Build an End-to-End Python Algorithmic Trading System (complete roadmap + skills + tools)

Bookmark this.

Bookmark this.

1) Foundations (1–2 weeks)

Learn these:

1. Python basics → data/ML

2. Pandas (data wrangling)

3. Scikit-learn (ML)

4. SQLAlchemy (DB access)

Learn these:

1. Python basics → data/ML

2. Pandas (data wrangling)

3. Scikit-learn (ML)

4. SQLAlchemy (DB access)

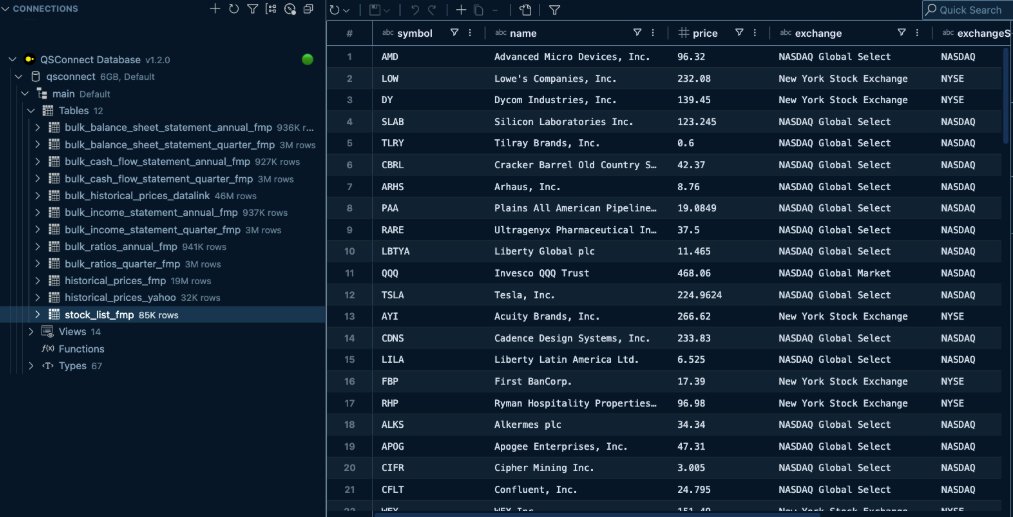

2) Data & Storage (free+paid)

1. Prices: yfinance (free)

2. Fundamentals: FMP (paid)

3. DB: DuckDB (fast, file-based)

Tip: go from raw data ▶ cleaned ▶ features as separate SQL tables.

1. Prices: yfinance (free)

2. Fundamentals: FMP (paid)

3. DB: DuckDB (fast, file-based)

Tip: go from raw data ▶ cleaned ▶ features as separate SQL tables.

3) Quant Research Lab

1. Track & compare ideas: MLflow (free)

2. Core playbooks: Momentum, Mean-Reversion, Seasonality

3. Metric stack: Sharpe, Sortino, MaxDD, hit-rate, turnover

Here's what my quant research lab looks like:

1. Track & compare ideas: MLflow (free)

2. Core playbooks: Momentum, Mean-Reversion, Seasonality

3. Metric stack: Sharpe, Sortino, MaxDD, hit-rate, turnover

Here's what my quant research lab looks like:

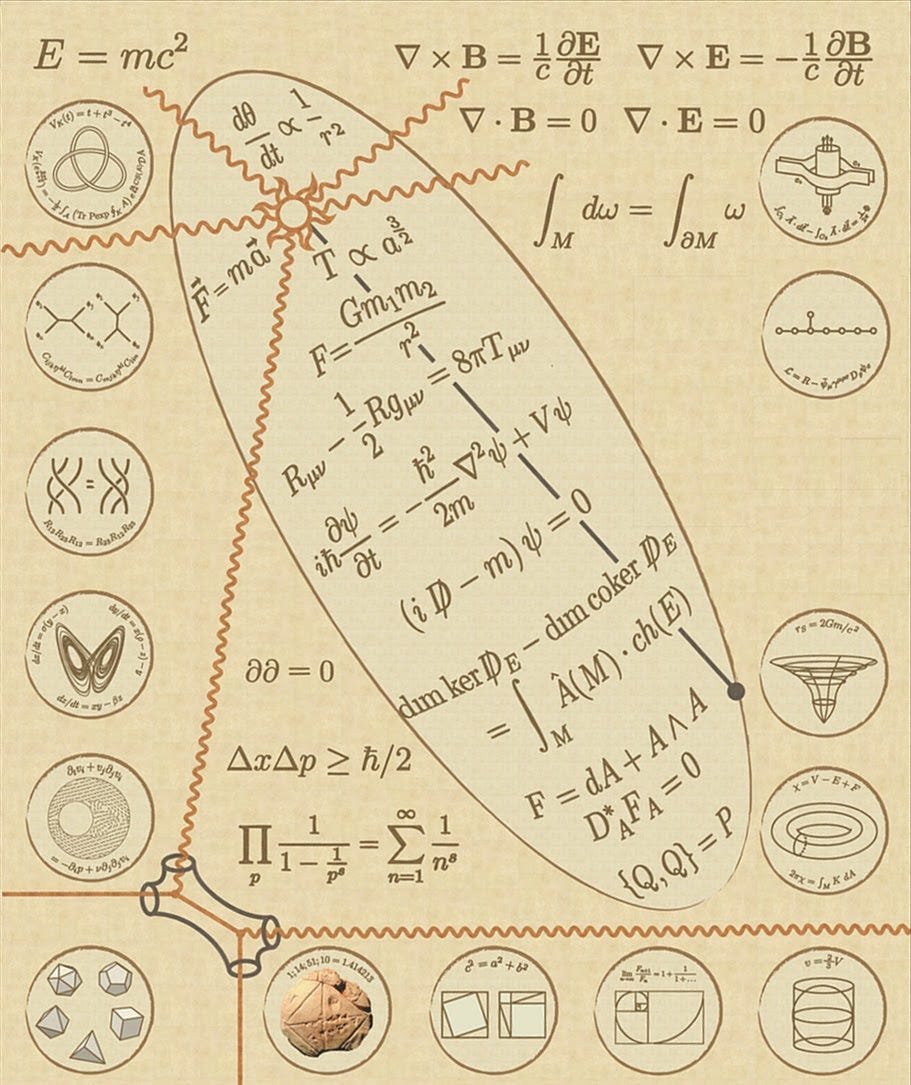

4) ML in the Loop (8-step flow)

1. Universe selection

2. Feature engineering (momentum, quality)

3. Time-series CV (no leakage)

4. Model training (XGBoost)

5. Validation (IC, IC-IR, feat importance)

6. Signal creation (scores)

7. Backtest (Zipline/VectorBT)

8. Portfolio analysis

1. Universe selection

2. Feature engineering (momentum, quality)

3. Time-series CV (no leakage)

4. Model training (XGBoost)

5. Validation (IC, IC-IR, feat importance)

6. Signal creation (scores)

7. Backtest (Zipline/VectorBT)

8. Portfolio analysis

5) Execution & Automation

1. Orchestration: Prefect (free)

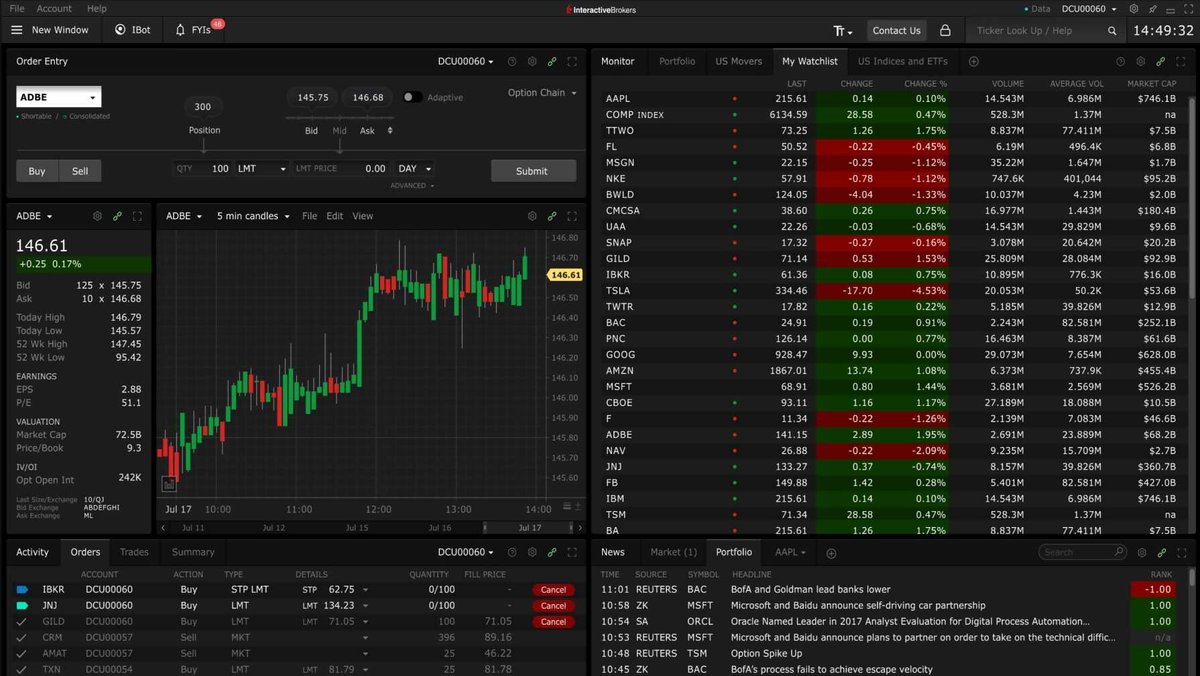

2. Broker: IBKR

3. Daily job: fetch → score → allocate → trade → log

4. Guardrails: position limits, slippage, stop rules

I use IBKR + Prefect (Orchestration)

1. Orchestration: Prefect (free)

2. Broker: IBKR

3. Daily job: fetch → score → allocate → trade → log

4. Guardrails: position limits, slippage, stop rules

I use IBKR + Prefect (Orchestration)

Starter quant stack (copy/paste these tools + skills to replicate a $20,000 terminal):

1. Python, Pandas, Polars, Scikit-learn

2. DuckDB, SQLAlchemy

3. yfinance, FMP

4. MLflow, Prefect

5. IBKR API

1. Python, Pandas, Polars, Scikit-learn

2. DuckDB, SQLAlchemy

3. yfinance, FMP

4. MLflow, Prefect

5. IBKR API

I have one more thing before you go.

If you want to become an algorithmic trader in 2025, then I'd like to help.

This is how: 👇

If you want to become an algorithmic trader in 2025, then I'd like to help.

This is how: 👇

🚨Free Training: How I built my hedge fund in Python

• QSConnect: Build your quant research database

• QSResearch: Research and run machine learning strategies

• Omega: Automate trade execution

👉 Join Our Free Algorithmic Trading Workshop: learn.quantscience.io/become-a-pro-q…

• QSConnect: Build your quant research database

• QSResearch: Research and run machine learning strategies

• Omega: Automate trade execution

👉 Join Our Free Algorithmic Trading Workshop: learn.quantscience.io/become-a-pro-q…

That's a wrap! Over the next 24 days, I'm sharing my top 24 algorithmic trading concepts to help you get started.

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1683526993059430411/status/1975537703690121551

P.S. - It took me 3 years to become confident in algorithmic trading.

So I spent 100 hours and made a free course to help others.

Join my free Algo Trading with Python Course + Roadmap here: startalgorithmictrading.com/beginners-algo…

So I spent 100 hours and made a free course to help others.

Join my free Algo Trading with Python Course + Roadmap here: startalgorithmictrading.com/beginners-algo…

• • •

Missing some Tweet in this thread? You can try to

force a refresh