A little macro thread to keep on your radar.

Some divergences happening today.

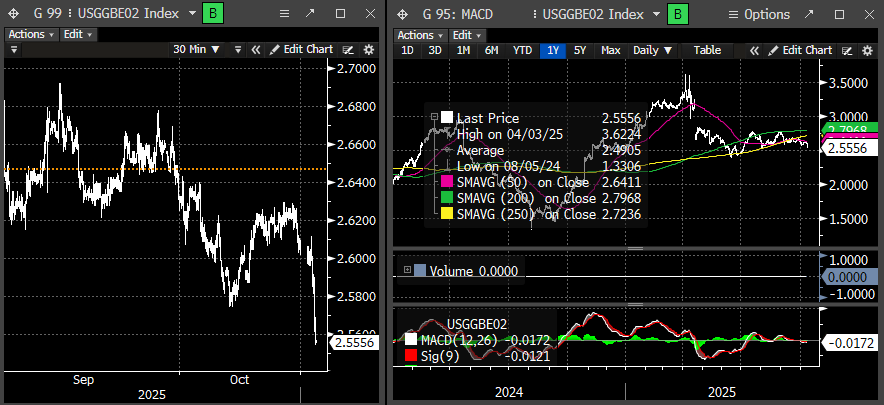

2 year inflation breakevens are telling us there is something funky going on.

They are rolling over to the downside indicating deflationary pressures are building, not inflationary!!

Where are the inflationistas?!

Fed probably needs to ease faster.

Oil under $59 bucks and HY Credit spreads are widening.

We are in a buyback blackout period & systematic funds are fully invested while retail call option open interest at one of the highest levels ever.

Some reasons to be careful....

Some divergences happening today.

2 year inflation breakevens are telling us there is something funky going on.

They are rolling over to the downside indicating deflationary pressures are building, not inflationary!!

Where are the inflationistas?!

Fed probably needs to ease faster.

Oil under $59 bucks and HY Credit spreads are widening.

We are in a buyback blackout period & systematic funds are fully invested while retail call option open interest at one of the highest levels ever.

Some reasons to be careful....

• • •

Missing some Tweet in this thread? You can try to

force a refresh