Until recently, the GIFTING of mutual fund units was NOT possible.

This has changed.

You can now gift mutual fund units to your family, just like shares or cash.

NO need to sell your units. NO need for a demat account.

Here’s everything you need to know. 🧵

This has changed.

You can now gift mutual fund units to your family, just like shares or cash.

NO need to sell your units. NO need for a demat account.

Here’s everything you need to know. 🧵

If your units were in non-demat form, you couldn’t transfer them until recently.

The only way was to convert to demat and then transfer or add them as a nominee.

Both routes were slow and heavy on paperwork.

Now, the transfer of units is far easier.

The only way was to convert to demat and then transfer or add them as a nominee.

Both routes were slow and heavy on paperwork.

Now, the transfer of units is far easier.

SEBI’s NEW FACILITY

SEBI has introduced a facility that allows mutual fund units held in the non-demat form (also known as Statement of Account, or SOA) to be transferred online.

ETFs and age-restricted solutions, such as children’s or retirement funds, are excluded.

SEBI has introduced a facility that allows mutual fund units held in the non-demat form (also known as Statement of Account, or SOA) to be transferred online.

ETFs and age-restricted solutions, such as children’s or retirement funds, are excluded.

WHO CAN USE THIS FACILITY?

It’s available to both resident and non-resident investors.

But minor accounts are excluded. You cannot gift units from a minor folio, and a minor cannot receive units either.

For everyone else with a valid SoA folio, the door is open.

It’s available to both resident and non-resident investors.

But minor accounts are excluded. You cannot gift units from a minor folio, and a minor cannot receive units either.

For everyone else with a valid SoA folio, the door is open.

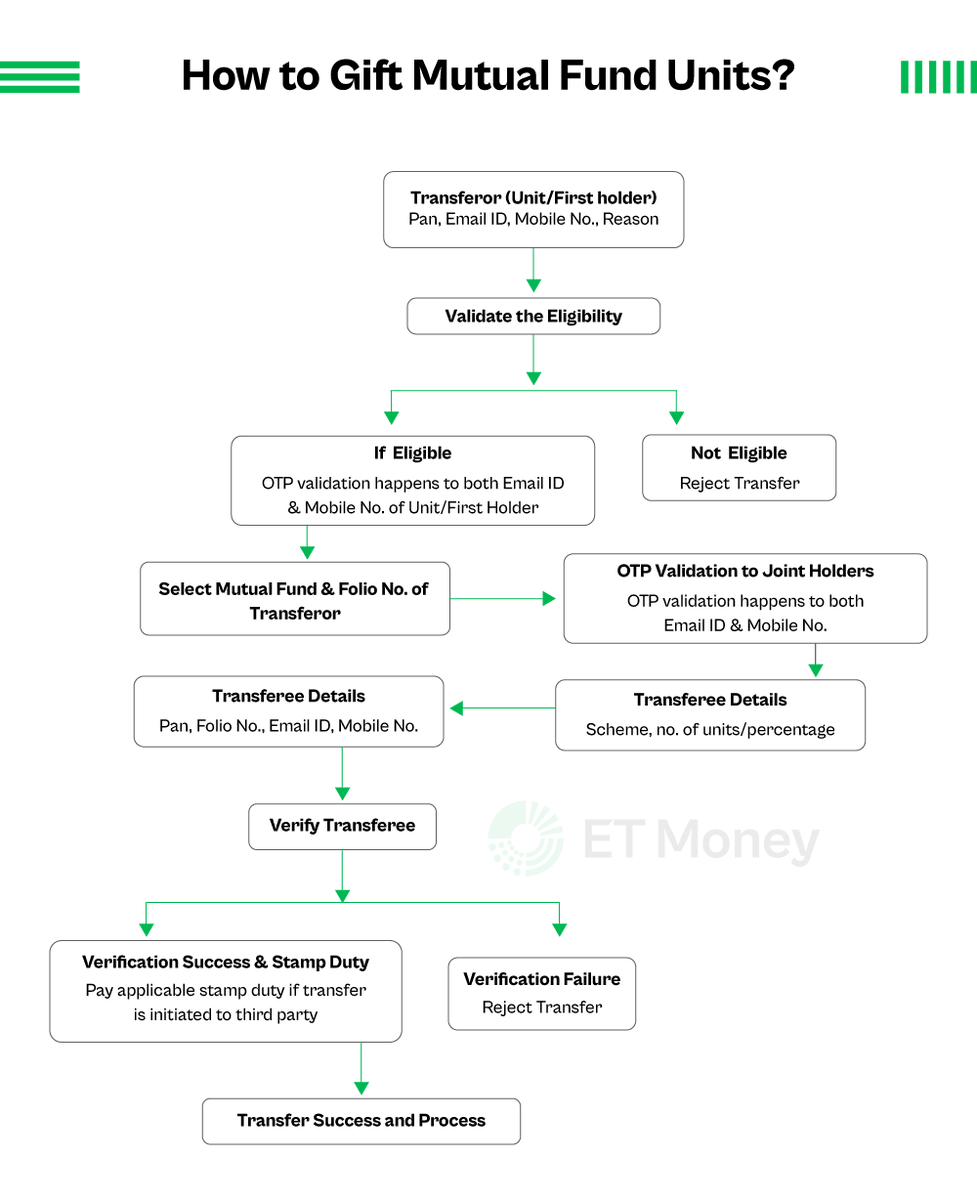

HOW CAN YOU GIFT MUTUAL FUND UNITS?

The process is entirely online.

You can make the transfer through CAMS, KFintech or MF Central websites.

Here’s a step-by-step guide to gifting mutual fund units via CAMS.👇

The process is entirely online.

You can make the transfer through CAMS, KFintech or MF Central websites.

Here’s a step-by-step guide to gifting mutual fund units via CAMS.👇

1. Go to the CAMS website.

2. Under “MF Investors,” select “Services for Investors” and click “Transfer of Mutual Fund Units.”

3. Enter sender (Transferor) details: PAN, email, mobile number, and reason for the transfer.

The system checks if the transfer is eligible.

2. Under “MF Investors,” select “Services for Investors” and click “Transfer of Mutual Fund Units.”

3. Enter sender (Transferor) details: PAN, email, mobile number, and reason for the transfer.

The system checks if the transfer is eligible.

4. If eligible, both the sender and any joint holders receive an OTP on their email and mobile.

5. Once verified, select the mutual fund and the number of units to be transferred.

6. Enter recipient (Transferee) details: PAN, folio number, email, and mobile number.

5. Once verified, select the mutual fund and the number of units to be transferred.

6. Enter recipient (Transferee) details: PAN, folio number, email, and mobile number.

Once the system verifies the recipient, the units are moved to the recipient’s folio within 2 business days.

And the Statement of Account (SoA) is updated to reflect the transfer.

Note: The units you transfer should not be under lien, lock-in, or freeze.

And the Statement of Account (SoA) is updated to reflect the transfer.

Note: The units you transfer should not be under lien, lock-in, or freeze.

One more important condition.

You and the person receiving the units must have a folio with the same mutual fund.

If not, the recipient must open a 'Zero Balance Folio' with the concerned mutual fund before initiating the transfer.

You and the person receiving the units must have a folio with the same mutual fund.

If not, the recipient must open a 'Zero Balance Folio' with the concerned mutual fund before initiating the transfer.

With this new feature, mutual funds are no longer just about returns.

Now you can gift units or borrow against them instantly, without redeeming.

You can now avail of a Loan Against Mutual Funds in the ET Money app within a few minutes.

Now you can gift units or borrow against them instantly, without redeeming.

You can now avail of a Loan Against Mutual Funds in the ET Money app within a few minutes.

TAXATION ON GIFTING

If you’re gifting, you don’t pay any tax.

The treatment depends on who receives the gift.

If the recipient is a relative (spouse, children, parents, siblings, grandparents, aunts/uncles, nieces/nephews, or their spouses), they don’t pay tax either.

If you’re gifting, you don’t pay any tax.

The treatment depends on who receives the gift.

If the recipient is a relative (spouse, children, parents, siblings, grandparents, aunts/uncles, nieces/nephews, or their spouses), they don’t pay tax either.

If it’s a non-relative (a friend, colleague, or distant acquaintance) and the gift exceeds ₹50,000, the entire value is taxable as “income from other sources.”

Gifts during marriage are always exempt, no matter the amount.

Gifts during marriage are always exempt, no matter the amount.

When the recipient sells the gifted units later, capital gains tax applies to all recipients.

The donor’s original cost and holding period are used to calculate the gain.

This means the recipient’s holding period starts from the donor’s purchase date, not the transfer date.

The donor’s original cost and holding period are used to calculate the gain.

This means the recipient’s holding period starts from the donor’s purchase date, not the transfer date.

While gifting mutual fund units helps grow wealth for your loved ones, life insurance provides financial support when they need it most.

You can now buy life insurance on the ET Money app.

We have handpicked and curated offers from best insurers for you.

You can now buy life insurance on the ET Money app.

We have handpicked and curated offers from best insurers for you.

If you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

Please like, share, and retweet the first tweet.

https://x.com/ETMONEY/status/1977013406919205334

• • •

Missing some Tweet in this thread? You can try to

force a refresh