#Trader #Investor ||Lifelong learner |📚 Avid Reader||Cricket🏏||Sharing Financial Insights|| Sebi Unregistered. Tweets purely for learning. No Recommendation

How to get URL link on X (Twitter) App

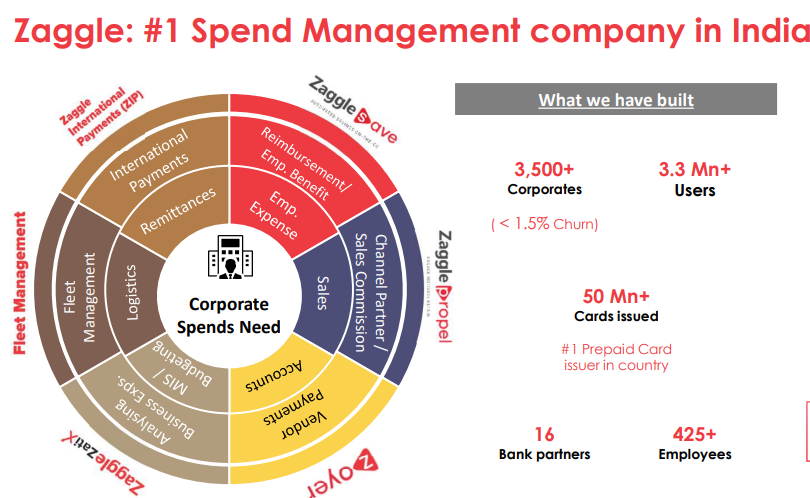

2️⃣ From Corporate Gifting to Full-Stack Fintech Evolution

2️⃣ From Corporate Gifting to Full-Stack Fintech Evolution

2/🧑🔧 Captain (Integrator): BDL

2/🧑🔧 Captain (Integrator): BDL

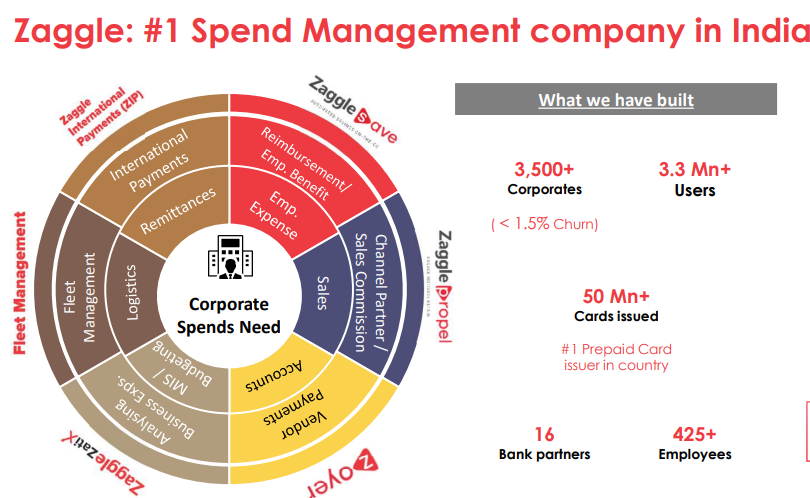

🔹 Massive Infrastructure Push

🔹 Massive Infrastructure Push

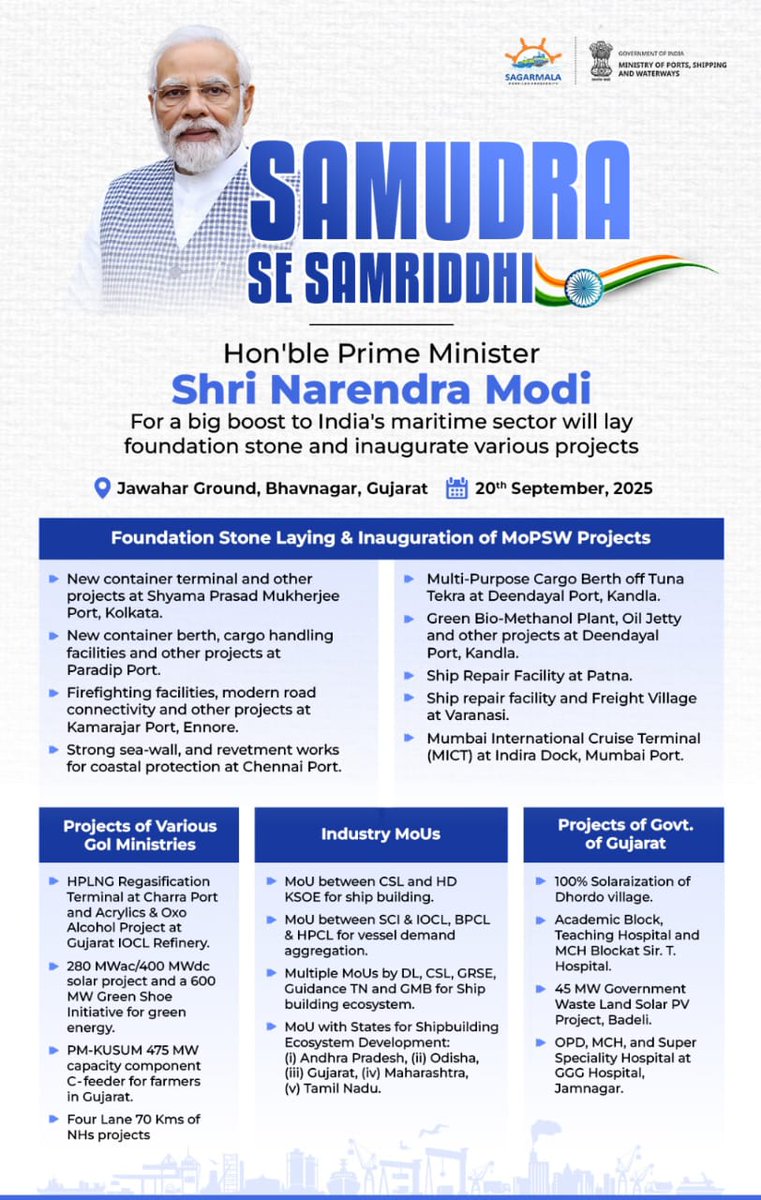

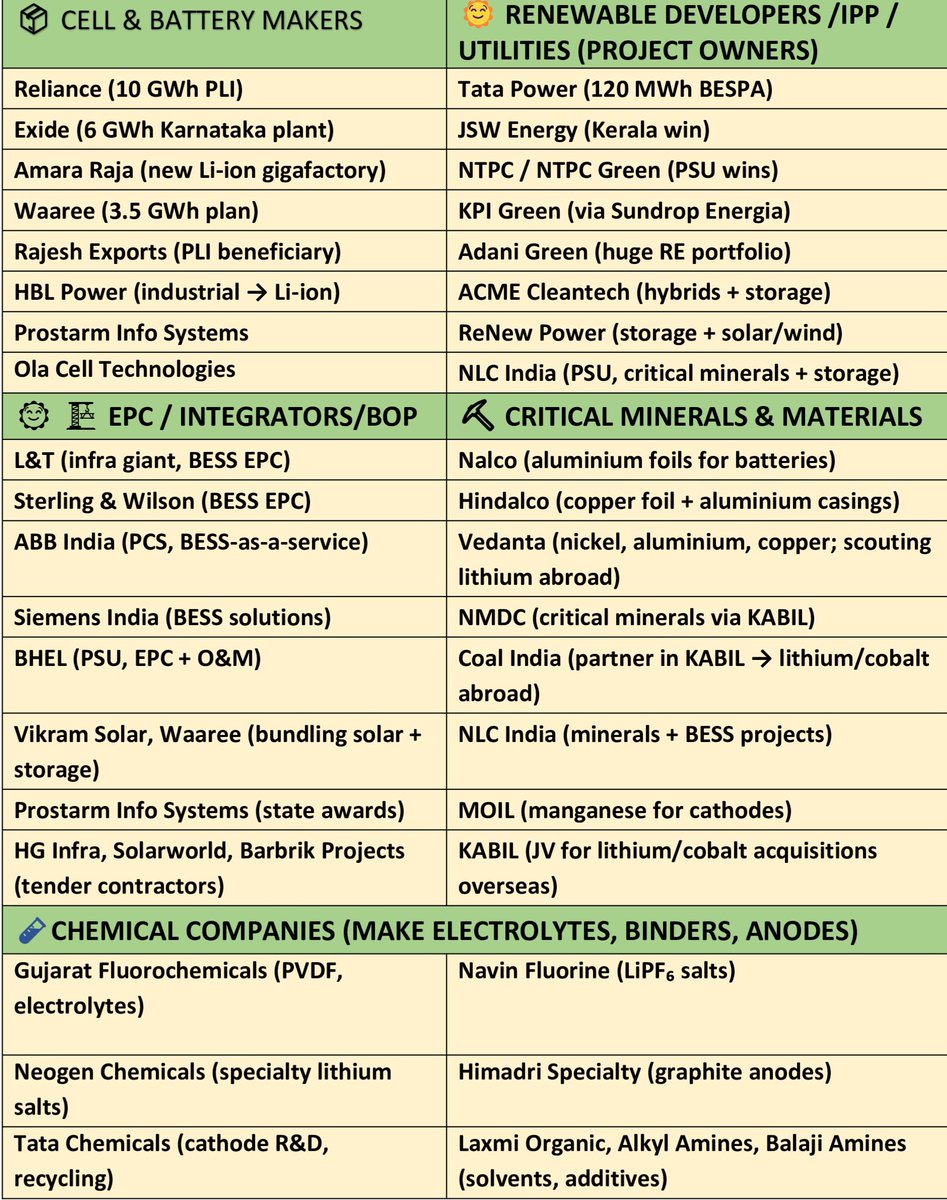

1️⃣What is BESS?

1️⃣What is BESS?

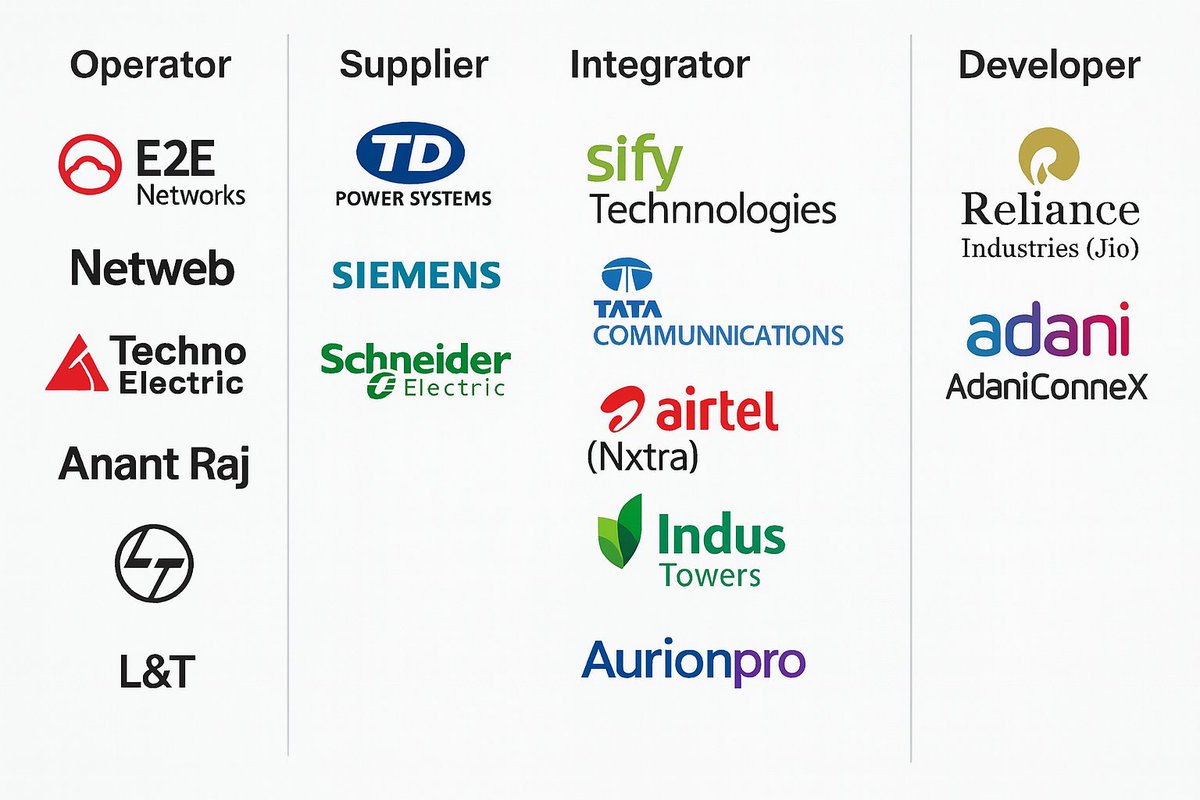

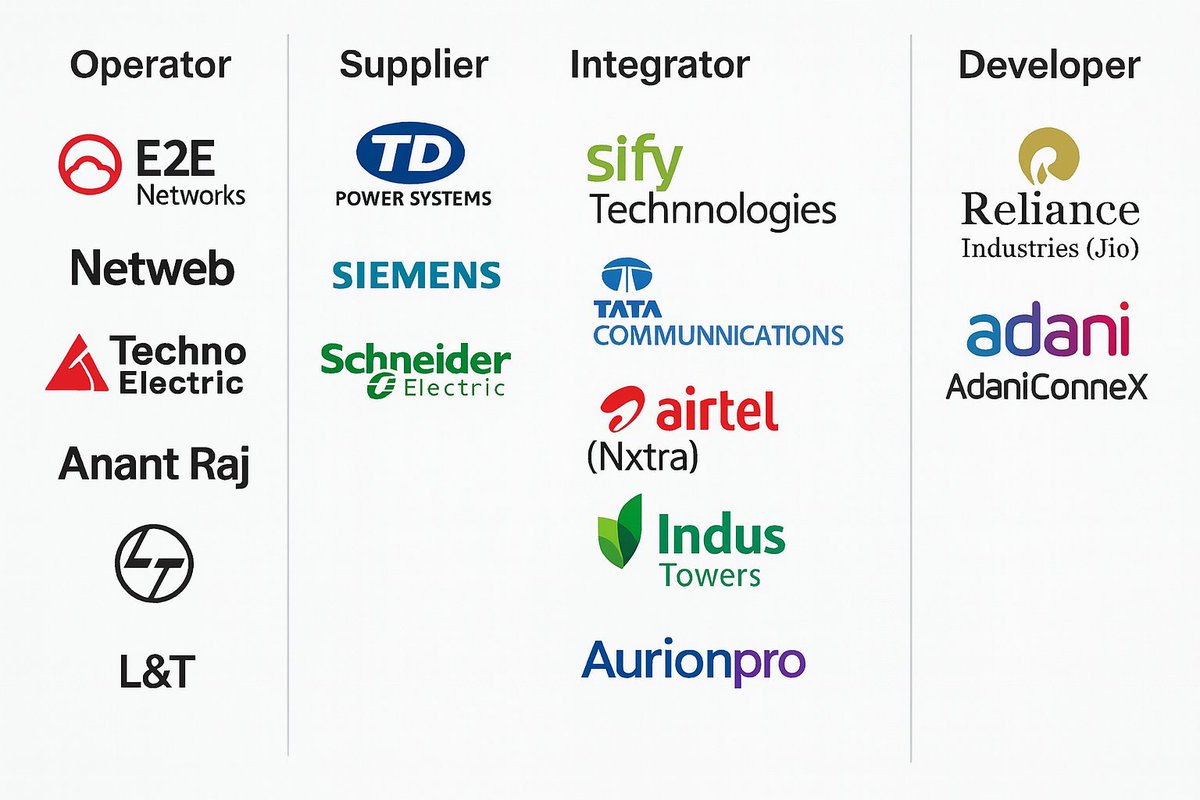

1/ 🔹 E2E Networks — local GPU cloud ☁️

1/ 🔹 E2E Networks — local GPU cloud ☁️

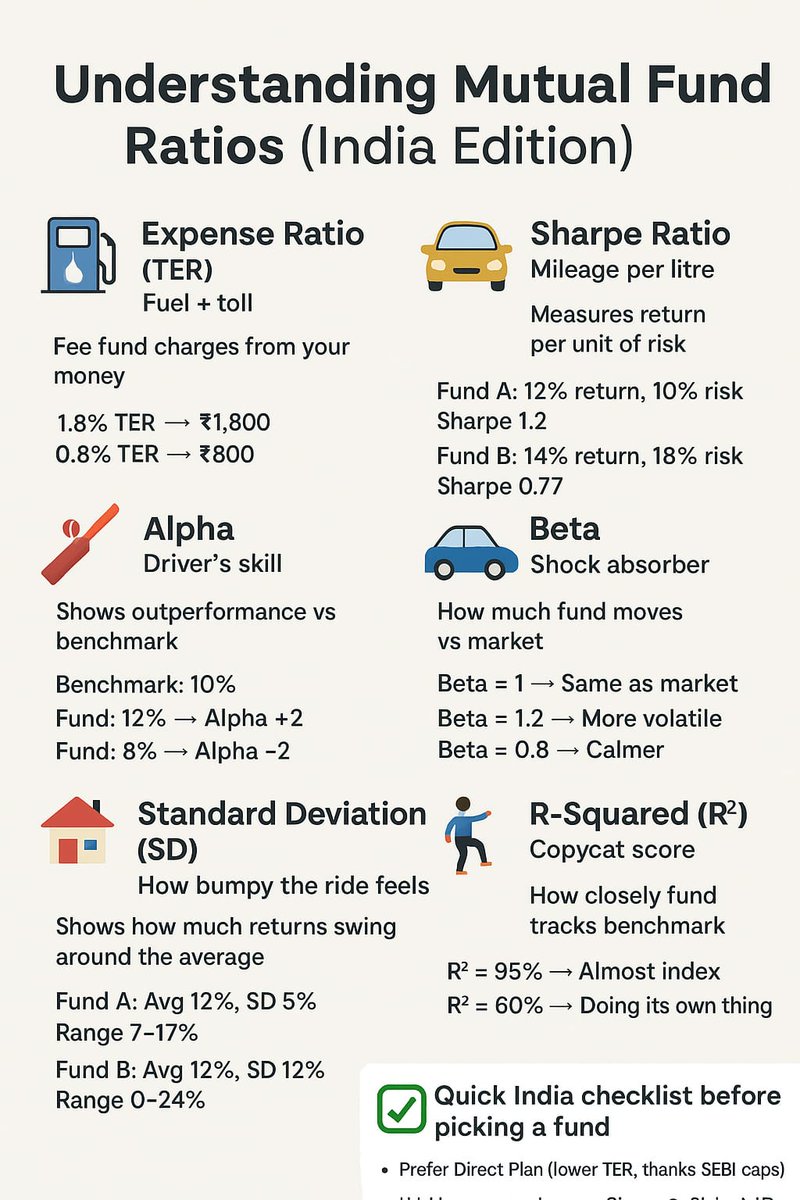

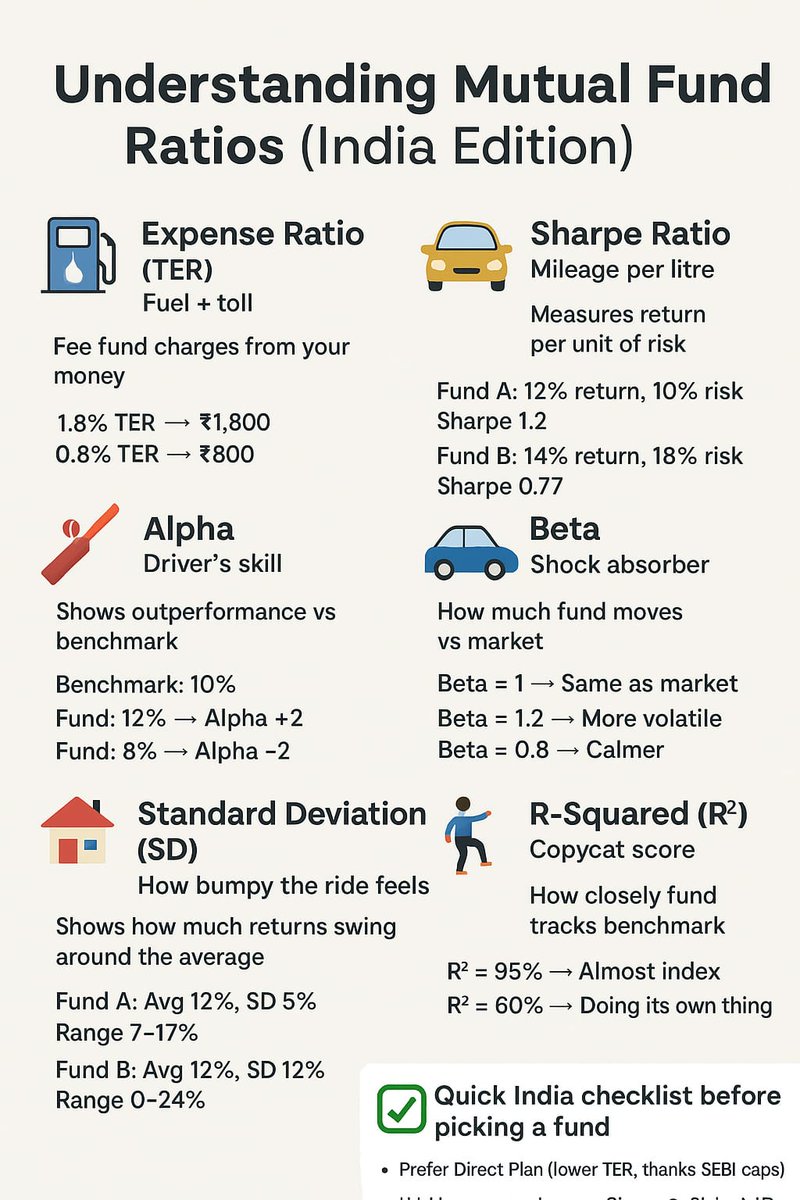

2/ Total Expense Ratio (TER) = “Fuel + toll”

2/ Total Expense Ratio (TER) = “Fuel + toll”