🚨 LEAKED: BIS & IMF papers describe a financial rail that doesn’t exist on Bitcoin or Ethereum… but matches XRPL line by line.

They won’t print “XRP” in the headline but the specs are too precise to ignore.

🧵👇 The hidden blueprint:

They won’t print “XRP” in the headline but the specs are too precise to ignore.

🧵👇 The hidden blueprint:

2/

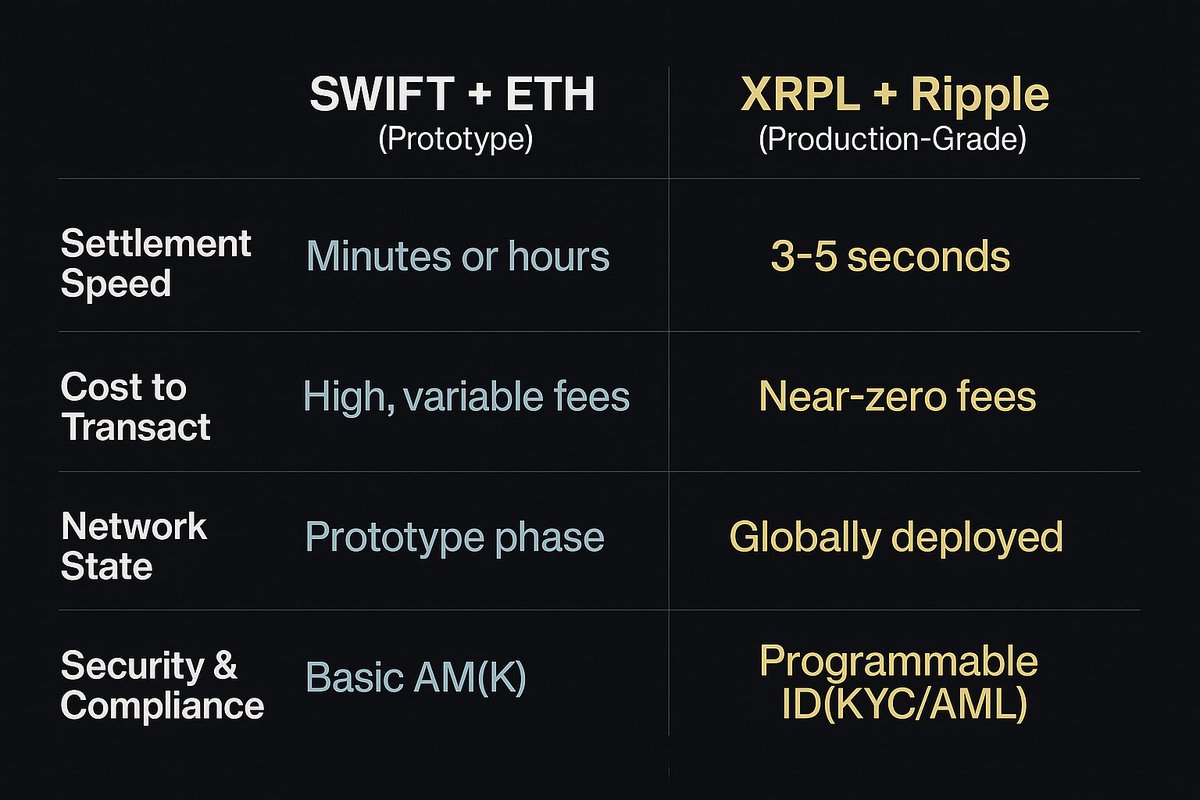

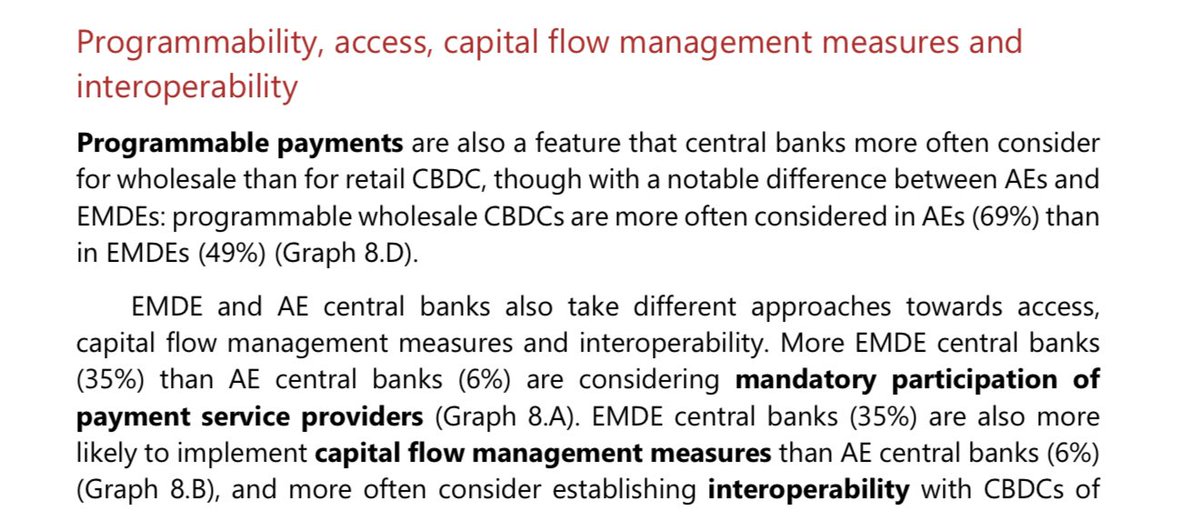

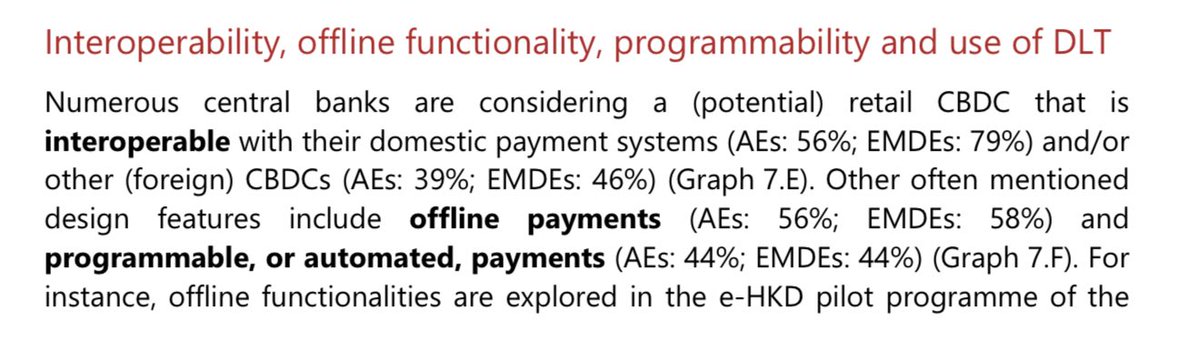

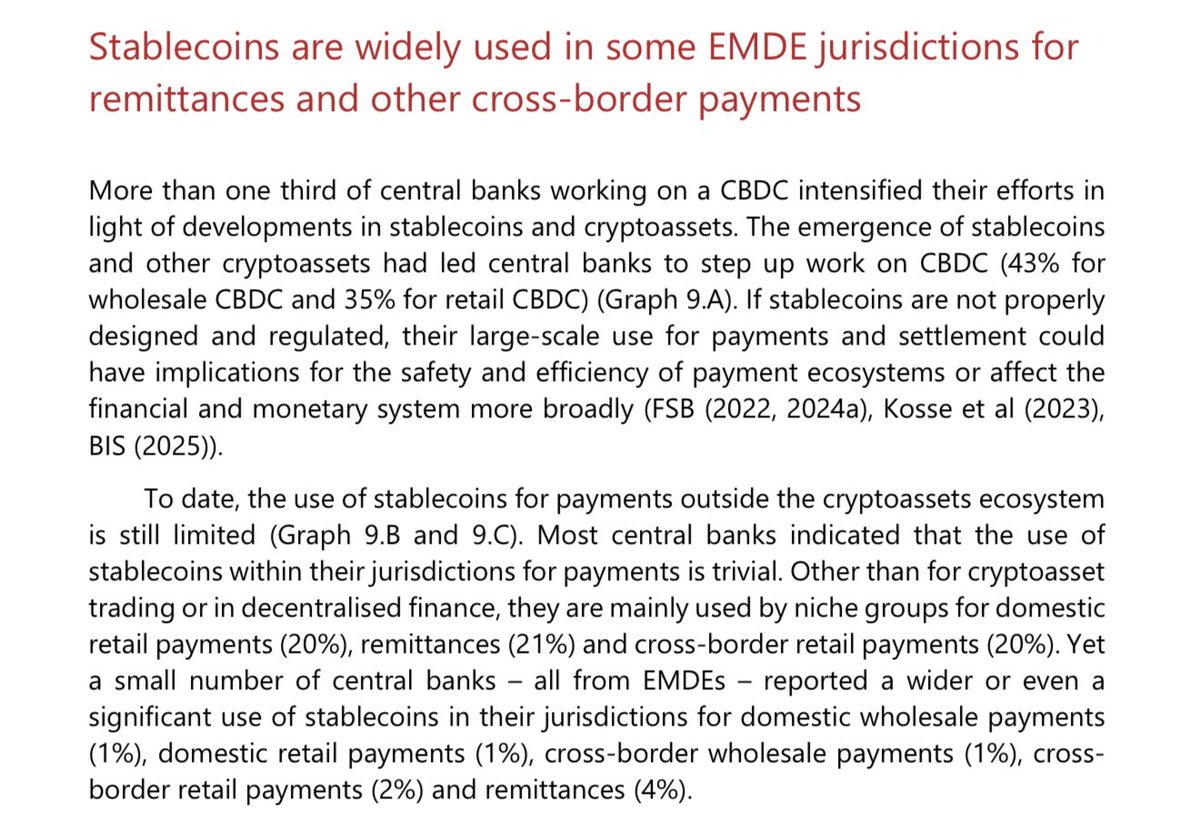

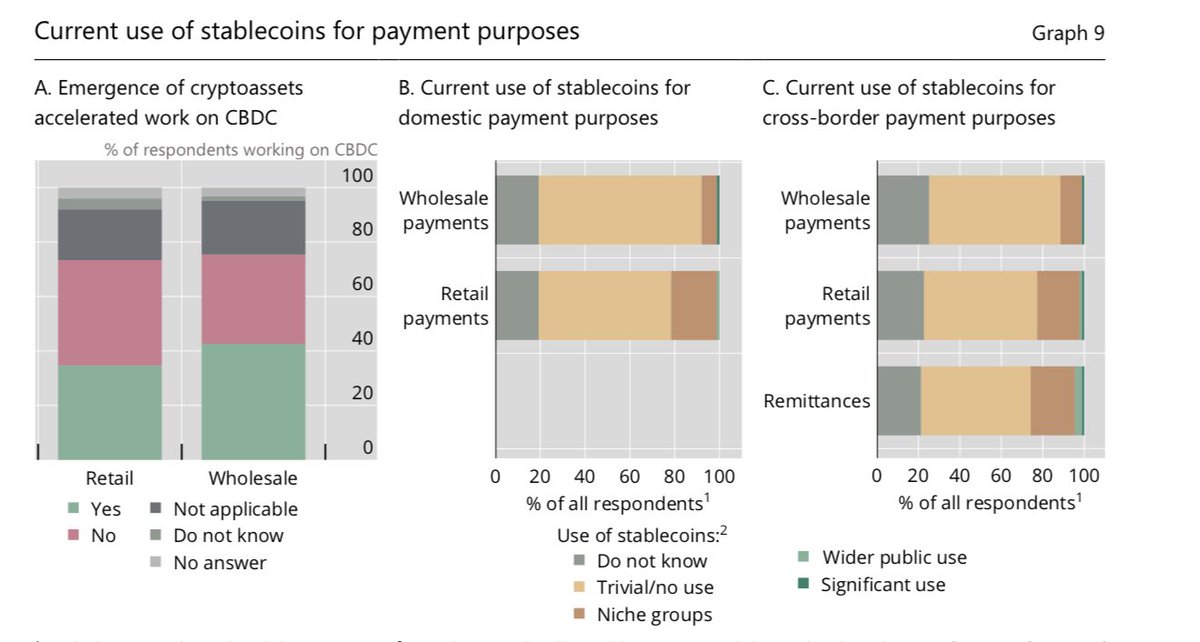

The BIS 2024/25 CBDC survey talks about “interoperable settlement layers compliant with ISO 20022,” handling trillions in tokenized assets with “instant finality.” That is XRPL’s core architecture live since 2012. They’re quietly admitting the future is already built.

The BIS 2024/25 CBDC survey talks about “interoperable settlement layers compliant with ISO 20022,” handling trillions in tokenized assets with “instant finality.” That is XRPL’s core architecture live since 2012. They’re quietly admitting the future is already built.

3/

The IMF 2025 paper on blockchain consensus lists conditions:

•Energy efficient (not Bitcoin)

•Fast, deterministic finality (not Ethereum)

•Scalable & regulator-friendly

Tell me: which ledger settles in 3–5 seconds, uses minimal energy, and is already being audited by banks? Only XRPL.

The IMF 2025 paper on blockchain consensus lists conditions:

•Energy efficient (not Bitcoin)

•Fast, deterministic finality (not Ethereum)

•Scalable & regulator-friendly

Tell me: which ledger settles in 3–5 seconds, uses minimal energy, and is already being audited by banks? Only XRPL.

4/

Even the annexes of IIF feedback to BIS go further: they name XRP as an example of faster, cheaper rails vs SWIFT. But these mentions are tucked away hidden in “technical consultation responses.” Why? Because they can’t reveal what’s really replacing SWIFT until the switch flips.

Even the annexes of IIF feedback to BIS go further: they name XRP as an example of faster, cheaper rails vs SWIFT. But these mentions are tucked away hidden in “technical consultation responses.” Why? Because they can’t reveal what’s really replacing SWIFT until the switch flips.

5/

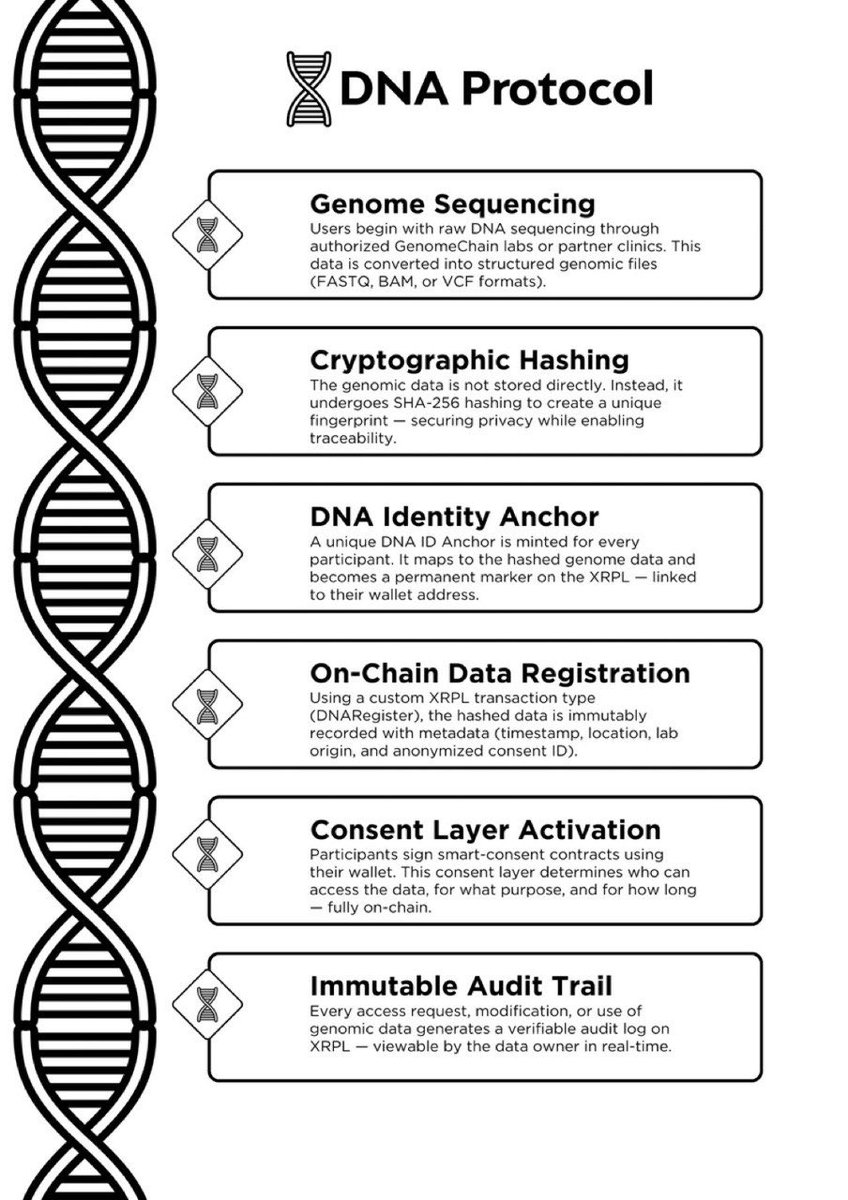

Now the theory deepens: Ripple has filed for a U.S. banking license, a Fed master account, and already launched RLUSD. Add to this DNA Protocol quietly onboarding labs in Africa & Asia to anchor biometric + genomic IDs.

The IMF says “supervisors need verifiable identity at scale.” That’s exactly what DNA is coding onto XRPL.

Now the theory deepens: Ripple has filed for a U.S. banking license, a Fed master account, and already launched RLUSD. Add to this DNA Protocol quietly onboarding labs in Africa & Asia to anchor biometric + genomic IDs.

The IMF says “supervisors need verifiable identity at scale.” That’s exactly what DNA is coding onto XRPL.

6/

Here’s the play:

•BIS publishes “requirements.”

•IMF writes “frameworks.”

•Ripple + DNA Protocol deliver the rails.

The names don’t appear in bold, but the architecture is a one-to-one match.

Here’s the play:

•BIS publishes “requirements.”

•IMF writes “frameworks.”

•Ripple + DNA Protocol deliver the rails.

The names don’t appear in bold, but the architecture is a one-to-one match.

7/

Why the silence? Because global adoption must look like an “organic transition,” not a forced reset. But the breadcrumbs are there. When the BIS says “cross-border tokenization frameworks,” they mean XRPL corridors. When the IMF says “identity anchoring,” they mean DNA Protocol on XRPL.

Why the silence? Because global adoption must look like an “organic transition,” not a forced reset. But the breadcrumbs are there. When the BIS says “cross-border tokenization frameworks,” they mean XRPL corridors. When the IMF says “identity anchoring,” they mean DNA Protocol on XRPL.

8/

The papers are code. The elites understand. The peasants ignore. But for those who can read between the lines… XRP is already enshrined as the hidden infrastructure of the next system.

👉 Full declassified intel: t.me/alexanderthewh…

The papers are code. The elites understand. The peasants ignore. But for those who can read between the lines… XRP is already enshrined as the hidden infrastructure of the next system.

👉 Full declassified intel: t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh