Absolute insanity:

Gold has now officially added +$10 TRILLION of market cap in 12 months, up a massive +55%.

Over the last 72 hours, gold has rallied on EVERY headline, even as the S&P 500 erased -$2.5 trillion in 5 hours.

What's next? Let us explain.

(a thread)

Gold has now officially added +$10 TRILLION of market cap in 12 months, up a massive +55%.

Over the last 72 hours, gold has rallied on EVERY headline, even as the S&P 500 erased -$2.5 trillion in 5 hours.

What's next? Let us explain.

(a thread)

Gold has reached a point where the technicals seem to be irrelevant.

Gold's MONTHLY RSI just hit 91.5, marking its most "overbought" level since 1980.

Yet, gold prices are up another +$110/oz on the day today.

Not even 2001, 2008, or 2020 saw a reading of 90+!

Gold's MONTHLY RSI just hit 91.5, marking its most "overbought" level since 1980.

Yet, gold prices are up another +$110/oz on the day today.

Not even 2001, 2008, or 2020 saw a reading of 90+!

For a while, it was all about the declining US Dollar.

But, take a look at this.

Even as the US Dollar has rebounded nearly +2% since October 4th, gold prices are up over +5% over the same period.

Gold is so strong that it's defying its historical relationship with the USD.

But, take a look at this.

Even as the US Dollar has rebounded nearly +2% since October 4th, gold prices are up over +5% over the same period.

Gold is so strong that it's defying its historical relationship with the USD.

So, what's happening?

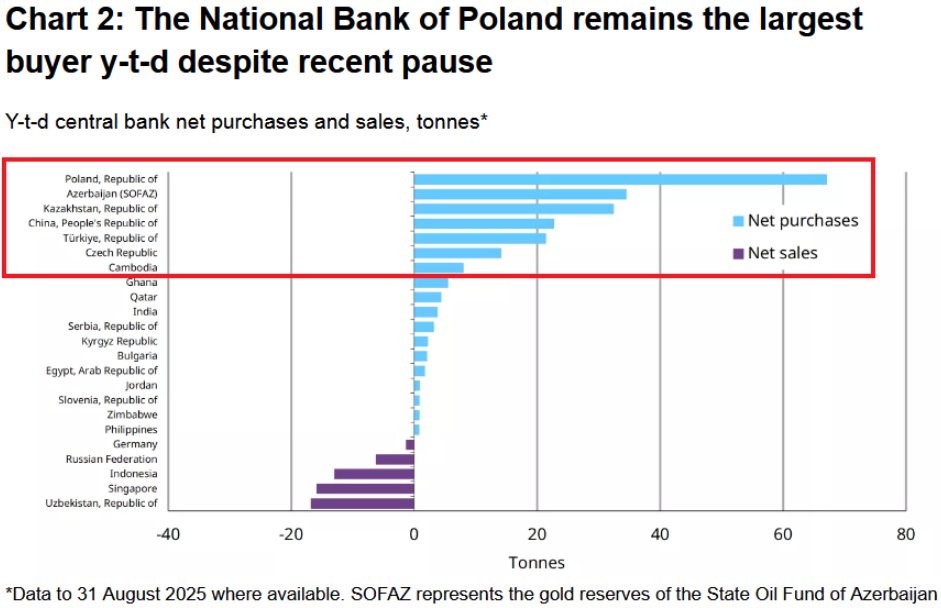

Central banks are loading up on gold at levels never seen before in history.

World central banks bought another 15 tonnes of gold in August.

This marks the 27th monthly purchase over the last 28 months.

Central banks know what's coming next.

Central banks are loading up on gold at levels never seen before in history.

World central banks bought another 15 tonnes of gold in August.

This marks the 27th monthly purchase over the last 28 months.

Central banks know what's coming next.

Take a look at China:

China's gold holdings are up from 1.0% to 6.5% of reserves since 2015, while US Treasury holdings have HALVED from 44% to 22%.

And, these central banks are not concerned about the technical backdrop.

They are much more forward looking.

China's gold holdings are up from 1.0% to 6.5% of reserves since 2015, while US Treasury holdings have HALVED from 44% to 22%.

And, these central banks are not concerned about the technical backdrop.

They are much more forward looking.

What's even more crazy is when you zoom out:

Amid the record buying, global official reserve assets in gold have risen toward 25%.

The USD has gone from ~55% down to ~40%.

But, this is barely starting to make a dent in the below chart.

Gold reserves can go much higher.

Amid the record buying, global official reserve assets in gold have risen toward 25%.

The USD has gone from ~55% down to ~40%.

But, this is barely starting to make a dent in the below chart.

Gold reserves can go much higher.

That leads us to this chart:

Gold prices adjusted for US Money Supply are breaking out of a 50+ year downtrend.

And, when you adjust gold prices for US money supply, the 1970s peak was ~4 TIMES higher.

When you zoom out, it begins looking like we are still early here.

Gold prices adjusted for US Money Supply are breaking out of a 50+ year downtrend.

And, when you adjust gold prices for US money supply, the 1970s peak was ~4 TIMES higher.

When you zoom out, it begins looking like we are still early here.

The other question: why are central banks loading up on gold while calling for a "soft landing?"

The Fed is cutting rates into 3%+ inflation and global debt is skyrocketing.

Global debt jumped +$14 TRILLION in Q2 2025, to a record $337.7 trillion.

Fiat is losing credibility.

The Fed is cutting rates into 3%+ inflation and global debt is skyrocketing.

Global debt jumped +$14 TRILLION in Q2 2025, to a record $337.7 trillion.

Fiat is losing credibility.

Meanwhile, silver prices are skyrocketing too, up another 6% today alone.

This puts silver up +68% in 2025 and above $50/oz for the first time since 1980.

Silver and gold are more than quadrupling the S&P 500's return in a historic EQUITIES bull market.

This is unprecedented.

This puts silver up +68% in 2025 and above $50/oz for the first time since 1980.

Silver and gold are more than quadrupling the S&P 500's return in a historic EQUITIES bull market.

This is unprecedented.

For the first time in 50+ years, central banks are actually buying silver as well.

The Saudi Central Bank purchased $28.5 million worth of $SLV in August.

Institutional capital has followed with purchases by many large Wall Street institutions.

Once again, a major shift.

The Saudi Central Bank purchased $28.5 million worth of $SLV in August.

Institutional capital has followed with purchases by many large Wall Street institutions.

Once again, a major shift.

Gold's record run is just the tip of the iceberg in the global currency crisis.

The backdrop is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The backdrop is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Lastly, foreign investors now hold a higher amount of gold than US treasuries.

The share of US Treasuries held by foreign investors is down from 49% in 2013 to 31% today.

Gold is the GLOBAL safe haven.

Follow us @KobeissiLetter for real time analysis as this develops.

The share of US Treasuries held by foreign investors is down from 49% in 2013 to 31% today.

Gold is the GLOBAL safe haven.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh