1/ Quality data is the backbone of quality research

In our research workflow, @tokenterminal is the foundation we build on every week

At the start of each week, when drafting long-form reports, TT is always the first stop 🧵

In our research workflow, @tokenterminal is the foundation we build on every week

At the start of each week, when drafting long-form reports, TT is always the first stop 🧵

2/ Token Terminal metrics help us validate insights, prioritize theses, structure comparisons, and add depth to every research product we deliver

See how we use them across our different reports👇

See how we use them across our different reports👇

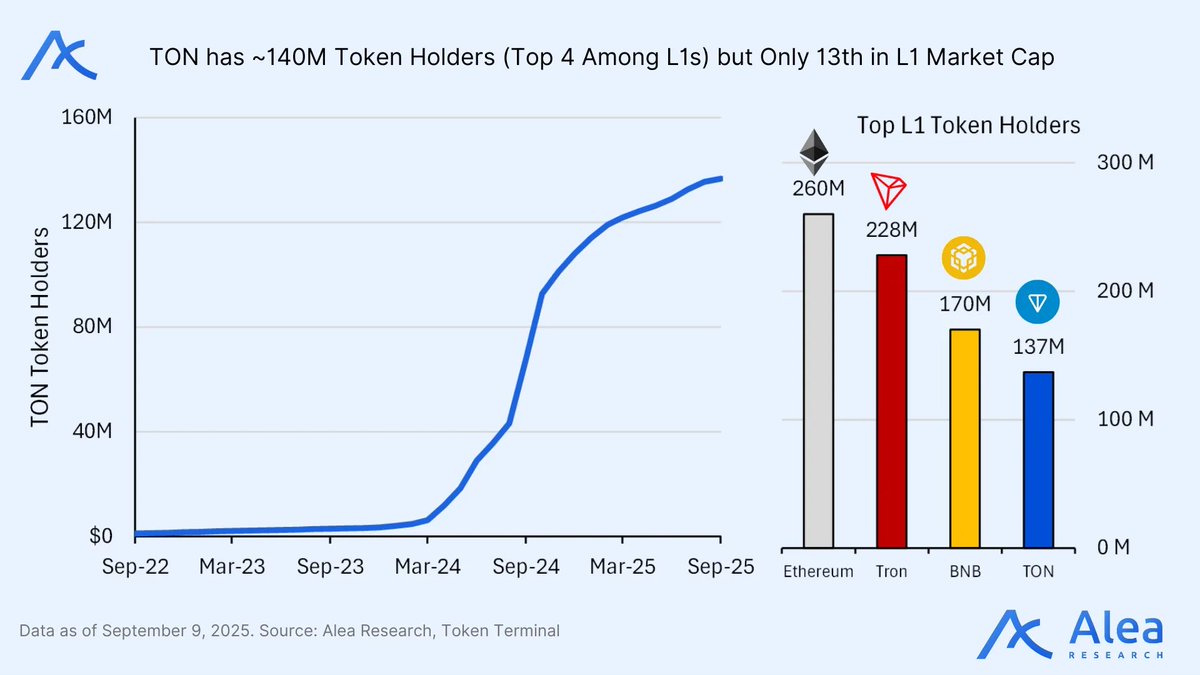

3/ Thesis – TON Case

In our Theses, TT data helps us separate hype from fundamentals

For TON, TT showed that, although TON had a spike in fees and MAUs due to Hamster Combat and Notcoin, most of those users didn’t stay

This was key to not overestimating the speculative episode

In our Theses, TT data helps us separate hype from fundamentals

For TON, TT showed that, although TON had a spike in fees and MAUs due to Hamster Combat and Notcoin, most of those users didn’t stay

This was key to not overestimating the speculative episode

4/ Beyond that episode, TT data showed that TON maintains solid foundations:

It is the only L1 embedded in Telegram, with 140M+ holders (top 4)

This integration lowers user acquisition costs and positions TON as native rails for payments, remittances, and micro-transactions

It is the only L1 embedded in Telegram, with 140M+ holders (top 4)

This integration lowers user acquisition costs and positions TON as native rails for payments, remittances, and micro-transactions

5/ TT data also shows that TON’s model adds strength:

~0.5–0.6% inflation and required use for mini-apps and ads create structural demand for $TON

Here, TT allowed us to contrast temporary signals with lasting advantages, which strengthens our institutional thesis

~0.5–0.6% inflation and required use for mini-apps and ads create structural demand for $TON

Here, TT allowed us to contrast temporary signals with lasting advantages, which strengthens our institutional thesis

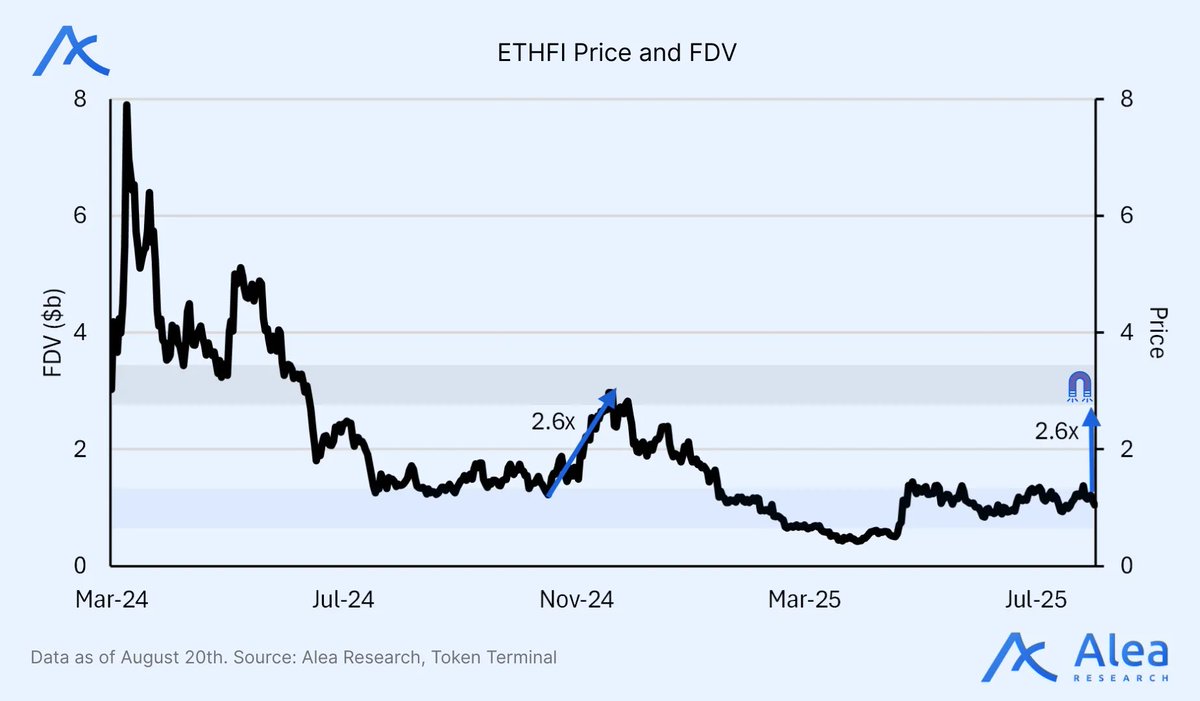

6/ Benchmarks - ETHFI Case

In our Benchmarks, Token Terminal lets us to track ETHFI’s arc:

FDV fell ~–90%, then recovered 2.6x (2024) and 4.1x (2025)

TT also made clear that the price base near ~$1B was fundamentals-driven, revenue and buybacks

In our Benchmarks, Token Terminal lets us to track ETHFI’s arc:

FDV fell ~–90%, then recovered 2.6x (2024) and 4.1x (2025)

TT also made clear that the price base near ~$1B was fundamentals-driven, revenue and buybacks

7/ Pulse – Market Overview

In Pulse, TT data is used to quantify capital turnover within the market, separate narrative from data, and to see which sectors are capturing market share

In this case, showing that BTC and ETH are steadily gaining dominance while alts lose share

In Pulse, TT data is used to quantify capital turnover within the market, separate narrative from data, and to see which sectors are capturing market share

In this case, showing that BTC and ETH are steadily gaining dominance while alts lose share

8/ TT is the foundation of our reports, every week at Alea starts here:

We scan KPIs (price, FDV, turnover, valuation ratios) to judge if a protocol looks stretched or attractive, then move from project metrics to sector comps to frame theses

We scan KPIs (price, FDV, turnover, valuation ratios) to judge if a protocol looks stretched or attractive, then move from project metrics to sector comps to frame theses

9/ For Benchmarks, TT’s balance-sheet style data gives us a head start

We validate, add correlations (KPI trends, beta vs ETH), and compare across sectors

Token prices and leaderboards are used in every Pulse issue, often where we spot alpha first

We validate, add correlations (KPI trends, beta vs ETH), and compare across sectors

Token prices and leaderboards are used in every Pulse issue, often where we spot alpha first

10/ Two TT datasets are used in every Pulse and most of our reports:

- Token prices

- Leaderboards

Prices underpin charts and derived metrics

Leaderboards surface divergences early

- Token prices

- Leaderboards

Prices underpin charts and derived metrics

Leaderboards surface divergences early

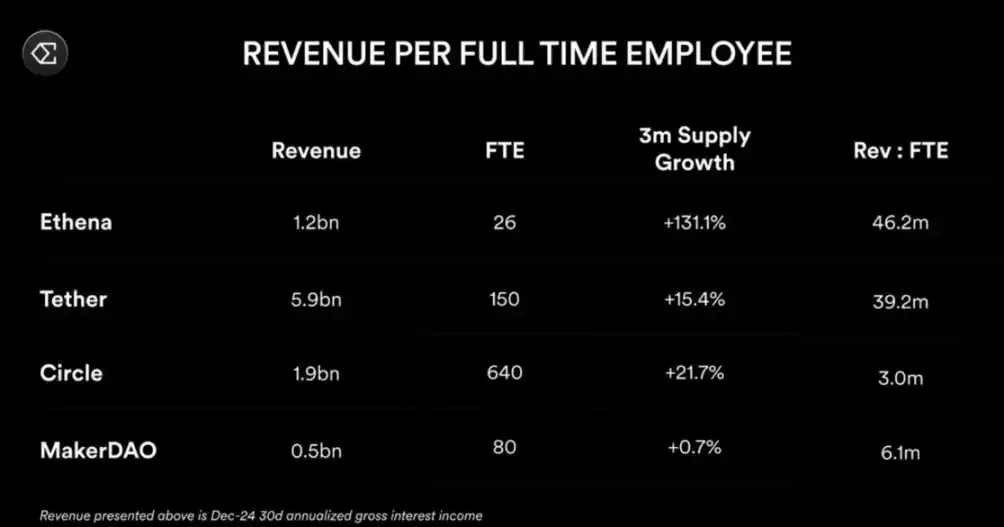

11/ Sector view: TT cuts noise. CT says fees led by Solana, Tron, or derivatives (Hyperliquid). TT shows stablecoin issuers (Tether, Circle) lead, then L1s, DEXs, lending, liquid staking, and derivatives

This insight shaped our Ethena thesis, since June, $ENA is up ~3x (+177%)

This insight shaped our Ethena thesis, since June, $ENA is up ~3x (+177%)

12/ @tokenterminal gives us the edge: a structured, empirical foundation that replaces speculation with data

From theses to benchmarks to Pulse, every report starts with TT data, and often where alpha is found

From theses to benchmarks to Pulse, every report starts with TT data, and often where alpha is found

• • •

Missing some Tweet in this thread? You can try to

force a refresh