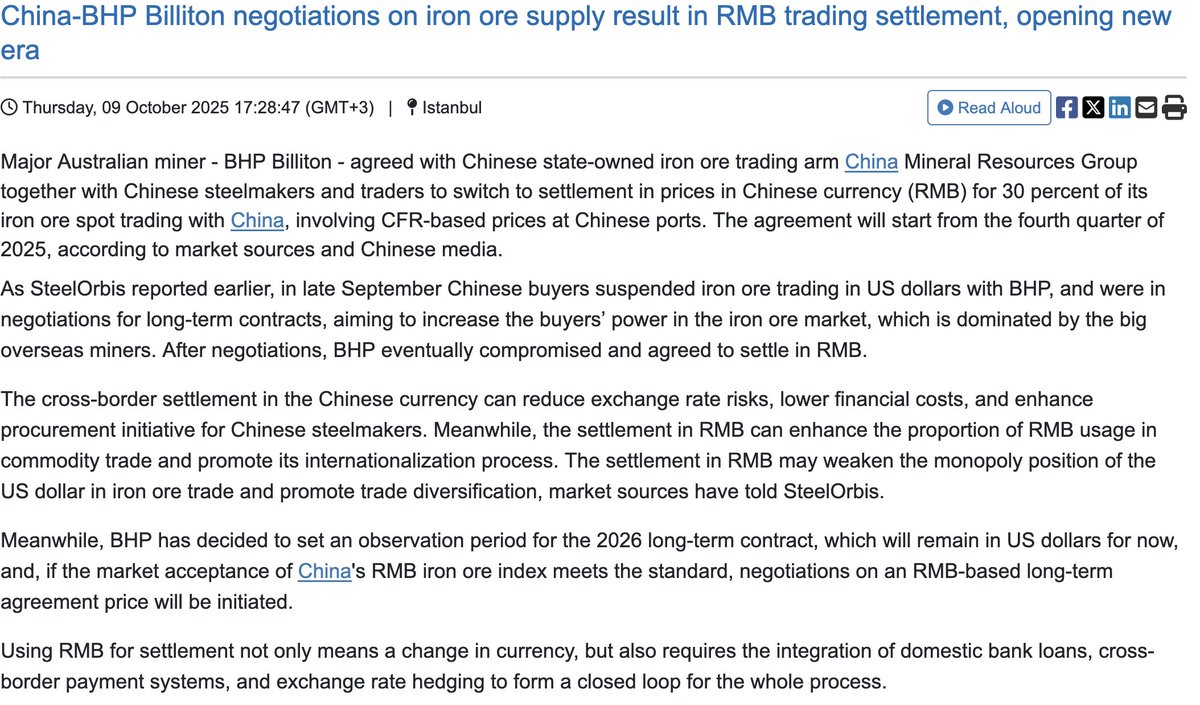

BHP accepted CMRG demand to settle 30% of spot trade in Q4 in RMB, a huge win for steelmakers like Baosteel & Ansteel.

Just how did China get past this Australian stranglehold as iron ore supplier & what does it mean for RMB internationalization, CIPS & Chinese banking sector?

Just how did China get past this Australian stranglehold as iron ore supplier & what does it mean for RMB internationalization, CIPS & Chinese banking sector?

https://twitter.com/tphuang/status/1974621078984249440

China set up CMRG back in 2022 due to its lack of power against iron ore cartel of Australia. As single largest global importer, it now has huge leverage against the mining giants, since they each sell 60-80% of production to China while CMRG only src 20% from each of them.

Thru China's increasing friendly relationship w/ Brazil, Vale agreed to sign 30B RMB of LTA w/ CMRG recently while Guinea's Simandou mine production is about to come on line (likely to be settleed all in RMB).

Table has turned for CMRG to push its advantage vs BHP.

Table has turned for CMRG to push its advantage vs BHP.

BHP still has not agreed to futures contract for 2026, but it's unlikely CMRG will back off on RMB settlement demand now that it has already won a battle.

CMRG will only expect RMB settlement & handling thru CIPS & Chinese banks to increase going fwd. Why only 30%?

CMRG will only expect RMB settlement & handling thru CIPS & Chinese banks to increase going fwd. Why only 30%?

China will need to make sure its iron ore index is legit, but other miners already use this, so shouldn't be hard.

Settlement will use Chinese banking system, CIPS & more BHP product will need to be traded on DCE. Long term, DCE needs to be center of global iron ore trading.

Settlement will use Chinese banking system, CIPS & more BHP product will need to be traded on DCE. Long term, DCE needs to be center of global iron ore trading.

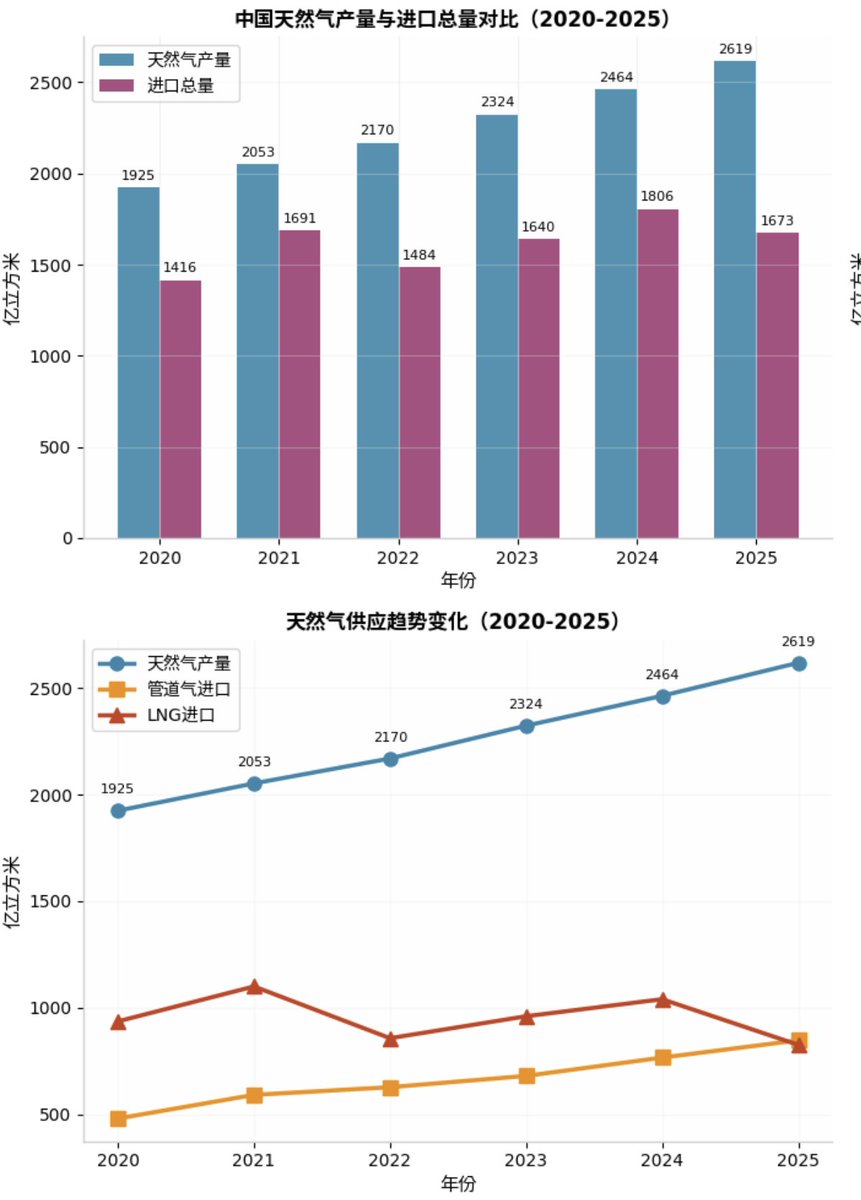

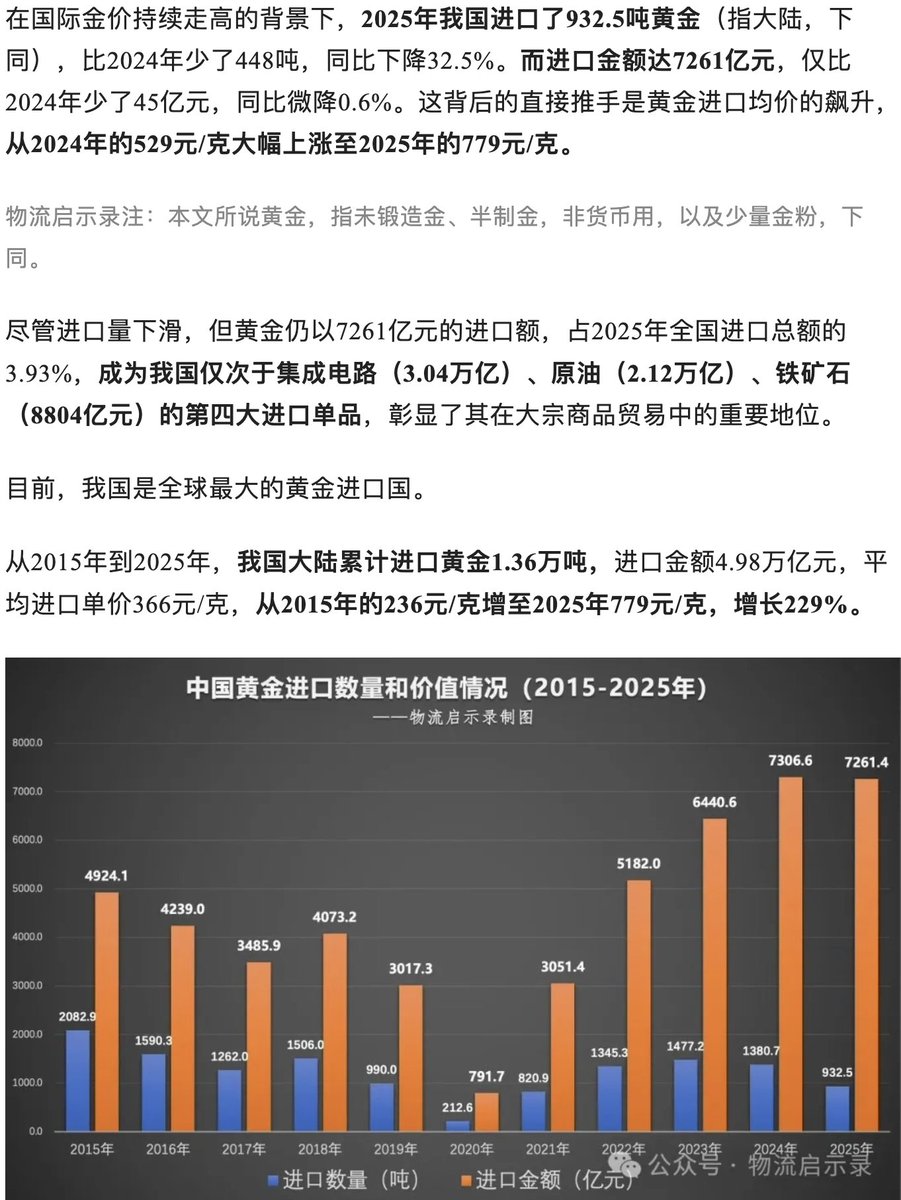

In case you are wondering about cross-border RMB settlement amount (blue), this has clearly been rapidly increasing in the past few yrs.

Trading (orange) settlement has also been increasingly settled in RMB due to the fear that Chinese financial system could face SWIFT sanction

Trading (orange) settlement has also been increasingly settled in RMB due to the fear that Chinese financial system could face SWIFT sanction

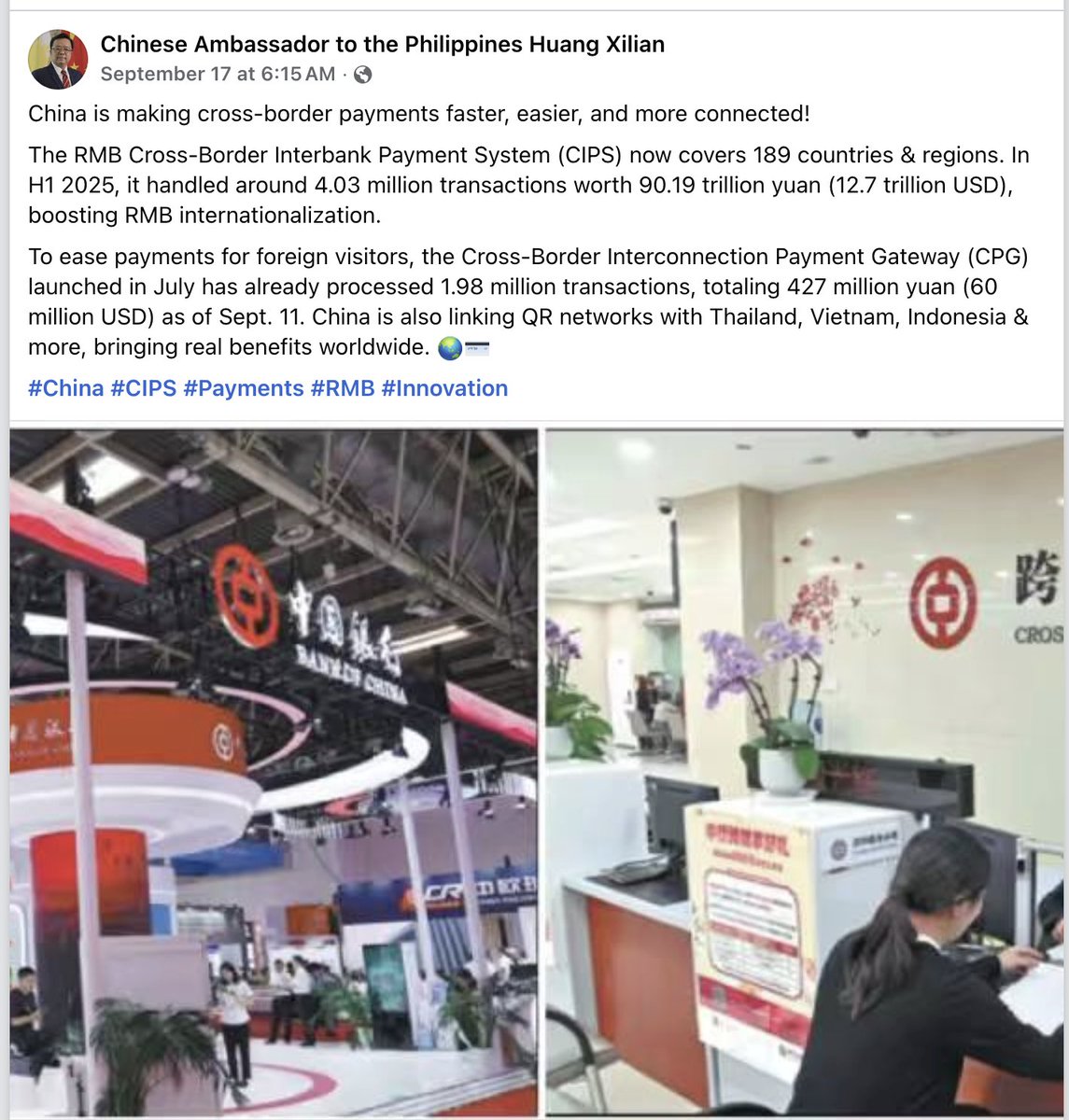

In 2024, CIPS handled as much as 175T worth of RMB volume. This total has continued to increase in 2025. The 1st half of the yr saw 90T RMB of settlement. It has only picked up since.

Q3 saw ~680B/day, which is equivalent to 248T/yr. Expect big jump from 2024 -> 2025.

Q3 saw ~680B/day, which is equivalent to 248T/yr. Expect big jump from 2024 -> 2025.

RMB internationalization thru:

1) continued optimizing cross-border RMB framework

2) Continue improving RMB internationalization infrastructure

3) Support high quality financial issuers to issue RMB bonds

4) Use multilateral & bilateral mechanism to help RMB internationalization

1) continued optimizing cross-border RMB framework

2) Continue improving RMB internationalization infrastructure

3) Support high quality financial issuers to issue RMB bonds

4) Use multilateral & bilateral mechanism to help RMB internationalization

Its because of this goal, China has been pushing for digital RMB & blockchain so that settlement period can be reduced from T+3 to T+0

see below for digital RMB connecting to ASEAN & MENA countries

see below for digital RMB connecting to ASEAN & MENA countries

https://x.com/rajivmehta19/status/1908220249180098581?lang=en

in 1st 3 quarters of this yr, China's local currency settlement ratio w/ Russia, Brazil & Argentina increased by 42% while usage of CIPS has increased by 67%.

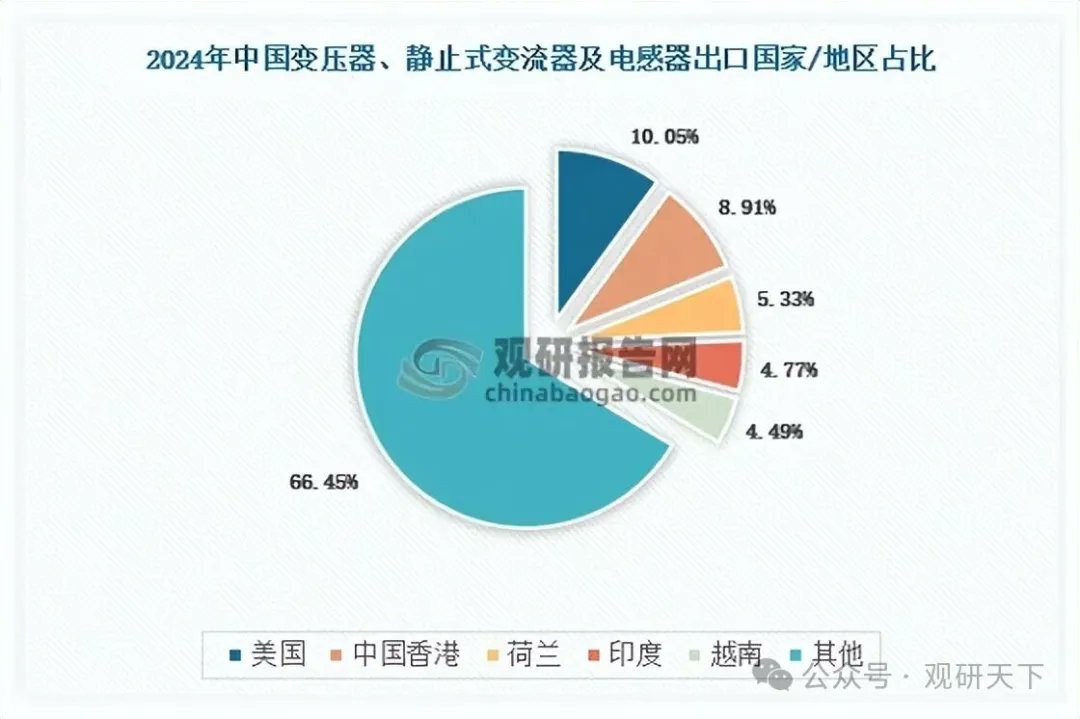

So, China is getting commodity & farming imports to be settled in RMB & processed w/ CIPS. Those RMB will in turn be used to buy Chinese goods.

So, China is getting commodity & farming imports to be settled in RMB & processed w/ CIPS. Those RMB will in turn be used to buy Chinese goods.

But this will go beyond just forcing commodity producers to use CIPS & RMB. Kenya recently just converted their SGR loan to RMB from $ & achieved $250m in interest saving annually.

It can now take RMB payment on its export so that RMB can be used to pay back on its loan.

It can now take RMB payment on its export so that RMB can be used to pay back on its loan.

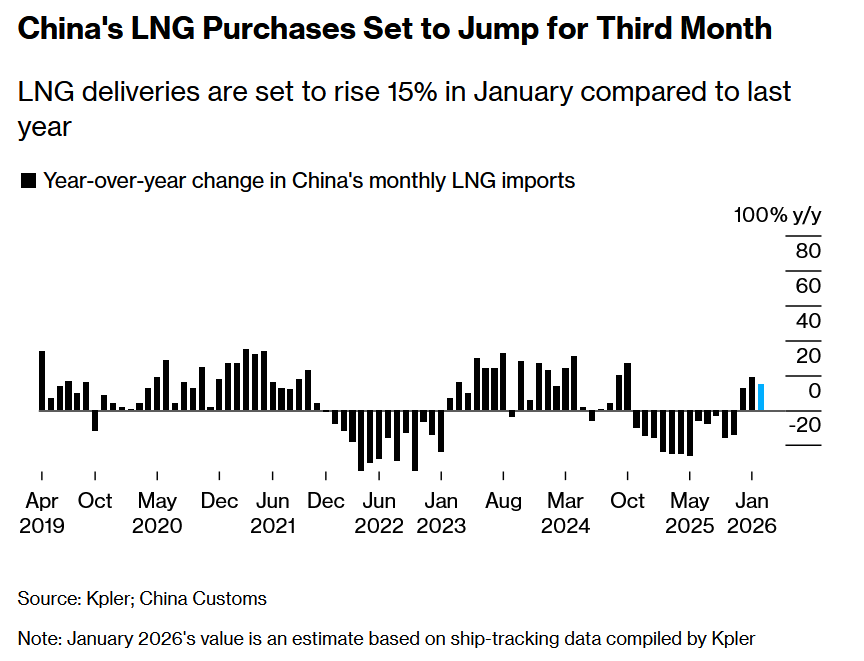

Also, more oil trading globally is switching over to RMB. Russians are now getting Indian refiners to pay oil in RMB. We know that Venezuela & Iran are also taking RMB payment for their oil. As such, Saudis, Emirates & Qataris will take RMB for increasing % of their hydrocarbon.

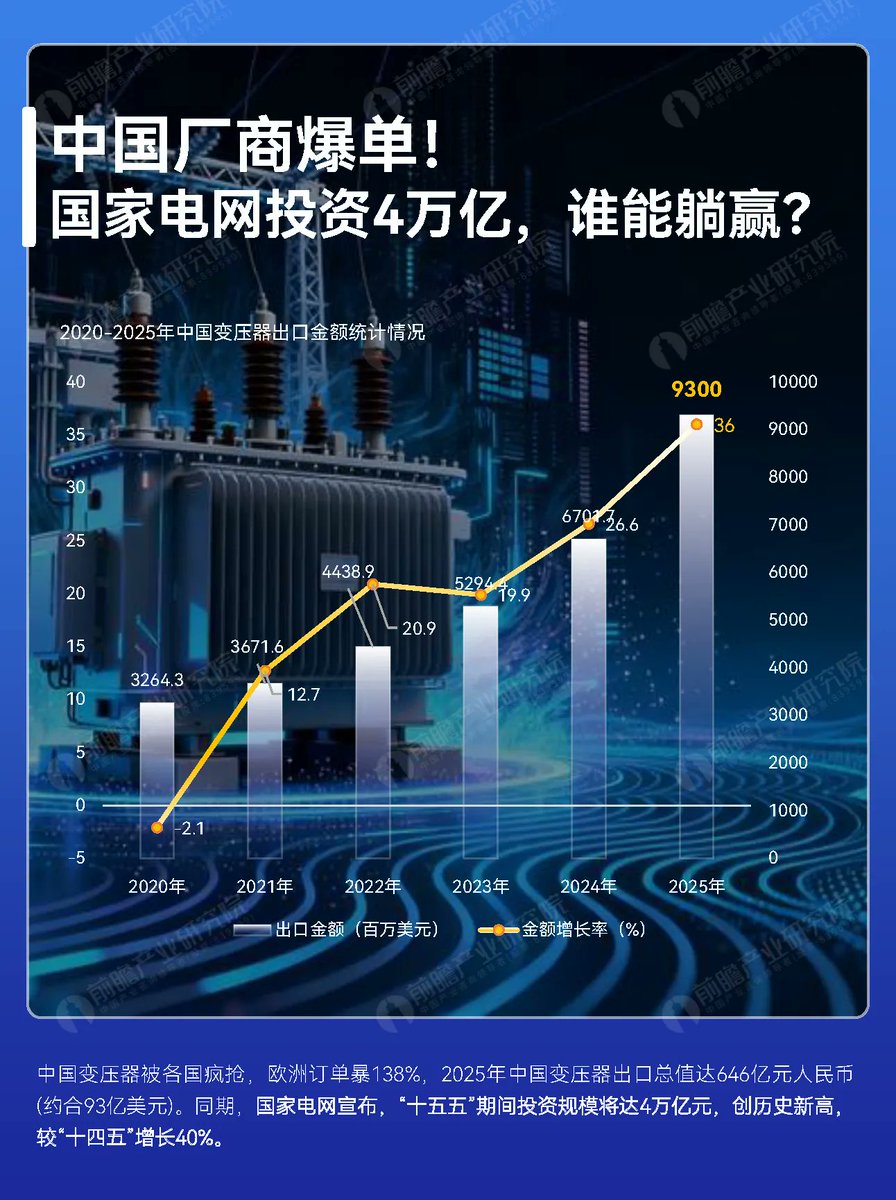

More countries in global south will look to convert their loans to RMB for lower interest rates. More commodity trading will be done in RMB since China is the largest consumer + has exchanges for that in DCE, SHFE, INE & SGE -> will become more attractive compared to ICE & LSE.

It was a very impactful wk in terms of RMB internationalization & growth of CIPS + Chinese banking sector. I expect more gold news to come out soon.

Ultimately, China needs to be prepared for the hawks in US that wants to sanction its financial sector. It really has no choice

Ultimately, China needs to be prepared for the hawks in US that wants to sanction its financial sector. It really has no choice

• • •

Missing some Tweet in this thread? You can try to

force a refresh