Here are 10 wonderful companies with more cash than Total liabilities you’ll want to keep on your watchlist:

Intuitive Surgical Inc. $ISRG

- Leader in robotic assisted surgery

- strong moat

- The stock has grown at 24% per year, delivering over 750% returns in 10 years.

Intuitive Surgical Inc. $ISRG

- Leader in robotic assisted surgery

- strong moat

- The stock has grown at 24% per year, delivering over 750% returns in 10 years.

Copart, Inc. $CPRT

- The largest online car auction

- strong moat

- The stock has grown at 27% per year, delivering over 991% returns in 10 years.

- The largest online car auction

- strong moat

- The stock has grown at 27% per year, delivering over 991% returns in 10 years.

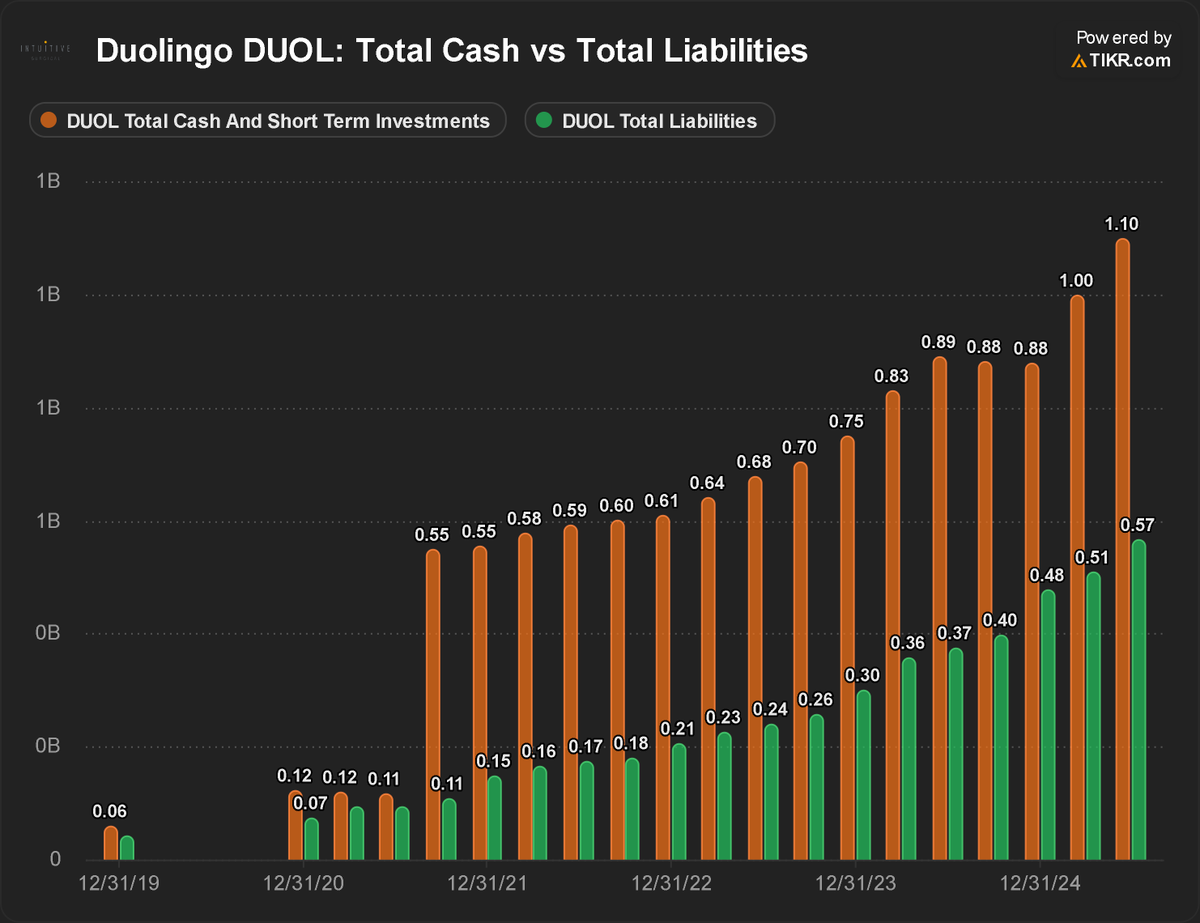

Duolingo, Inc. $DUOL

- 48 million daily active users

- 11 million paid Subscribers

- Companies make money from ads placed throughout their apps.

- 48 million daily active users

- 11 million paid Subscribers

- Companies make money from ads placed throughout their apps.

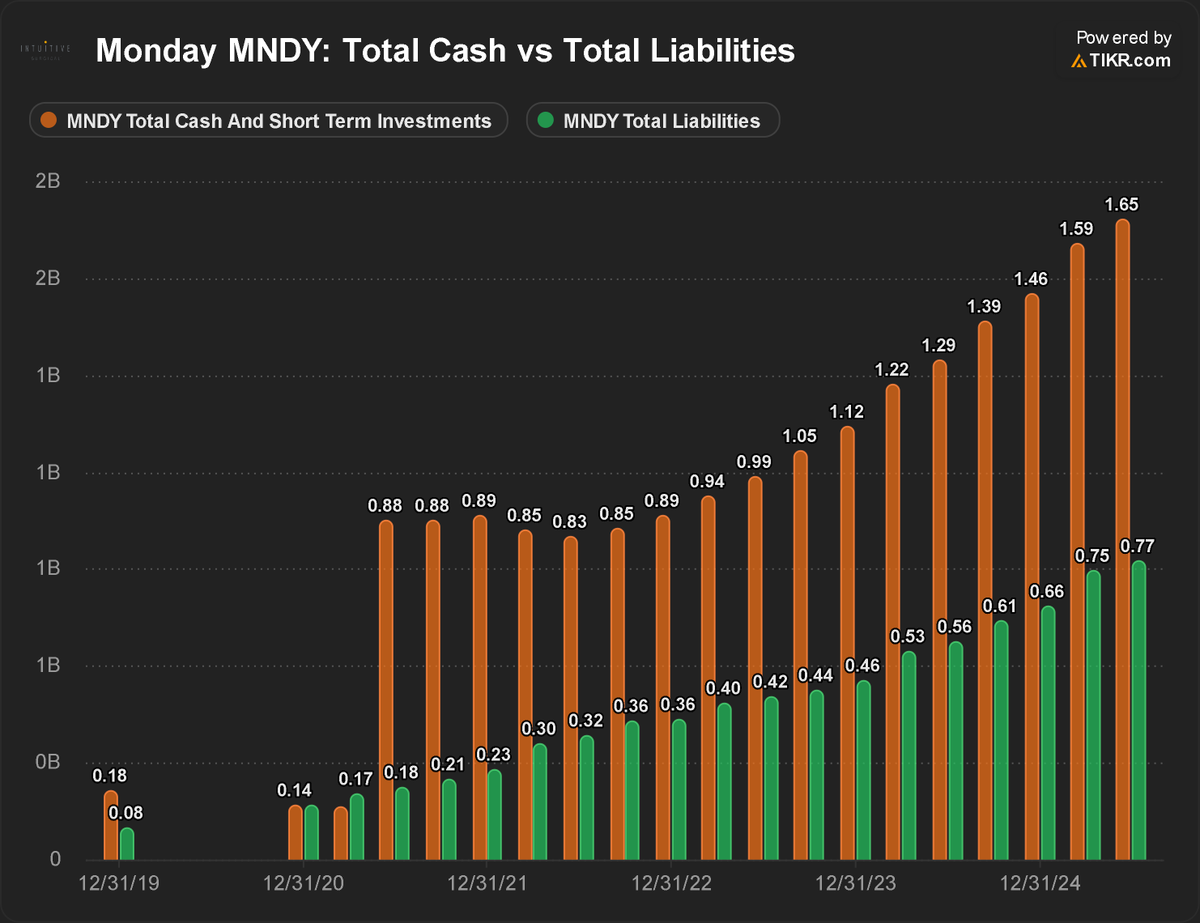

monday $MNDY

- The company is experiencing its worst correction since 2022.

- The number of customers with annual recurring revenue exceeding $50,000 has surpassed 3,700.

- The company has its lowest PEG ratio since 2022, and it is below 1.

- The company is experiencing its worst correction since 2022.

- The number of customers with annual recurring revenue exceeding $50,000 has surpassed 3,700.

- The company has its lowest PEG ratio since 2022, and it is below 1.

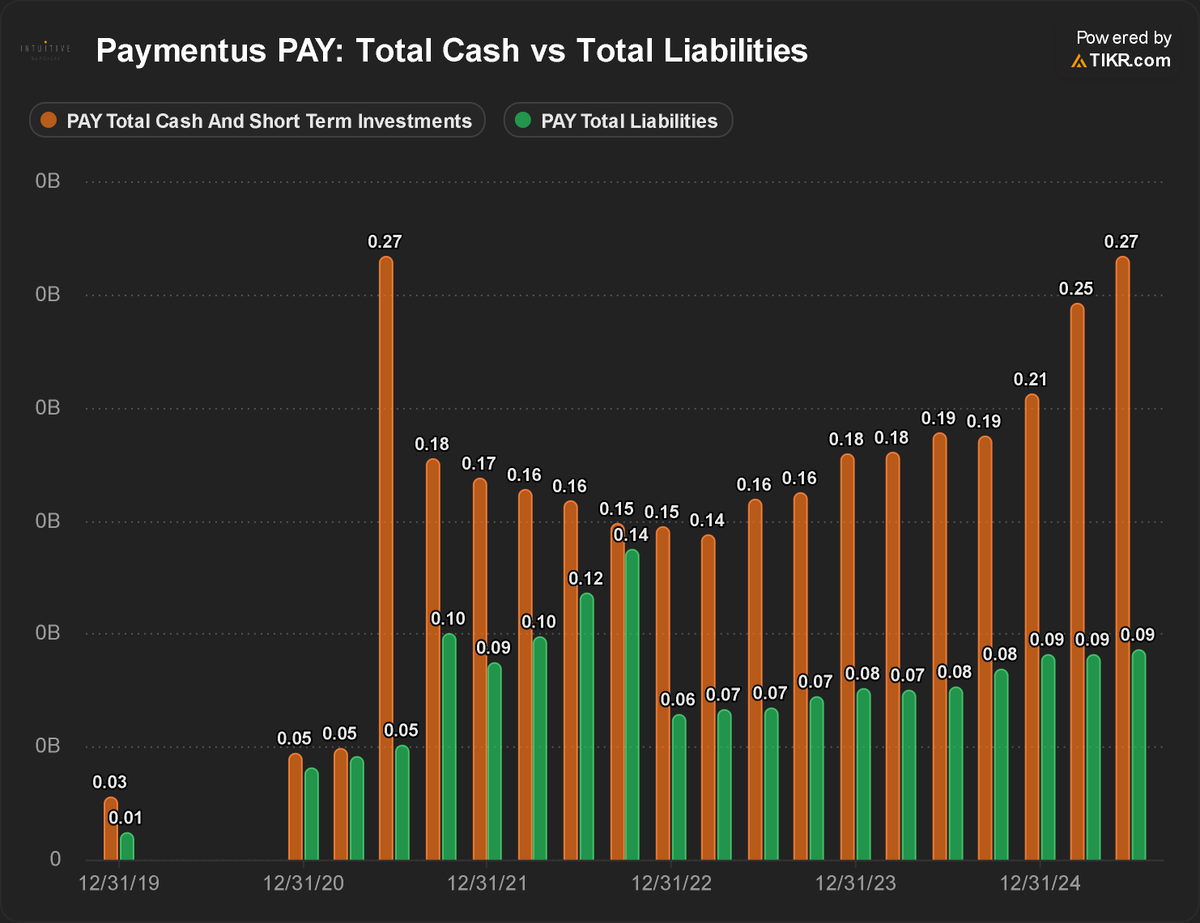

Paymentus Holdings, Inc. $PAY

- Fintech

- Payment Transaction Processing Revenue has been growing 32% per year since 2020

- Revenue and EPS are expecting to grow +20%

- Fintech

- Payment Transaction Processing Revenue has been growing 32% per year since 2020

- Revenue and EPS are expecting to grow +20%

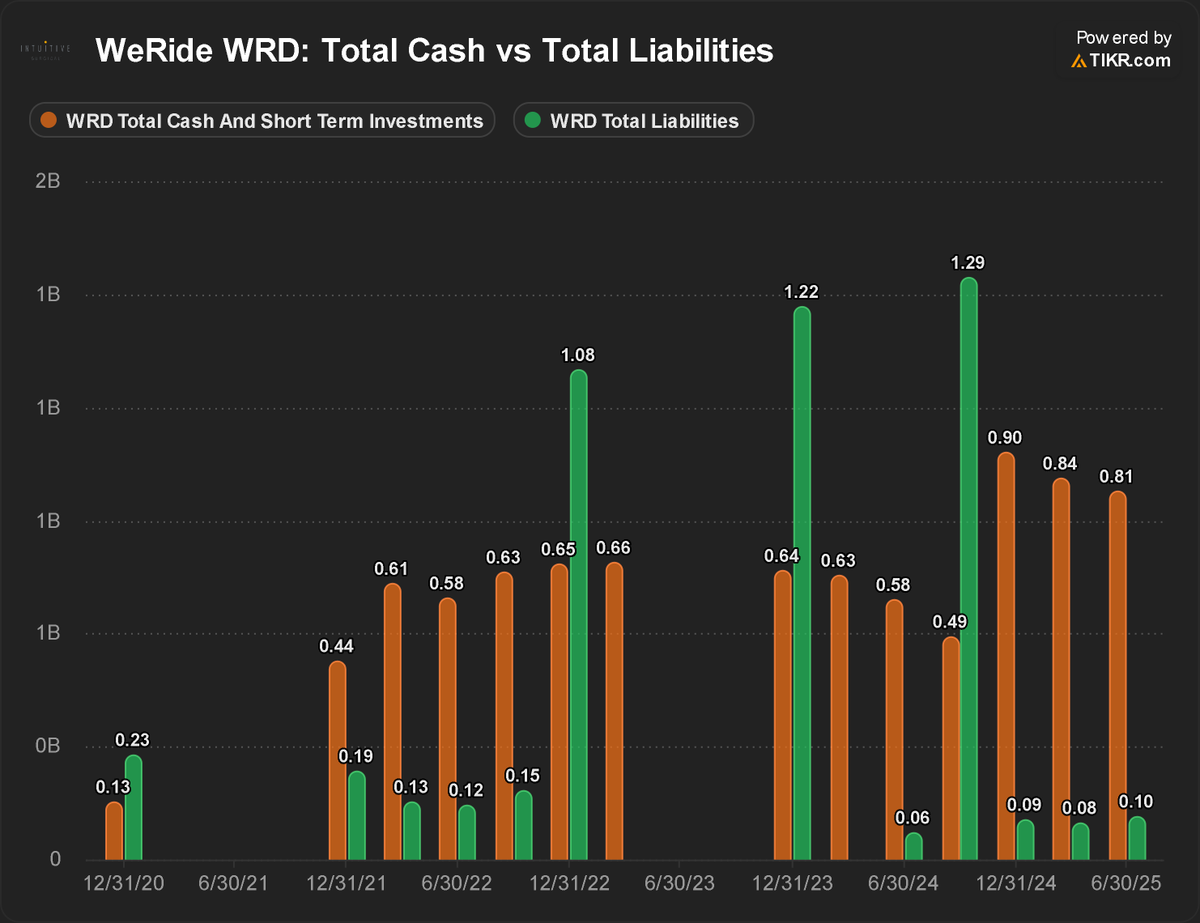

WeRide Inc. $WRD

- They have numerous partnerships in Asia, including one with Grab Holdings.

- $NVDA added this company a few months ago.

- It’s worth keeping this company on your watchlist, as they are expecting massive growth.

- They have numerous partnerships in Asia, including one with Grab Holdings.

- $NVDA added this company a few months ago.

- It’s worth keeping this company on your watchlist, as they are expecting massive growth.

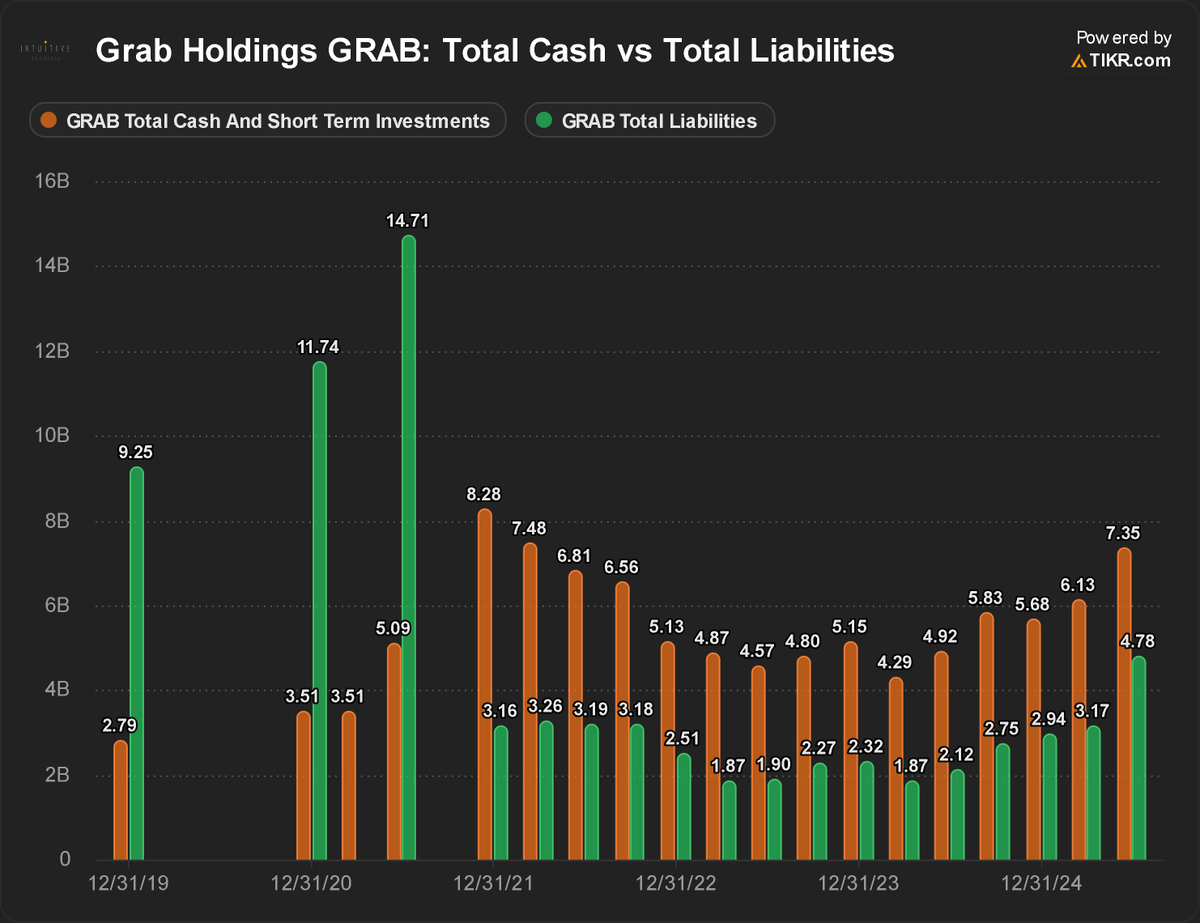

Grab Holdings $GRAB

- A smaller version of MercadoPago

- Making significant strides in autonomous vehicles

- They have over 45 million monthly transacting users, and this number is expected to reach 50 million.

All charts are from @theTIKR

- A smaller version of MercadoPago

- Making significant strides in autonomous vehicles

- They have over 45 million monthly transacting users, and this number is expected to reach 50 million.

All charts are from @theTIKR

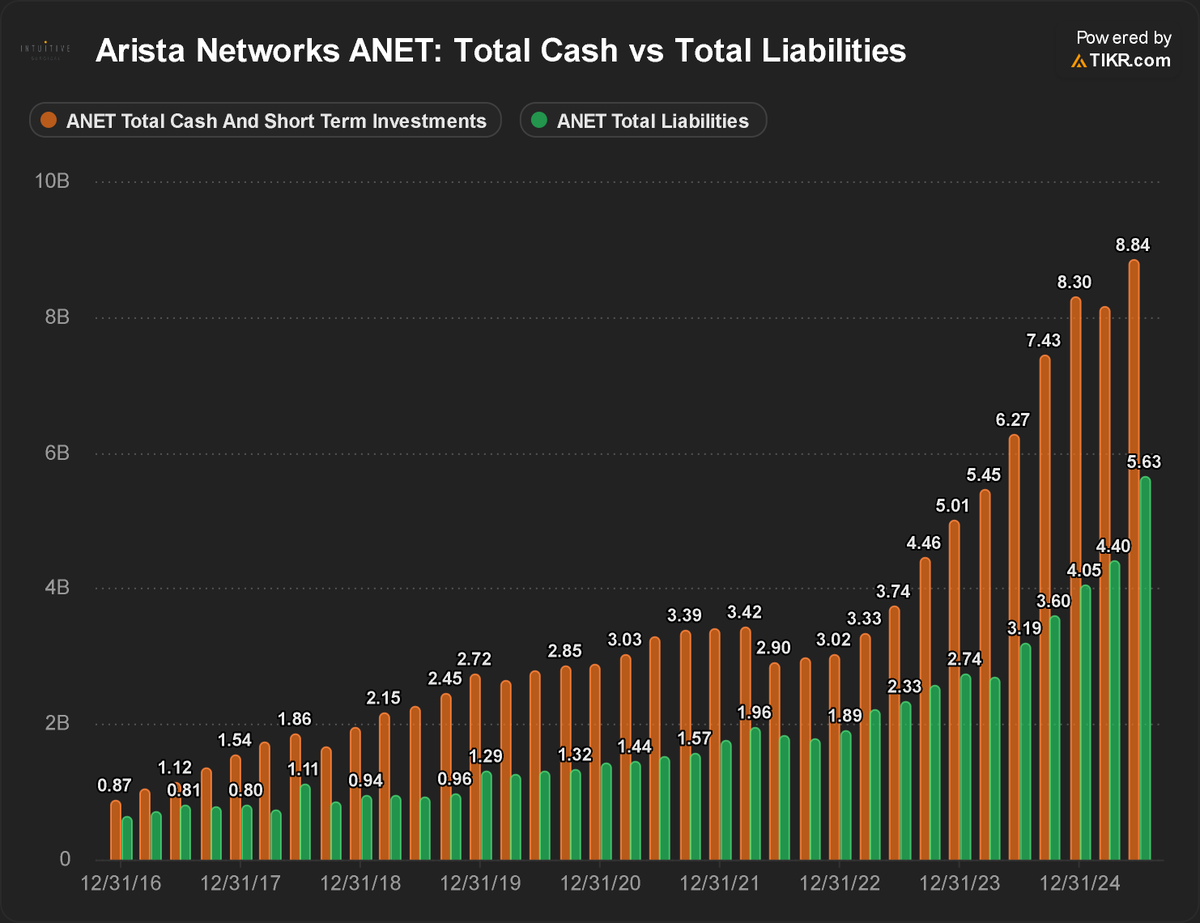

Arista Networks Inc $ANET

- One of the best companies to add after Liberation Day

- Very conservative management

- The company has been accumulating cash and conducting significant share buybacks

Another correction i will buy more

- One of the best companies to add after Liberation Day

- Very conservative management

- The company has been accumulating cash and conducting significant share buybacks

Another correction i will buy more

• • •

Missing some Tweet in this thread? You can try to

force a refresh