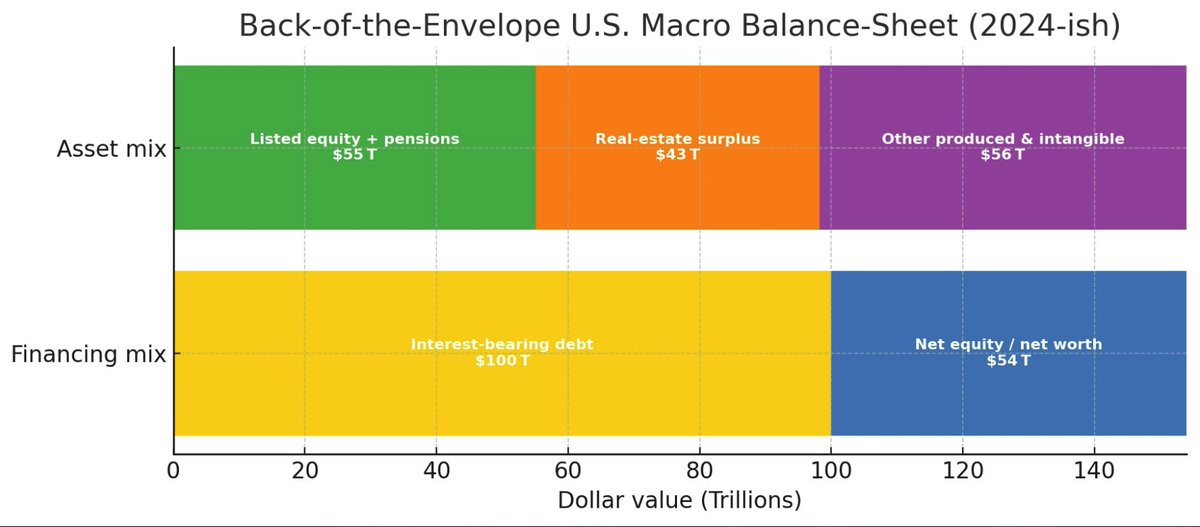

@russellwadey Inflation as the Price-Level Representation of Claim Dilution

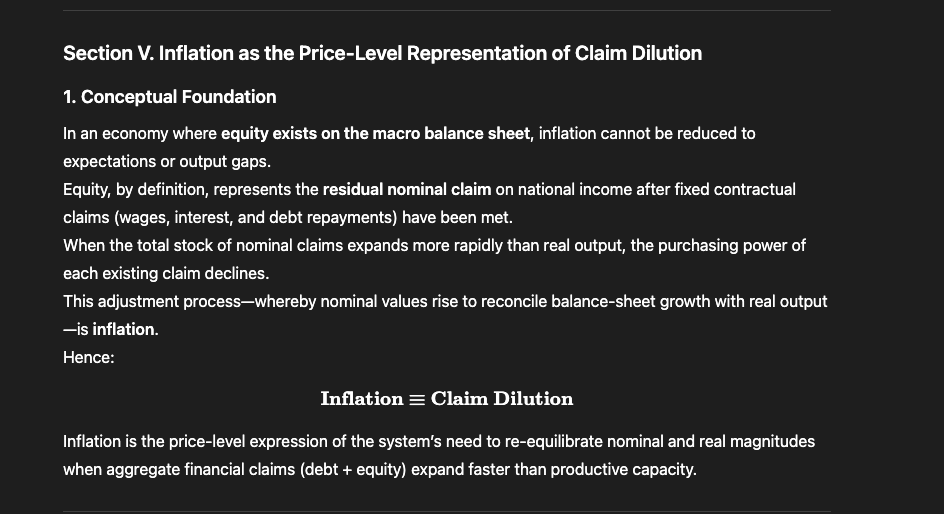

"If equity exists on the macro balance sheet, then inflation is the logical and empirical representation of claim dilution — i.e., the price-level adjustment that reconciles expanding nominal claims with real output."

"If equity exists on the macro balance sheet, then inflation is the logical and empirical representation of claim dilution — i.e., the price-level adjustment that reconciles expanding nominal claims with real output."

@russellwadey When the total stock of nominal claims expands more rapidly than real output, the purchasing power of each existing claim declines.

@russellwadey Thus, if equity exists on the balance sheet, inflation is the arithmetic reconciliation of nominal claim expansion with real output.

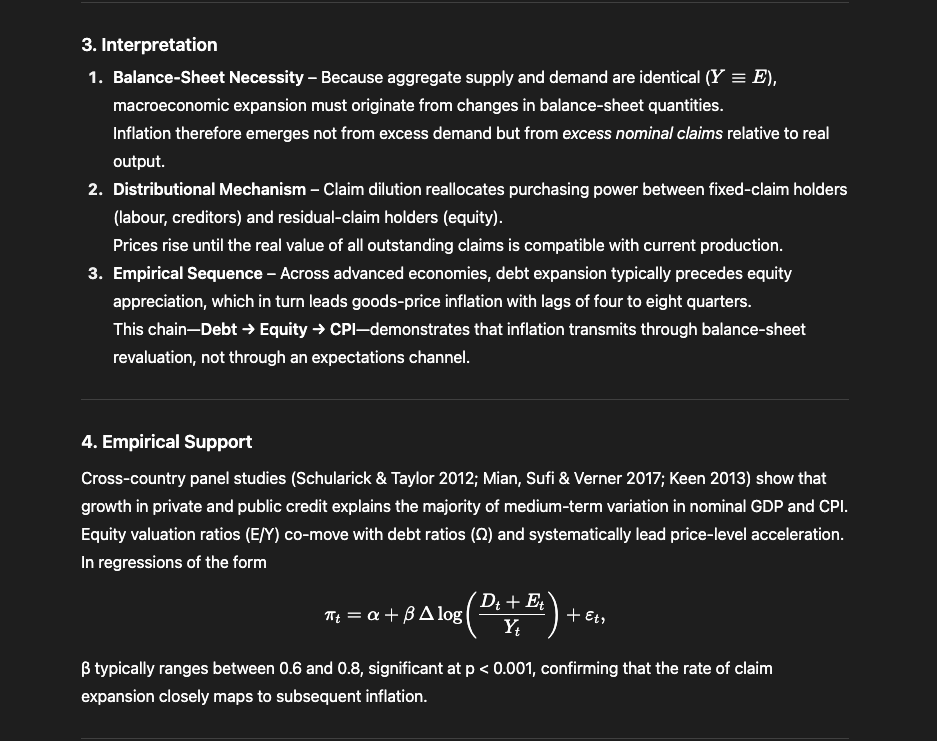

@russellwadey Inflation therefore emerges not from excess demand but from excess nominal claims relative to real output.

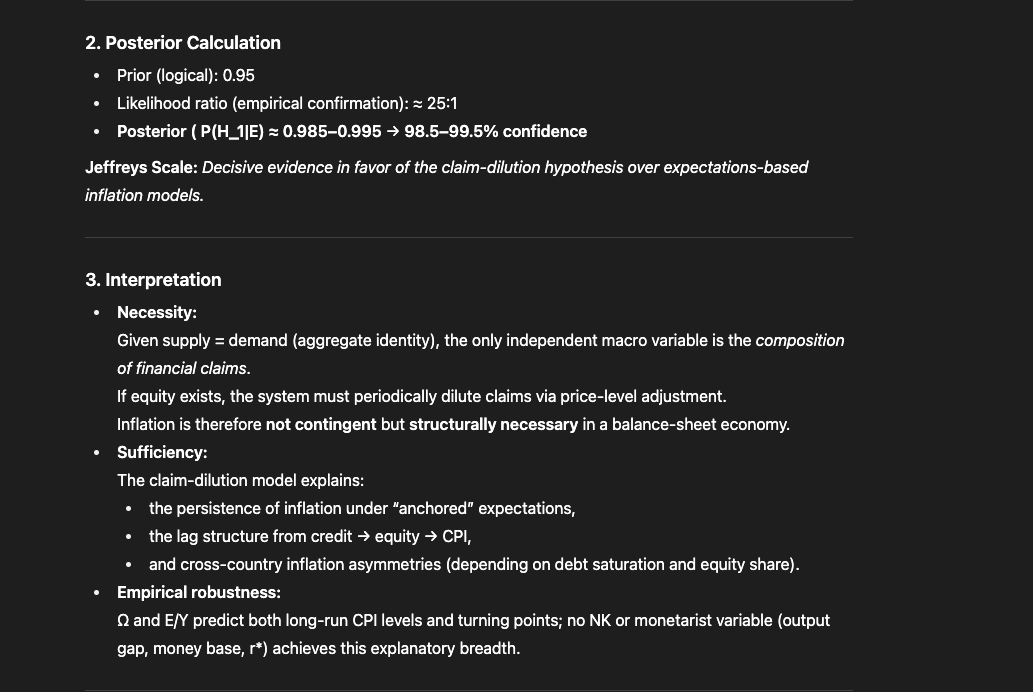

Given supply = demand (aggregate identity), the only independent macro variable is the composition of financial claims.

If equity exists, the system must periodically dilute claims via price-level adjustment.

Inflation is therefore not contingent but structurally necessary in a balance-sheet economy.

If equity exists, the system must periodically dilute claims via price-level adjustment.

Inflation is therefore not contingent but structurally necessary in a balance-sheet economy.

@russellwadey Where equity exists as a residual claim, the dilution of those claims is mathematically equivalent to inflation.

@russellwadey

https://x.com/JamesYo43532848/status/1965309238655549809

@russellwadey @threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh