🚨Critical Illness policy-A Compulsory requirement now?

If you are diagnosed with critical illnesses like

🩺Cancer

🩺Heart illness

🩺Kidney diseases etc

Your Health insurance policy pays for your Hospital bill,

But,

What about the loss of employment?

A critical illness policy will help you with Lumpsum payment in case of diagnosis of Critical illnesses

A thread🧵on critical illness policy and why is it necessary?👇

If you are diagnosed with critical illnesses like

🩺Cancer

🩺Heart illness

🩺Kidney diseases etc

Your Health insurance policy pays for your Hospital bill,

But,

What about the loss of employment?

A critical illness policy will help you with Lumpsum payment in case of diagnosis of Critical illnesses

A thread🧵on critical illness policy and why is it necessary?👇

What are critical illnesses?

There are illnesses that cause grave danger to the body and are expensive to treat!

These include

🩺Cancer,

🩺 Coronary Artery Bypass Surgery,

🩺First Heart Attack (Myocardial Infarction),

🩺Kidney Failure,

🩺 Major Organ Transplant,

🩺Stroke, Aorta Graft Surgery,

🩺Primary Pulmonary Arterial Hypertension,

🩺Multiple Sclerosis with Persisting Symptoms

🩺Permanent Paralysis of Limbs are few of the critical illnesses etc.

There are illnesses that cause grave danger to the body and are expensive to treat!

These include

🩺Cancer,

🩺 Coronary Artery Bypass Surgery,

🩺First Heart Attack (Myocardial Infarction),

🩺Kidney Failure,

🩺 Major Organ Transplant,

🩺Stroke, Aorta Graft Surgery,

🩺Primary Pulmonary Arterial Hypertension,

🩺Multiple Sclerosis with Persisting Symptoms

🩺Permanent Paralysis of Limbs are few of the critical illnesses etc.

The treatment for these illnesses can cost anywhere b/w 5L to 50L

For eg,

For the treatment of cancer,

Immunotherapy costs anywhere b/w 30-50L

Chemotherapy costs anywhere b/w 20-50L

The treatment of these illnesses also may cause permanent loff of employment as well

For eg,

For the treatment of cancer,

Immunotherapy costs anywhere b/w 30-50L

Chemotherapy costs anywhere b/w 20-50L

The treatment of these illnesses also may cause permanent loff of employment as well

So what is critical illness cover?

On the diagnosis of any of the critical illnesses listed as per your policy document,

The policyholder receives a lump sum of the sum insured.

This can be used for medical care and any lifestyle changes.

On the diagnosis of any of the critical illnesses listed as per your policy document,

The policyholder receives a lump sum of the sum insured.

This can be used for medical care and any lifestyle changes.

For Eg,

Mr X bought critical illness insurance for 50L.(which covers diagnosis of cancer)

Some years down the line Mr X is diagnosed with cancer.

The insurance company will pay a lump sum of 50L to the insurance company for the cancer cover

Mr X bought critical illness insurance for 50L.(which covers diagnosis of cancer)

Some years down the line Mr X is diagnosed with cancer.

The insurance company will pay a lump sum of 50L to the insurance company for the cancer cover

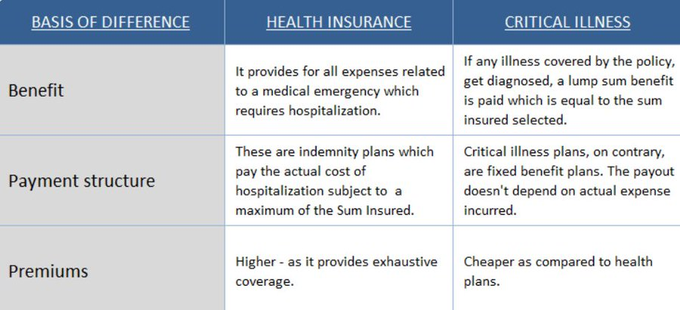

Health insurance vs Critical illness?

Health insurance covers all types of illnesses and pays only ur hospital bill.

Critical illnesses cover only specific illnesses and give you lumpsum payouts as defined in our policy.

Critical illness payouts can be used to as per ur own needs

Whereas

Health insurance can only be used to pay ur hospital bills

Health insurance covers all types of illnesses and pays only ur hospital bill.

Critical illnesses cover only specific illnesses and give you lumpsum payouts as defined in our policy.

Critical illness payouts can be used to as per ur own needs

Whereas

Health insurance can only be used to pay ur hospital bills

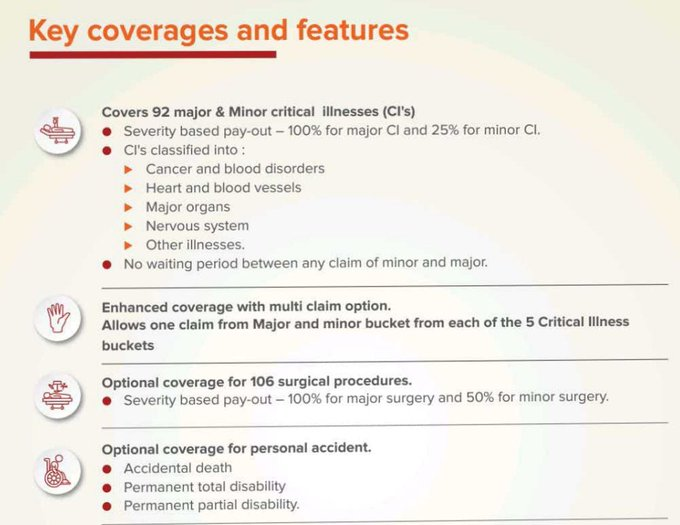

Some policies available for critical illnesses

1. ICICI Critishield

The ICICI policy is the most comprehensive policy.

It covers near about 96 illnesses and has a maximum sum insured of 40L

1. ICICI Critishield

The ICICI policy is the most comprehensive policy.

It covers near about 96 illnesses and has a maximum sum insured of 40L

HDFC critical illness policy

HDFC's policy has 15 illnesses covered with a maximum sum insured of 50L

No mandatory medical check-up up to 45 years

HDFC's policy has 15 illnesses covered with a maximum sum insured of 50L

No mandatory medical check-up up to 45 years

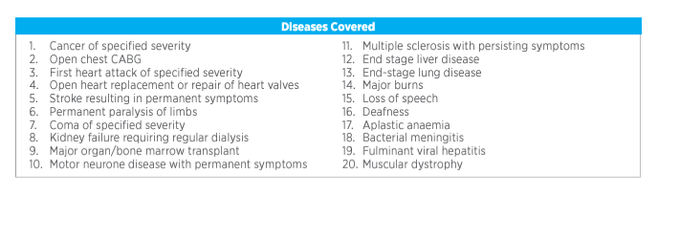

Niva Criticare policy

Niva's policy covers up to 20 illness and has a sum insured of up to 1cr -2cr

There is a compulsory medical check up to this policy

Niva's policy covers up to 20 illness and has a sum insured of up to 1cr -2cr

There is a compulsory medical check up to this policy

Conclusion:-

In times of rising illnesses,

A critical illness policy is a must,

A critical illness policy can help fighting critical illnesses in a better way

In times of rising illnesses,

A critical illness policy is a must,

A critical illness policy can help fighting critical illnesses in a better way

• • •

Missing some Tweet in this thread? You can try to

force a refresh