How to get URL link on X (Twitter) App

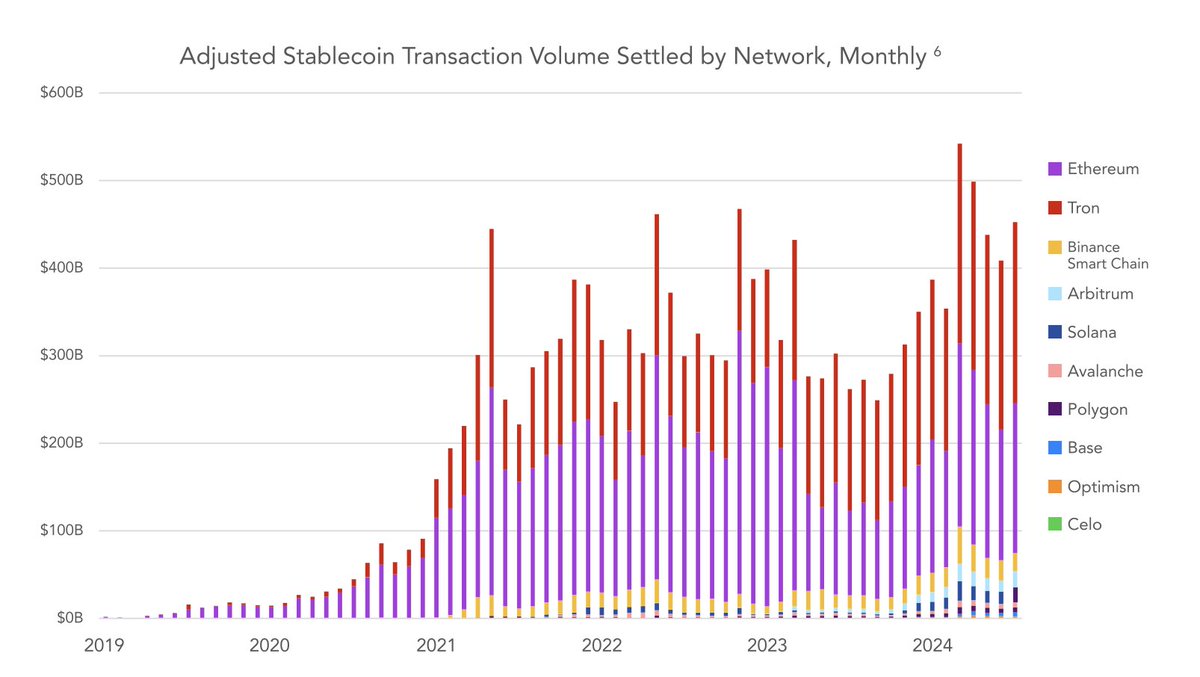

2/ Trillions in settlement.

2/ Trillions in settlement.

https://twitter.com/RyanSAdams/status/1188901380913795072?s=20

https://twitter.com/RyanSAdams/status/11291146589238435842/ What about Ether supply?