Should @Plasma be an L2?

AJ argues that Plasma should be an L2 in order to save on validator costs - $550m per year in savings.

I think this is long-term correct however the market structure has to fundamentally change to make it long-term correct.

The L1 Premium ROI

Right now there's an L1 premium even for assets that aren't competing as a store of value.

Should this be the case?

I can't see why - not in the long-term. But the market currently disagrees.

Let's look at FDV comps:

Arbitrum (L2) - $4.3 billion

Optimism (L2) - $2.9 billion

ZKSync (L2) - $1.1 billion

Compare these to EVM L1 chains that could be L2s:

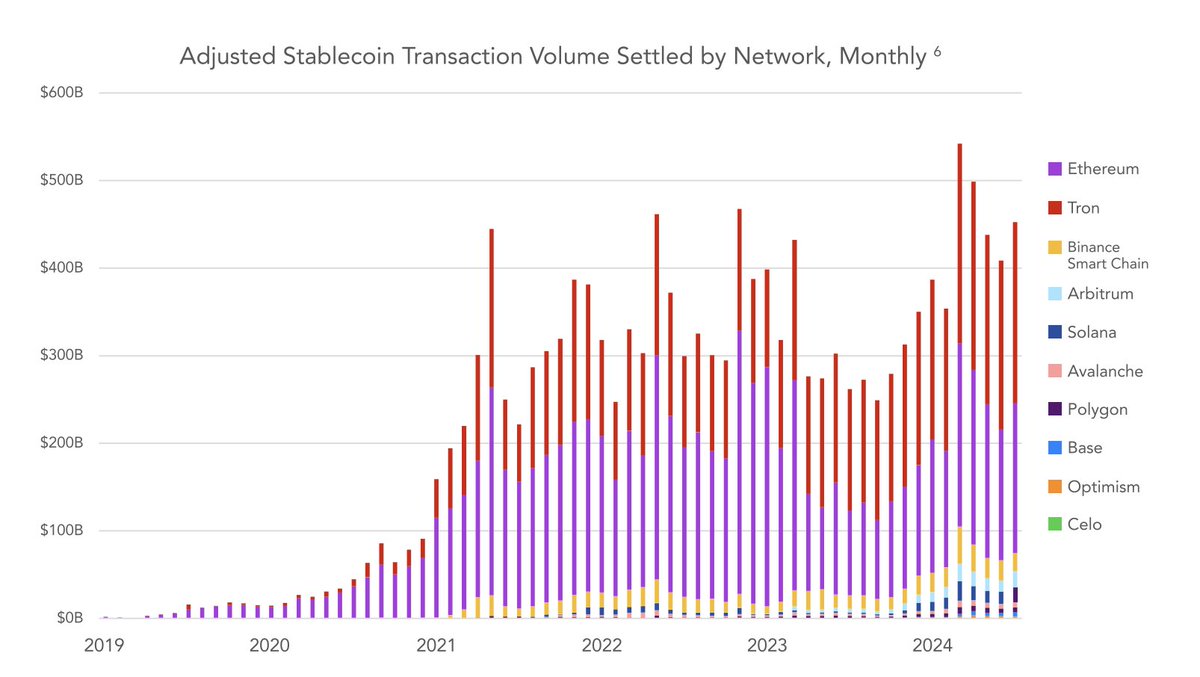

Tron (L1) - $32 billion

Plasma (L1) - $9.6 billion

There's clearly an L1 Premium.

Say $5 billion of Plasma's current FDV is due to L1 premium. That's worth 10 years of $500m (5% of FDV) per year in validator costs. Add to this: Plasma can throttle issuance at any time - why not decrease validator rewards to 1-2% as the network grows?

If you think you can be a deca-billion network it's market rational to launch an L1 instead of an L2 because of the L1 Premium.

That's why Stripe's Tempo, Circle's Arc, Tether's Plasma are all launching as L1s instead of Ethereum L2s. The technical reasons they give are ex post facto rationalizations for the real reason: L1s are higher ROI because of the L1 Premium.

Look at it from their perspective. Worst case - the L1 Premium evaporates in the years ahead. Fine, they just pivot to an L2 - they've lost nothing.

Will the L1 Premium persist?

Truthfully, i don't know.

Maybe as the market matures we'll move from a Dumb L1 Premium to a Smart L1 Premium - only the assets truly competing as a nation-state grade censorship resistant store of value (SoV) will get the L1 premium and all other L1/L2 assets will be valued based on revenue and supply sinks. To me, BTC and ETH pass the SoV bar and it's very much TBD on everything else.

But i'm not the market. The market says XRP is worth $300 billion and that the L1 Premium is real.

So that's the takeaway for L2 lovers.

Until the L1 Premium disappears expect to see more L1s.

AJ argues that Plasma should be an L2 in order to save on validator costs - $550m per year in savings.

I think this is long-term correct however the market structure has to fundamentally change to make it long-term correct.

The L1 Premium ROI

Right now there's an L1 premium even for assets that aren't competing as a store of value.

Should this be the case?

I can't see why - not in the long-term. But the market currently disagrees.

Let's look at FDV comps:

Arbitrum (L2) - $4.3 billion

Optimism (L2) - $2.9 billion

ZKSync (L2) - $1.1 billion

Compare these to EVM L1 chains that could be L2s:

Tron (L1) - $32 billion

Plasma (L1) - $9.6 billion

There's clearly an L1 Premium.

Say $5 billion of Plasma's current FDV is due to L1 premium. That's worth 10 years of $500m (5% of FDV) per year in validator costs. Add to this: Plasma can throttle issuance at any time - why not decrease validator rewards to 1-2% as the network grows?

If you think you can be a deca-billion network it's market rational to launch an L1 instead of an L2 because of the L1 Premium.

That's why Stripe's Tempo, Circle's Arc, Tether's Plasma are all launching as L1s instead of Ethereum L2s. The technical reasons they give are ex post facto rationalizations for the real reason: L1s are higher ROI because of the L1 Premium.

Look at it from their perspective. Worst case - the L1 Premium evaporates in the years ahead. Fine, they just pivot to an L2 - they've lost nothing.

Will the L1 Premium persist?

Truthfully, i don't know.

Maybe as the market matures we'll move from a Dumb L1 Premium to a Smart L1 Premium - only the assets truly competing as a nation-state grade censorship resistant store of value (SoV) will get the L1 premium and all other L1/L2 assets will be valued based on revenue and supply sinks. To me, BTC and ETH pass the SoV bar and it's very much TBD on everything else.

But i'm not the market. The market says XRP is worth $300 billion and that the L1 Premium is real.

So that's the takeaway for L2 lovers.

Until the L1 Premium disappears expect to see more L1s.

• • •

Missing some Tweet in this thread? You can try to

force a refresh