Policy Regimes Are Balance-Sheet States, Not Discretionary Switches

“Using a Markov-switching reaction function and logit bridge, we show that the probability of an ‘active’ Fed regime rises systematically with total-debt-to-GDP (Ω). Policy regime is not independent; it’s a balance-sheet state.”

“Using a Markov-switching reaction function and logit bridge, we show that the probability of an ‘active’ Fed regime rises systematically with total-debt-to-GDP (Ω). Policy regime is not independent; it’s a balance-sheet state.”

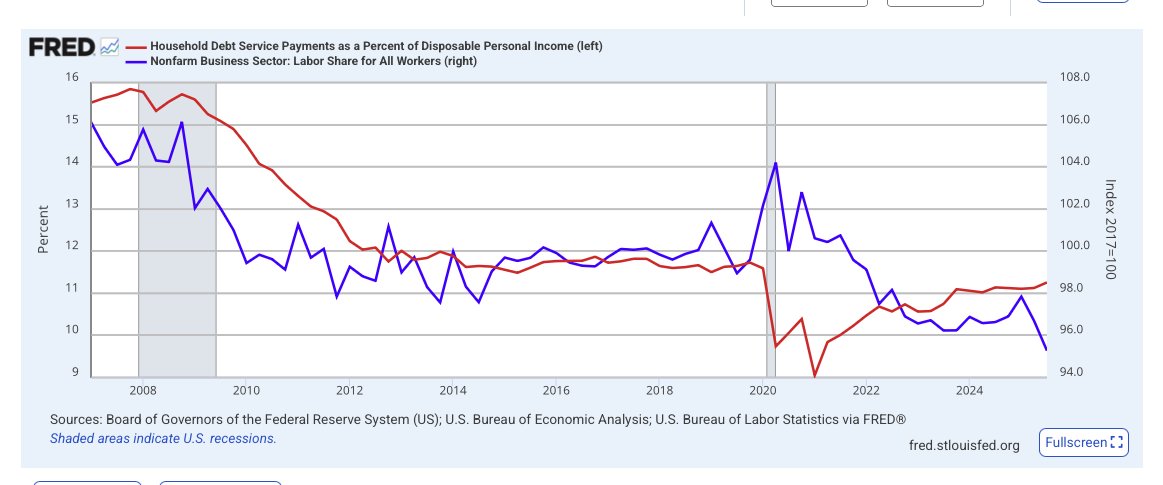

The Markov model’s “regime switches” are not free policy choices; they are balance-sheet phases. Rising Ω (claim load) statistically raises the probability we observe the active reaction-function state.

Scope: This establishes state-contingency, not a one-variable monocause. DSR and profitability also matter, consistent with a cash-flow feasibility view of policy.

Across specifications, the probability increases systematically with Ω, implying that policy stance is endogenously determined by debt saturation rather than exogenously chosen.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh