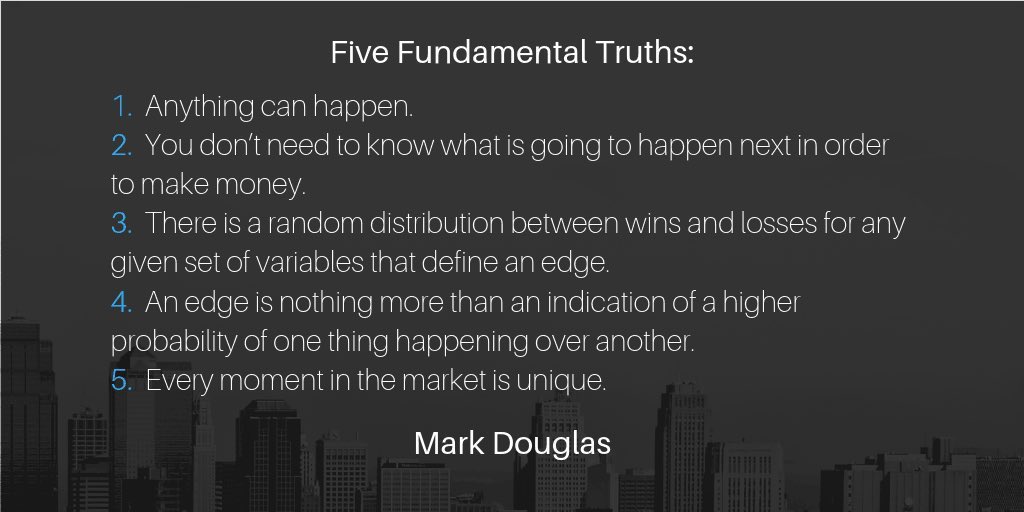

Trading in the Zone by Mark Douglas

Summarized in 20 quotes so you don’t have to read it 🧵

$SPY $SPX $QQQ $TSLA

Summarized in 20 quotes so you don’t have to read it 🧵

$SPY $SPX $QQQ $TSLA

All that I ask is that you RT and LIKE for others to learn 📚

Follow @realjgbanks for more tips! $SPY

Follow @realjgbanks for more tips! $SPY

• • •

Missing some Tweet in this thread? You can try to

force a refresh