What just happened?

At 10:57 AM ET, President Trump canceled his meeting with China and said "massive" tariff increases are coming.

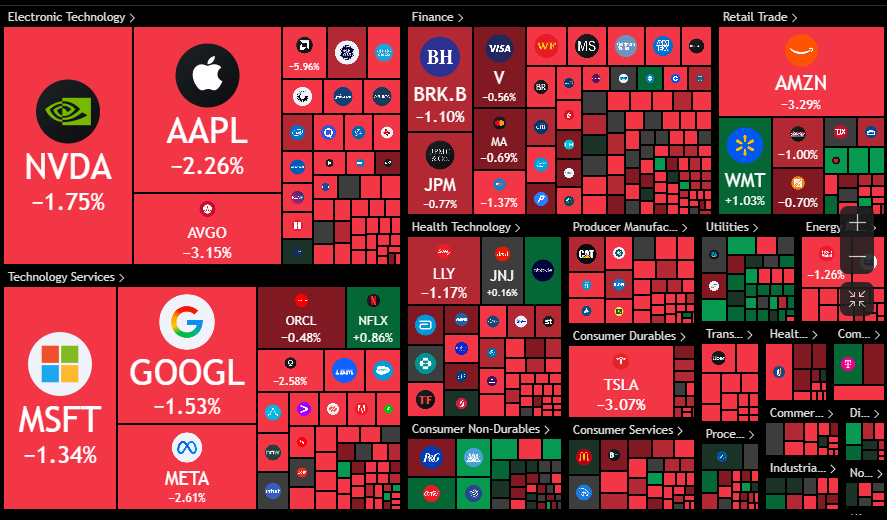

40 minutes later, the S&P 500 erased -$1.2 TRILLION of market cap.

Is this dip a BUYING opportunity? Let us explain.

(a thread)

At 10:57 AM ET, President Trump canceled his meeting with China and said "massive" tariff increases are coming.

40 minutes later, the S&P 500 erased -$1.2 TRILLION of market cap.

Is this dip a BUYING opportunity? Let us explain.

(a thread)

Here is the statement that President Trump posted today.

He accused China of "lying" and imposing export controls on rare earth metals.

Trump cancelled his meeting in 2 weeks with China's President Xi and said "massive" tariff increases are coming.

So, what does it all mean?

He accused China of "lying" and imposing export controls on rare earth metals.

Trump cancelled his meeting in 2 weeks with China's President Xi and said "massive" tariff increases are coming.

So, what does it all mean?

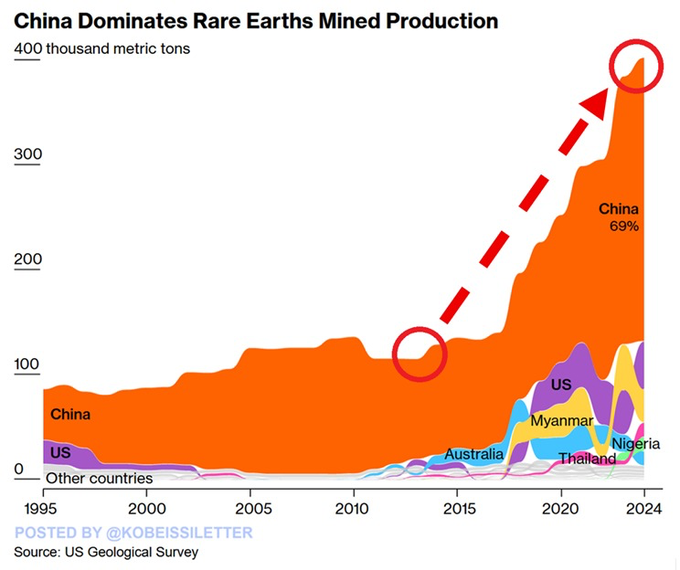

Rare earths have been very important for Trump.

Between a Ukraine deal and the US-China trade war, Trump has prioritized rare earths.

These metals are CRUCIAL for the production of weapons, chips, AI, and strategic leverage.

The US gets ~70% of its rare earths from China.

Between a Ukraine deal and the US-China trade war, Trump has prioritized rare earths.

These metals are CRUCIAL for the production of weapons, chips, AI, and strategic leverage.

The US gets ~70% of its rare earths from China.

When the first US-China trade deal was signed on May 12th, rare earths were a critical component.

Now, President Trump claims that China is attempting to impose export controls on these metals.

The market collapsed on this headline on fears of the trade war returning.

Now, President Trump claims that China is attempting to impose export controls on these metals.

The market collapsed on this headline on fears of the trade war returning.

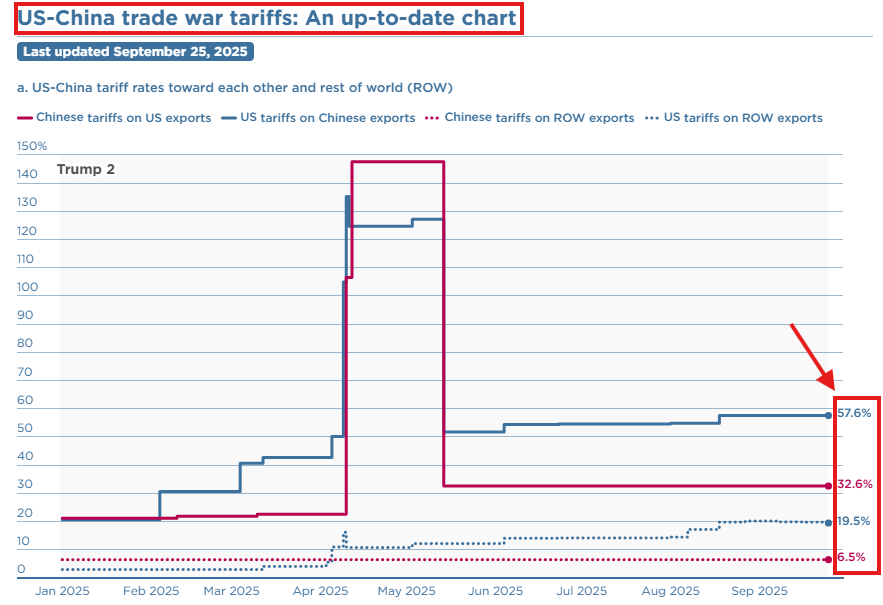

But, we believe the market is in a VASTLY different situation now than in April 2025.

It is clear now more than ever that the trade deal is becoming largely focused on China.

We believe today's statement is a bargaining chip.

As a result, we think this dip will be BOUGHT.

It is clear now more than ever that the trade deal is becoming largely focused on China.

We believe today's statement is a bargaining chip.

As a result, we think this dip will be BOUGHT.

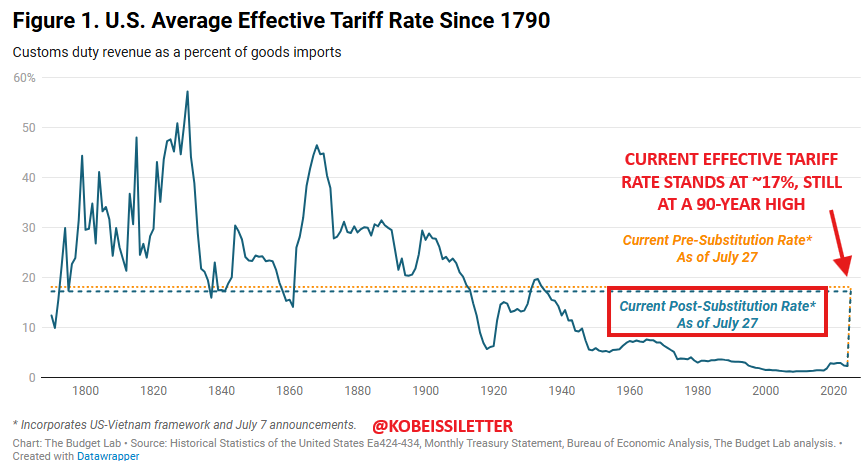

It's also worth noting that most of the tariff news is priced-in.

The US effective tariff rate still stands at 17.3%, the highest since 1935.

Markets have known this for months now and the rally was technically overbought.

We view today's Trump post as a "reason" to selloff.

The US effective tariff rate still stands at 17.3%, the highest since 1935.

Markets have known this for months now and the rally was technically overbought.

We view today's Trump post as a "reason" to selloff.

Meanwhile, Fed rate cuts will resume as the labor market clearly deteriorates.

Underemployment is at 8.1%, the highest since 2021.

All while 60% of items in CPI inflation are now rising by at least 3%.

As we continue to reiterate, asset owners will continue to be rewarded.

Underemployment is at 8.1%, the highest since 2021.

All while 60% of items in CPI inflation are now rising by at least 3%.

As we continue to reiterate, asset owners will continue to be rewarded.

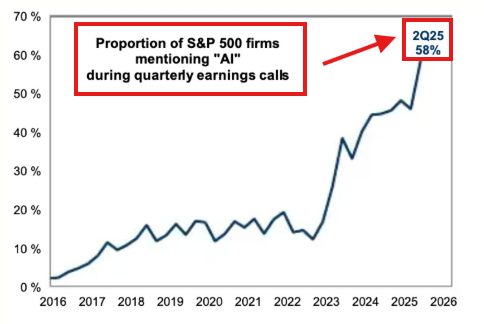

On top of this, the AI Revolution is accelerating at an unprecedented pace.

Magnificent 7 companies are investing over +$100B in CapEx PER QUARTER.

AI now accounts for ~40% of S&P 500 CapEx spend.

We believe fighting this unprecedented level of investment is dangerous.

Magnificent 7 companies are investing over +$100B in CapEx PER QUARTER.

AI now accounts for ~40% of S&P 500 CapEx spend.

We believe fighting this unprecedented level of investment is dangerous.

Then, you have the USD rapidly declining, now down over -10% YTD.

This puts the USD on track for its worst annual performance since 1973.

As seen since 2021, nominal asset prices are strong in this macroeconomy backdrop.

Again, our view is that asset owners WILL be rewarded.

This puts the USD on track for its worst annual performance since 1973.

As seen since 2021, nominal asset prices are strong in this macroeconomy backdrop.

Again, our view is that asset owners WILL be rewarded.

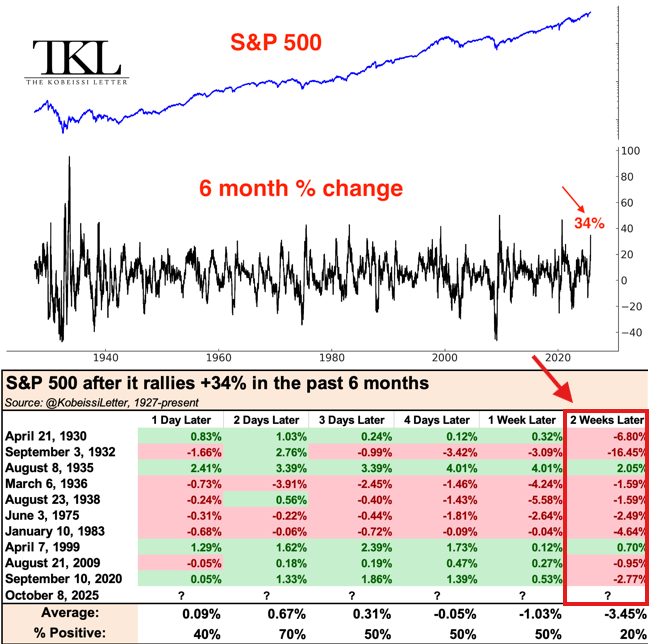

That said, we think the market will be taking a more "bumpy" road higher into year-end.

Trade war fears are resurfacing, Fed uncertainty remains, and the government is shut down.

All while the S&P 500 is up +34% in 6 months, a move only seen 10 previous times since 1930.

Trade war fears are resurfacing, Fed uncertainty remains, and the government is shut down.

All while the S&P 500 is up +34% in 6 months, a move only seen 10 previous times since 1930.

Change is the only certainty in markets today - investors must adapt to it.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Overall, we believe the return of a prolonged trade war is highly unlikely.

Tariff headlines are near-term noise amid the AI Revolution and rate cuts into inflation.

We believe asset owners will be rewarded.

Follow us @KobeissiLetter for real time analysis as this develops.

Tariff headlines are near-term noise amid the AI Revolution and rate cuts into inflation.

We believe asset owners will be rewarded.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh