Objective analysis for sophisticated capital allocators. Helping protocols with strategic positioning.

https://t.co/DFYzbB3Eap

4 subscribers

How to get URL link on X (Twitter) App

2/ Token Terminal metrics help us validate insights, prioritize theses, structure comparisons, and add depth to every research product we deliver

2/ Token Terminal metrics help us validate insights, prioritize theses, structure comparisons, and add depth to every research product we deliver

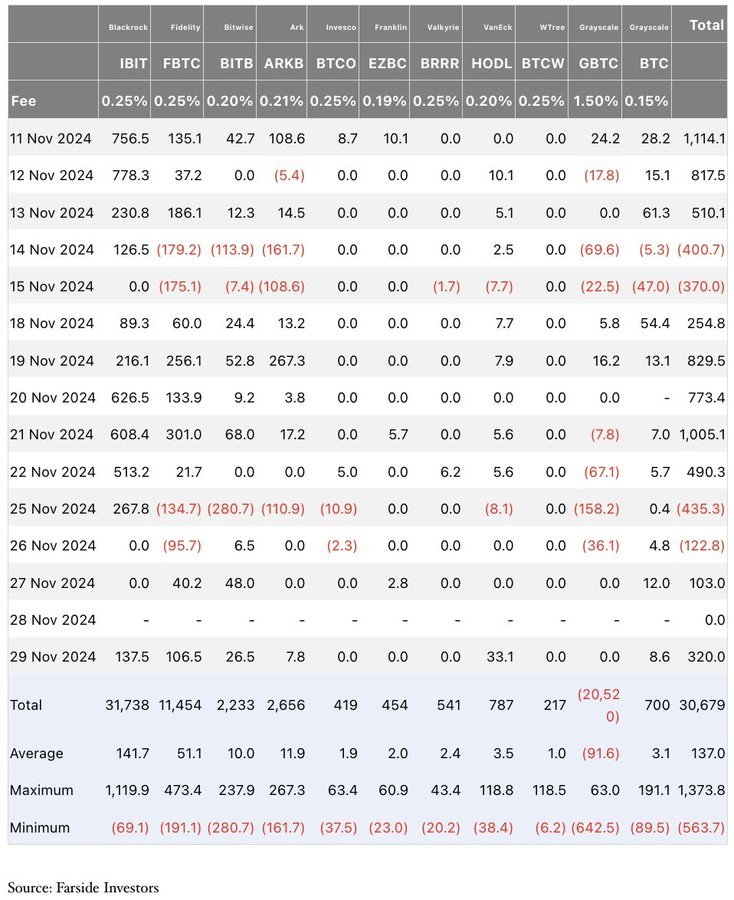

Right now, the largest yield-bearing stablecoin float, @ethena_labs is expanding its revenue sources with an appeal to both retail and institutions, all while maintaining a lean stature.

Right now, the largest yield-bearing stablecoin float, @ethena_labs is expanding its revenue sources with an appeal to both retail and institutions, all while maintaining a lean stature.

https://x.com/chameleon_jeff/status/1890443240186462684

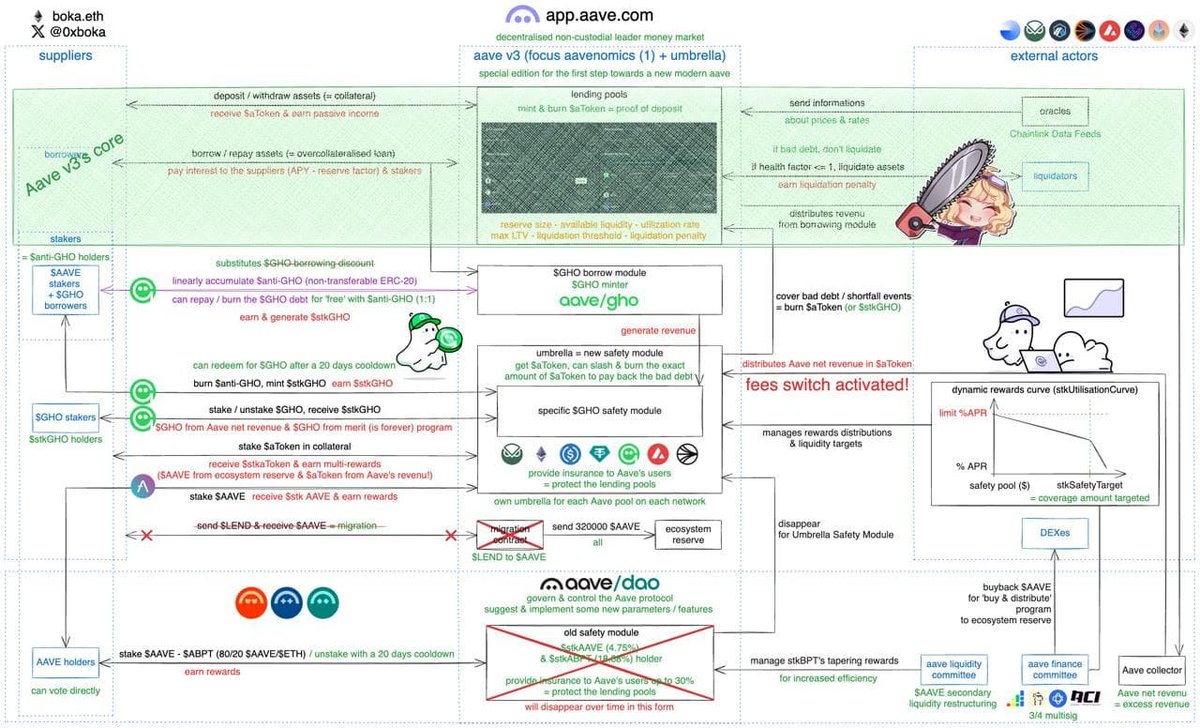

https://twitter.com/aave/status/1896940185469984901The Aave team has recently presented the latest version of the Aavenomics proposal.

https://x.com/lemiscate/status/1896897365145235752

Trump's U.S. Crypto Reserve post confirms the President’s desire for the Federal government to establish holdings of crypto, and it extends the possibilities for what assets might be in this reserve beyond Bitcoin.

Trump's U.S. Crypto Reserve post confirms the President’s desire for the Federal government to establish holdings of crypto, and it extends the possibilities for what assets might be in this reserve beyond Bitcoin.

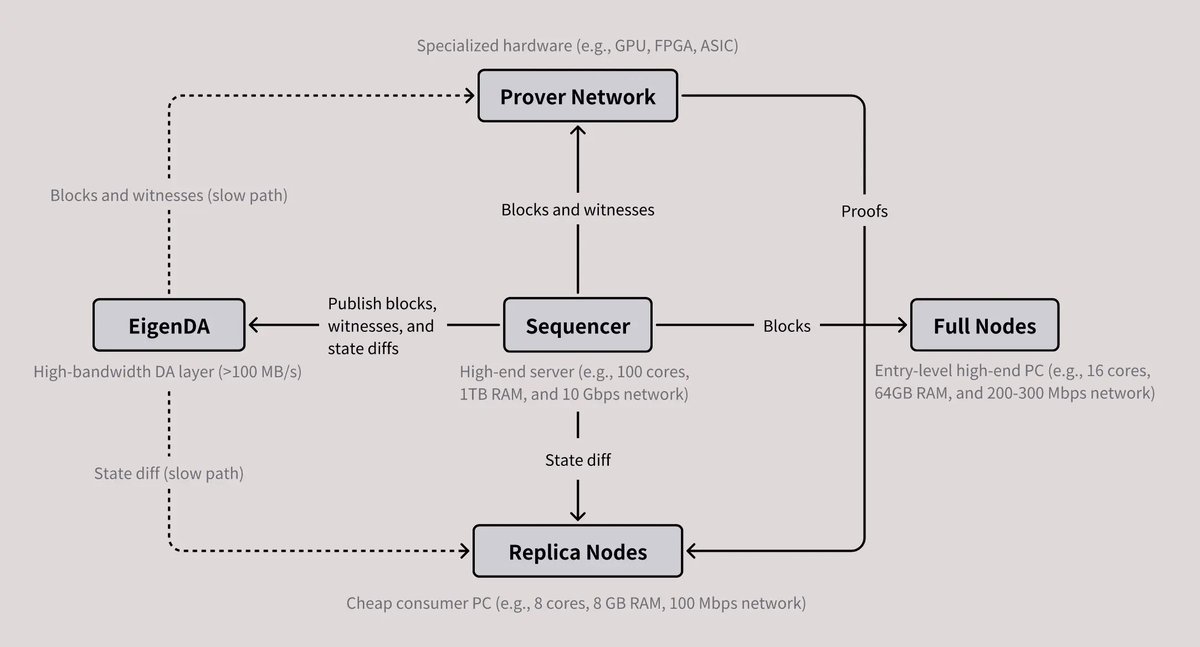

https://x.com/monad_xyz/status/1892227817149997212

Of the new generation of chains launching this cycle, @monad_xyz has raised the most; $253M in total.

Of the new generation of chains launching this cycle, @monad_xyz has raised the most; $253M in total.

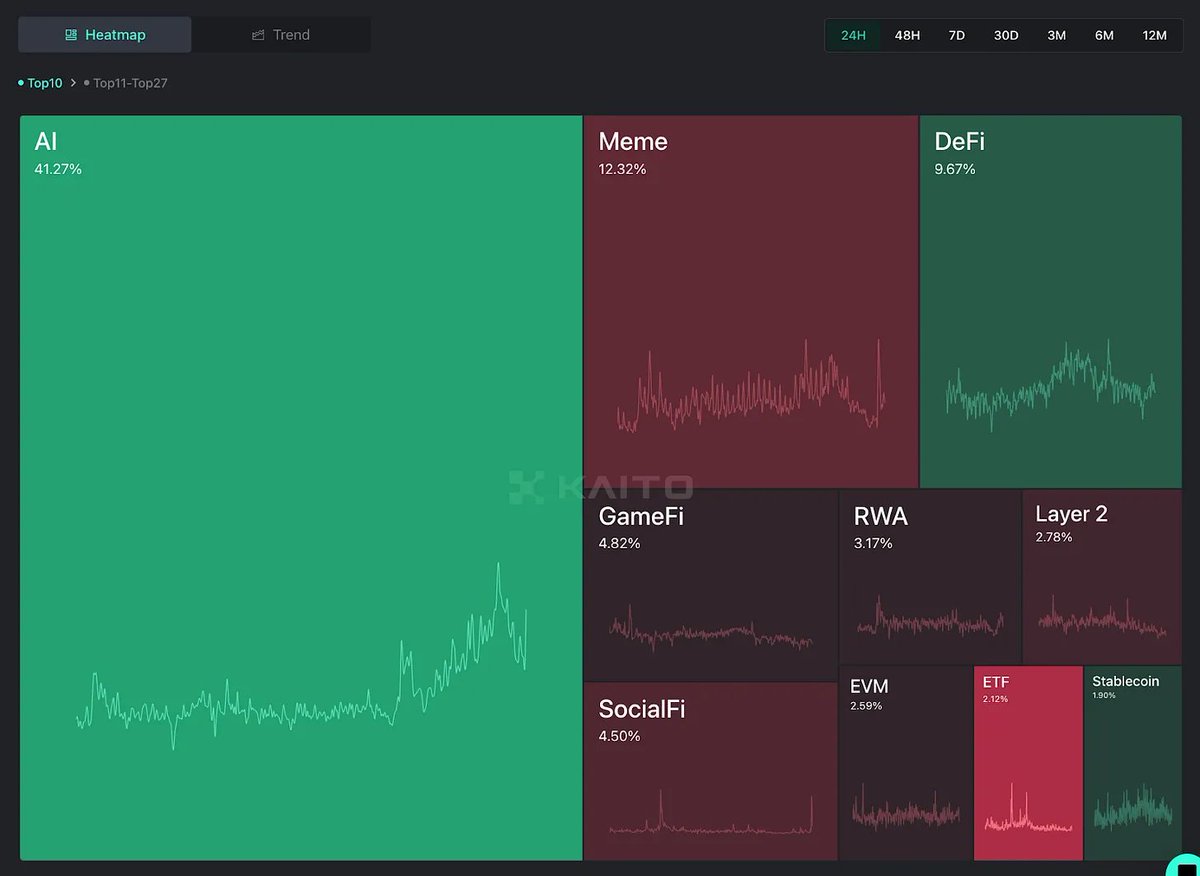

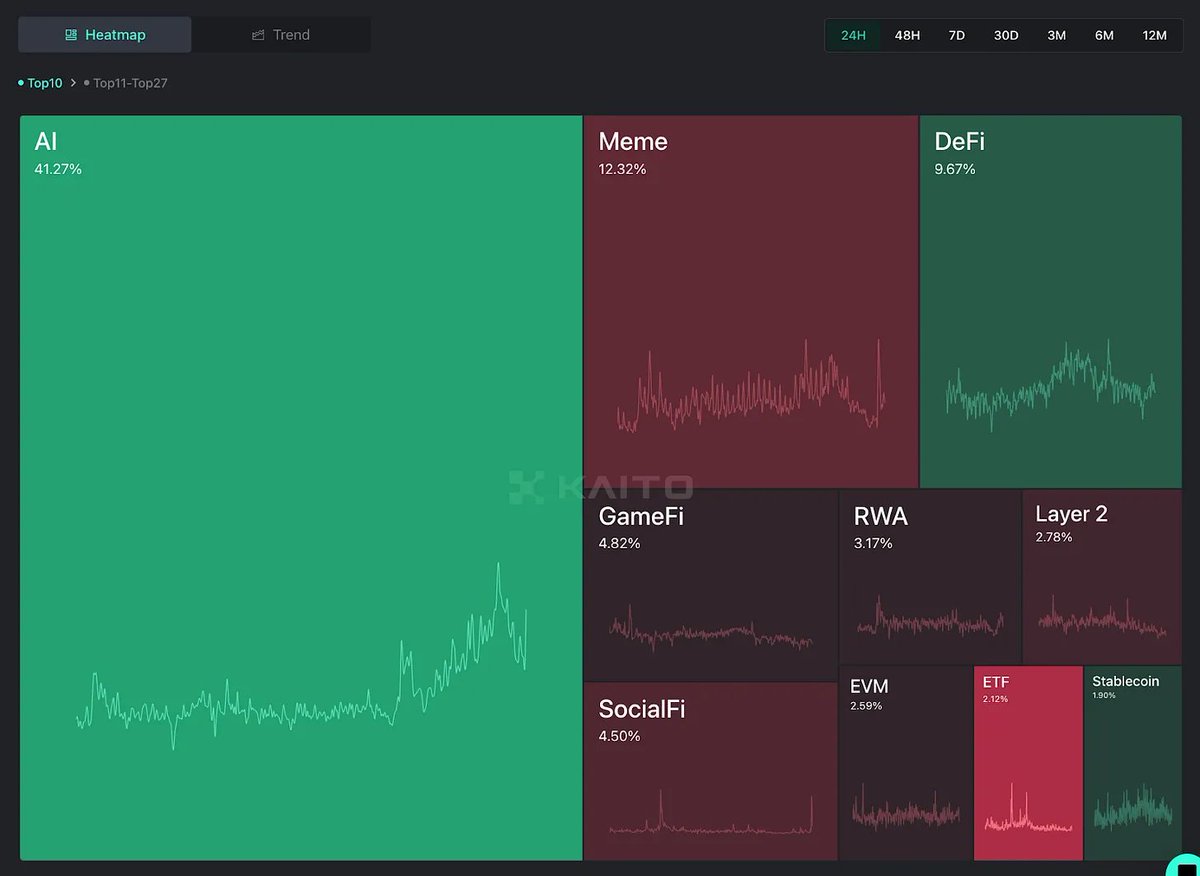

We first covered DeepSeek’s impact on the AI space in last week’s Ailea Bulletin.

We first covered DeepSeek’s impact on the AI space in last week’s Ailea Bulletin.

https://twitter.com/USDT0_to/status/1879921612838805583Silicon Valley isn’t just betting on AI agents this year—stablecoins are a prime target, though less flashy.

https://twitter.com/HeyAnonai/status/1878468256454893769The DeFAI sector is all customization, giving each person a customized AI agent that already masters everything on-chain: from sourcing information to executing transactions as you instruct it to; and it can also adapt autonomously over time.

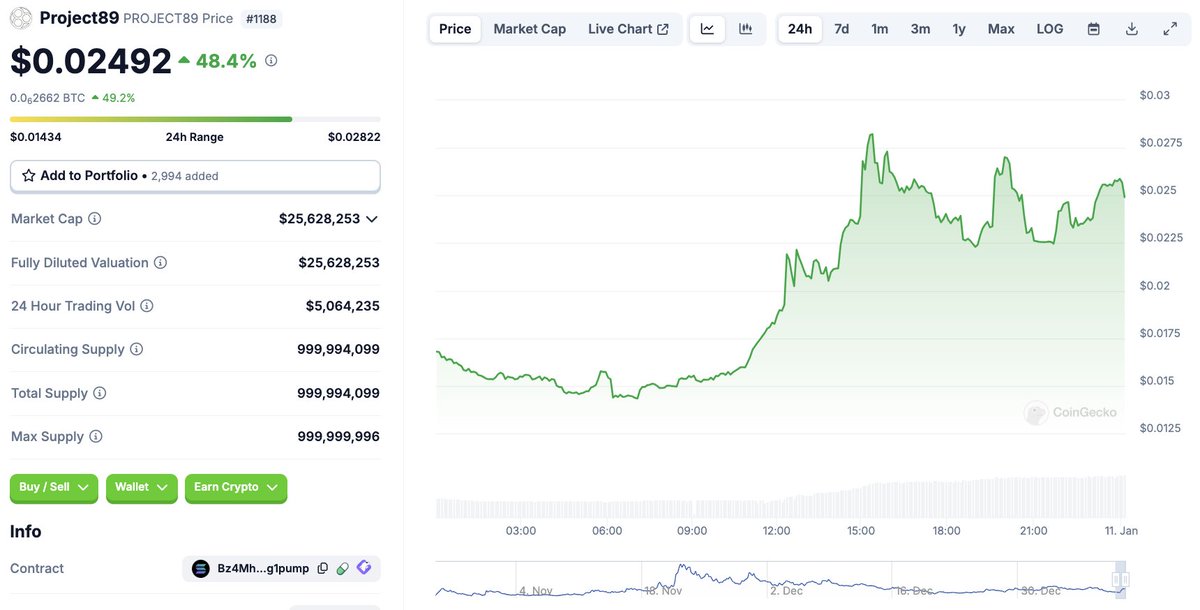

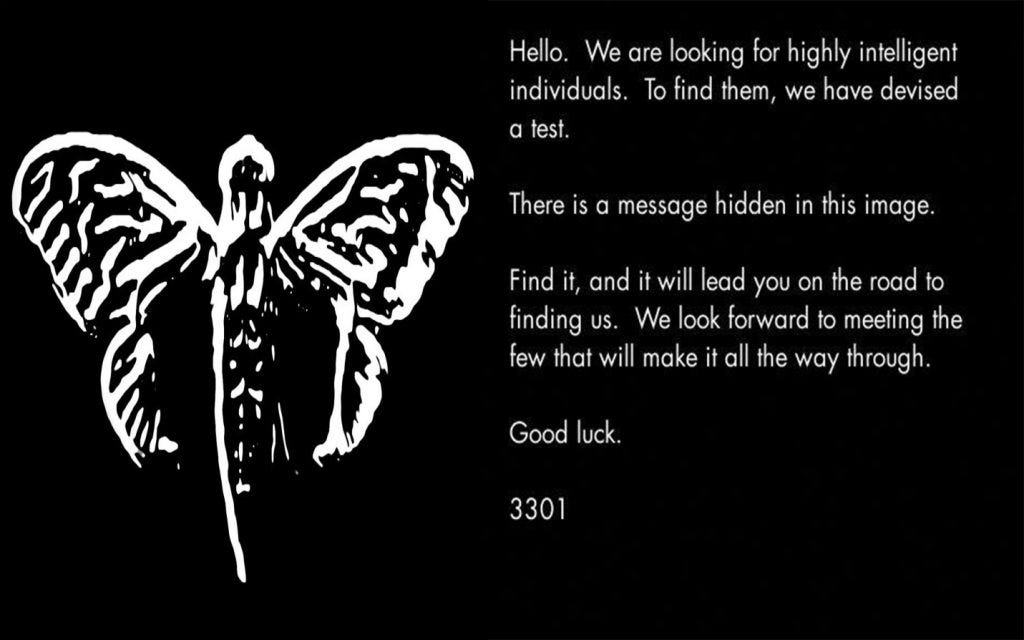

Parallels can be drawn between Project 89 & Cicada 3301.

Parallels can be drawn between Project 89 & Cicada 3301.

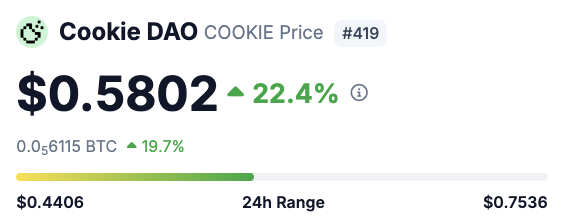

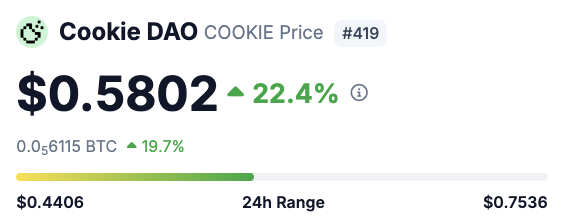

Cookie DAO is a decentralized organization that creates advanced data aggregation infrastructure for AI agents.

Cookie DAO is a decentralized organization that creates advanced data aggregation infrastructure for AI agents. https://x.com/cookiedotfun/status/1875211985194766554

2/ The $190T fixed income markets dwarf everything we've seen in crypto. The Australian debt market alone is bigger than the entire crypto market cap. That's just one country with 0.5% of the world's population.

2/ The $190T fixed income markets dwarf everything we've seen in crypto. The Australian debt market alone is bigger than the entire crypto market cap. That's just one country with 0.5% of the world's population.

https://twitter.com/AleaResearch/status/1866978426315583910

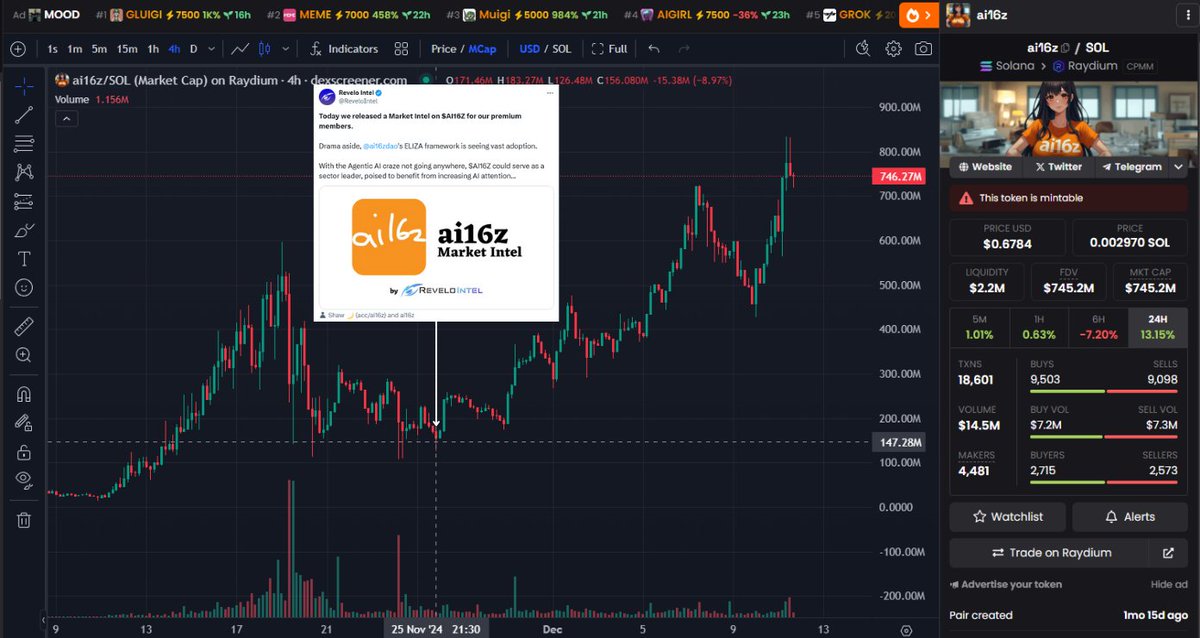

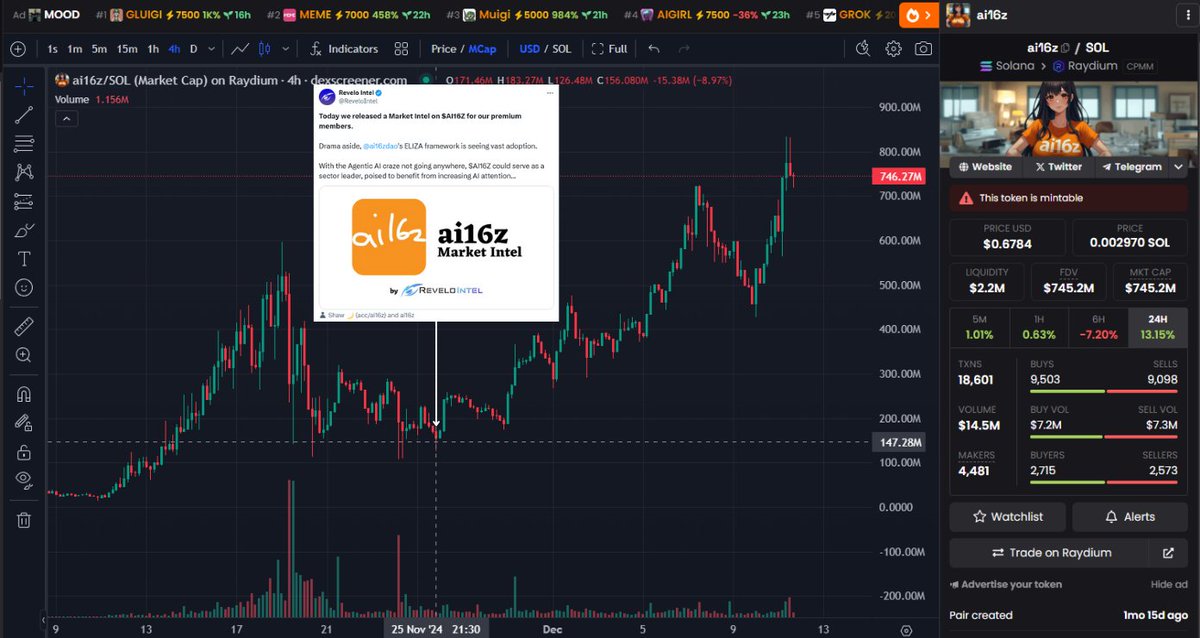

Now, other developers & teams have also caught onto the concept of acquiring culturally significant twitter handles & creating their own agents to increase engagement, though motivations may differ.

Now, other developers & teams have also caught onto the concept of acquiring culturally significant twitter handles & creating their own agents to increase engagement, though motivations may differ.

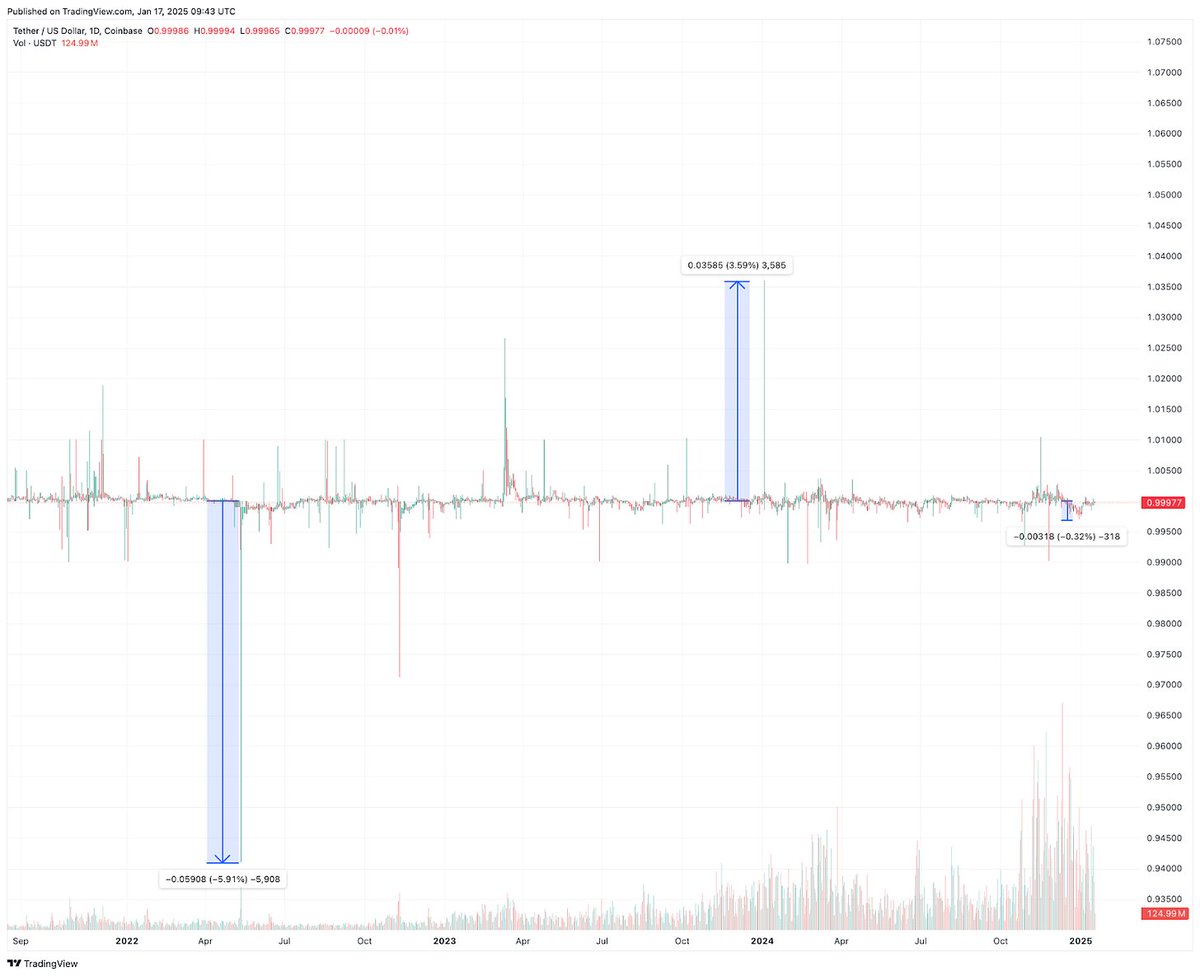

After several weeks of optimistic bias, some (short-lived) fear was put back in the markets, as clearly shown by the VIX (the SPX volatility index), which spiked to over 30 points.

After several weeks of optimistic bias, some (short-lived) fear was put back in the markets, as clearly shown by the VIX (the SPX volatility index), which spiked to over 30 points.

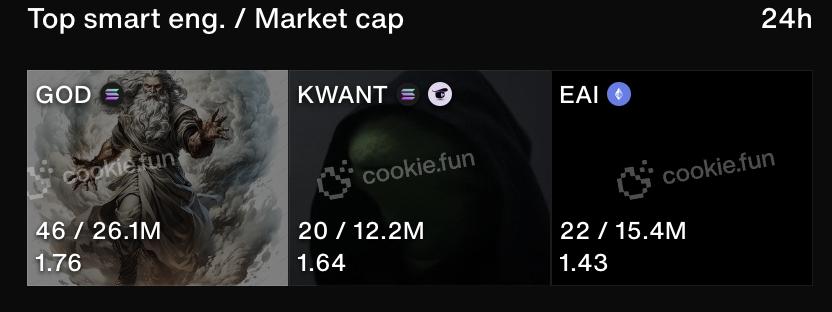

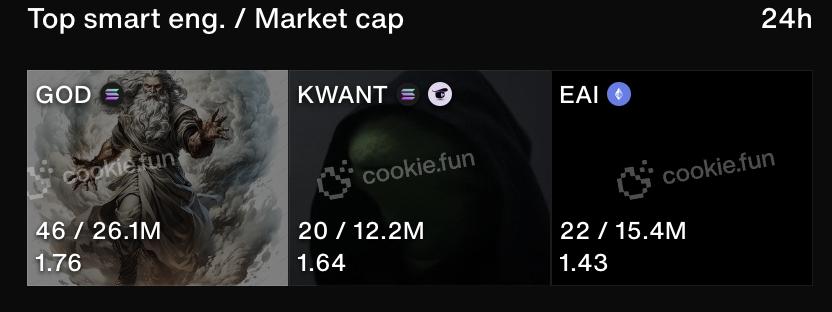

Most memes, as well as AI agent tokens, thrive off of attention.

Most memes, as well as AI agent tokens, thrive off of attention.https://x.com/TrustlessState/status/1866888704171602116

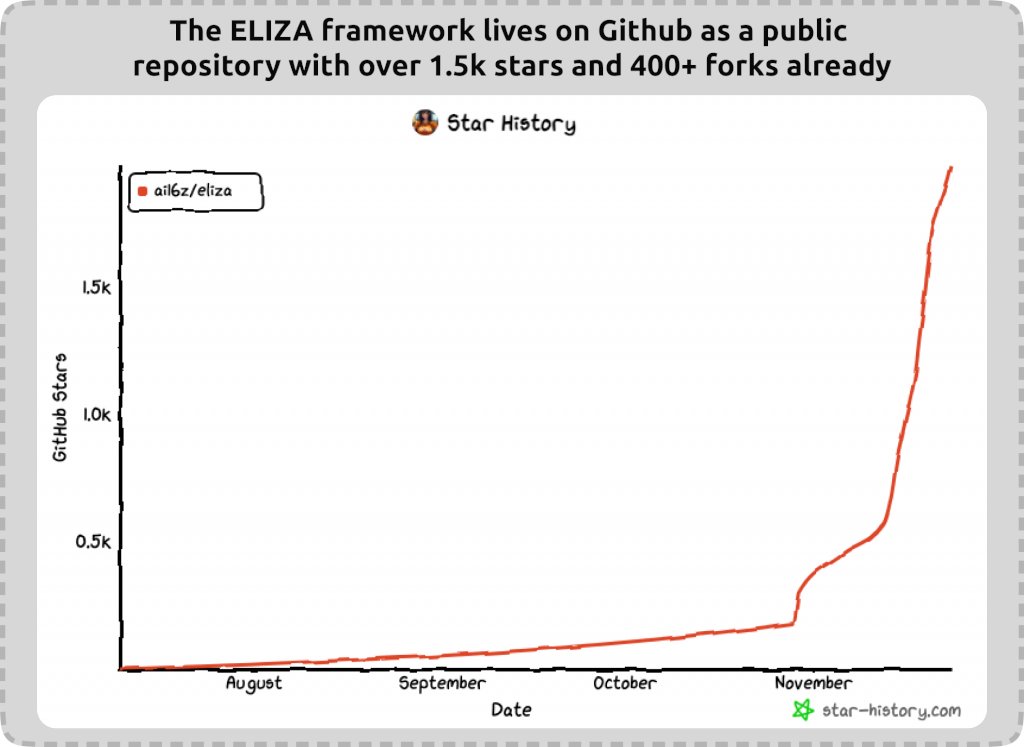

2/ The sentiment flip on $GOAT to all-time lows coincided with rising developer activity on $ai16z.

2/ The sentiment flip on $GOAT to all-time lows coincided with rising developer activity on $ai16z.