The H1-B Visa Situation:

President Trump just raised the cost of an H-1B Visa to $100,000 PER YEAR, a +1,000% increase.

The US issues ~85,000 new H-1B Visas per year, which will now cost $8.5 BILLION/year.

What are the economic implications? Let us explain.

(a thread)

President Trump just raised the cost of an H-1B Visa to $100,000 PER YEAR, a +1,000% increase.

The US issues ~85,000 new H-1B Visas per year, which will now cost $8.5 BILLION/year.

What are the economic implications? Let us explain.

(a thread)

An H-1B visa allows US employers to hire foreign workers in specialty occupations.

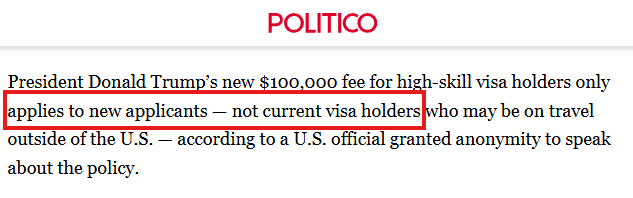

The initial Executive Order raised the cost of an H-1B visa to $100,000 for new AND existing holders.

The implications are MASSIVE.

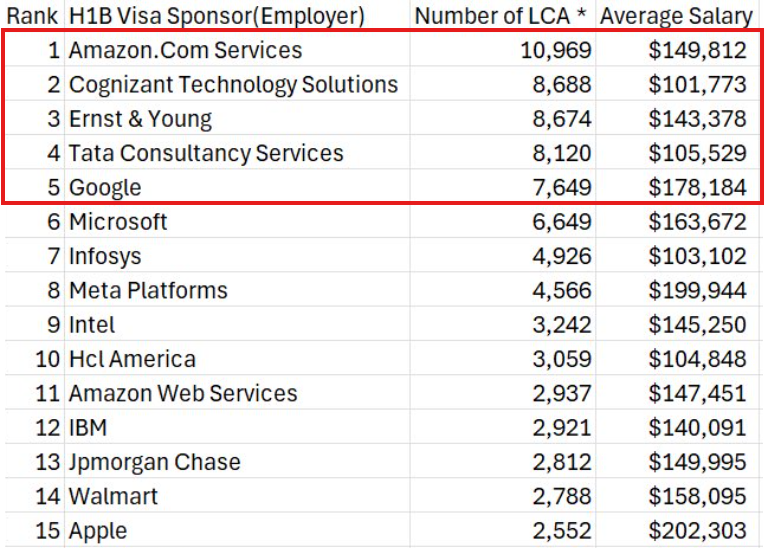

For example, take a look at the top 15 H-1B visa employers.

The initial Executive Order raised the cost of an H-1B visa to $100,000 for new AND existing holders.

The implications are MASSIVE.

For example, take a look at the top 15 H-1B visa employers.

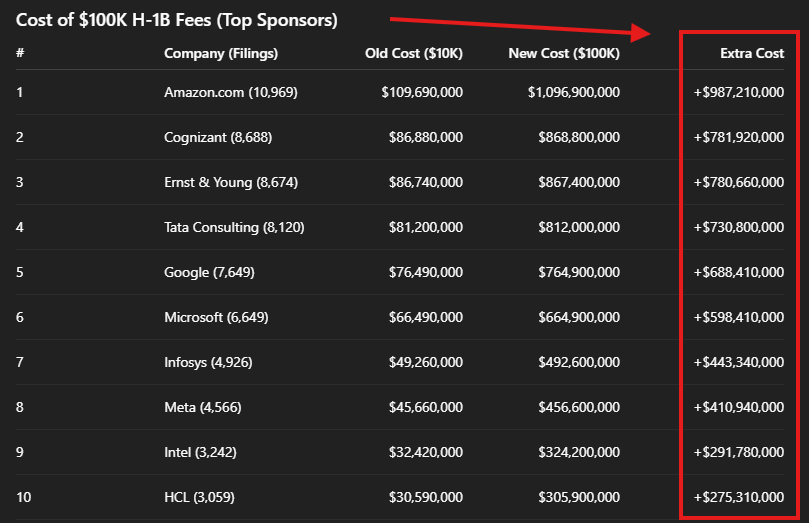

Amazon has ~11,000 employees on H-1B visas.

Assuming the cost of an H-1B goes from ~$10,000 to $100,000:

This would cost Amazon alone an incremental ~$990M PER YEAR.

These top 15 firms would incur an additional $7.2 billion per year in expense under the INITIAL Order.

Assuming the cost of an H-1B goes from ~$10,000 to $100,000:

This would cost Amazon alone an incremental ~$990M PER YEAR.

These top 15 firms would incur an additional $7.2 billion per year in expense under the INITIAL Order.

After an initial widespread panic among many large employers, the Trump Administration made a change today.

According to Politico, the fee increase will now ONLY count for NEW applicants.

While this is a huge change, it will have widespread implications on the labor market.

According to Politico, the fee increase will now ONLY count for NEW applicants.

While this is a huge change, it will have widespread implications on the labor market.

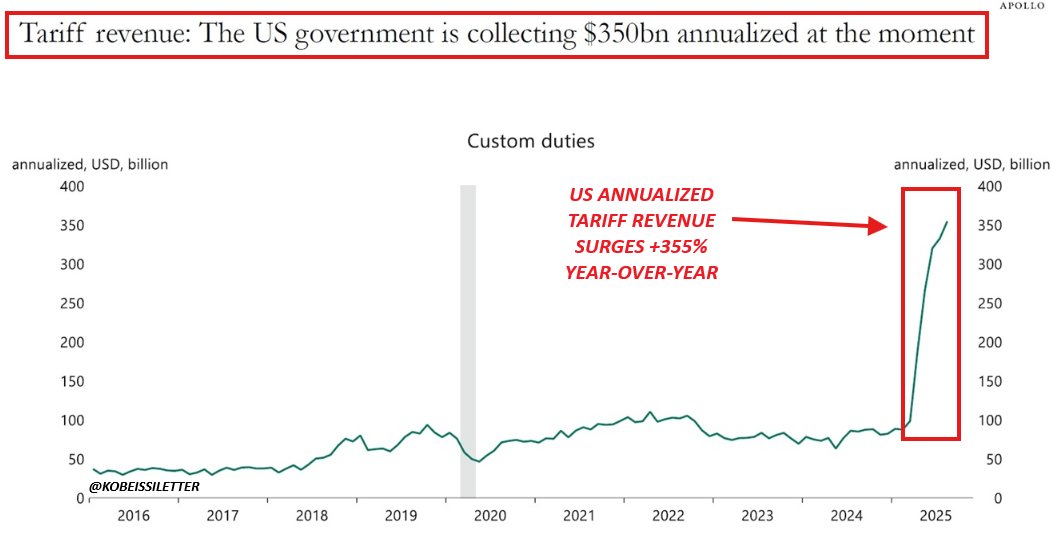

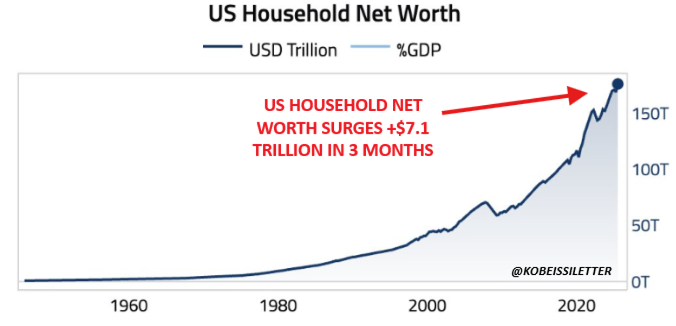

Just to put this into perspective:

At any given time, there are ~700,000 active H-1B workers in the U.S.

This means the initial policy would have raised ~$63 billion per year.

Under the change, only the ~85,000 new applications per year will be required to pay, for $8.5B/yr.

At any given time, there are ~700,000 active H-1B workers in the U.S.

This means the initial policy would have raised ~$63 billion per year.

Under the change, only the ~85,000 new applications per year will be required to pay, for $8.5B/yr.

The new policy will create a massive barrier to entry for non-US citizens in the US labor market.

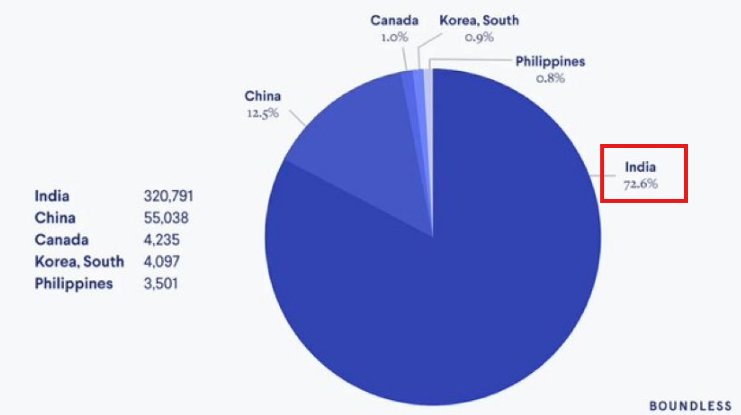

Currently, ~73% of the H-1B visa program comes from India and ~13% from China.

Existing holders will actually benefit from less competition.

New applications will fall sharply.

Currently, ~73% of the H-1B visa program comes from India and ~13% from China.

Existing holders will actually benefit from less competition.

New applications will fall sharply.

Here's where it gets even more interesting:

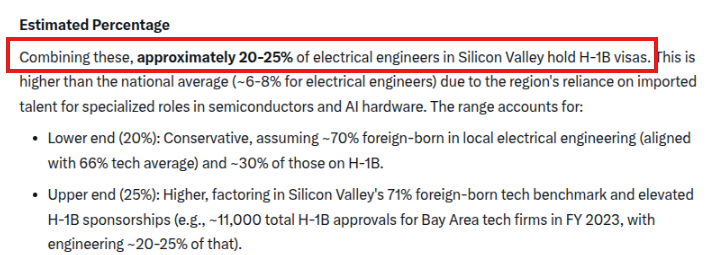

If you take a look at the list of H1-B visa employers, it is highly concentrated in tech.

In fact, 20% to 25% of electrical engineers in Silicon Valley hold H-1B visas.

That's more than TRIPLE the national average.

If you take a look at the list of H1-B visa employers, it is highly concentrated in tech.

In fact, 20% to 25% of electrical engineers in Silicon Valley hold H-1B visas.

That's more than TRIPLE the national average.

The initial reaction by employers has been full of panic.

Alphabet, the parent company of Google, is advising all H1-B visa holders who are abroad to return BEFORE September 21st.

Microsoft and other technology giants have done the same amid the sudden change in policy.

Alphabet, the parent company of Google, is advising all H1-B visa holders who are abroad to return BEFORE September 21st.

Microsoft and other technology giants have done the same amid the sudden change in policy.

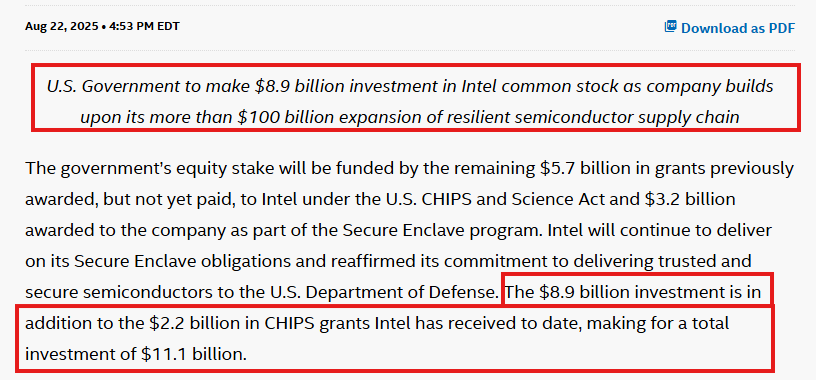

Strangely enough, this policy materially harms Intel, $INTC, which is the 9th largest employer of H-1B visa holders.

This is the same company that the Trump Administration just took a 10% stake in.

And, it's also the same company that Nvidia invested $5B in just 2 days prior.

This is the same company that the Trump Administration just took a 10% stake in.

And, it's also the same company that Nvidia invested $5B in just 2 days prior.

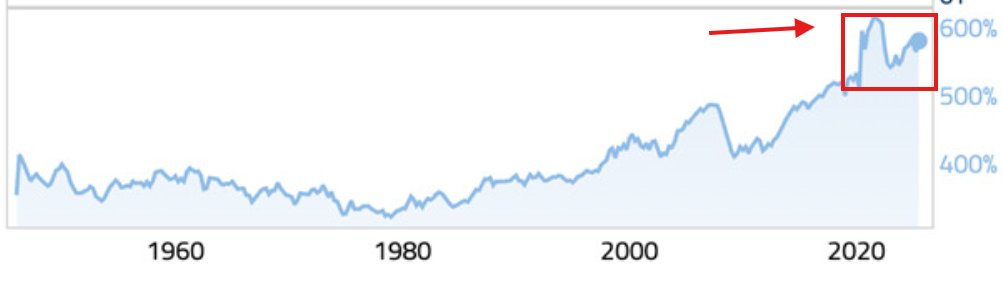

Take a look at Infosys, the 7th largest employer of H-1B visas:

The news came out at 1:50 PM ET on Friday and Infosys stock, $INFY, was -8% lower just 30 minutes later.

We expect some relief on Monday as markets react to the news that existing H-1Bs will not be impacted.

The news came out at 1:50 PM ET on Friday and Infosys stock, $INFY, was -8% lower just 30 minutes later.

We expect some relief on Monday as markets react to the news that existing H-1Bs will not be impacted.

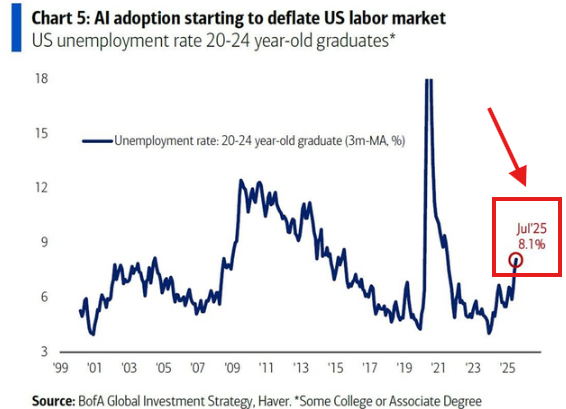

Ultimately, President Trump believes he is bringing jobs back to Americans with this move.

Particularly for Americans who are seeking entry level jobs.

The US unemployment rate for youth graduates aged 20-24 has averaged 8.1% over the last 3 months, the highest in 4 years.

Particularly for Americans who are seeking entry level jobs.

The US unemployment rate for youth graduates aged 20-24 has averaged 8.1% over the last 3 months, the highest in 4 years.

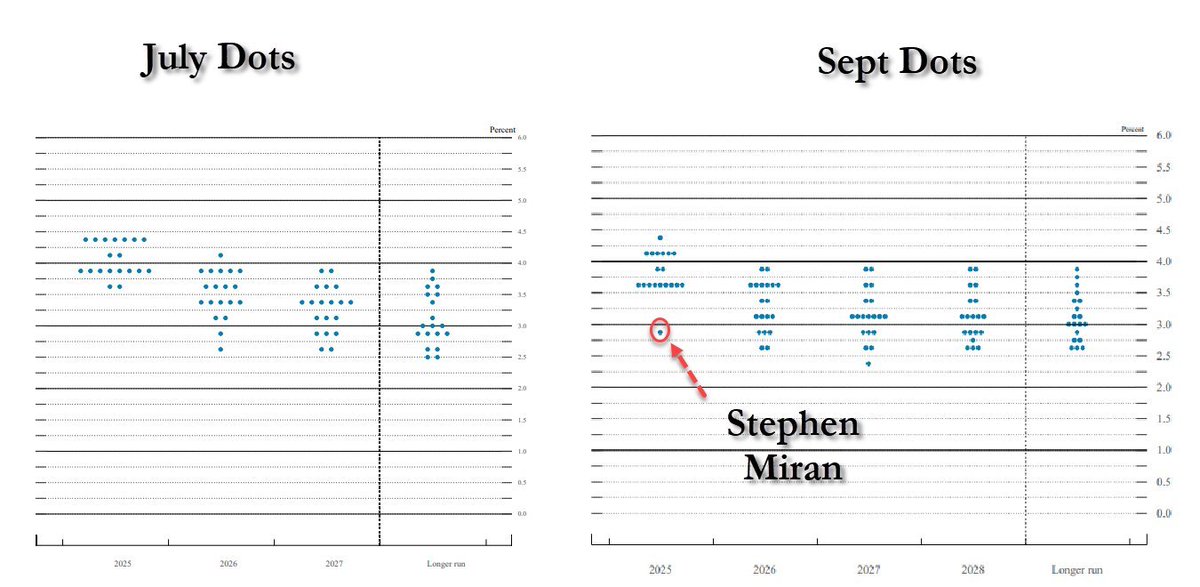

Sudden changes to economic policy are the new norm.

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

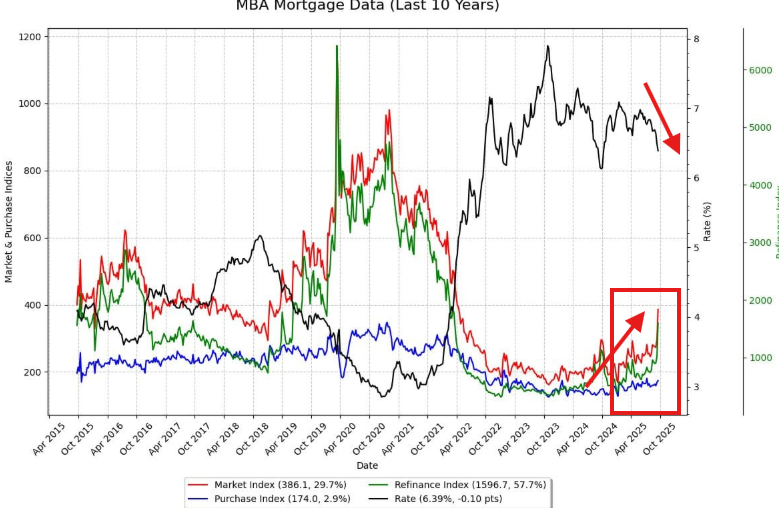

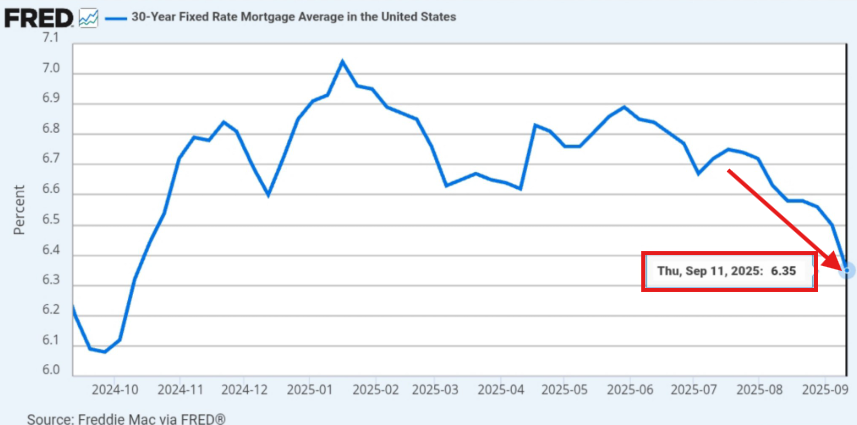

As the labor market weakens, we expect more policy changes from President Trump.

The underemployment rate in the US just jumped to 8.1%, the highest since 2021.

The labor market has taken the spotlight.

Follow us @KobeissiLetter for real time analysis as this develops.

The underemployment rate in the US just jumped to 8.1%, the highest since 2021.

The labor market has taken the spotlight.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh