🚨 THE $25 XRP ENDGAME IS SET 🚨

It’s September 2025.

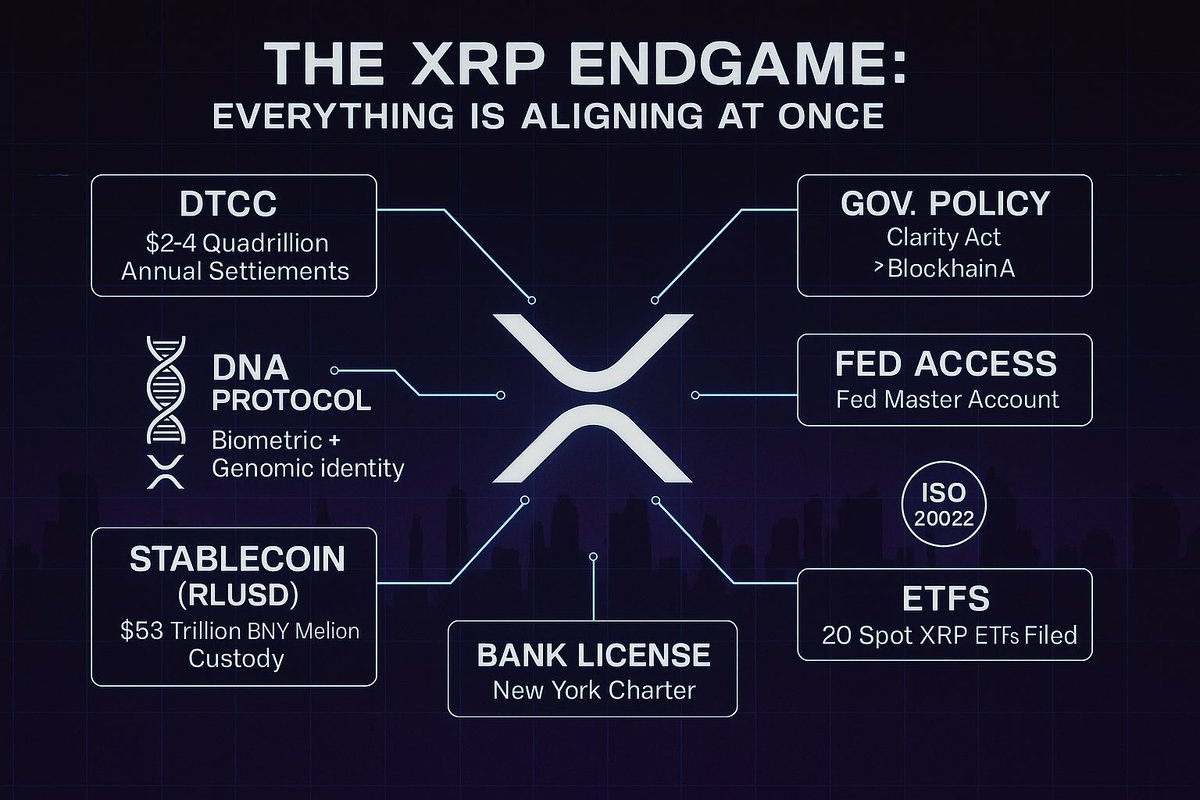

The dominos are aligned.

The clock is ticking.

And if everything proceeds as planned… XRP will hit $25+ by December 2025.

Let’s connect the dots 👇🧵

It’s September 2025.

The dominos are aligned.

The clock is ticking.

And if everything proceeds as planned… XRP will hit $25+ by December 2025.

Let’s connect the dots 👇🧵

1/ The Lawsuit is Over. The Rails Are Open.

After 5 brutal years, Ripple crushed the SEC.

XRP now has the strongest legal clarity in U.S. history.

This is why banks, funds, and corporates are finally stepping in, they know it’s legally bulletproof.

After 5 brutal years, Ripple crushed the SEC.

XRP now has the strongest legal clarity in U.S. history.

This is why banks, funds, and corporates are finally stepping in, they know it’s legally bulletproof.

2/ ETF Frenzy, October Is Key

Nearly 20 Spot XRP ETFs are filed.

Polymarket odds show 93% likelihood of approval by mid-October.

ETFs = Trillions in institutional liquidity unlocked.

This is the true Wall Street ignition moment.

Nearly 20 Spot XRP ETFs are filed.

Polymarket odds show 93% likelihood of approval by mid-October.

ETFs = Trillions in institutional liquidity unlocked.

This is the true Wall Street ignition moment.

3/ RLUSD Is Spreading

Ripple’s stablecoin RLUSD is live in the U.S., expanding into Japan (Q1 2026) via SBI.

Backed by U.S. Treasuries + bank deposits, audited monthly.

This makes XRP Ledger the settlement backbone for institutions.

Ripple’s stablecoin RLUSD is live in the U.S., expanding into Japan (Q1 2026) via SBI.

Backed by U.S. Treasuries + bank deposits, audited monthly.

This makes XRP Ledger the settlement backbone for institutions.

4/ Ripple Becoming a Bank

New York Banking Charter = almost done.

Fed Master Account = pending.

When approved, Ripple becomes a sovereign-level bank plugged into the Fed’s settlement system.

This isn’t crypto hype. This is structural power.

New York Banking Charter = almost done.

Fed Master Account = pending.

When approved, Ripple becomes a sovereign-level bank plugged into the Fed’s settlement system.

This isn’t crypto hype. This is structural power.

5/ Legacy Finance Plugging In

Franklin Templeton → XRPL tokenized funds.

DBS → Ripple + RLUSD rollout in Asia.

BBVA → custody built on Ripple rails.

This is how trillion-dollar players are onboarding. Quietly, but irreversibly.

Franklin Templeton → XRPL tokenized funds.

DBS → Ripple + RLUSD rollout in Asia.

BBVA → custody built on Ripple rails.

This is how trillion-dollar players are onboarding. Quietly, but irreversibly.

6/ The Macro Backdrop

$35 TRILLION U.S. debt.

Dollar trust collapsing.

BIS + IMF openly calling for blockchain rails.

The U.S. Treasury testing digital ID + KYC rails on blockchain.

Which ledger already has DNA anchoring + zk privacy for KYC? XRP. ()xdna.dnaprotocol.org

$35 TRILLION U.S. debt.

Dollar trust collapsing.

BIS + IMF openly calling for blockchain rails.

The U.S. Treasury testing digital ID + KYC rails on blockchain.

Which ledger already has DNA anchoring + zk privacy for KYC? XRP. ()xdna.dnaprotocol.org

/END

September 2025 marks the calm before the storm.

By December, XRP could break $25 and rewrite financial history.

Those who position now will own the asymmetric upside of a century.

Follow me on Telegram for what comes next:

t.me/alexanderthewh…

September 2025 marks the calm before the storm.

By December, XRP could break $25 and rewrite financial history.

Those who position now will own the asymmetric upside of a century.

Follow me on Telegram for what comes next:

t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh