India's "growth story" has echoed in boardrooms for decades. But an economic slowdown in recent years has sparked worrying commentary. One thing caught our attention—private capex, the engine of long-term growth, is failing us.

Let's find out why. 🧵👇

Let's find out why. 🧵👇

When businesses build new factories, set up plants, or invest in new technology, they create jobs, boost demand for raw materials, and set up future production capacity. Government spending helps, but private companies make growth broad-based and self-sustaining.

Here's the paradox. Private investment is touching new highs in absolute terms, yet as a share of GDP it remains historically low. Even the Finance Ministry has flagged that weak private investment could "restrict acceleration in economic momentum."

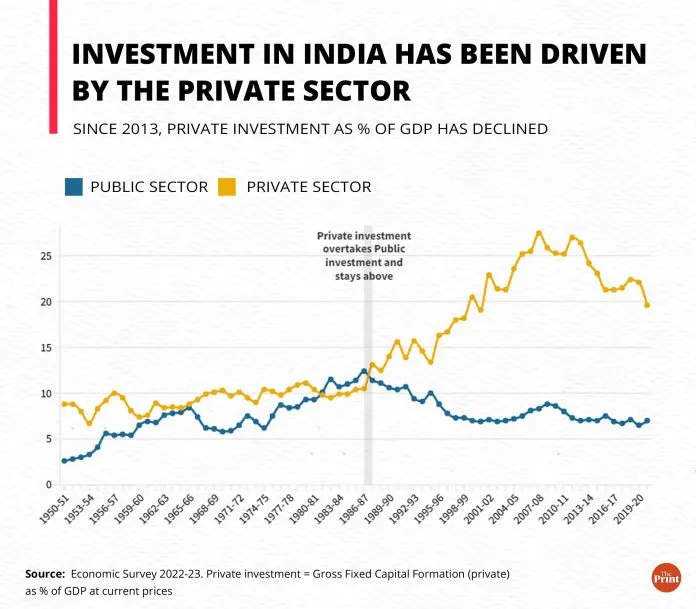

Following the 1991 reforms, private investment climbed steadily for two decades—from ~13% of GDP to a peak of ~27.5% in 2007-08. Even the 2008 Global Financial Crisis caused only a temporary dip. This period coincided with India's high GDP growth in the 90s and 2003-11.

Since 2012, private capex as a share of GDP has been sliding downward. It fell to ~21% by 2015-16 and has hovered there since. By end of 2024, total Gross Capital Formation was ~30% of GDP, well below the 41% peak in 2011.

The private sector's share of total fixed investment has shrunk—from over 40% in 2015-16 down to only 33% in 2023-24. Not only have overall investments gone down, but the private sector's share in the decreasing pie has also declined.

The reasons behind this decline are hard to ascertain, but the post-2011 period marked the end of the last big capex cycle. Many companies took on heavy debts during the mid-2000s boom, then ran into distress when projects failed to yield expected returns.

This led to a twin balance sheet crisis in the 2010s—highly-indebted corporates and banks laden with non-performing loans. By the early 2020s, firms had deleveraged and banks cleaned up their books. But the risk appetite of corporate India had been severely scarred.

Even though balance sheets are healthier now, the past trauma of excess capacity and loan defaults make executives twice shy about aggressive investments. The main hurdle is not availability of finance, but uncertainty. Businesses are choosing to delay new capacity expansion.

Could it just be that it's costlier to fund projects now? Financing conditions have not been a binding constraint. During the pandemic, interest rates were cut sharply. Even after rates rose in 2022-23, large companies still find capital reasonably accessible.

When interest rates were very low, many corporates avoided bank loans and tapped cheaper market funding. NPAs are at decade-low levels, giving banks confidence to lend. But firms are deliberately choosing not to leverage too much. The cost of capital is not the primary issue.

The problem comes back to the lack of confidence in levels of demand. Both urban and rural consumption have shown weakness. Export demand has been uncertain due to global trade frictions and slowing world economy. Indian firms cannot bank on surging exports either.

Beyond measurable factors, there's an intangible trust deficit. ThePrint's analysis found that usual determinants don't fully account for the slowdown. Instead, it pointed to a "general lack of confidence in the way the Indian economy is being managed," as perceived by businesses.

Unpredictability in economic policies or regulatory overreach can make companies hesitant. Abrupt policy moves like sudden tax or regulatory changes, demonetization—these may have made business leaders more risk-averse. Even profitable firms now sit on cash or return it to shareholders.

The government hasn't been idle. First, it fixed the banking system—bad loans written off, bankruptcy code put in place, PSBs recapitalized. The expectation was that once credit flowed freely, investment would follow. But it didn't.

Then came the 2019 corporate tax cut, one of the steepest in India's history. Lower taxes should boost profits, and higher profits should lead to investments. But that assumed companies were held back by high taxes, not weak demand. Naturally, since it got the cause wrong, it didn't work.

Next came PLI—800 projects worth ₹1.76 lakh crore were cleared. Post-pandemic, public capex was ramped up to historic levels. GST simplifications and income tax cuts followed. Investment intentions went up, but not enough to shift the investment-to-GDP story meaningfully.

The foundation is there—cleaner balance sheets, lower tax rates, simpler GST, massive infrastructure, sector incentives. What's missing is the spark. Stronger, broad-based demand and confidence that tomorrow will be worth betting on. Until that returns, India's growth engine runs on one cylinder. And that's never how you win a long race.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here: thedailybrief.zerodha.com/p/is-there-a-p…

All links here: thedailybrief.zerodha.com/p/is-there-a-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh