Most traders see the crash after it happens.

This thread shows how to spot market stress before it breaks, and how to tell if the damage is short-term or structural.

We’ll use two moments — the August ATH and yesterday’s selloff —to show how @bitcoinvector alerts reveal the structure beneath price.

🧵 Read this if you trade volatility ↓

This thread shows how to spot market stress before it breaks, and how to tell if the damage is short-term or structural.

We’ll use two moments — the August ATH and yesterday’s selloff —to show how @bitcoinvector alerts reveal the structure beneath price.

🧵 Read this if you trade volatility ↓

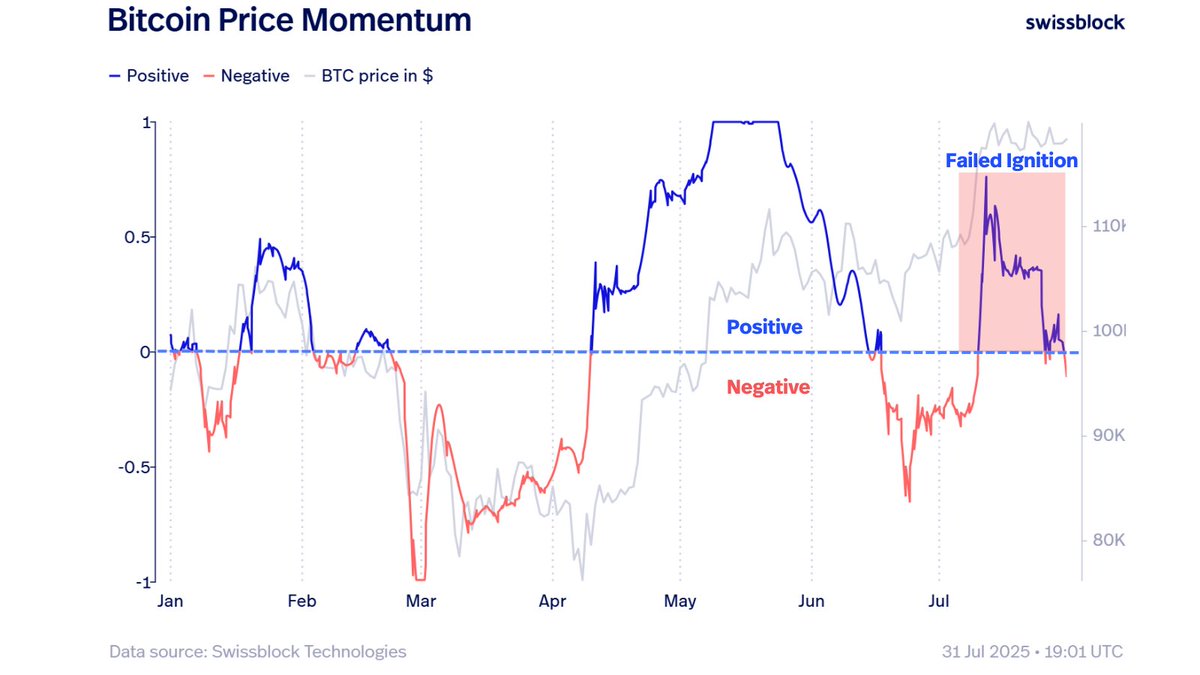

Local Stress (Flash Crash Alert)

Every breakdown begins quietly — as local stress.

⚪️The Flash Crash alert detects short-term volatility shocks before price collapses.

In both August and yesterday, these alerts fired hours ahead of the main move, mapping fast-building downside pressure while most of the market was still calm.That early signal is the first layer of protection.

Every breakdown begins quietly — as local stress.

⚪️The Flash Crash alert detects short-term volatility shocks before price collapses.

In both August and yesterday, these alerts fired hours ahead of the main move, mapping fast-building downside pressure while most of the market was still calm.That early signal is the first layer of protection.

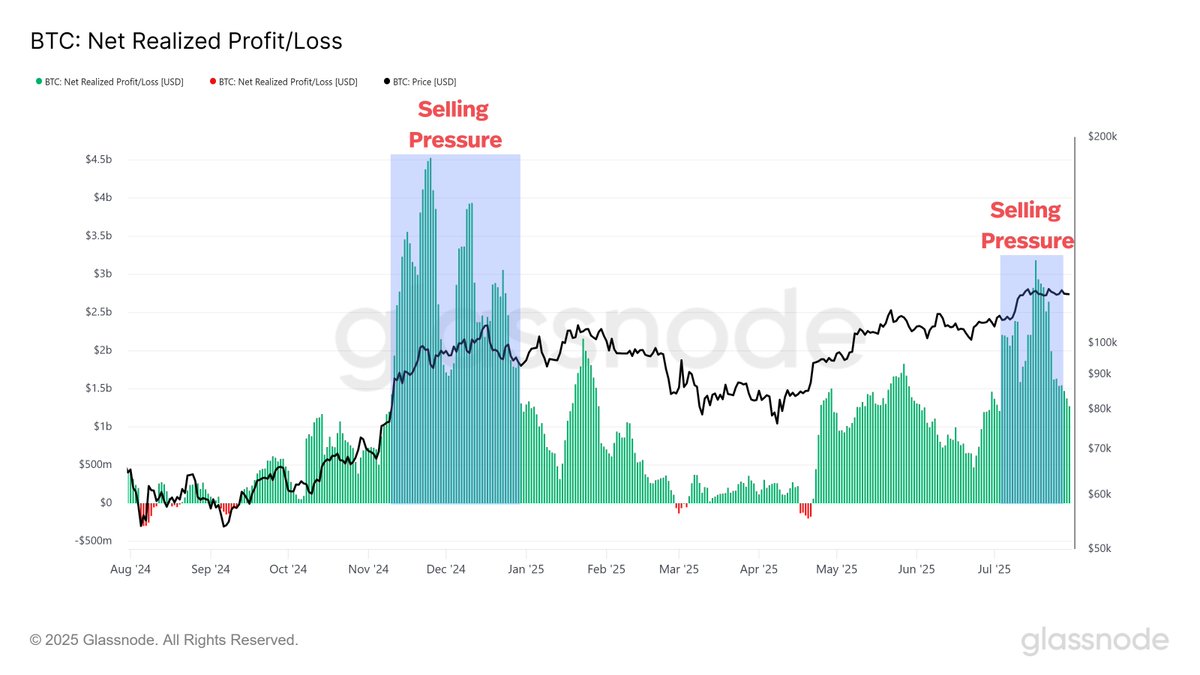

Stabilization (When the Panic Ends)

After each selloff, @bitcoinvector tracks volatility compression to identify when sellers exhaust.

This triggers a “Stabilizing Price” phase 🟢 — showing when local stress fades and the market resets. It helps you know when to pause and when to re-enter — avoiding false recoveries that trap reactive traders.

After each selloff, @bitcoinvector tracks volatility compression to identify when sellers exhaust.

This triggers a “Stabilizing Price” phase 🟢 — showing when local stress fades and the market resets. It helps you know when to pause and when to re-enter — avoiding false recoveries that trap reactive traders.

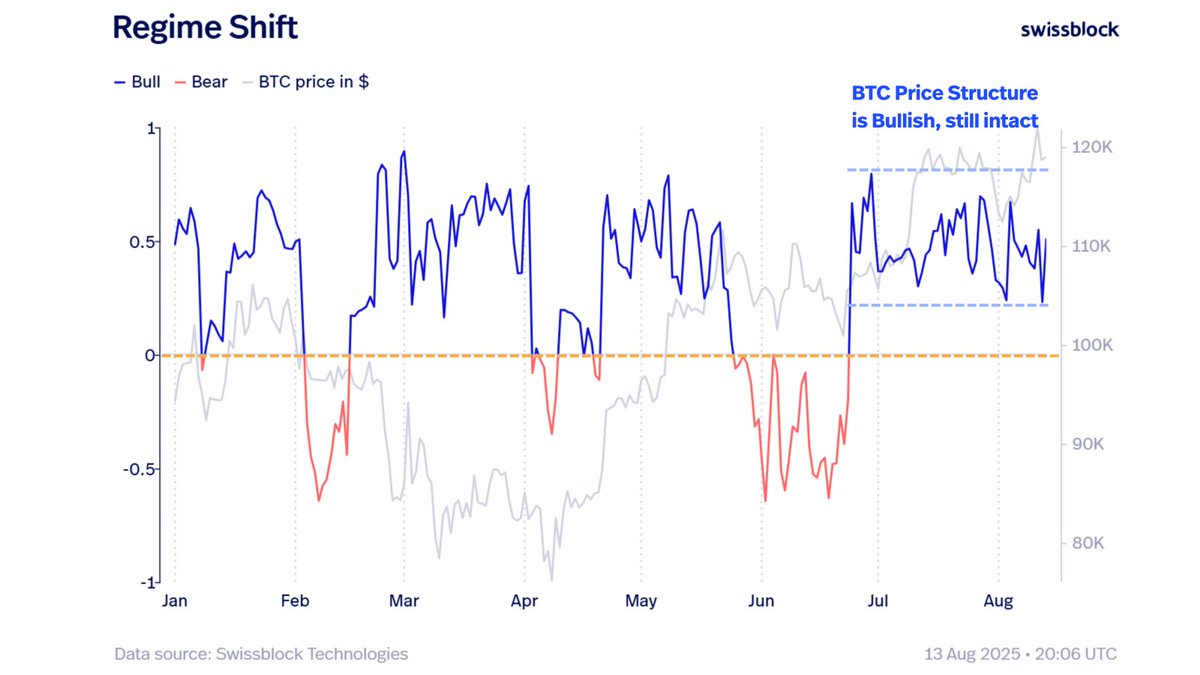

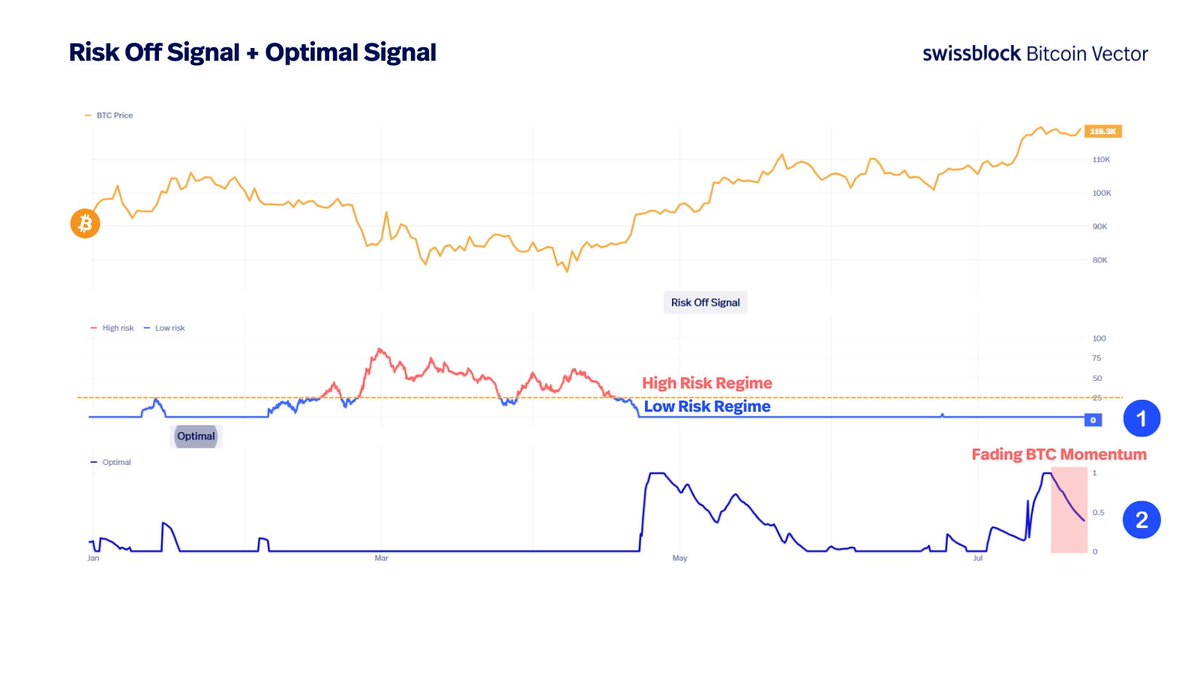

The key question: Was it just stress — or a structural breakdown?

In the chart 👇

(1) Regime Shift Signal → volatility skew flips bearish — first sign of structural change.

(2) Risk-Off Signal → confirms full systemic deterioration — liquidity contraction and prolonged downside risk.

• August ATH: both (1) + (2) triggered → full structural breakdown.

• Yesterday: only (1) → stress elevated, but not systemic yet.

In the chart 👇

(1) Regime Shift Signal → volatility skew flips bearish — first sign of structural change.

(2) Risk-Off Signal → confirms full systemic deterioration — liquidity contraction and prolonged downside risk.

• August ATH: both (1) + (2) triggered → full structural breakdown.

• Yesterday: only (1) → stress elevated, but not systemic yet.

The difference between reaction and anticipation is structure.

@bitcoinvector Advanced gives you the same alerts that identify stress before the crowd sees it —

from Flash Crash triggers to Regime Shift and Risk-Off transitions.

Stay informed. Stay positioned. Stay ahead.

🔗 Join here → swissblock.net/products/repor…

@bitcoinvector Advanced gives you the same alerts that identify stress before the crowd sees it —

from Flash Crash triggers to Regime Shift and Risk-Off transitions.

Stay informed. Stay positioned. Stay ahead.

🔗 Join here → swissblock.net/products/repor…

• • •

Missing some Tweet in this thread? You can try to

force a refresh