I removed everything from my system

removed indicators, removed complexity, removed the noise.

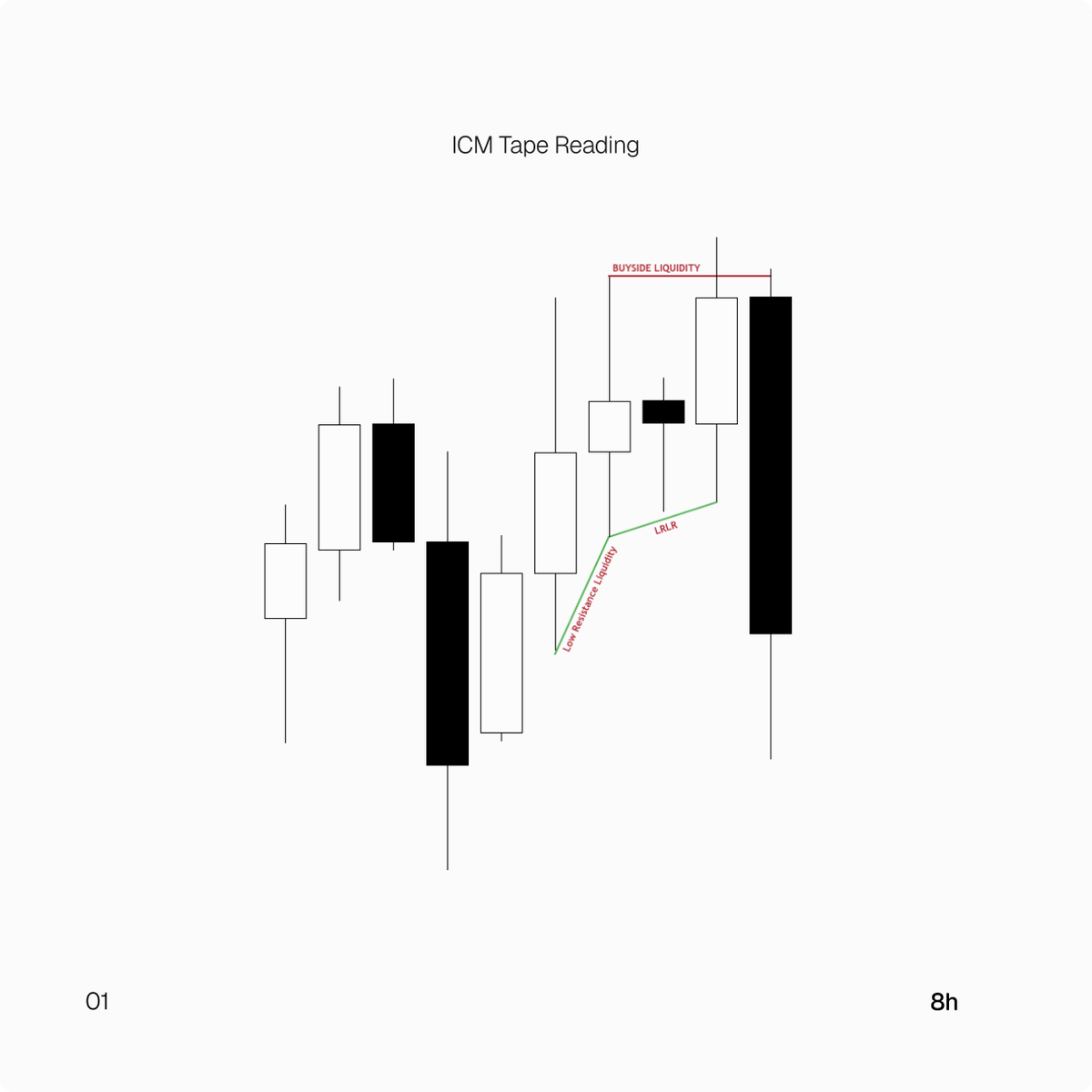

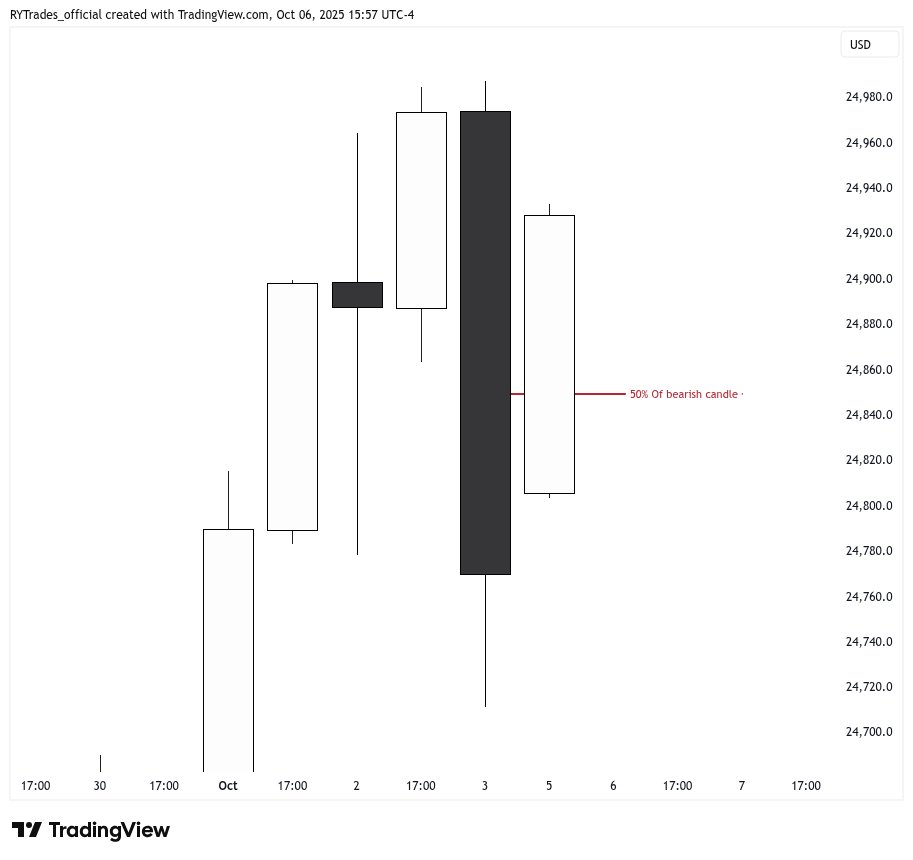

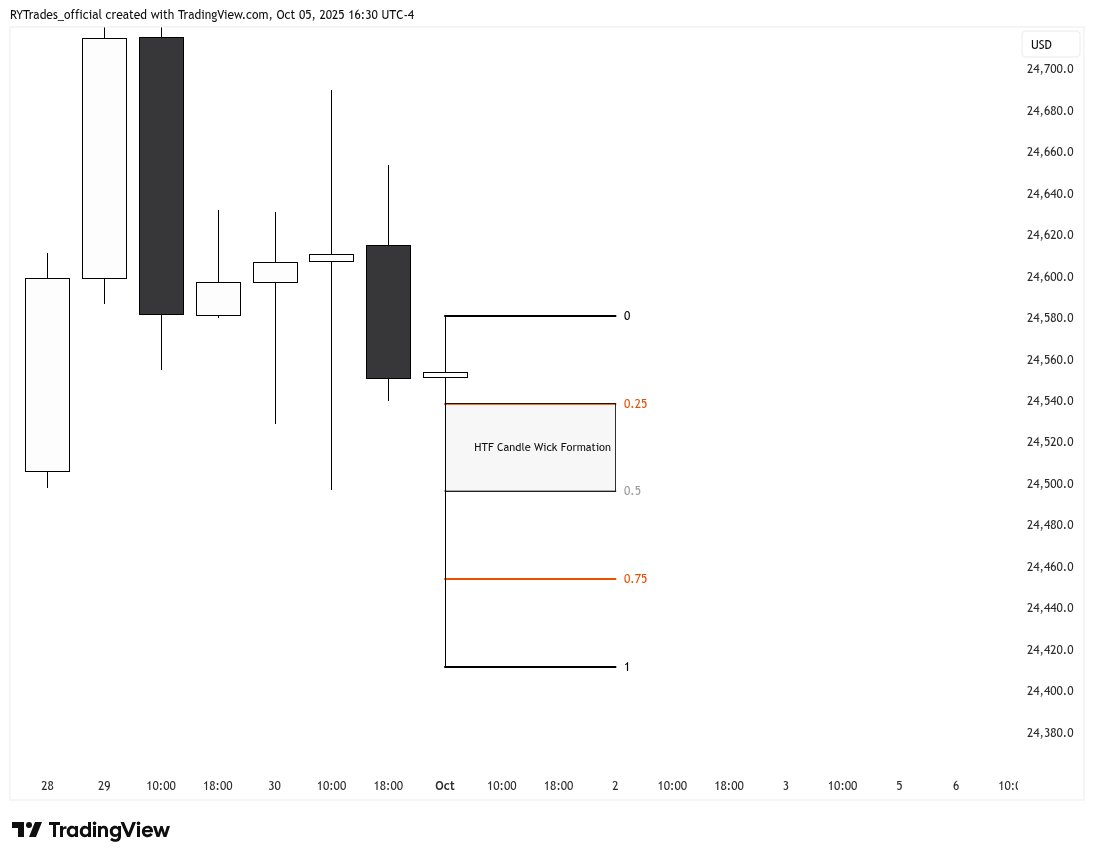

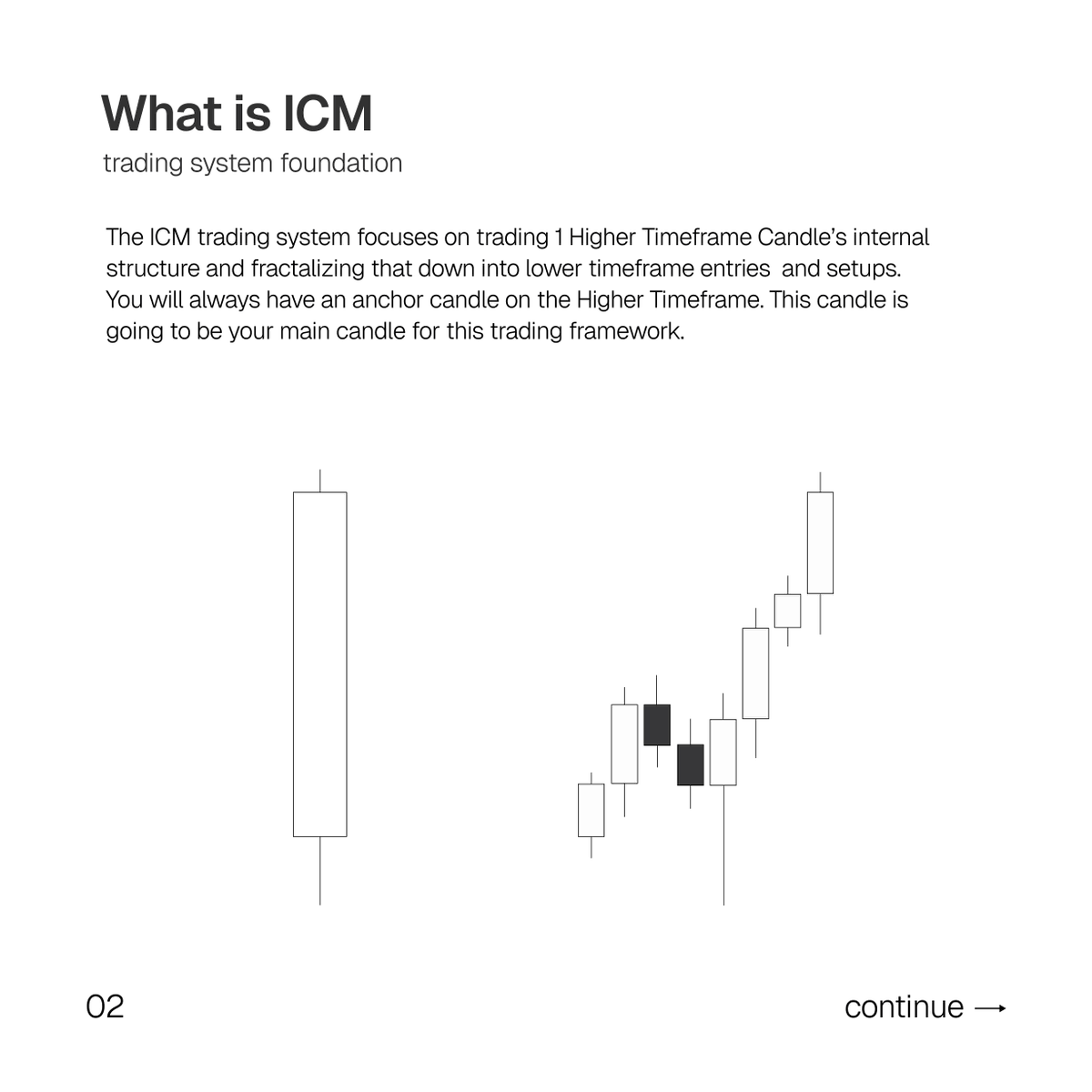

what's left? the ICM model

one candle

15 minutes per day

I made $70,000 in September alone trading just this model.

Here is my full ICM trading model🧵

removed indicators, removed complexity, removed the noise.

what's left? the ICM model

one candle

15 minutes per day

I made $70,000 in September alone trading just this model.

Here is my full ICM trading model🧵

make sure to follow if you want to see more of my model and how I implement it on a daily basis.

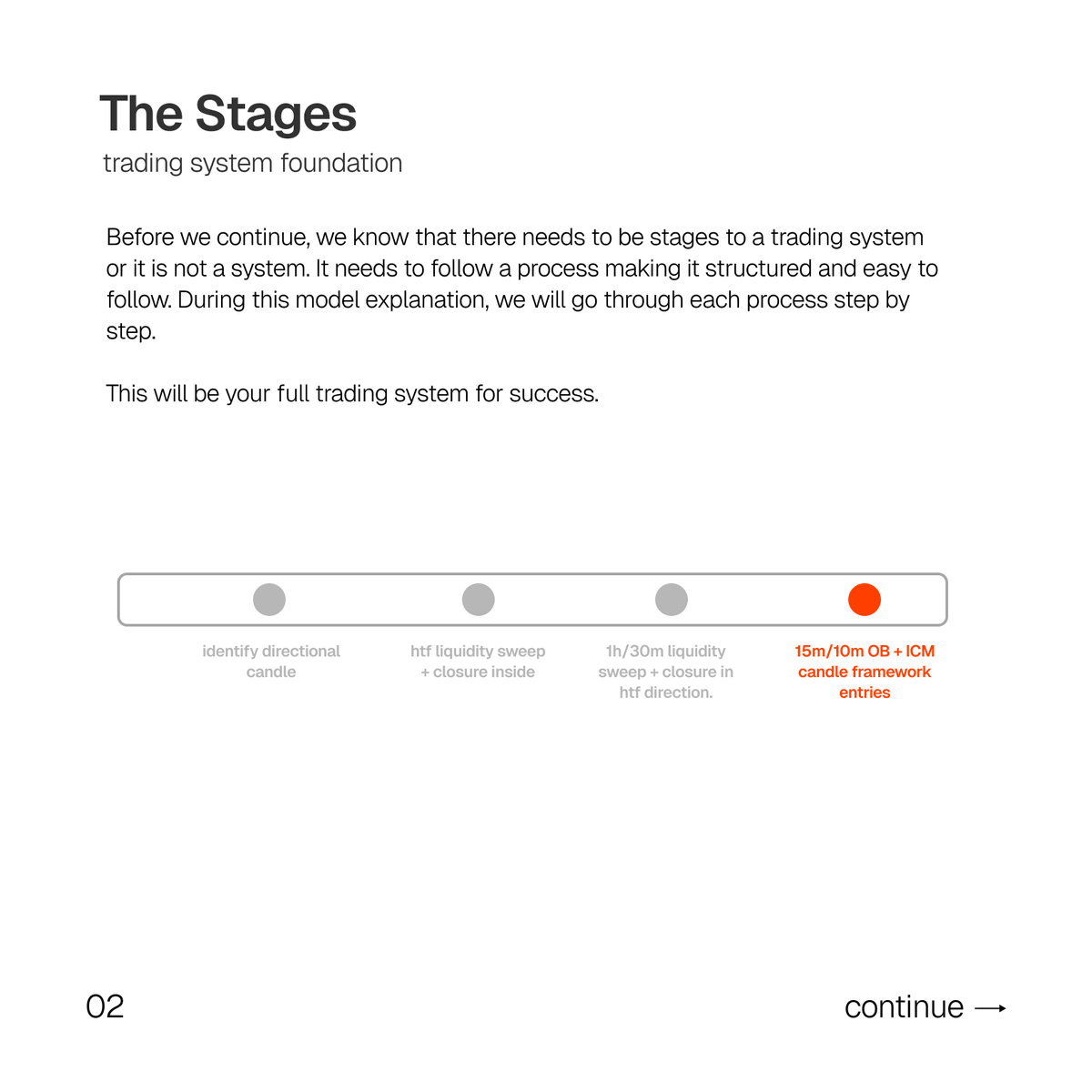

this model was created on a foundation of ICT + ICM and a few other concepts I learned in my years of trading.

you have done yourself a huge favor by reading, understanding and implementing this model. this is the simplest and fastest way to profitability.

hope you guys enjoy the read, feel free to share with others as well to help someone else.

this model was created on a foundation of ICT + ICM and a few other concepts I learned in my years of trading.

you have done yourself a huge favor by reading, understanding and implementing this model. this is the simplest and fastest way to profitability.

hope you guys enjoy the read, feel free to share with others as well to help someone else.

• • •

Missing some Tweet in this thread? You can try to

force a refresh