The liquidity flowing into crypto has more to do with the fact that the US/China relationship than it does with the Fed or "money printing."

If you understand the drivers, the next bear market won't catch you off guard 🧵

If you understand the drivers, the next bear market won't catch you off guard 🧵

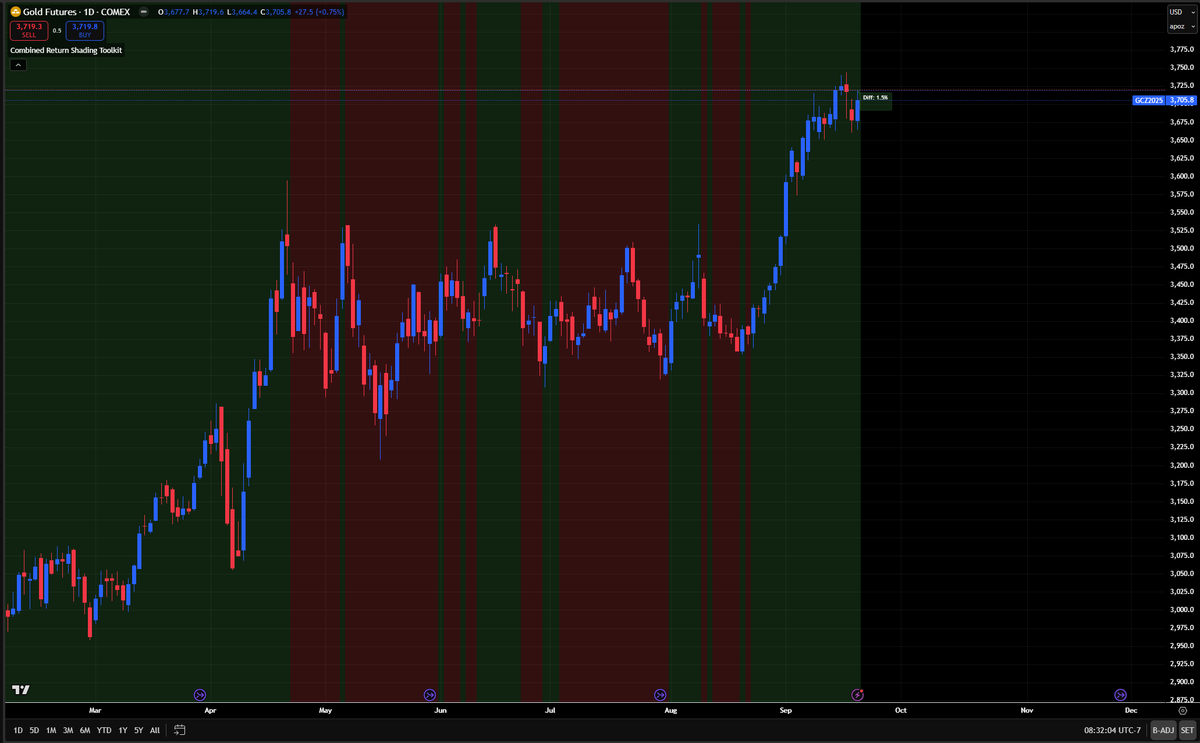

Crypto, Bitcoin, Gold, and Silver are ALL release valves for macro liquidity. I laid this out in the thread here for the current performance and BTC educational primer

https://x.com/Globalflows/status/1969432780196233465

The flows of liquidity are linked to credit risk and duration risk:

see these threads

-here: x.com/Globalflows/st…

-here: x.com/Globalflows/st…

-here: x.com/Globalflows/st…

-here:

see these threads

-here: x.com/Globalflows/st…

-here: x.com/Globalflows/st…

-here: x.com/Globalflows/st…

-here:

People always focus on whatever source of liquidity is most politically charged in the moment. So think about, people focus on the Fed, then government spending, then treasury companies and then ETF flows. But no one seems to know WHERE all this money comes from.

Fundamentally, the dollar devaluation narrative people use for Bitcoin falls apart when you try to predict the price to impose a definition of what money actually is.

There are no rules for what money "should be"

There are no rules for what money "should be"

https://x.com/Globalflows/status/1958603928658223493

All of this frames how the US China relationship connects to crypto. I already laid out the framework here:

https://x.com/Globalflows/status/1969095498033205478

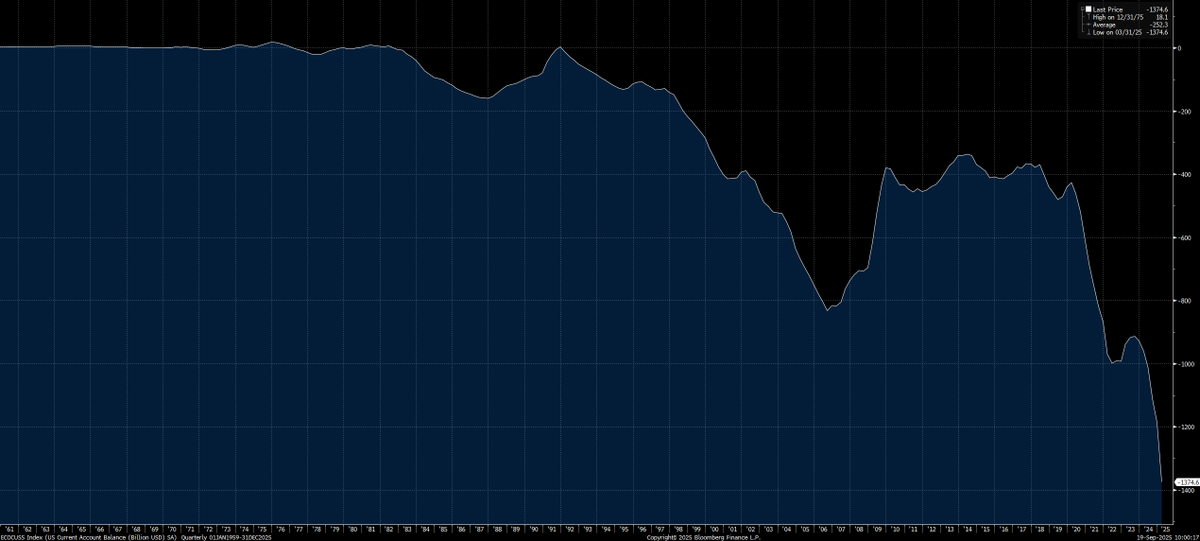

Under the current international monetary system, many countries—especially China—run persistent trade surpluses with the U.S. to sustain growth through exports. To keep their currencies from appreciating (which would hurt exports), they:

- Intervene in FX markets (sell their currency, buy dollars),

- Accumulate dollar-denominated assets (primarily U.S. Treasuries, but increasingly others),

- Suppress domestic consumption to support production.

This creates a global glut of savings—primarily dollar-denominated capital—looking for places to park and grow.

- Intervene in FX markets (sell their currency, buy dollars),

- Accumulate dollar-denominated assets (primarily U.S. Treasuries, but increasingly others),

- Suppress domestic consumption to support production.

This creates a global glut of savings—primarily dollar-denominated capital—looking for places to park and grow.

Crypto is uniquely positioned to absorb and reflect the marginal flows of global liquidity, because:

- It’s unregulated, borderless, and dollar-settled,

- It reflects expectations about fiat debasement and monetary excess,

- It’s accessible to foreign capital locked out of traditional markets.

Thus, cross-border flows from global savers—especially from surplus countries like China—can end up in:

- Bitcoin and Ethereum (as long-duration digital assets),

- Stablecoins (as offshoring vehicles and dollar proxies),

- Altcoins and crypto equities (as speculative leverage vehicles).

- It’s unregulated, borderless, and dollar-settled,

- It reflects expectations about fiat debasement and monetary excess,

- It’s accessible to foreign capital locked out of traditional markets.

Thus, cross-border flows from global savers—especially from surplus countries like China—can end up in:

- Bitcoin and Ethereum (as long-duration digital assets),

- Stablecoins (as offshoring vehicles and dollar proxies),

- Altcoins and crypto equities (as speculative leverage vehicles).

This creates a global capital feedback loop into crypto that’s orthogonal to the Fed’s balance sheet. Even if the Fed isn’t easing, capital seeking returns or hedges against debasement will push into crypto via global liquidity spillovers.

https://x.com/Globalflows/status/1969584769429356798

There is a reason why Bitcoin rallied so much in lockstep with Chinese equities in 2017

It didn't have anything to do with the Bitcoin halving; it was macro liquidity from the largest balance of payments imbalance we have ever seen in history

It didn't have anything to do with the Bitcoin halving; it was macro liquidity from the largest balance of payments imbalance we have ever seen in history

As I explained in this report, the next bear market isnt likely to be driven by the Fed, it will be driven by crossborder flows as everyone is distracted by Fed watching

https://x.com/Globalflows/status/1969095561421996058

• • •

Missing some Tweet in this thread? You can try to

force a refresh