Despite receiving huge subsidies and curtailment payments, yet another wind farm investor is issuing profit warnings. What is going on at Greencoat UK Wind $UKW ? Sunday thread 🧵(1/n)

The UKW share price has been on a downward trend since peaking in September 2022 despite paying large dividends and buying back shares (2/n)

The large dividends can be paid because the windfarms UKW has a stake in have been paid billions in subsidies, over £8.7bn in total, of which UKW will have received a share. They also get paid to turn off when it's too windy - curtailment payments (3/n)

UKW's business model faces risks. They want to increase dividends and preserve capital, but net asset value fell in 2024 and they recently announced a plan to sell assets. This is not a recipe for increasing dividends or capital growth (4/n)

theaic.co.uk/aic/news/indus…

theaic.co.uk/aic/news/indus…

Rising interest rates mans the discount rate is rising, which has the impact of reducing asset values, partly offset by rising inflation (5/n)

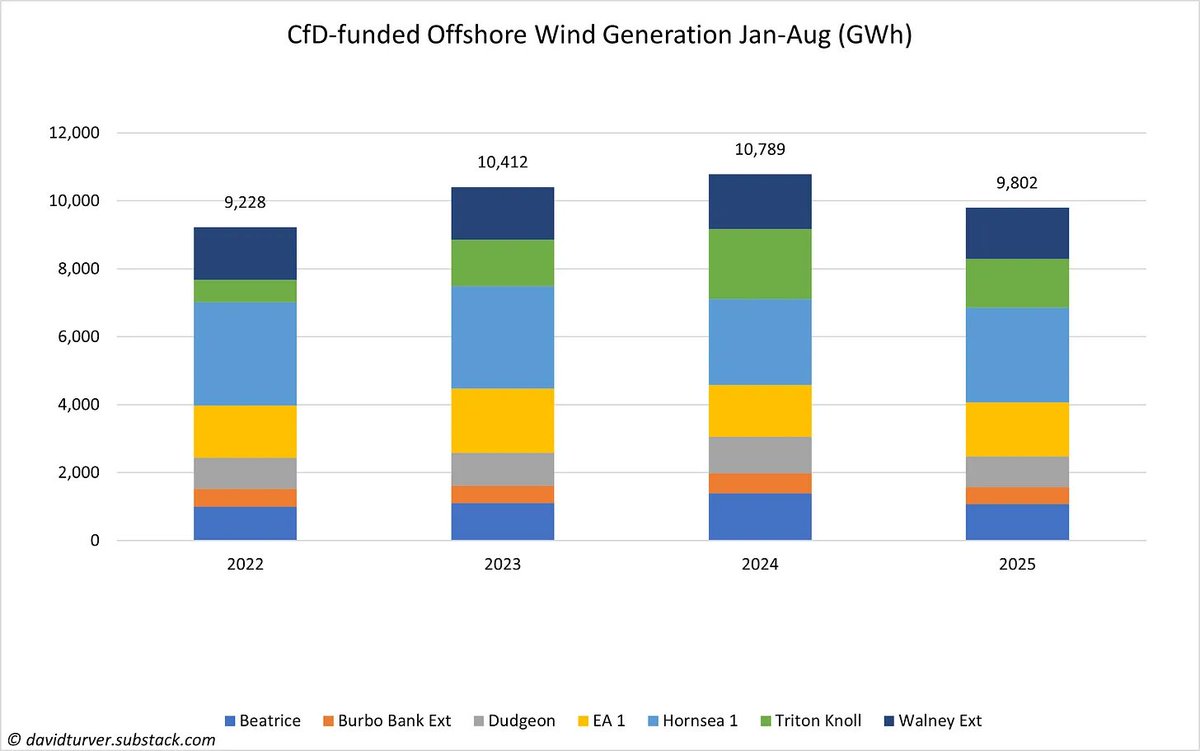

Falling electricity generation is another risk and they have been woeful at forecasting generation, coming in under budget in every year since 2016 and have warned about 2025 generation too (6/n)

They're also very optimistic about asset lives. They assume 30-year lives as a base case. RWE operate London Array & expect 23 year asset life & decommissioning in 2036. UKW assume it will operate without subsidy to 2042 (7/n)

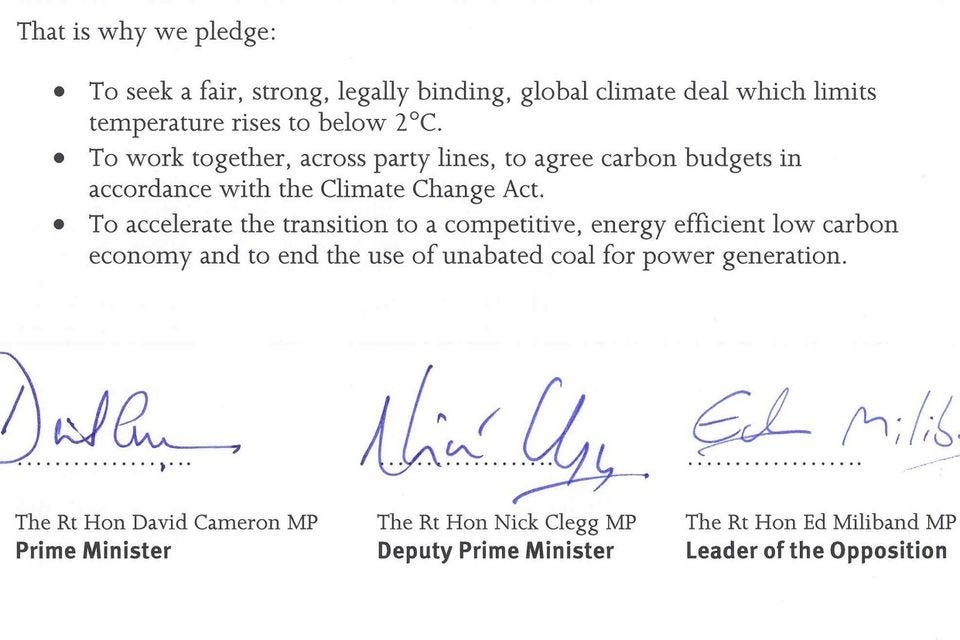

UKW is also vulnerable to falling realised electricity prices. Reform's commitment to ditch Net Zero & Claire Coutinho's promise to abolish ROC's & eliminate carbon taxes mean UKW's asset value would collapse if either gained office (8/n)

They identify £280m of guarantees and indemnities to cover decommissioning etc. But don't reduce NAV by this amount because they “do not expect Group cashflows to crystalise as a result of these guarantees” (9/n)

Looking at just three of their windfarms, we can see EBITDA plummets as ROC subsidies roll off and they need to be decommissioned. Early subsidy expiry and removal of carbon taxes will make it worse for the other assets (10/n)

The falling share price perhaps tells us that the market is catching on to the risks surrounding funds of this nature. It looks like shareholders will be left flapping in the wind for some time to come (11/n)

If you enjoyed this thread please like and share. You can sign up for free to read the full article on the link below (12/12).

open.substack.com/pub/davidturve…

open.substack.com/pub/davidturve…

Hi @threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh