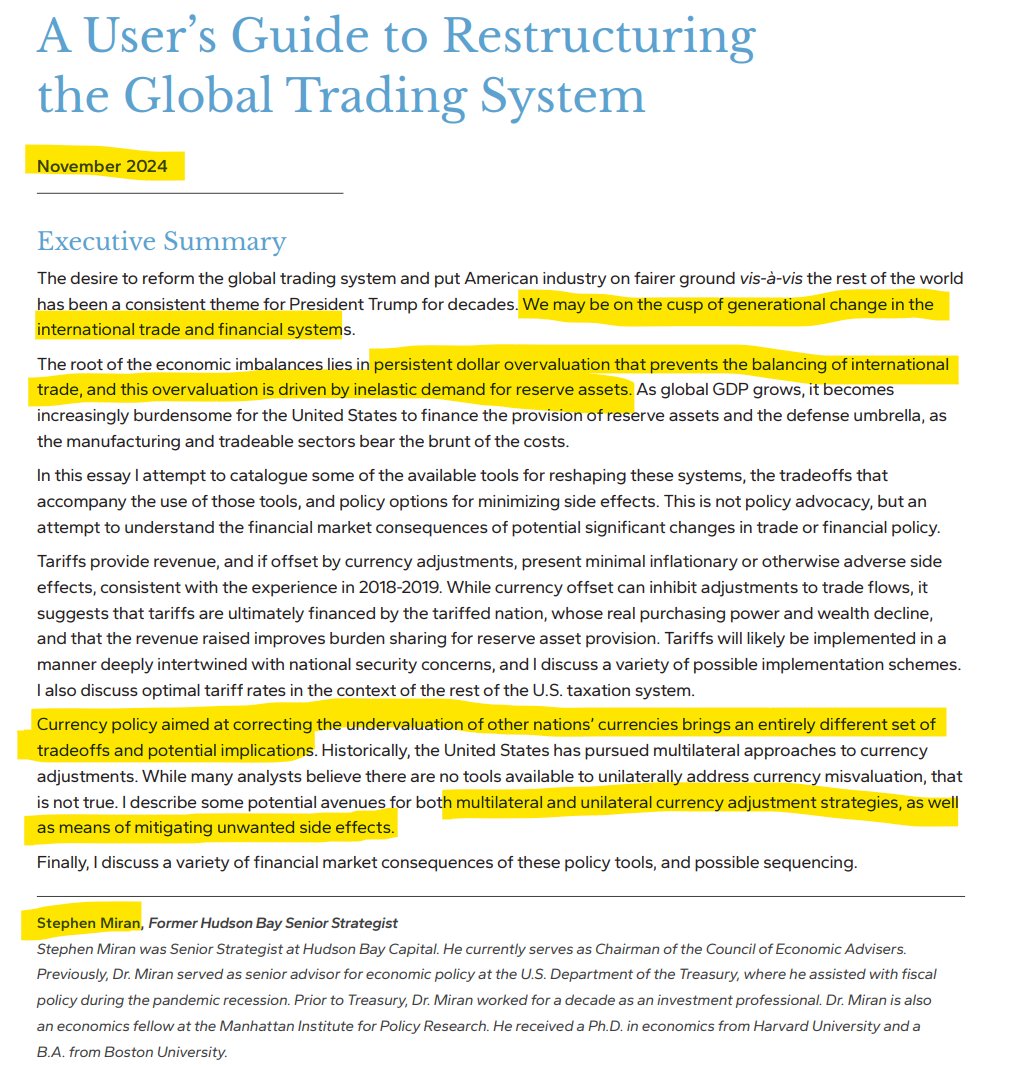

The current administration is addressing the actual imbalances that exist from the dollar's reserve currency status

@SteveMiran is now in a position of influence on the political side and the monetary side

This has implications for politics, markets, the Fed, and midterms🧵

@SteveMiran is now in a position of influence on the political side and the monetary side

This has implications for politics, markets, the Fed, and midterms🧵

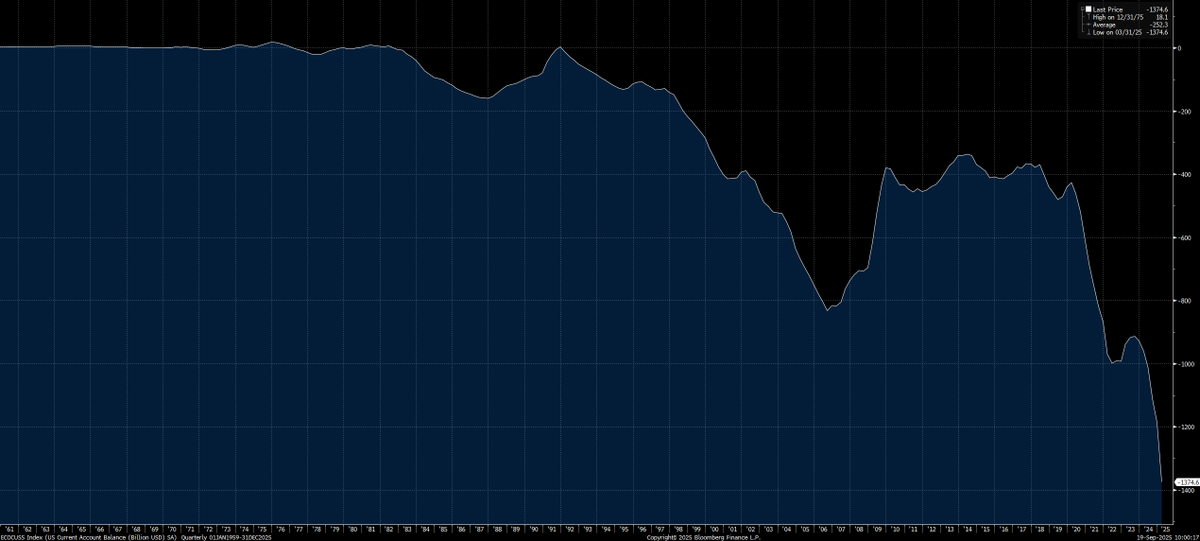

The current account in the US has been in free fall for years now which represents the entire import/export relationship.

In simple terms, the US imports way more than it exports.

In simple terms, the US imports way more than it exports.

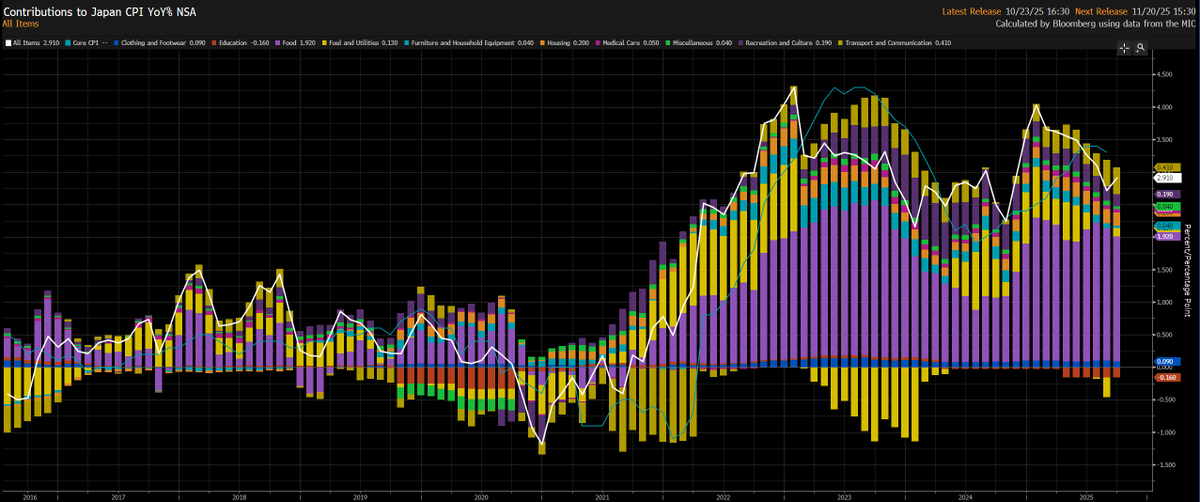

The system incentivizes other countries to suppress consumption at home in order to run trade surpluses and build dollar reserves:

- Countries like Germany and China deliberately depress wages and household consumption to create large savings surpluses.

- These surpluses are exported in the form of capital outflows, which must be matched by U.S. capital inflows and thus trade deficits.

- This means American workers and firms are systematically undercut by foreign producers with artificially low costs, worsening inequality in the U.S.

- Countries like Germany and China deliberately depress wages and household consumption to create large savings surpluses.

- These surpluses are exported in the form of capital outflows, which must be matched by U.S. capital inflows and thus trade deficits.

- This means American workers and firms are systematically undercut by foreign producers with artificially low costs, worsening inequality in the U.S.

Because the U.S. economy is forced to absorb global surpluses:

- American households and the government borrow more to maintain demand.

- The inflow of cheap foreign capital inflates asset prices, creating bubbles in housing, stocks, and credit.

- This leads to a fragile domestic economy, overly reliant on debt-fueled consumption and financial markets.

- American households and the government borrow more to maintain demand.

- The inflow of cheap foreign capital inflates asset prices, creating bubbles in housing, stocks, and credit.

- This leads to a fragile domestic economy, overly reliant on debt-fueled consumption and financial markets.

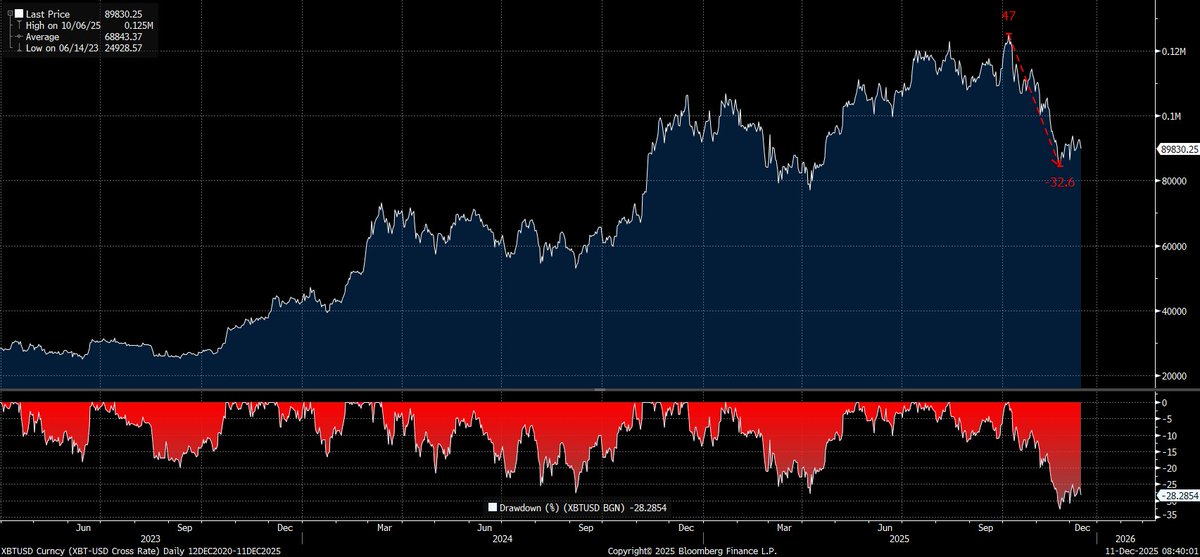

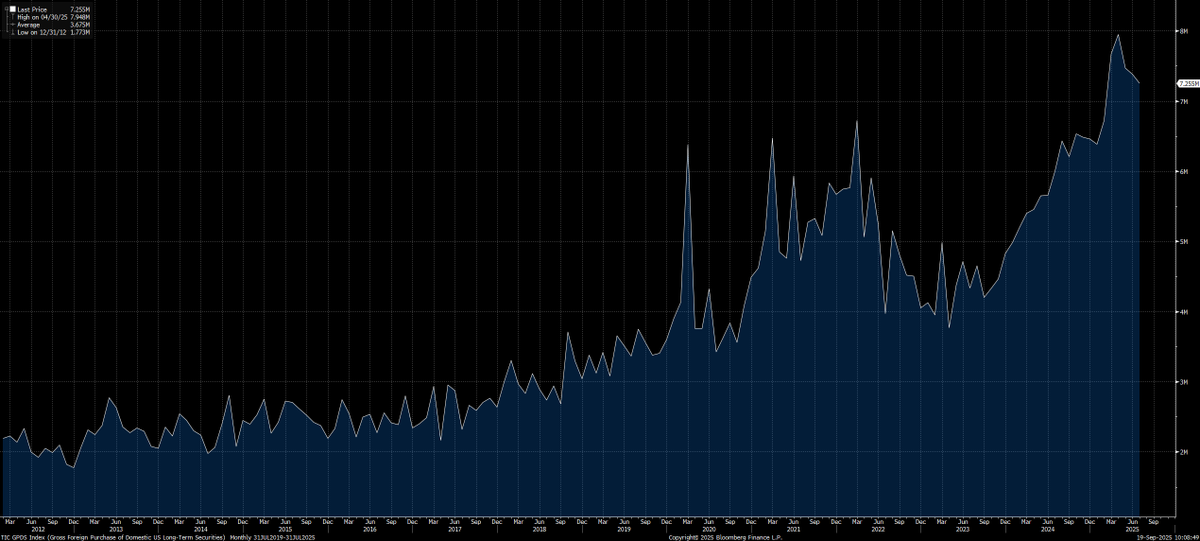

The purchase of US securities by foreigners has become a massive factor in US markets as a result of this: (Chart below shows gross purchase of US securities)

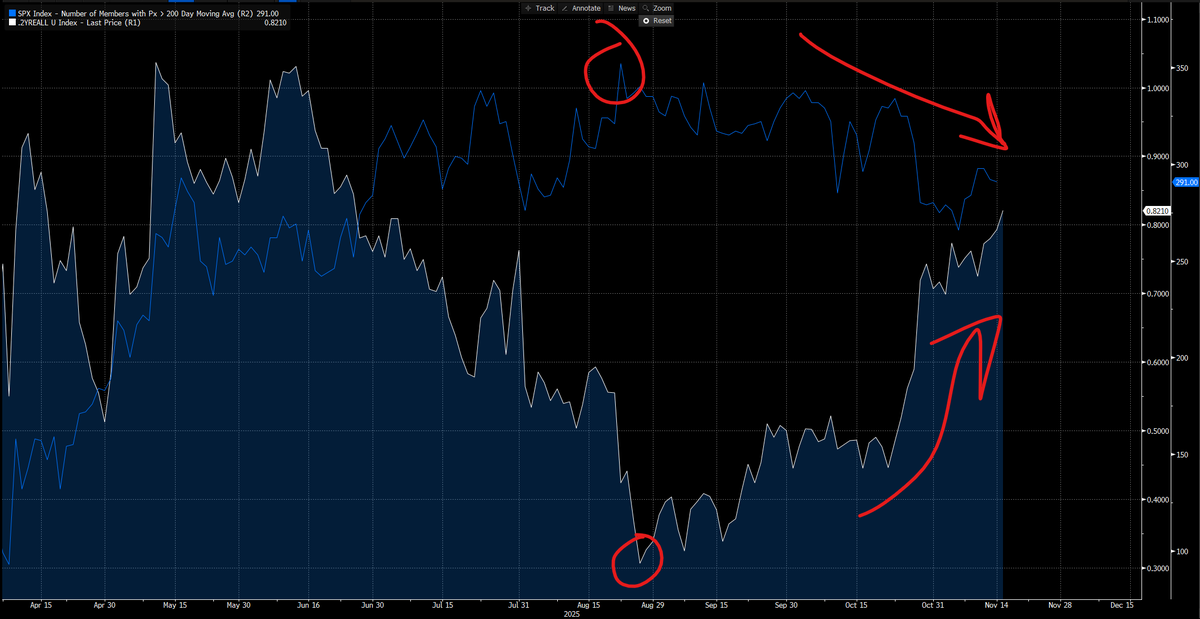

On net, this has created a massive long position by foreigners in US markets. In simple terms, imagine a massive hedge fund that is long the US. It is possible for them to buy more or have to sell, depending on their liquidity constraints.

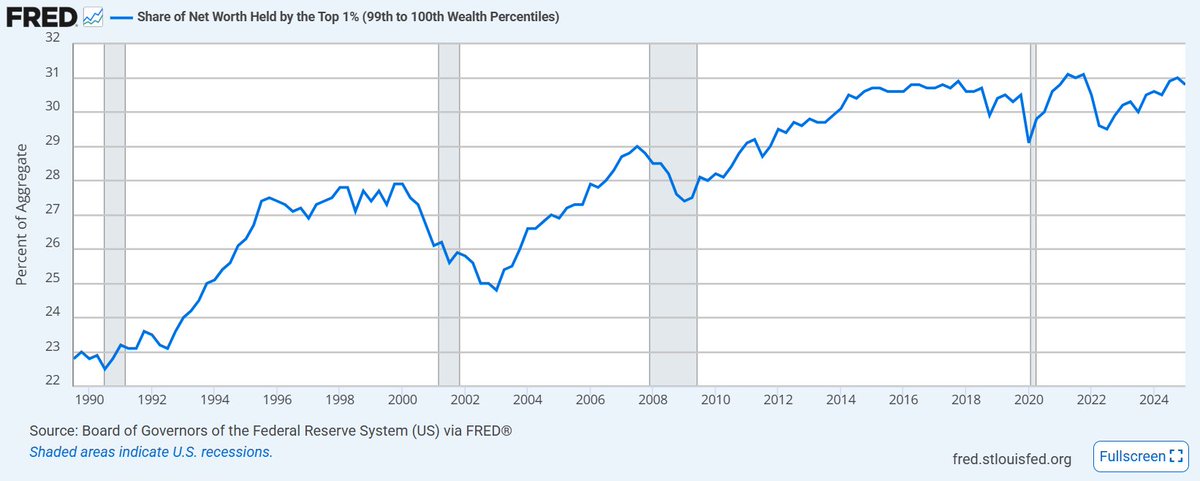

These dynamics don’t affect all Americans equally:

- Owners of capital benefit from asset price inflation and globalization.

- Workers face job insecurity and wage stagnation, especially in manufacturing.

- The U.S. ends up with internal class warfare, as the reserve currency status acts like a reverse wealth transfer—from labor to capital.

- Owners of capital benefit from asset price inflation and globalization.

- Workers face job insecurity and wage stagnation, especially in manufacturing.

- The U.S. ends up with internal class warfare, as the reserve currency status acts like a reverse wealth transfer—from labor to capital.

The political division we see in the United States today is directly linked to the financial imbalances! This is why we see inequality exists.

The @DOGE dynamic we saw earlier this year by @elonmusk was an important and critical step toward visibility. The larger macro constraints for any spending exist in the financial imbalances.

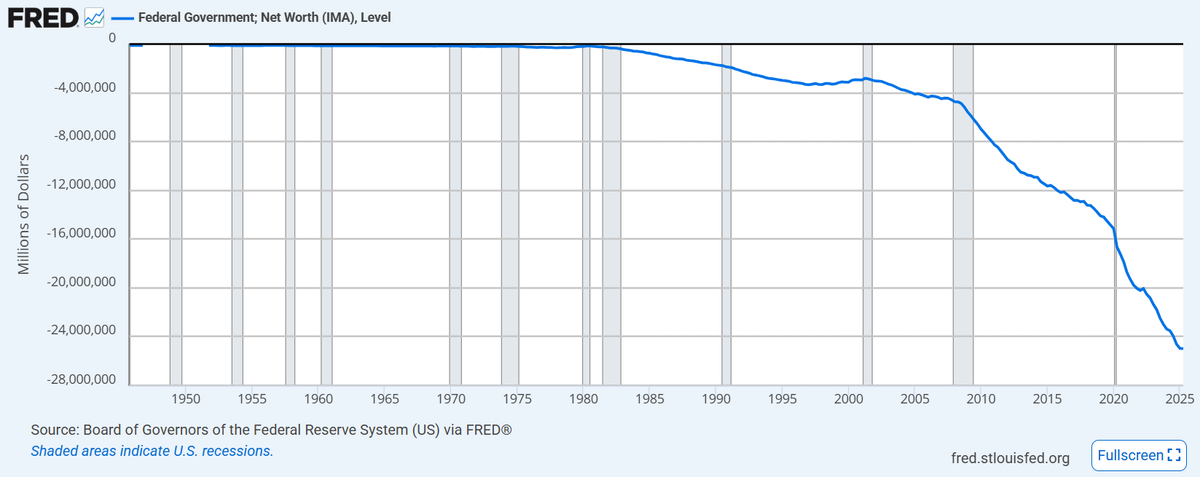

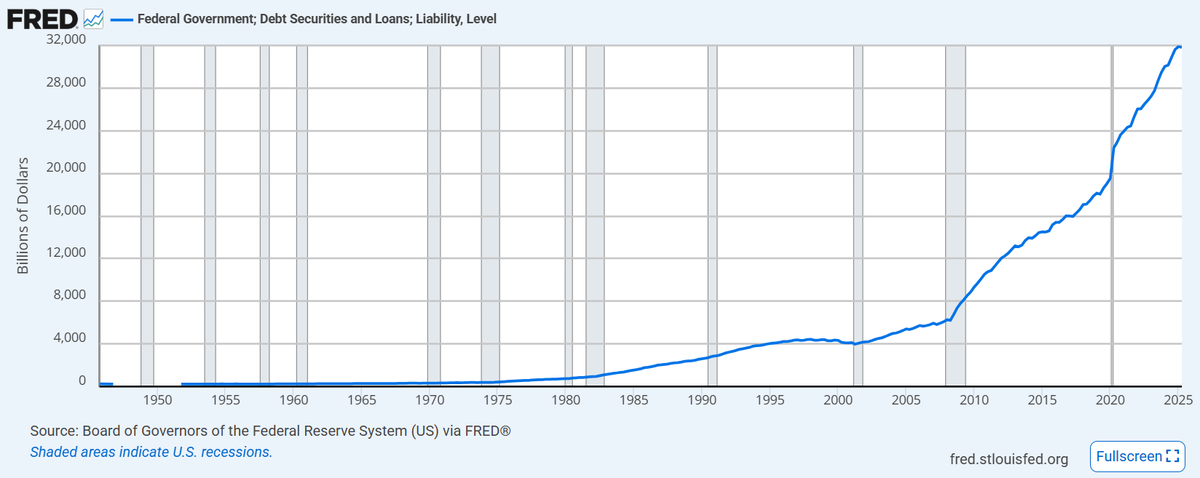

The government spending we have seen is only increasing and directly linked with the dollar's reserve currency status (chart below shows government expenditures)

When foreign capital floods into the U.S., someone must borrow and spend it. If the U.S. government doesn’t run a fiscal deficit, the private sector is forced to do so instead, often through:

In simple terms, when we have a massive financial imbalance with cheap capital flowing, the government or private sector needs to take on the debt. In the run up to the GFC, the private sector took on the debt which created a housing bubble. After 2008, the government took on all the debt

In simple terms, when we have a massive financial imbalance with cheap capital flowing, the government or private sector needs to take on the debt. In the run up to the GFC, the private sector took on the debt which created a housing bubble. After 2008, the government took on all the debt

This is WHY the trade policy and changes are critical to understand. This is where many of the issues lie.

If this issue is truly fixed, it will literally change the world.

If this issue is truly fixed, it will literally change the world.

The problem is that not enough people are aware of the actual issues due to their complexity. On top of this, the entire situation is politically charged, which is actually a reflection of the inequality and imbalances that exist!

If we can have a dramatic change, it would fundamentally improve the entire financial system and economy.

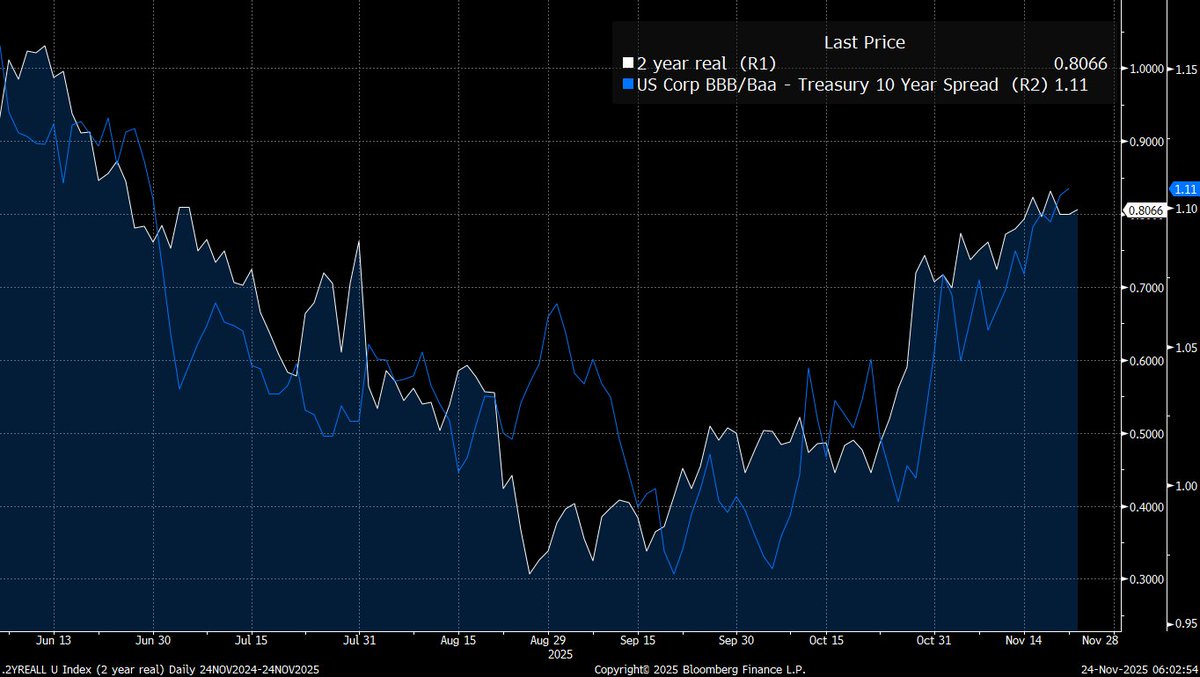

These changes require coordination of the fiscal and monetary sides, which are beginning to take place

These changes require coordination of the fiscal and monetary sides, which are beginning to take place

As we approach midterms, the most important talking point should revolve around the financial/trade imbalances the US has, how the Fed is moving policy toward this solution, and how this change will boost the real incomes of consumers so inequality falls.

This is THE ONLY WAY to grow out of the amount of debt we have in the system right now. It is impossible to inflate away the debt or grow out of the debt unless the structural imbalance is reversed.

The inflation and higher interest rates over the last 3 years only made the debt issue worse.

The only way forward is addressing the root causes.

The inflation and higher interest rates over the last 3 years only made the debt issue worse.

The only way forward is addressing the root causes.

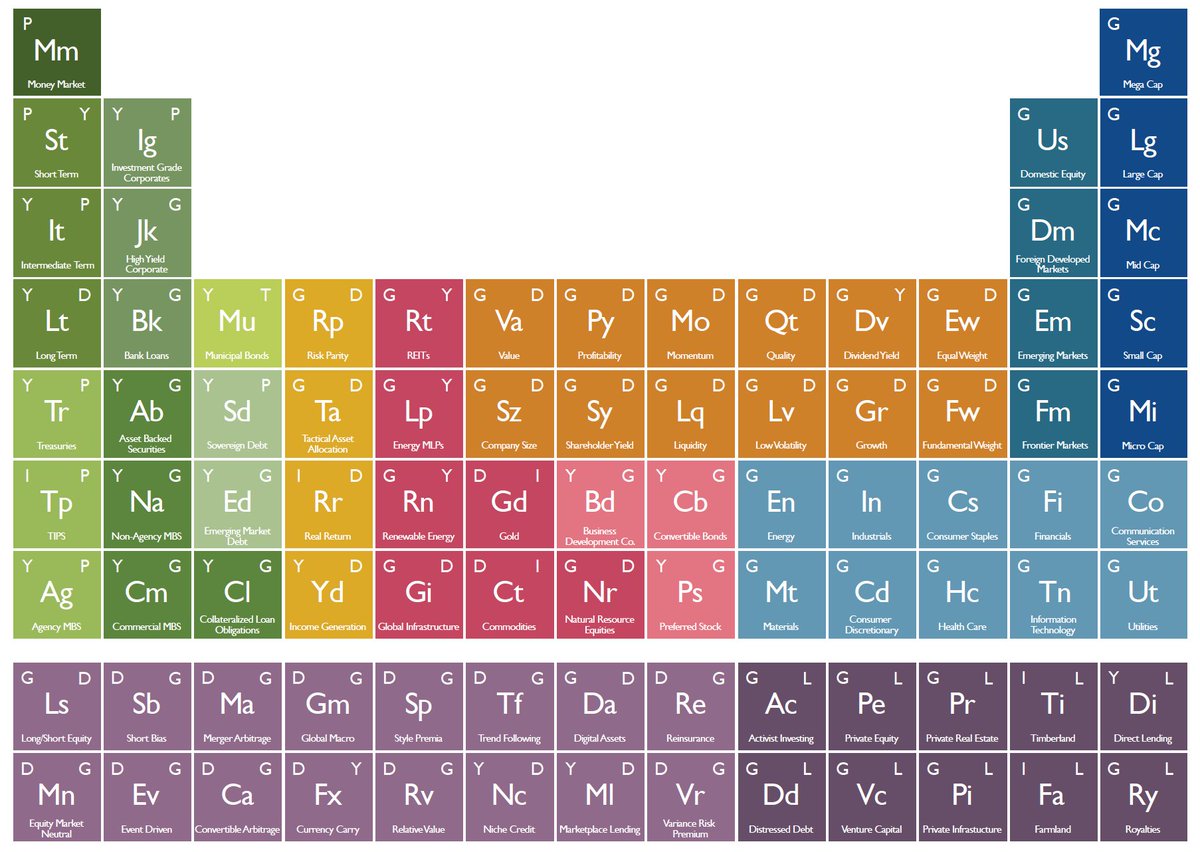

I laid out the full market implications for all of these flows in a comprehensive report that can be found here: capitalflowsresearch.com/p/macro-report…

• • •

Missing some Tweet in this thread? You can try to

force a refresh