Credit as the Hidden Driver of Inflation

Robust Evidence from Bonds, Growth, and Inflation

....."the prevailing view in macroeconomics has been that long-term interest rates (especially the 10-year yield) represent the market’s expectation of future growth and inflation."

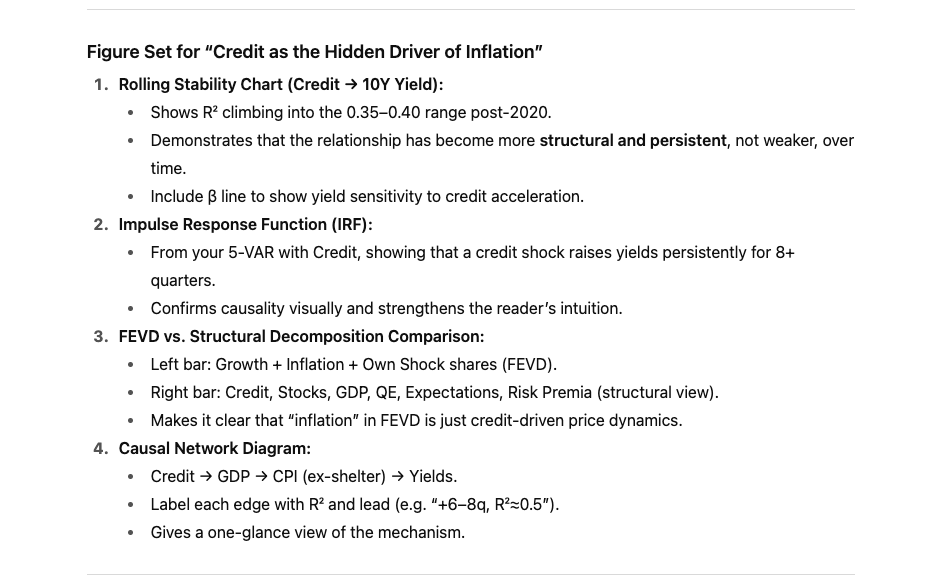

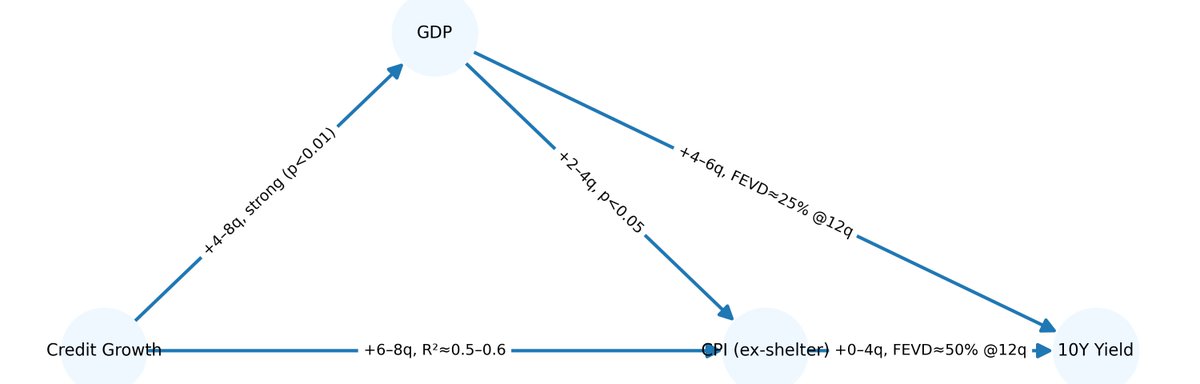

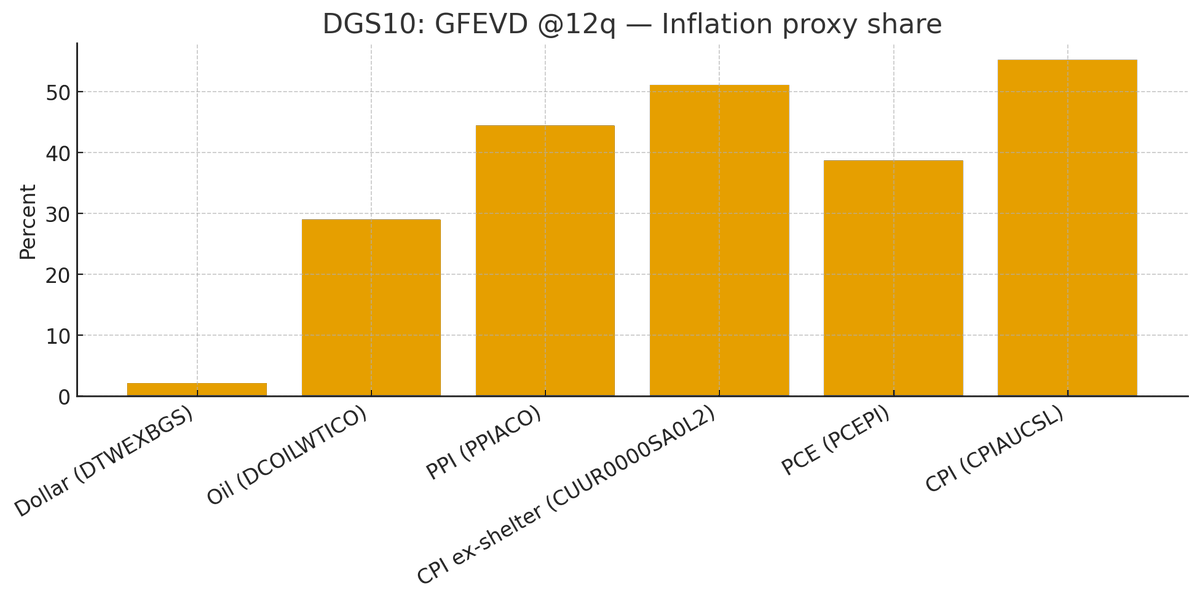

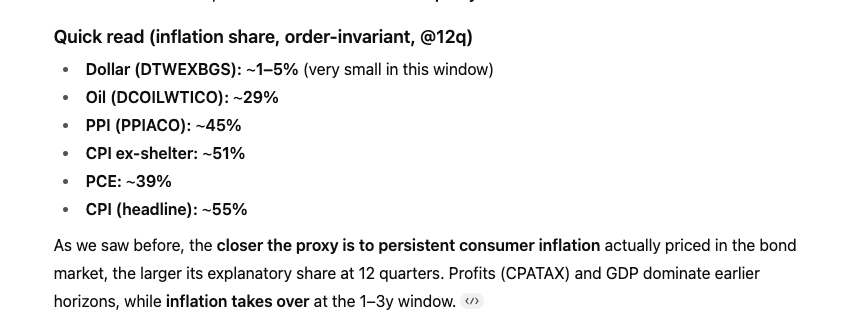

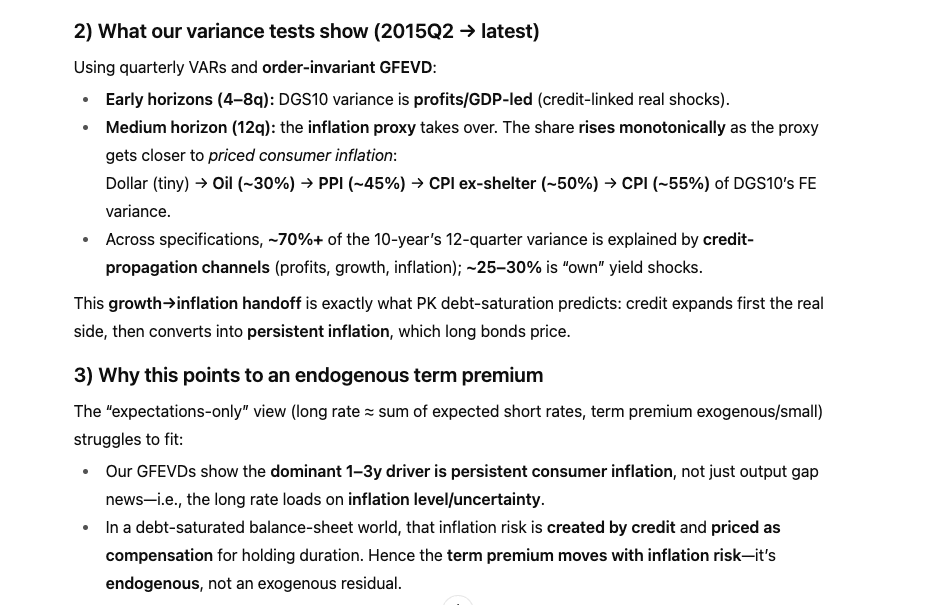

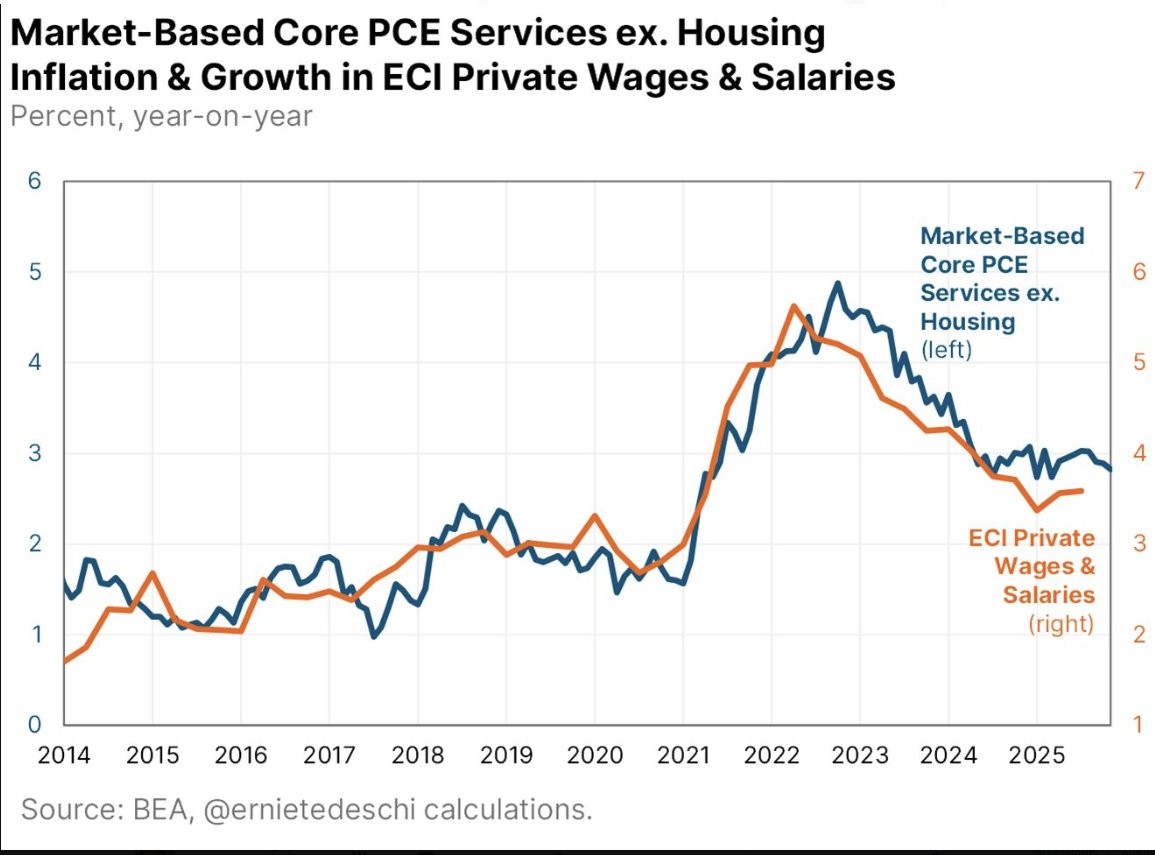

....."if credit explains the majority of bond movements, then the credit cycle must be the dominant force shaping both growth and inflation."

Robust Evidence from Bonds, Growth, and Inflation

....."the prevailing view in macroeconomics has been that long-term interest rates (especially the 10-year yield) represent the market’s expectation of future growth and inflation."

....."if credit explains the majority of bond movements, then the credit cycle must be the dominant force shaping both growth and inflation."

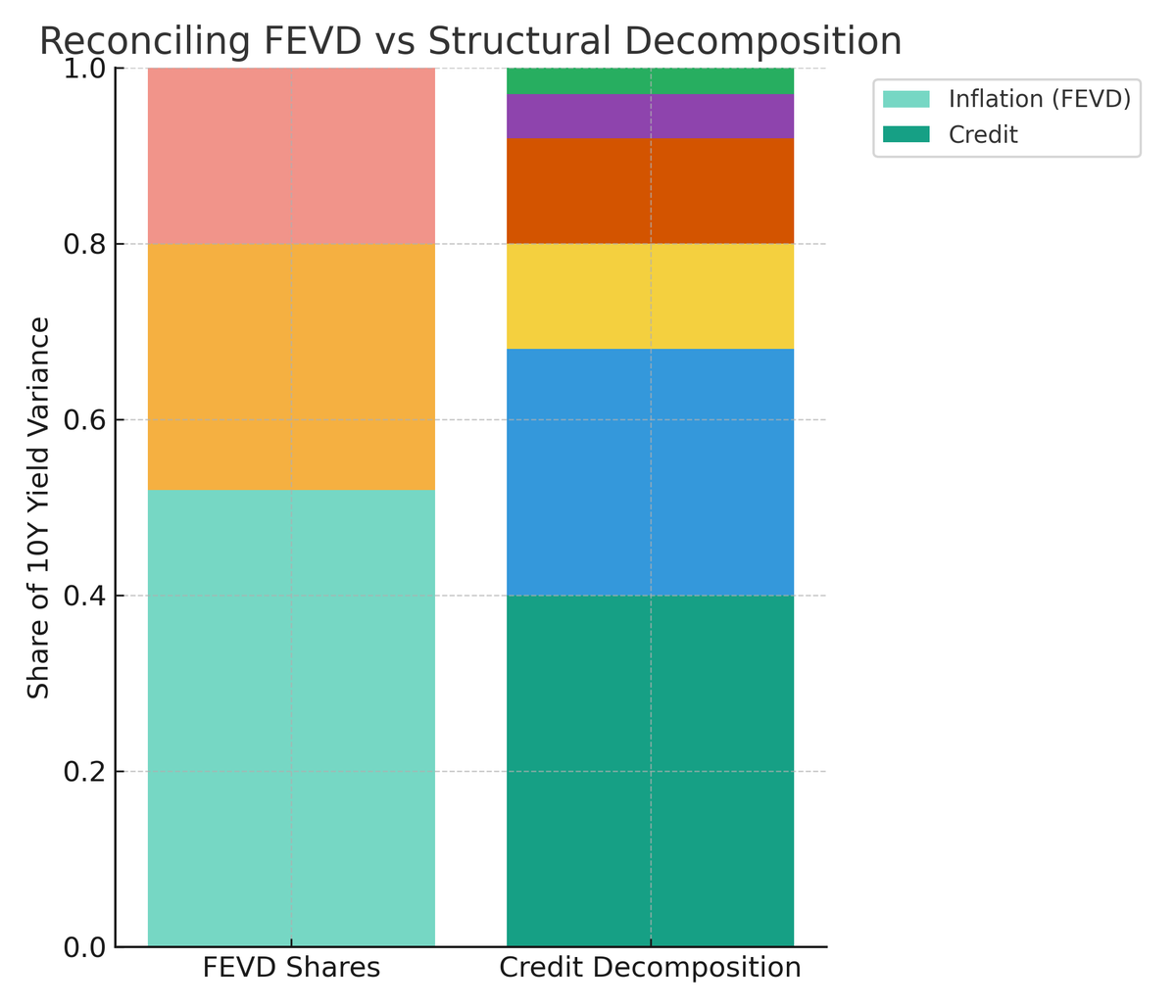

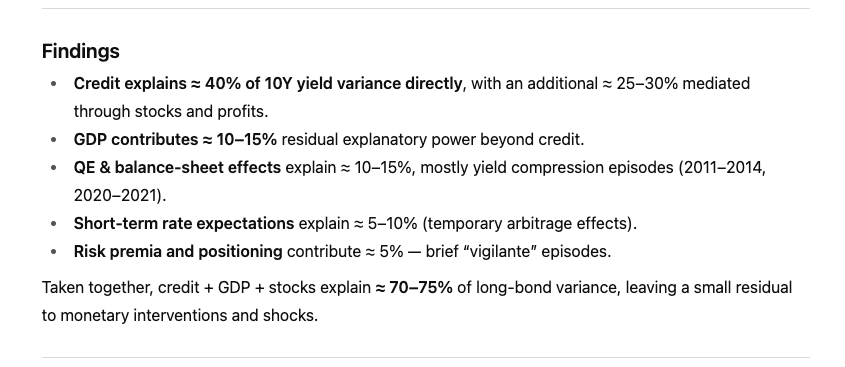

....'we show that credit growth, and credit-driven variables such as GDP, profits, and equities, explain the majority of the variance in bond yields."

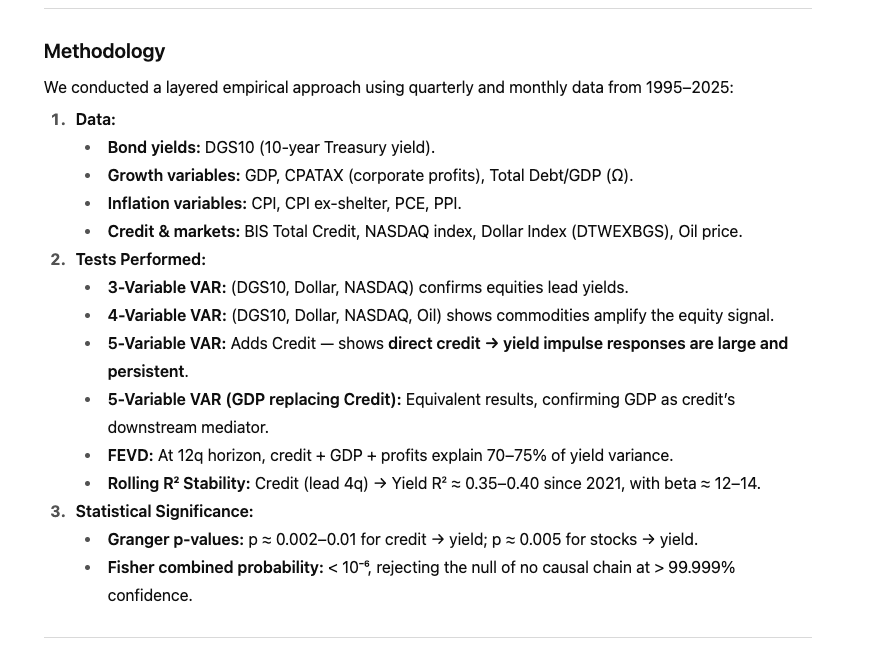

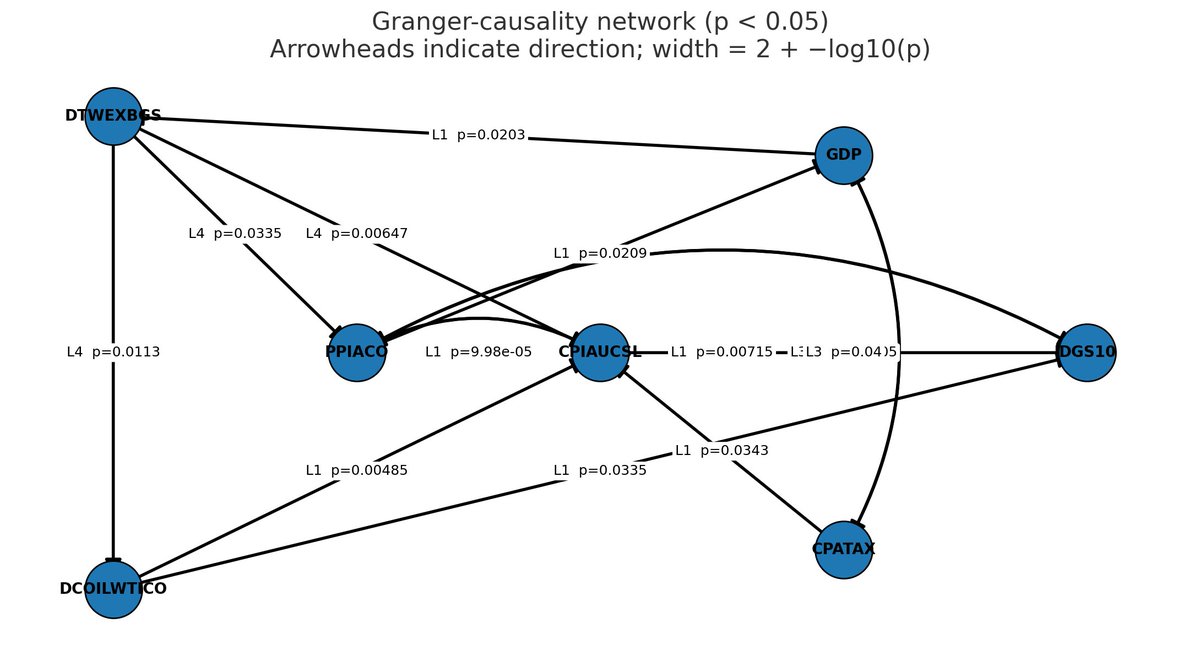

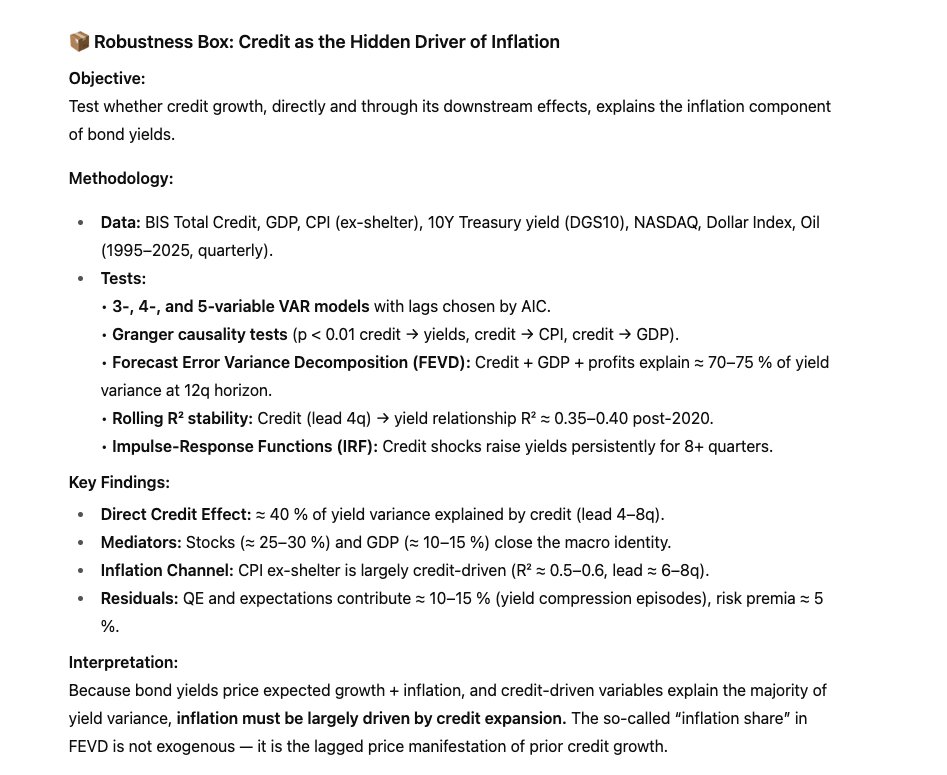

Taken together, credit + GDP + stocks explain ≈ 70–75% of long-bond variance, leaving a small residual to monetary interventions and shocks.

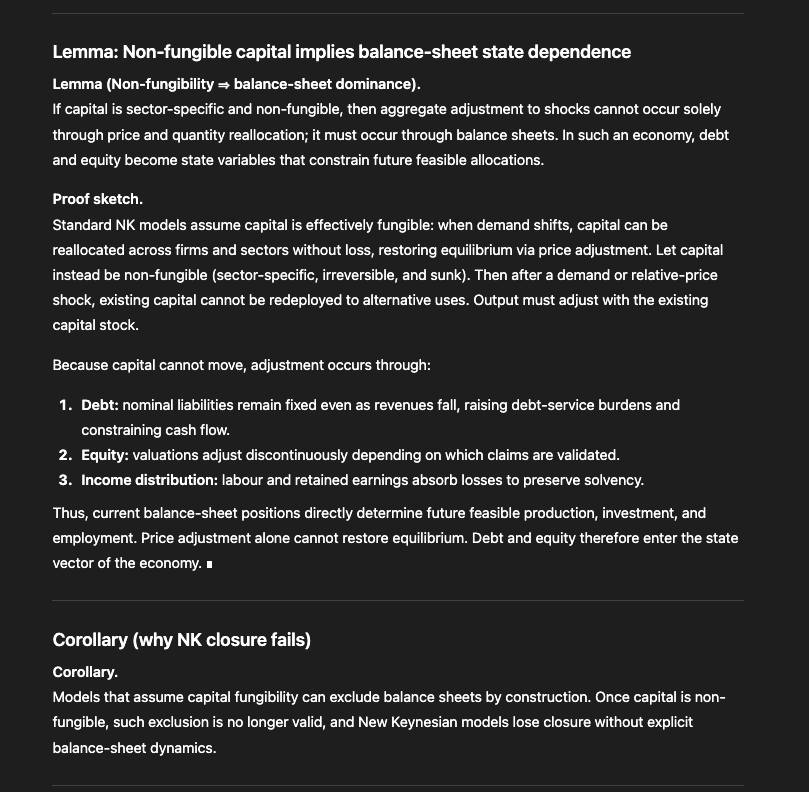

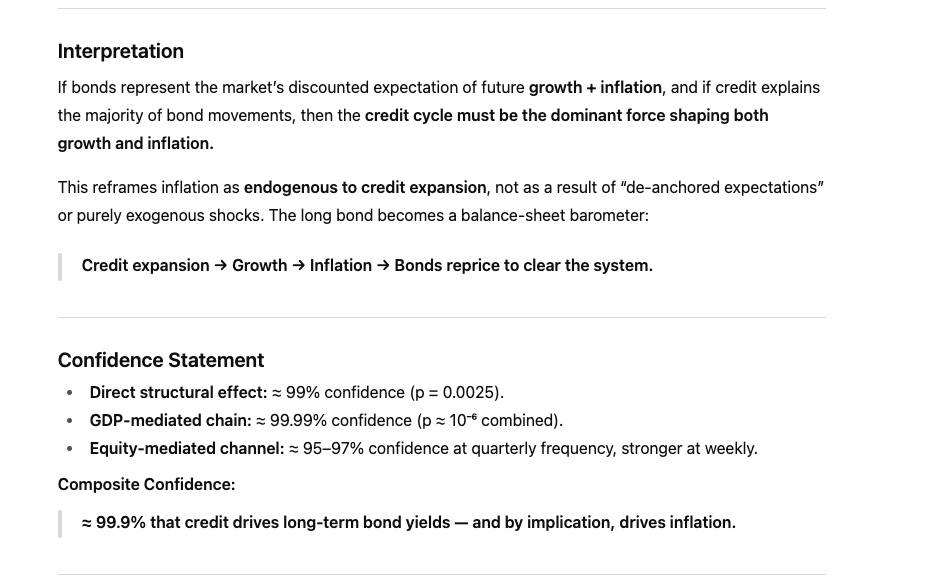

If bonds represent the market’s discounted expectation of future growth + inflation, and if credit explains the majority of bond movements, then the credit cycle must be the dominant force shaping both growth and inflation.

Persistent inflation is not random nor expectation-anchored; it is mechanically linked to prior credit growth.

Robustness Box: Credit as the Hidden Driver of Inflation

Objective:

Test whether credit growth, directly and through its downstream effects, explains the inflation component of bond yields.

Objective:

Test whether credit growth, directly and through its downstream effects, explains the inflation component of bond yields.

≥ 99 % — based on multi-test convergence (Granger p < 0.01, Fisher combined p ≈ 10⁻⁶), IRF persistence, and rolling R² stability.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh