An affordability nightmare:

It would take a -38% drop in home prices OR a +60% JUMP in household income JUST for affordability to go back to 2019 levels.

You must now make ~$113,000/year to afford the MEDIAN home in the US.

Will housing ever be affordable again?

(a thread)

It would take a -38% drop in home prices OR a +60% JUMP in household income JUST for affordability to go back to 2019 levels.

You must now make ~$113,000/year to afford the MEDIAN home in the US.

Will housing ever be affordable again?

(a thread)

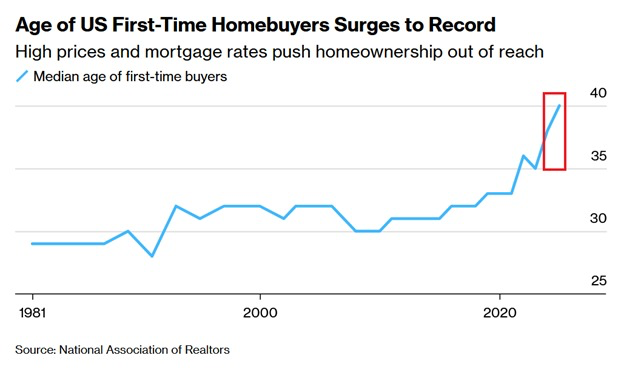

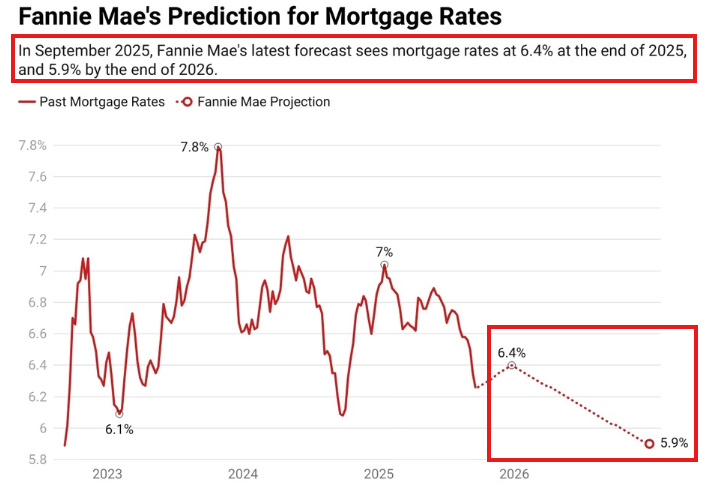

According to Fannie Mae calculations, affordability is at record lows for the US housing market.

Just for housing affordability to return to 2019 levels, mortgage rates would need to fall ~415 basis points.

The combination of inflation and higher rates has been catastrophic.

Just for housing affordability to return to 2019 levels, mortgage rates would need to fall ~415 basis points.

The combination of inflation and higher rates has been catastrophic.

A big issue is that wage growth has significantly underperformed productivity.

Between 1948 and 2014, productivity rose ~240% while wages rose ~109%.

On top of this, home prices have risen at a much faster pace than wage growth over the last 5-10 years.

All as rates spiked.

Between 1948 and 2014, productivity rose ~240% while wages rose ~109%.

On top of this, home prices have risen at a much faster pace than wage growth over the last 5-10 years.

All as rates spiked.

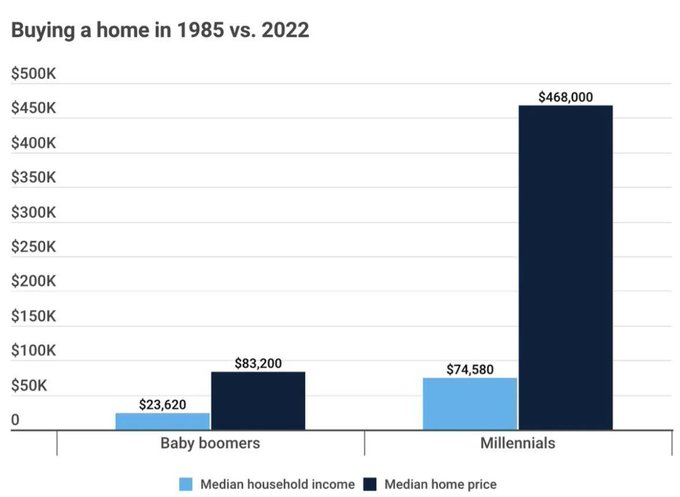

Take this as an example:

In 1985, median household income was $23,620 while the median home price was $83,200, or 3.5x higher.

In 2022, median household income was $74,580 while the median home price was $468,000, or 6.3x higher.

The data behind this crisis is crystal clear.

In 1985, median household income was $23,620 while the median home price was $83,200, or 3.5x higher.

In 2022, median household income was $74,580 while the median home price was $468,000, or 6.3x higher.

The data behind this crisis is crystal clear.

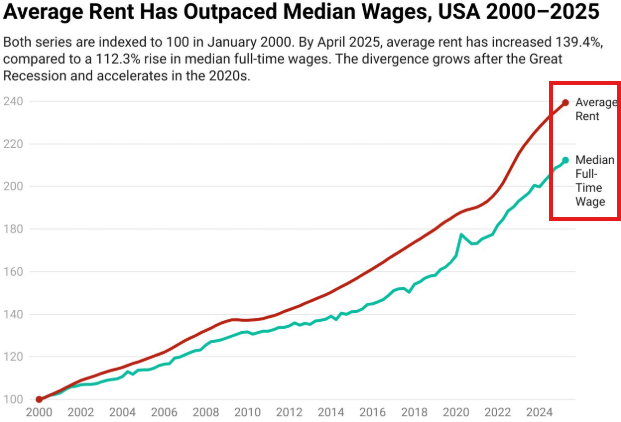

This has translated into a rental affordability crisis as well.

Since 2000, average rent has increased by +139.4% compared to +112.3% for median full-time wages.

Growth in rents has outpaced wage growth by +24 percentage points.

Not even renting is considered affordable anymore.

Since 2000, average rent has increased by +139.4% compared to +112.3% for median full-time wages.

Growth in rents has outpaced wage growth by +24 percentage points.

Not even renting is considered affordable anymore.

So, will the long-anticipated Fed rate cuts fix this issue?

Our short answer is no.

Currently, ~80% of borrowers pay interest rates below 6% and ~73% have rates under 5%.

This creates a "financial disincentive" to sell, which must be eliminated to spur more supply.

Our short answer is no.

Currently, ~80% of borrowers pay interest rates below 6% and ~73% have rates under 5%.

This creates a "financial disincentive" to sell, which must be eliminated to spur more supply.

And, while mortgage rates have come down with the first Fed rate cut, we are nowhere near 3%.

Fannie Mae sees mortgage rates coming down to 5.9% at the end of 2026.

This would be just ~60 basis points below current levels and well above levels seen in the post-pandemic period.

Fannie Mae sees mortgage rates coming down to 5.9% at the end of 2026.

This would be just ~60 basis points below current levels and well above levels seen in the post-pandemic period.

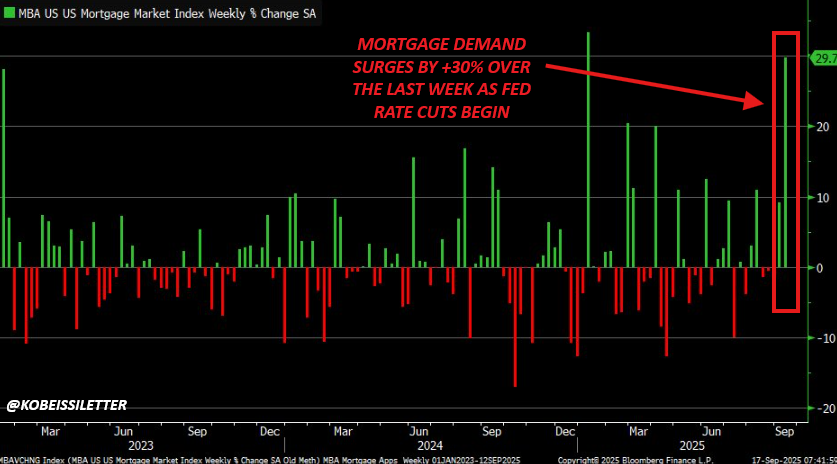

The result will be modestly higher supply with materially higher demand.

We are already seeing it as US mortgage demand surged +29.7% 2 weeks ago as Fed rate cuts began.

Refinance applications jumped +58% in ONE WEEK to levels not seen since the 2020 pandemic.

We are already seeing it as US mortgage demand surged +29.7% 2 weeks ago as Fed rate cuts began.

Refinance applications jumped +58% in ONE WEEK to levels not seen since the 2020 pandemic.

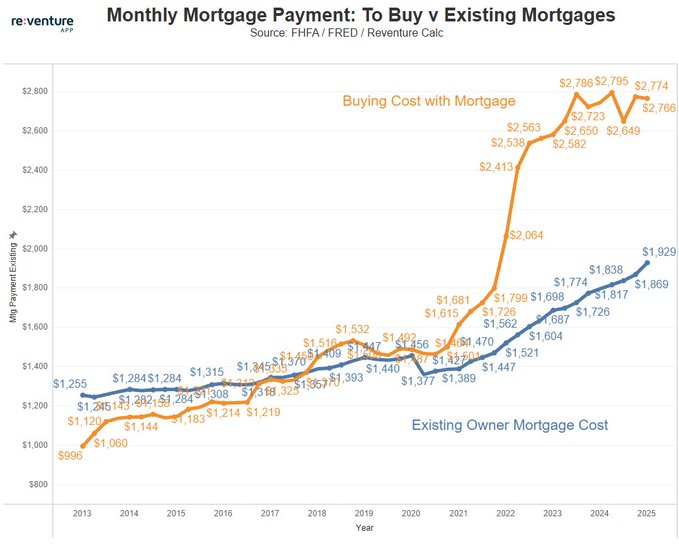

This creates slightly more affordable financing, but prices will rise further.

According to Reventure, it costs ~$800/mo more to buy a house with a mortgage than to keep your house with a mortgage.

As long as this financial disincentive remains, housing will be stagnant.

According to Reventure, it costs ~$800/mo more to buy a house with a mortgage than to keep your house with a mortgage.

As long as this financial disincentive remains, housing will be stagnant.

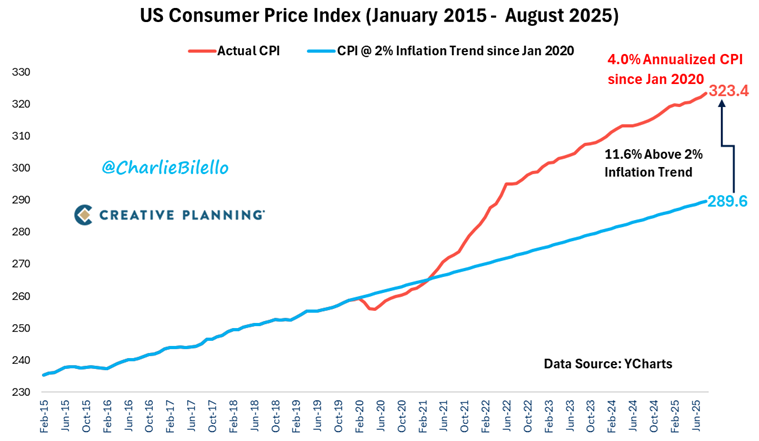

We will likely also see input costs rise for the construction of new homes.

After all, the Fed is cutting rates into PCE inflation at 2.9%+ for the first time in 30+ years.

On top of this, many components of new homes are currently being tariffed at rates of 20%+.

After all, the Fed is cutting rates into PCE inflation at 2.9%+ for the first time in 30+ years.

On top of this, many components of new homes are currently being tariffed at rates of 20%+.

As we look ahead, we believe the themes driving home prices will result in major macroeconomic shifts.

This is redefining the way markets are moving.

Want to see how we are capitalizing on it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

This is redefining the way markets are moving.

Want to see how we are capitalizing on it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

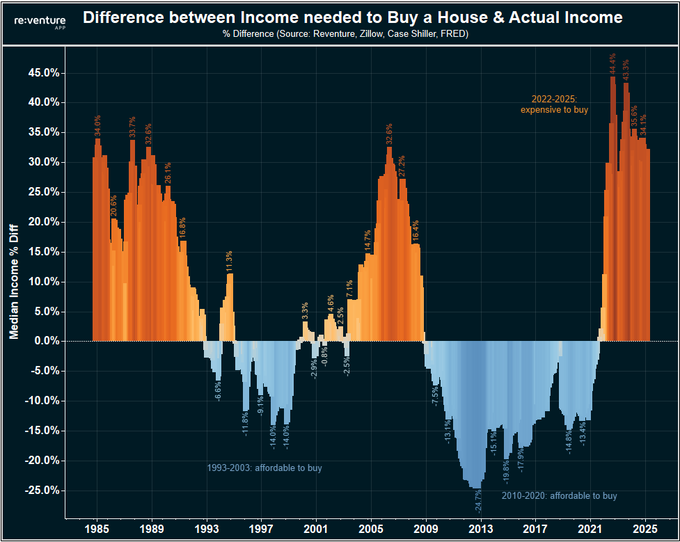

Lastly, take a look at this graph of income needed to buy a home versus household income, per Reventure.

This metric has not been below ~25% in almost 4 years.

We are seeing compounding affordability losses.

Follow us @KobeissiLetter for real time analysis as this develops.

This metric has not been below ~25% in almost 4 years.

We are seeing compounding affordability losses.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh