Pioneering the next investment frontiers, block by block

@bitcoinvector @altcoinvector

https://t.co/FzuBsdcsZQ

How to get URL link on X (Twitter) App

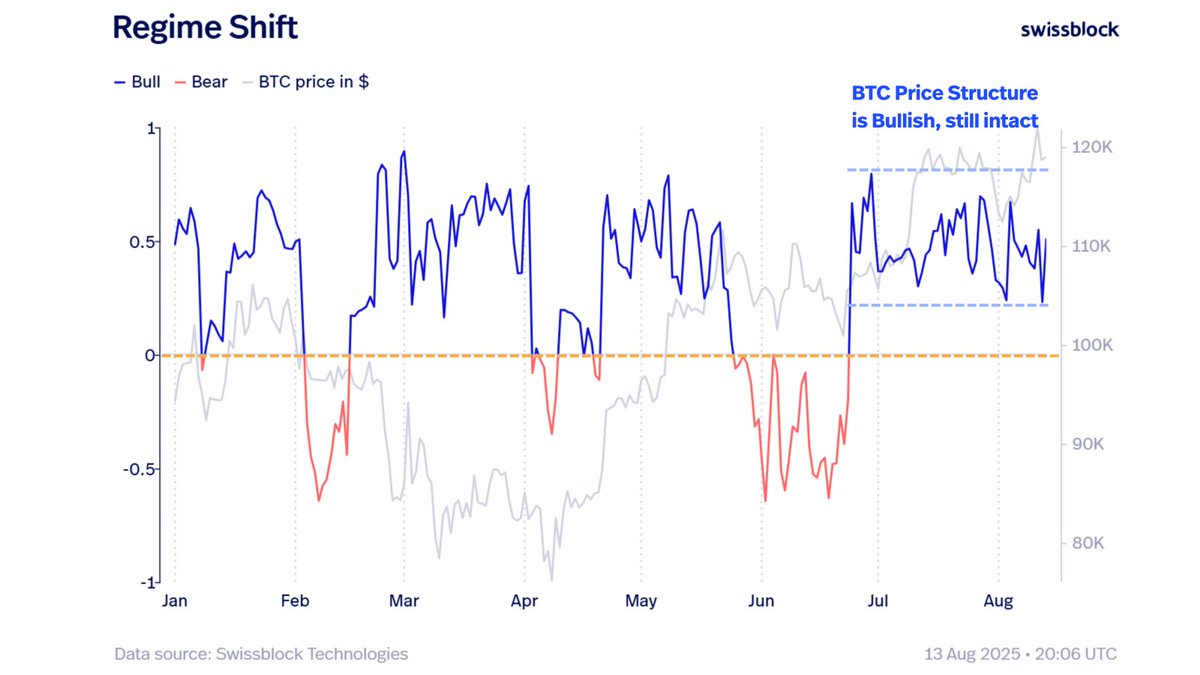

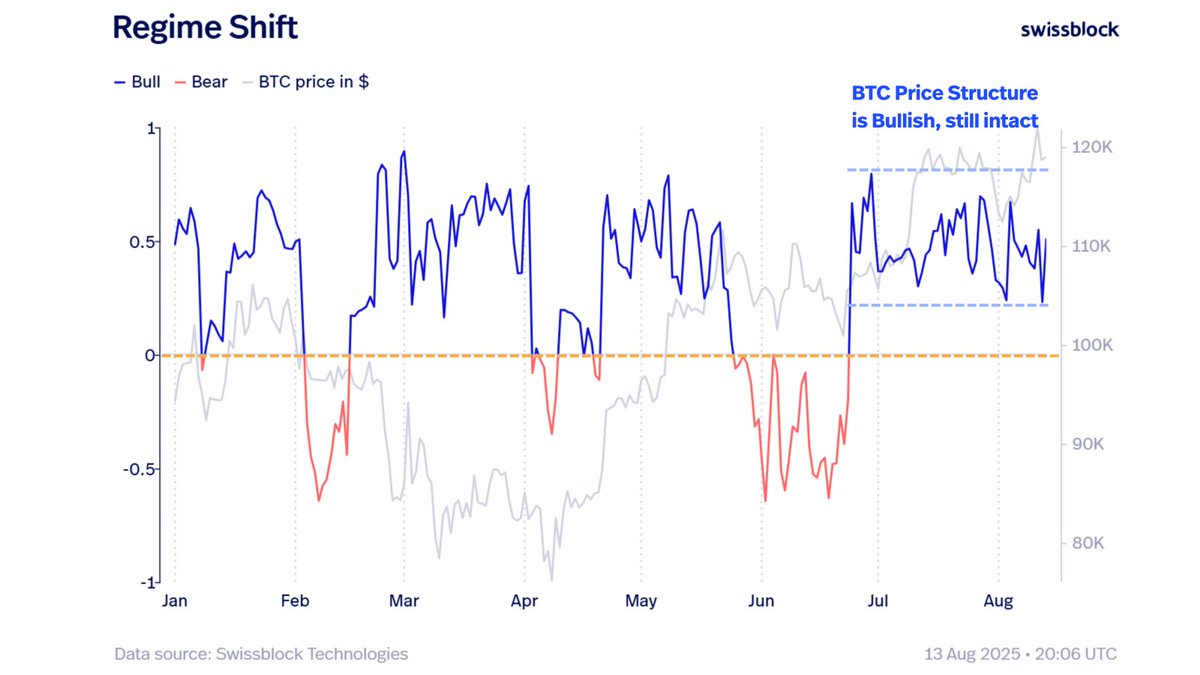

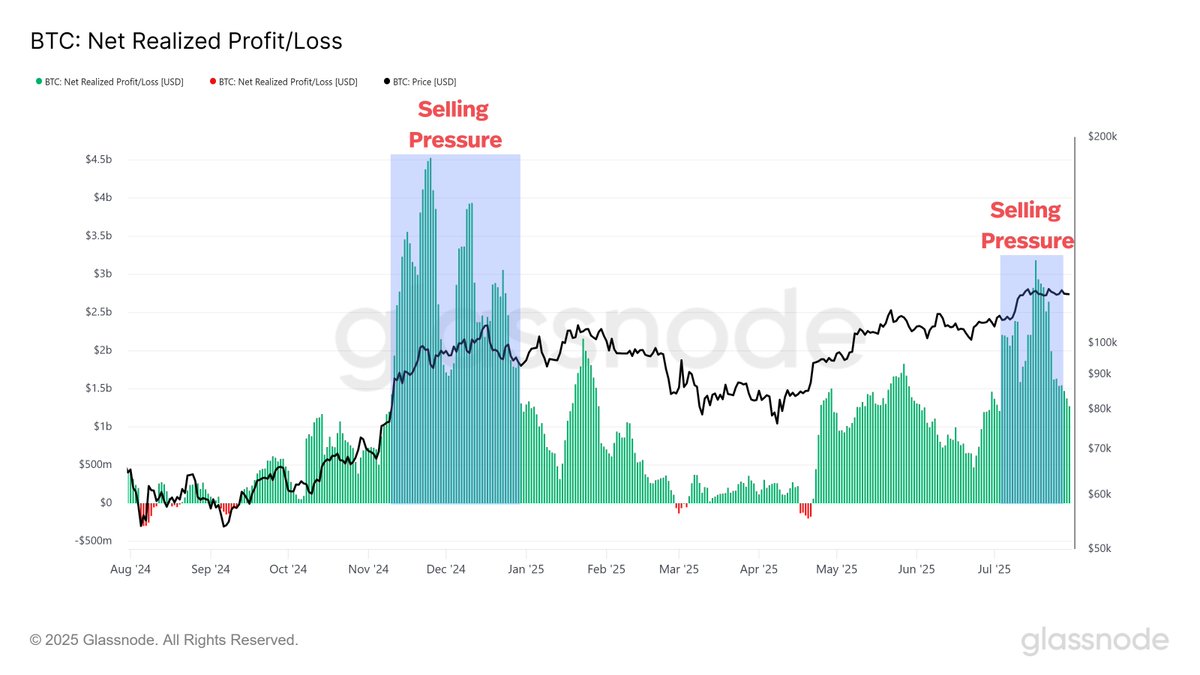

BTC is fundamentally strong, backed by solid on-chain metrics.

BTC is fundamentally strong, backed by solid on-chain metrics.

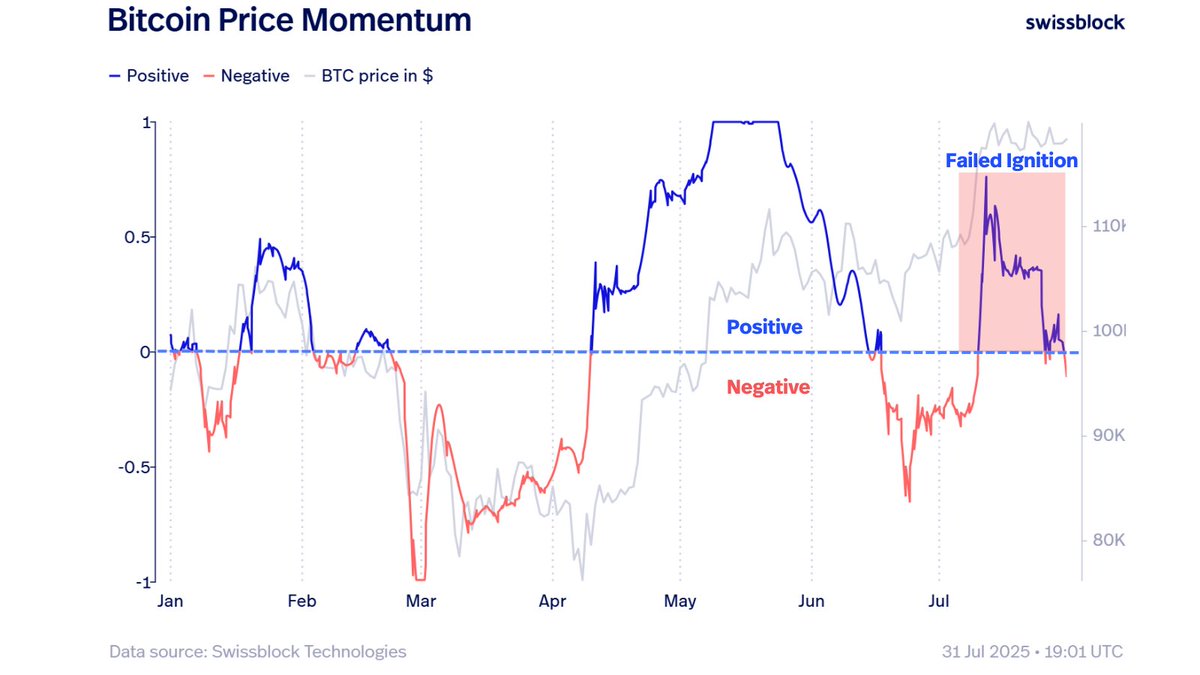

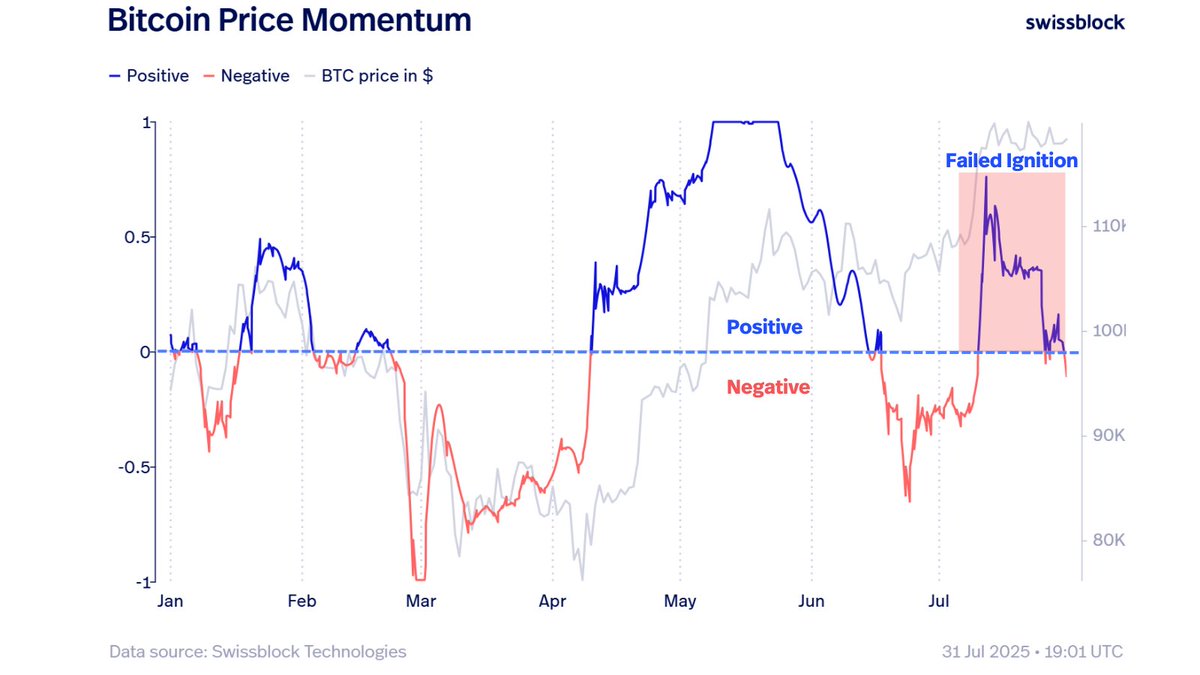

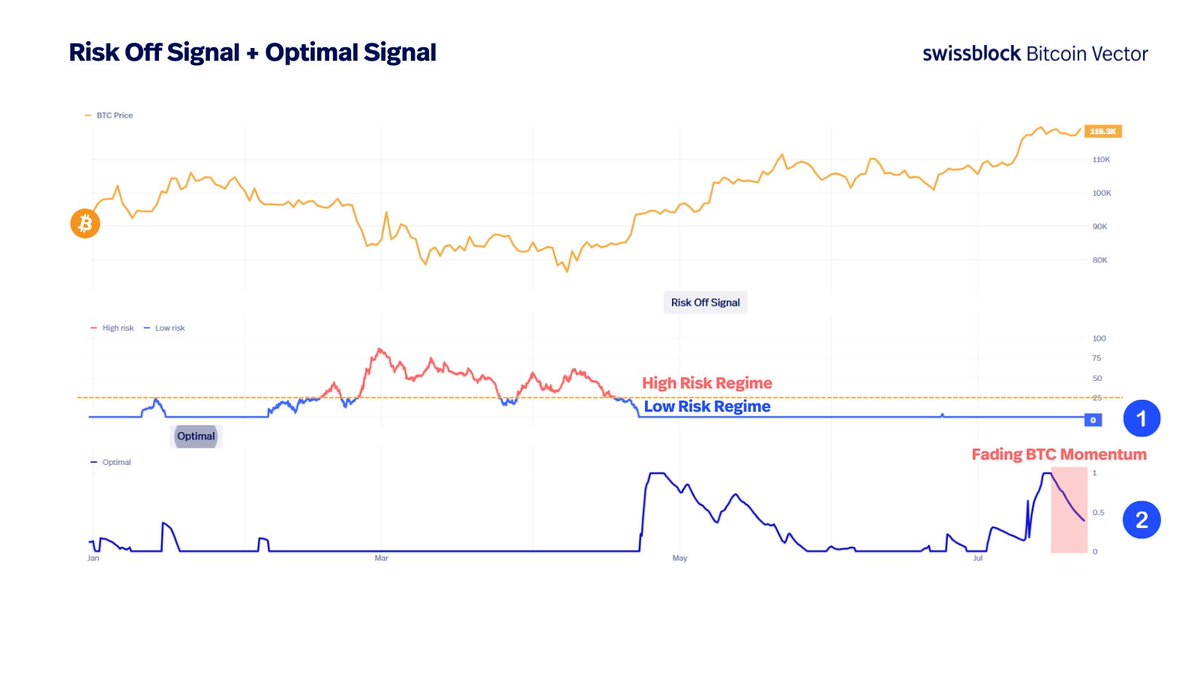

Why is momentum stalling?

Why is momentum stalling?

https://x.com/bitcoinvector/status/1947507699480203629