It's official:

Crypto just saw its LARGEST liquidation event in history with 1.6 MILLION traders liquidated.

Over $19 BILLION worth of leveraged crypto positions were liquidated in 24 hours, 9 TIMES the previous record.

Why did this happen? Let us explain.

(a thread)

Crypto just saw its LARGEST liquidation event in history with 1.6 MILLION traders liquidated.

Over $19 BILLION worth of leveraged crypto positions were liquidated in 24 hours, 9 TIMES the previous record.

Why did this happen? Let us explain.

(a thread)

To put this into perspective:

The liquidation event we saw over the last 24 hours was ~$17 BILLION larger than the February 2025 crash.

It was more than 19 TIMES larger than the March 2020 crash and collapse of FTX.

Never in history have we seen anything even close to this.

The liquidation event we saw over the last 24 hours was ~$17 BILLION larger than the February 2025 crash.

It was more than 19 TIMES larger than the March 2020 crash and collapse of FTX.

Never in history have we seen anything even close to this.

Amid the liquidation, Bitcoin recorded a $20,000 DAILY candlestick.

This marks a $380 BILLION swing in Bitcoin's market cap alone, in a single-day.

That's more than the market cap of all but 25 public companies in the world.

Once again, this has never happened in history.

This marks a $380 BILLION swing in Bitcoin's market cap alone, in a single-day.

That's more than the market cap of all but 25 public companies in the world.

Once again, this has never happened in history.

But, why did this happen? To better understand, take a look at the timeline below:

At 9:50 AM ET, crypto began selling off before the 10:57 AM ET Trump tariff post.

At 4:30 PM ET, a large "whale" took shorts in crypto.

At 4:50 PM ET, Trump announced a 100% tariff on China.

At 9:50 AM ET, crypto began selling off before the 10:57 AM ET Trump tariff post.

At 4:30 PM ET, a large "whale" took shorts in crypto.

At 4:50 PM ET, Trump announced a 100% tariff on China.

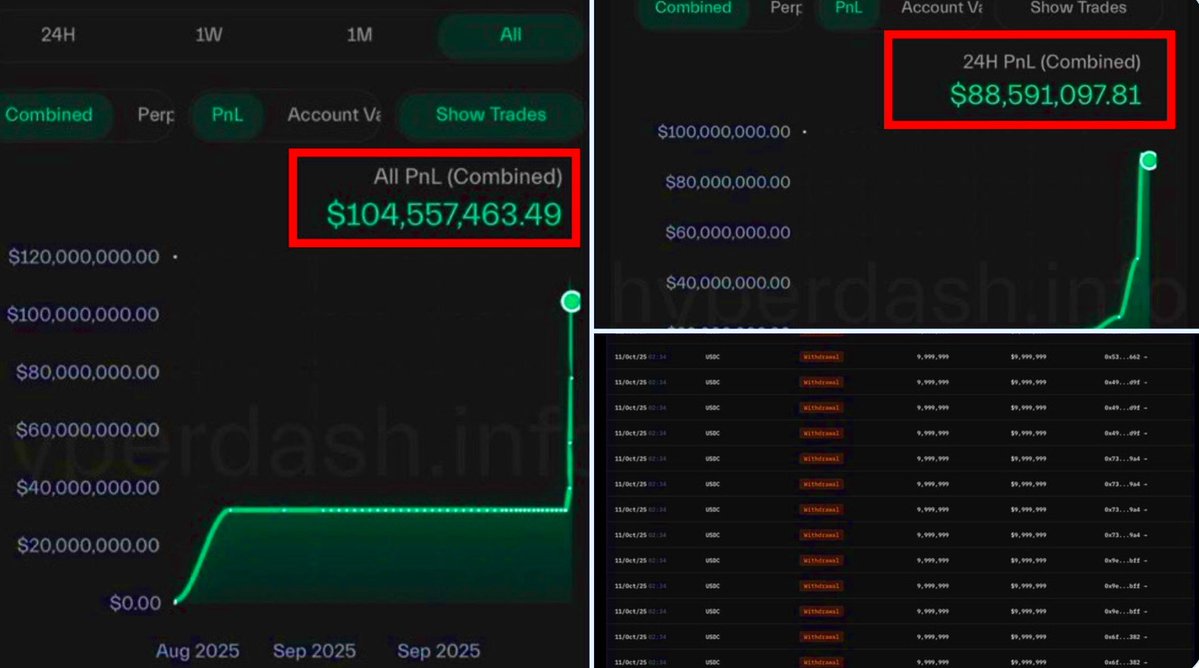

The first question becomes, how did this large "whale" time the drop so perfectly?

By 5:20 PM ET, 30 minutes after Trump's tariff announcement, liquidations hit -$19.5 billion.

The shorts were closed promptly after the drop for +$192M in profit.

But, there's more.

By 5:20 PM ET, 30 minutes after Trump's tariff announcement, liquidations hit -$19.5 billion.

The shorts were closed promptly after the drop for +$192M in profit.

But, there's more.

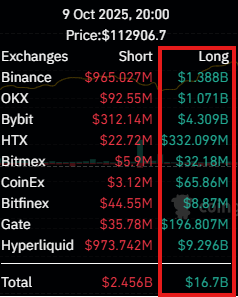

The main culprit of this appears to be a combination of excessive leverage and risk.

If you take a look at the breakdown of liquidations it was heavily skewed towards longs.

$16.7 billion in longs were liquidated compared to ~$2.5 billion in shorts.

That's a 6.7:1 ratio.

If you take a look at the breakdown of liquidations it was heavily skewed towards longs.

$16.7 billion in longs were liquidated compared to ~$2.5 billion in shorts.

That's a 6.7:1 ratio.

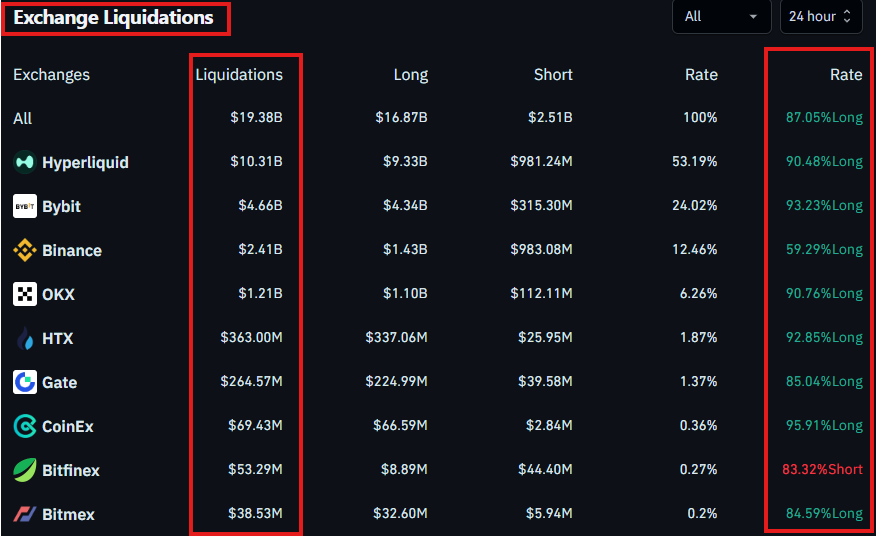

Even more evidence of the excessive long leverage in the market:

ALL major exchanges except for Bitfinex saw an overwhelming percentage of long liquidations.

Most were 90%+ long including a massive $10.3 BILLION on Hyperliquid alone.

The same exchange the "whale" used.

ALL major exchanges except for Bitfinex saw an overwhelming percentage of long liquidations.

Most were 90%+ long including a massive $10.3 BILLION on Hyperliquid alone.

The same exchange the "whale" used.

The next component was the "shock effect."

Markets became excessively crowded to the long direction after a historic run from the April 2025 low.

Greed exceeded 60, as shown below, days before the crash.

The sudden shock of the tariff post led to a MASSIVE shift in sentiment.

Markets became excessively crowded to the long direction after a historic run from the April 2025 low.

Greed exceeded 60, as shown below, days before the crash.

The sudden shock of the tariff post led to a MASSIVE shift in sentiment.

Liquidity was the next issue:

Trump's announcement came 50 minutes after US markets closed Friday.

As seen many times, Friday night and Sunday night often come with LARGE crypto moves.

Why? Liquidity is thin.

The sudden rush of volume after the post led to a domino effect.

Trump's announcement came 50 minutes after US markets closed Friday.

As seen many times, Friday night and Sunday night often come with LARGE crypto moves.

Why? Liquidity is thin.

The sudden rush of volume after the post led to a domino effect.

So, what's next?

We believe this crash was due to the combination of multiple sudden technical factors.

It does NOT have long-term fundamental implications.

A technical correction was overdue, we think a trade deal will be reached, and crypto remains strong.

We are bullish.

We believe this crash was due to the combination of multiple sudden technical factors.

It does NOT have long-term fundamental implications.

A technical correction was overdue, we think a trade deal will be reached, and crypto remains strong.

We are bullish.

This week's rebound in volatility means opportunity for investors.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Yesterday's drop was a reminder of how fragile yet profitable markets have become.

Between 9:30 AM ET and 5:20 PM ET, crypto erased -$800 BILLION of market cap.

Remain objective and capitalize on volatility.

Follow us @KobeissiLetter for real time analysis as this develops.

Between 9:30 AM ET and 5:20 PM ET, crypto erased -$800 BILLION of market cap.

Remain objective and capitalize on volatility.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh