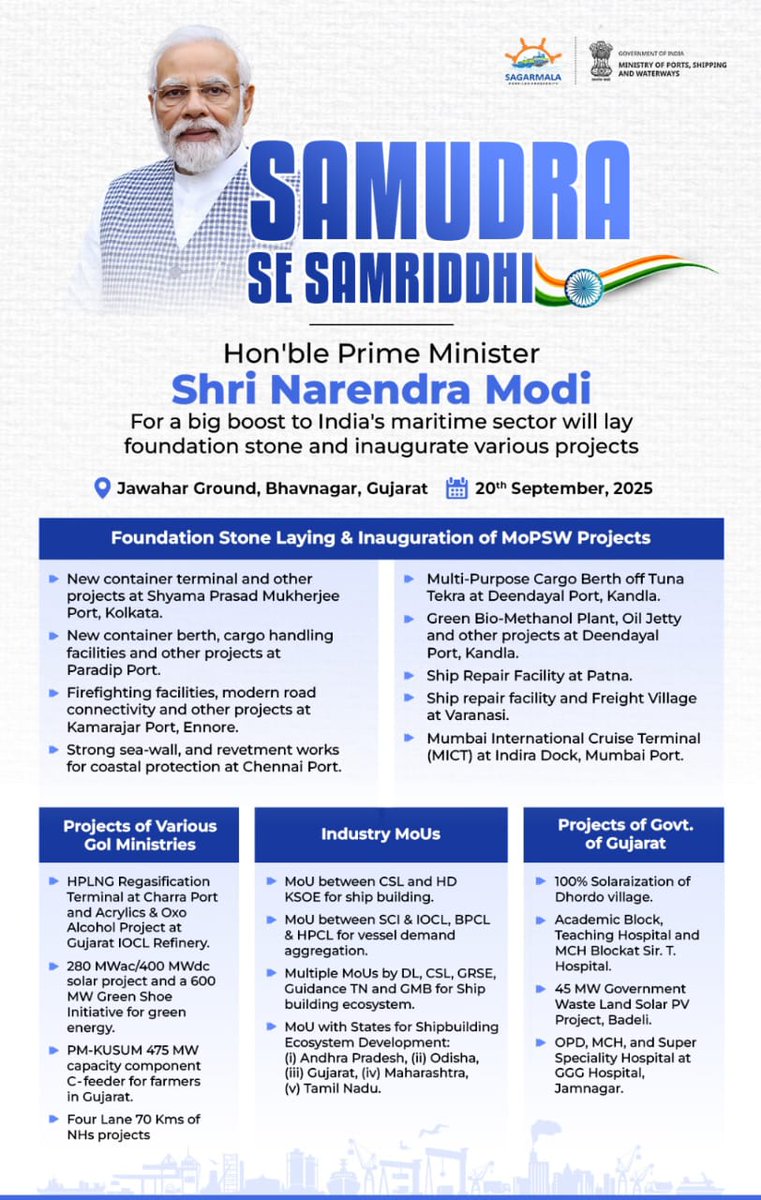

🚢🇮🇳 India’s Big Maritime Push – Samudra Se Samriddhi 🧵

🇮🇳 pays ₹6 lakh CR annually to foreign shippers.

PM Modi unveiled a historic plan to make India a global maritime power 🌍.

Here’s a complete breakdown of the projects, MoUs & listed stocks that could benefit 👇

🇮🇳 pays ₹6 lakh CR annually to foreign shippers.

PM Modi unveiled a historic plan to make India a global maritime power 🌍.

Here’s a complete breakdown of the projects, MoUs & listed stocks that could benefit 👇

🔹 Massive Infrastructure Push

New container terminals at Kolkata & Paradip

Cargo berths at Paradip & Tuna Tekra (Kandla)

Strong sea-wall & revetments at Chennai Port 🌊

Ship repair hubs at Patna & Varanasi

Mumbai International Cruise Terminal 🚢

➡️ This means more cargo handling, new trade hubs & global-scale passenger traffic.

New container terminals at Kolkata & Paradip

Cargo berths at Paradip & Tuna Tekra (Kandla)

Strong sea-wall & revetments at Chennai Port 🌊

Ship repair hubs at Patna & Varanasi

Mumbai International Cruise Terminal 🚢

➡️ This means more cargo handling, new trade hubs & global-scale passenger traffic.

🔹 Green & Energy Projects

Green Bio-Methanol Plant at Deendayal Port 🌱

HPLNG regasification terminal at Charra Port

280 MWac Solar + 600 MW Green Shoe initiative

PM-KUSUM: 475 MW solar for farmers in Gujarat

➡️ Push for cleaner shipping fuels & renewable-powered ports.

Green Bio-Methanol Plant at Deendayal Port 🌱

HPLNG regasification terminal at Charra Port

280 MWac Solar + 600 MW Green Shoe initiative

PM-KUSUM: 475 MW solar for farmers in Gujarat

➡️ Push for cleaner shipping fuels & renewable-powered ports.

🔹 Industry MoUs

Cochin Shipyard + HD KSOE (shipbuilding JV)

SCI, BPCL, HPCL, IOCL for vessel aggregation

Multiple MoUs with Cochinship, GRSE, Mazagon Dock etc.

State-level shipbuilding ecosystem pacts (AP, Odisha, Gujarat, Maharashtra, TN)

➡️ A public-private fleet building alliance in the making.

Cochin Shipyard + HD KSOE (shipbuilding JV)

SCI, BPCL, HPCL, IOCL for vessel aggregation

Multiple MoUs with Cochinship, GRSE, Mazagon Dock etc.

State-level shipbuilding ecosystem pacts (AP, Odisha, Gujarat, Maharashtra, TN)

➡️ A public-private fleet building alliance in the making.

🔹 Projects of Gujarat Govt

100% solarisation of Dhordo village

New academic + hospital infra (Jamnagar, Rajkot, Surat)

45 MW Waste Land Solar project

➡️ Gujarat doubling down as India’s maritime + green energy hub.

👇

100% solarisation of Dhordo village

New academic + hospital infra (Jamnagar, Rajkot, Surat)

45 MW Waste Land Solar project

➡️ Gujarat doubling down as India’s maritime + green energy hub.

👇

🔹 Listed Stocks to Watch

Shipping Operators: SCI, Great Eastern, Essar, Seamec, Global Offshore, ABS Marine, Sadhav, Shahi, Chowgule, Shreeji, Transworld

Shipbuilders: Cochin Shipyard, Garden Reach (GRSE), Mazagon Dock

Ports & Terminals: Adani Ports, Gujarat Pipavav, JSW Infra, Gateway Distriparks, Allcargo, Aegis Logistics/Vopak

Dredging: Dredging Corp of India

Shipping Operators: SCI, Great Eastern, Essar, Seamec, Global Offshore, ABS Marine, Sadhav, Shahi, Chowgule, Shreeji, Transworld

Shipbuilders: Cochin Shipyard, Garden Reach (GRSE), Mazagon Dock

Ports & Terminals: Adani Ports, Gujarat Pipavav, JSW Infra, Gateway Distriparks, Allcargo, Aegis Logistics/Vopak

Dredging: Dredging Corp of India

1️⃣ Shipping Operators (Shipowners & Offshore)

Shipping Corporation of India (SCI)

PSU giant, carries crude, dry bulk, containers.

✅ Upside: Govt divestment, rising crude trade.

⚠️ Risk: Global freight volatility.

Great Eastern Shipping (GESHIP)

India’s largest private shipowner. Tankers + dry bulk fleet.

✅ Upside: Freight cycle tailwinds.

⚠️ Risk: Cyclical downturn.

Essar Shipping

Dry bulk, tankers, offshore rigs.

✅ Upside: Group restructuring, asset revival.

⚠️ Debt & legacy issues.

SEAMEC Ltd

Offshore oilfield & subsea services.

✅ Upside: Offshore drilling revival.

⚠️ High dependence on crude cycles.

Global Offshore Services

Offshore support vessels for oil & gas.

✅ Upside: ONGC / global E&P activity.

⚠️ Asset-heavy, leveraged.

ABS Marine / Sadhav / Shahi/ Chowgule / Shreeji / Transworld

Smaller but niche shipping & coastal logistics players.

✅ Upside: Coastal shipping push, Sagarmala.

⚠️ Thin liquidity, small balance sheets.

Shipping Corporation of India (SCI)

PSU giant, carries crude, dry bulk, containers.

✅ Upside: Govt divestment, rising crude trade.

⚠️ Risk: Global freight volatility.

Great Eastern Shipping (GESHIP)

India’s largest private shipowner. Tankers + dry bulk fleet.

✅ Upside: Freight cycle tailwinds.

⚠️ Risk: Cyclical downturn.

Essar Shipping

Dry bulk, tankers, offshore rigs.

✅ Upside: Group restructuring, asset revival.

⚠️ Debt & legacy issues.

SEAMEC Ltd

Offshore oilfield & subsea services.

✅ Upside: Offshore drilling revival.

⚠️ High dependence on crude cycles.

Global Offshore Services

Offshore support vessels for oil & gas.

✅ Upside: ONGC / global E&P activity.

⚠️ Asset-heavy, leveraged.

ABS Marine / Sadhav / Shahi/ Chowgule / Shreeji / Transworld

Smaller but niche shipping & coastal logistics players.

✅ Upside: Coastal shipping push, Sagarmala.

⚠️ Thin liquidity, small balance sheets.

2️⃣ Shipbuilders / Repair Yards

Cochin Shipyard (COCHINSHIP)

Builds & repairs commercial + defence ships.

✅ Upside: Defence orders, cruise ship builds, exports.

⚠️ PSU delays, capex-heavy.

Garden Reach Shipbuilders(GRSE)

Defence-focused, builds warships.

✅ Upside: Defence capex boom.

⚠️ Lumpy order execution.

Mazagon Dock (MAZDOCK)

Builds submarines & destroyers.

✅ Upside: Naval modernisation.

⚠️ Long project timelines, dependence on MoD.

Cochin Shipyard (COCHINSHIP)

Builds & repairs commercial + defence ships.

✅ Upside: Defence orders, cruise ship builds, exports.

⚠️ PSU delays, capex-heavy.

Garden Reach Shipbuilders(GRSE)

Defence-focused, builds warships.

✅ Upside: Defence capex boom.

⚠️ Lumpy order execution.

Mazagon Dock (MAZDOCK)

Builds submarines & destroyers.

✅ Upside: Naval modernisation.

⚠️ Long project timelines, dependence on MoD.

3️⃣ Ports & Terminals 🌊

Adani Ports & SEZ(ADANIPORTS)

India’s largest port operator.

✅ Upside: Cargo growth, logistics integration.

⚠️ Regulatory / leverage concerns.

Gujarat Pipavav Port (GPPL)

Container + bulk terminal.

✅ Upside: Strategic location, APM Terminals backing.

⚠️ Competition from Mundra.

JSW Infrastructure (JSWINFRA)

Fastest-growing private port company.

✅ Upside: JSW group cargo, expansion.

⚠️ Customer concentration.

Gateway Distriparks

ICDs, CFS, rail logistics.

✅ Upside: DFC (Dedicated Freight Corridor) boost.

⚠️ Intense competition in container logistics.

Allcargo Terminals.

Part of Allcargo Group, CFS operator.

✅ Upside: Consolidation in CFS business.

⚠️ Volume-linked revenues.

Aegis Logistics / Aegis Vopak Terminals

Handles LPG, chemicals at ports.

✅ Upside: LNG/LPG import growth.

⚠️ Regulatory price caps.

Paradeep Parivahan / Infra-linked small plays

Niche port-related exposure.

Adani Ports & SEZ(ADANIPORTS)

India’s largest port operator.

✅ Upside: Cargo growth, logistics integration.

⚠️ Regulatory / leverage concerns.

Gujarat Pipavav Port (GPPL)

Container + bulk terminal.

✅ Upside: Strategic location, APM Terminals backing.

⚠️ Competition from Mundra.

JSW Infrastructure (JSWINFRA)

Fastest-growing private port company.

✅ Upside: JSW group cargo, expansion.

⚠️ Customer concentration.

Gateway Distriparks

ICDs, CFS, rail logistics.

✅ Upside: DFC (Dedicated Freight Corridor) boost.

⚠️ Intense competition in container logistics.

Allcargo Terminals.

Part of Allcargo Group, CFS operator.

✅ Upside: Consolidation in CFS business.

⚠️ Volume-linked revenues.

Aegis Logistics / Aegis Vopak Terminals

Handles LPG, chemicals at ports.

✅ Upside: LNG/LPG import growth.

⚠️ Regulatory price caps.

Paradeep Parivahan / Infra-linked small plays

Niche port-related exposure.

4️⃣ Dredging & Marine Construction

Dredging Corporation of India (DREDGECORP)

Maintains ports & channels.

✅ Upside: Sagarmala, new deep-draft ports.

⚠️ PSU delays, tender-based model.

Dredging Corporation of India (DREDGECORP)

Maintains ports & channels.

✅ Upside: Sagarmala, new deep-draft ports.

⚠️ PSU delays, tender-based model.

⚓ Sector Upside Triggers

✅Govt’s Samudra Se Samriddhi initiative 🚢

✅Rising global freight rates 📈

✅India’s push for defence shipbuilding 🇮🇳

✅Coastal shipping & inland waterways policy

✅Green shipping (methanol, LNG fuel) future

✅Sagarmala + Inland waterways push

✅Govt’s Samudra Se Samriddhi initiative 🚢

✅Rising global freight rates 📈

✅India’s push for defence shipbuilding 🇮🇳

✅Coastal shipping & inland waterways policy

✅Green shipping (methanol, LNG fuel) future

✅Sagarmala + Inland waterways push

⚓ Sector Risks

⚠️Cyclical downturns in global trade

⚠️Global oil & commodity volatility

⚠️Global freight volatility 📉

⚠️PSU execution delays

⚠️Capex-heavy projects → debt risks

⚠️Global trade slowdown risk

⚠️Regulatory pricing in ports & fuels

⚠️Cyclical downturns in global trade

⚠️Global oil & commodity volatility

⚠️Global freight volatility 📉

⚠️PSU execution delays

⚠️Capex-heavy projects → debt risks

⚠️Global trade slowdown risk

⚠️Regulatory pricing in ports & fuels

🔥 Takeaway

India’s maritime sector is under-owned but at the cusp of a mega-cycle.

If India shifts even 20% of cargo from foreign to domestic players → ₹1L+ CR opportunity unlocked.

Bookmark this 🧵 for the entire Shipping & Maritime pack on Indian markets!

#shipping #SamudraSeSamriddhi #Maritime

India’s maritime sector is under-owned but at the cusp of a mega-cycle.

If India shifts even 20% of cargo from foreign to domestic players → ₹1L+ CR opportunity unlocked.

Bookmark this 🧵 for the entire Shipping & Maritime pack on Indian markets!

#shipping #SamudraSeSamriddhi #Maritime

• • •

Missing some Tweet in this thread? You can try to

force a refresh