Crypto adoption is about to SURGE:

A new Bank of America survey shows 75% of investors have ZERO exposure to crypto.

Now, US lawmakers are requesting the SEC implements President Trump's Executive Order allowing 401(K)s to BUY crypto.

What's next? Let us explain.

(a thread)

A new Bank of America survey shows 75% of investors have ZERO exposure to crypto.

Now, US lawmakers are requesting the SEC implements President Trump's Executive Order allowing 401(K)s to BUY crypto.

What's next? Let us explain.

(a thread)

Below is a letter that was sent by lawmakers to the SEC this week.

It asks the SEC to begin opening up 401(K) plans to crypto "swiftly."

This opens ~$10 TRILLION worth of capital, which is 2.5 TIMES the current market cap of crypto.

It asks the SEC to begin opening up 401(K) plans to crypto "swiftly."

This opens ~$10 TRILLION worth of capital, which is 2.5 TIMES the current market cap of crypto.

On August 7th, Trump signed the below Executive Order.

This called for the "democratization of access to alternative assets," also known as crypto.

Prior to this, 401(K)s could only buy crypto ETFs and some stocks.

Now, Congress is calling for the SEC to implement the Order.

This called for the "democratization of access to alternative assets," also known as crypto.

Prior to this, 401(K)s could only buy crypto ETFs and some stocks.

Now, Congress is calling for the SEC to implement the Order.

Take a look at the current TOTAL market cap of crypto.

At a record ~$4.1 trillion, this is still $6 trillion LESS than the total amount of assets in 401(K) plans.

Even if just 2% of 401(K) assets went into crypto, this would spur a major bull market.

Bitcoin could hit $200K.

At a record ~$4.1 trillion, this is still $6 trillion LESS than the total amount of assets in 401(K) plans.

Even if just 2% of 401(K) assets went into crypto, this would spur a major bull market.

Bitcoin could hit $200K.

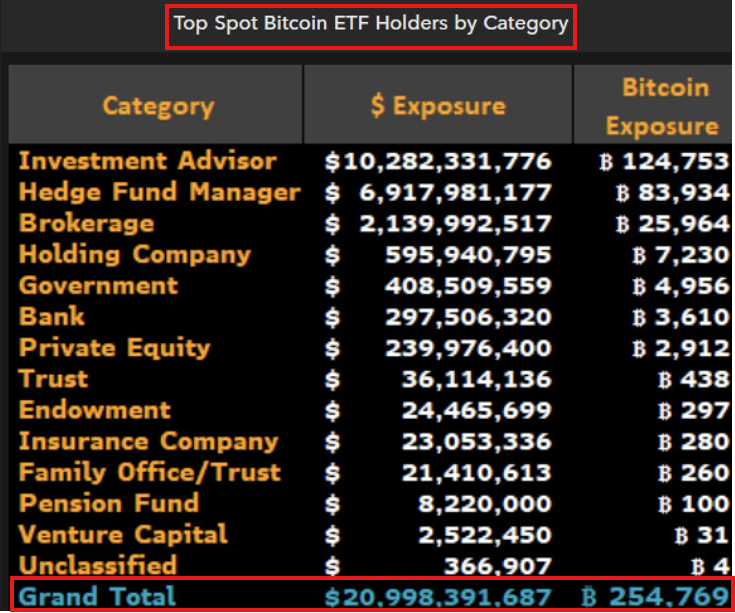

Here's what's even more shocking:

The average professional fund manager allocation toward crypto is 0.3% of AUM.

This is referring to PROFESSIONAL investors who are generally more educated on crypto than others.

Mainstream crypto adoption is even lower right now.

The average professional fund manager allocation toward crypto is 0.3% of AUM.

This is referring to PROFESSIONAL investors who are generally more educated on crypto than others.

Mainstream crypto adoption is even lower right now.

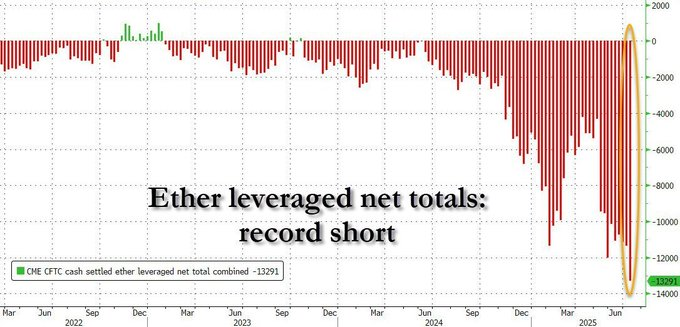

Many institutional investors were actually SHORT crypto into this recent bull market.

Heading into July, net leverage shorts on Ethereum hit a record high, per Zerohedge.

In fact, net short exposure was ~25% ABOVE levels seen in February 2025.

That has rapidly changed.

Heading into July, net leverage shorts on Ethereum hit a record high, per Zerohedge.

In fact, net short exposure was ~25% ABOVE levels seen in February 2025.

That has rapidly changed.

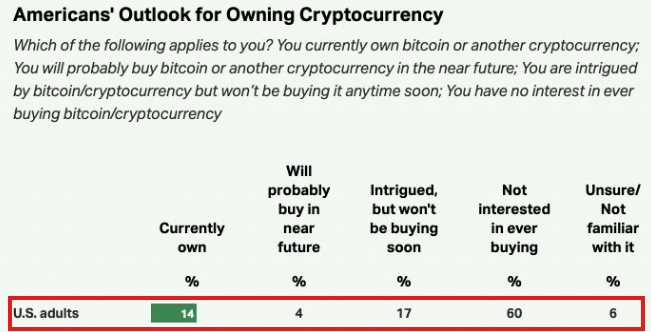

Also, take a look at this recently conducted Gallup poll.

Currently, just 14% of adults in the US own Bitcoin or any other crypto currency.

The reality is less than 5% of Americans even have any material exposure to crypto at all.

This Executive Order will change that.

Currently, just 14% of adults in the US own Bitcoin or any other crypto currency.

The reality is less than 5% of Americans even have any material exposure to crypto at all.

This Executive Order will change that.

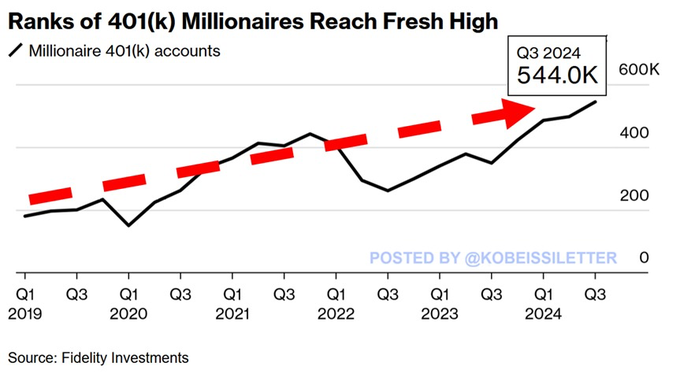

Heading into 2025, the number of US millionaire 401(K) accounts surged.

The number of 401(K) accounts with a balance of $1+ million jumped to a record 544,000 in Q3 2024.

This was up from 349,000 in 2023 and is likely nearing 600,000+ now.

These accounts may soon buy crypto.

The number of 401(K) accounts with a balance of $1+ million jumped to a record 544,000 in Q3 2024.

This was up from 349,000 in 2023 and is likely nearing 600,000+ now.

These accounts may soon buy crypto.

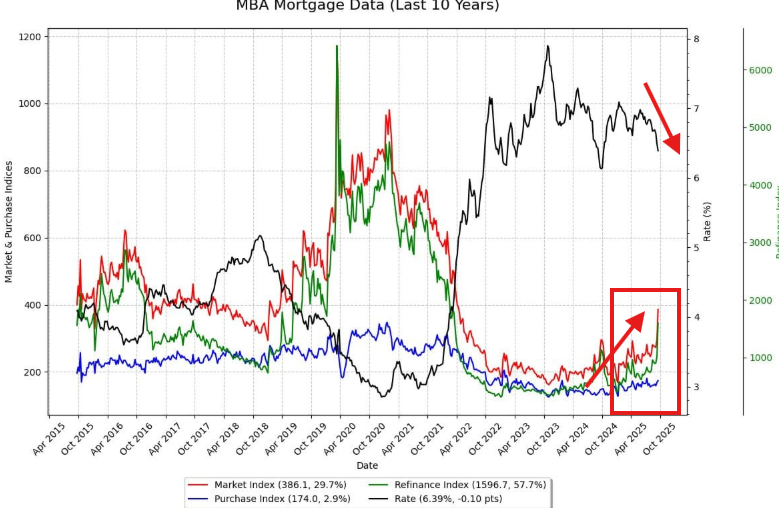

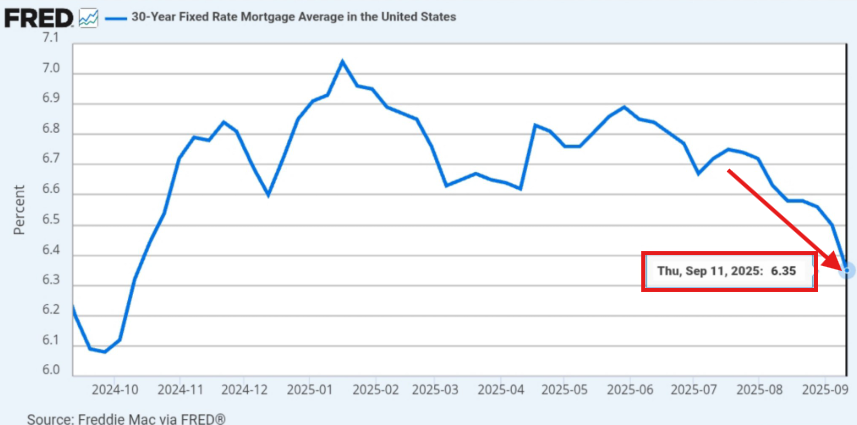

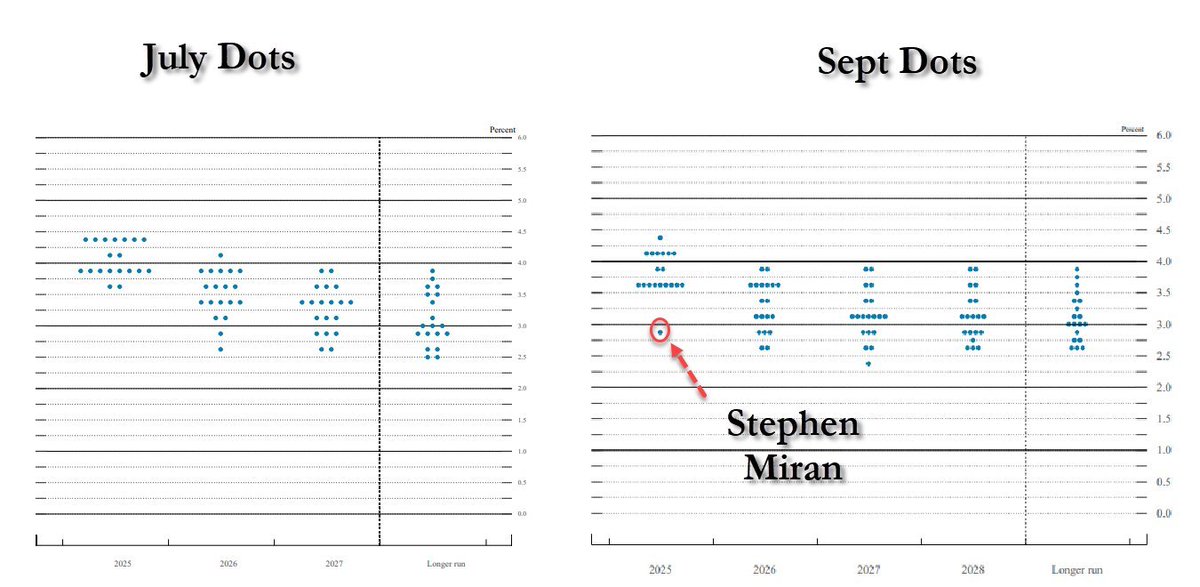

On top of this, the Fed is adding fuel to the fire.

September marked the first Fed interest rate cut with Core PCE inflation at 2.9%+ in 30+ years.

The labor market is simply too weak, even as inflation has risen.

Bitcoin and gold have known this for months now.

September marked the first Fed interest rate cut with Core PCE inflation at 2.9%+ in 30+ years.

The labor market is simply too weak, even as inflation has risen.

Bitcoin and gold have known this for months now.

As we look ahead, we believe the themes driving crypto higher will result in major macroeconomic shifts.

This is redefining the way markets are moving.

Want to see how we are capitalizing on it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

This is redefining the way markets are moving.

Want to see how we are capitalizing on it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Lastly, as the US Dollar falls, crypto and gold are gaining.

The USD is having one of its worst years in history, with Bitcoin up 30 percentage points MORE YTD.

Investors are hedging against inflation.

Follow us @KobeissiLetter for real time analysis as this develops.

The USD is having one of its worst years in history, with Bitcoin up 30 percentage points MORE YTD.

Investors are hedging against inflation.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh