How to get URL link on X (Twitter) App

why is this important and how can we do this?

why is this important and how can we do this?

Why is trading the correct asset so important and why it applies not only to ES and YM and NQ but also to other correlating assets.

Why is trading the correct asset so important and why it applies not only to ES and YM and NQ but also to other correlating assets.

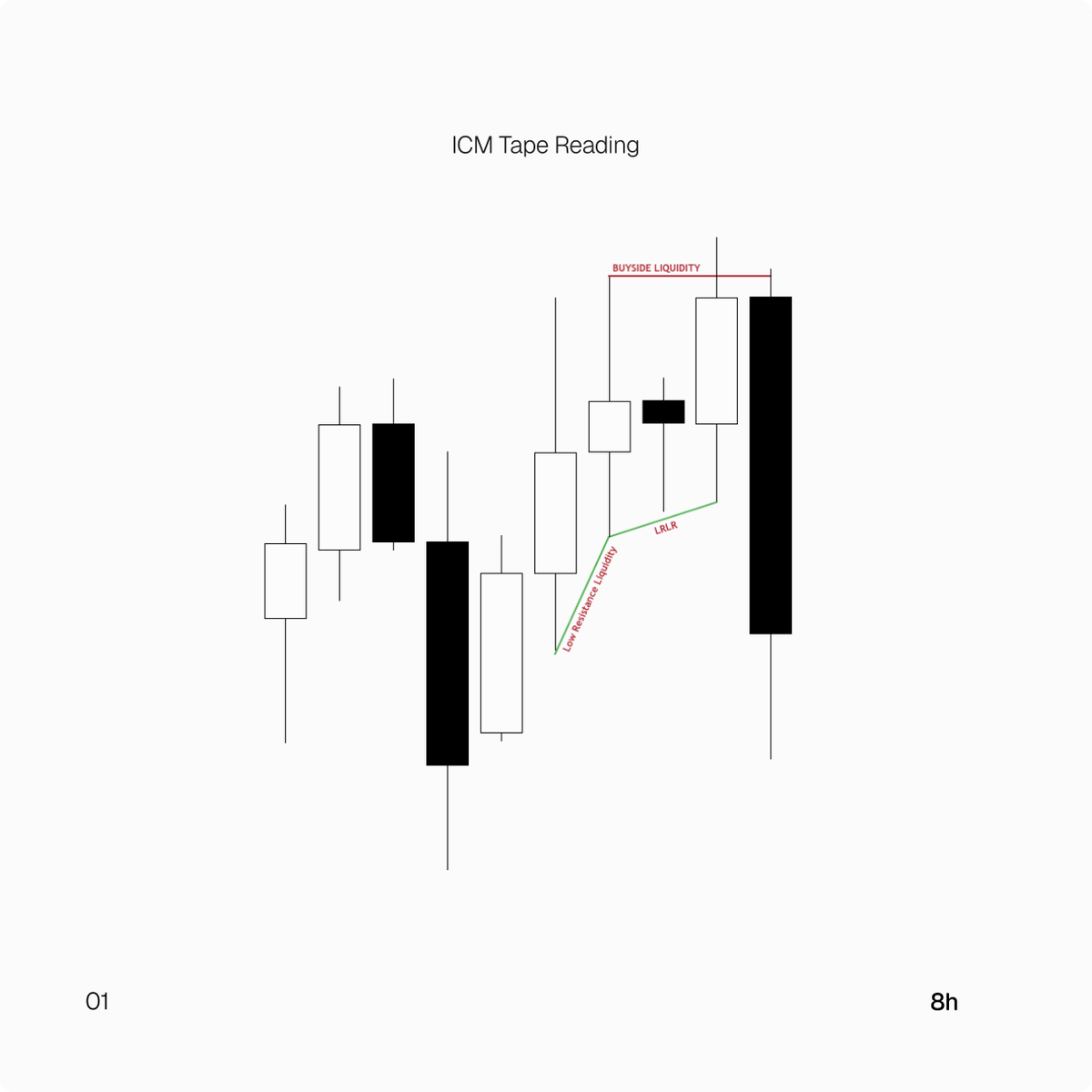

At first look on the 8h going into the 10AM candle, we can see that we had Low resistance liquidity lows.

At first look on the 8h going into the 10AM candle, we can see that we had Low resistance liquidity lows.

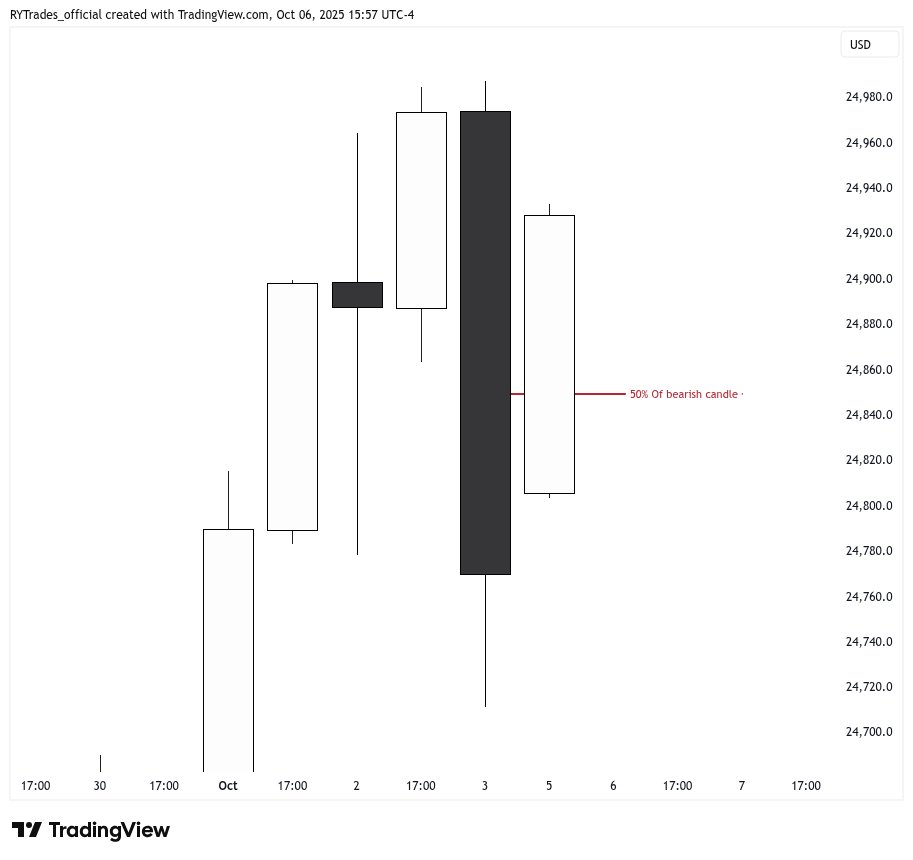

On the NQ today, the first thing we had in mind on the 12H chart was that there was a large bearish candle.

On the NQ today, the first thing we had in mind on the 12H chart was that there was a large bearish candle.

8H Chart

8H Chart

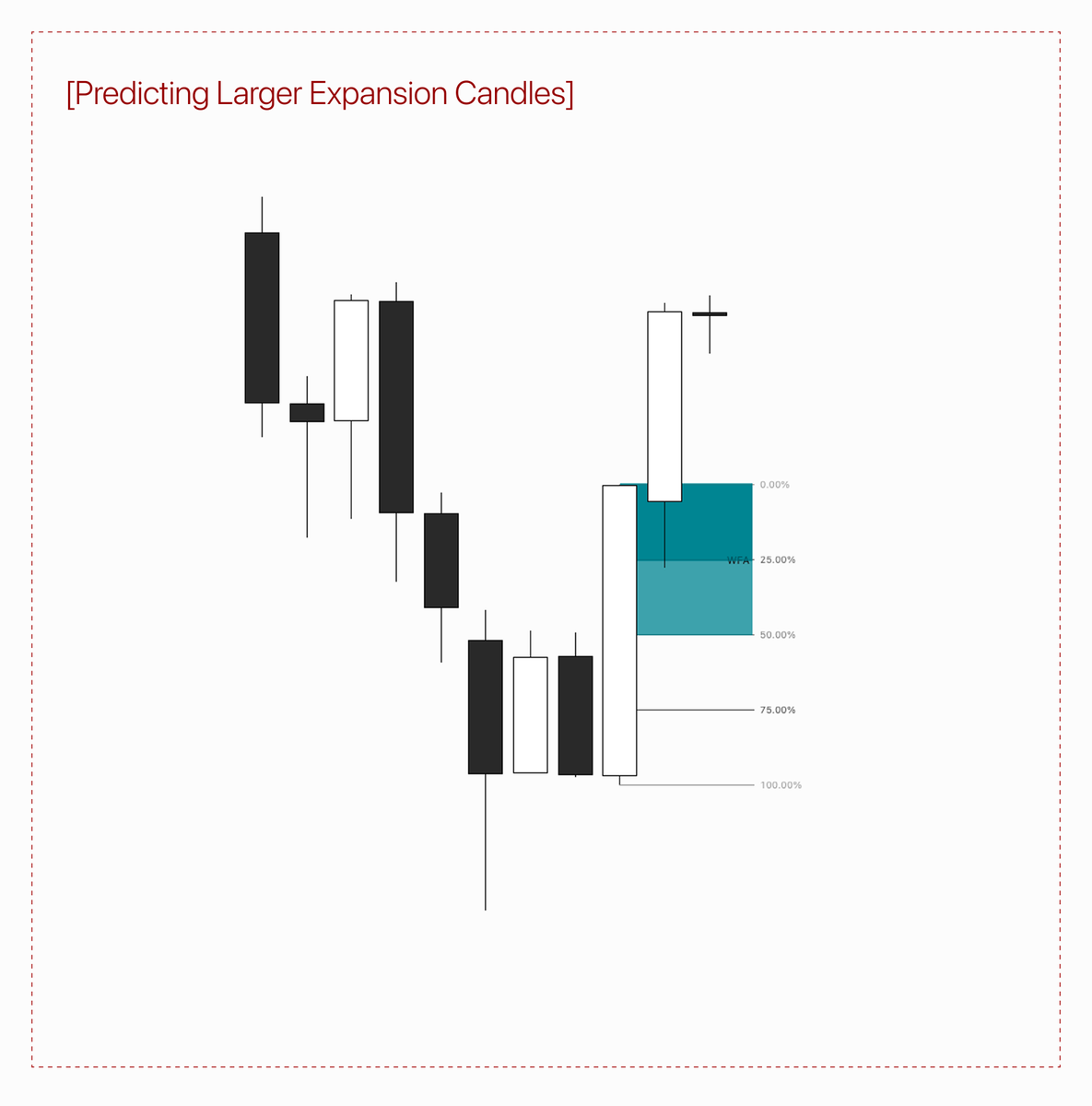

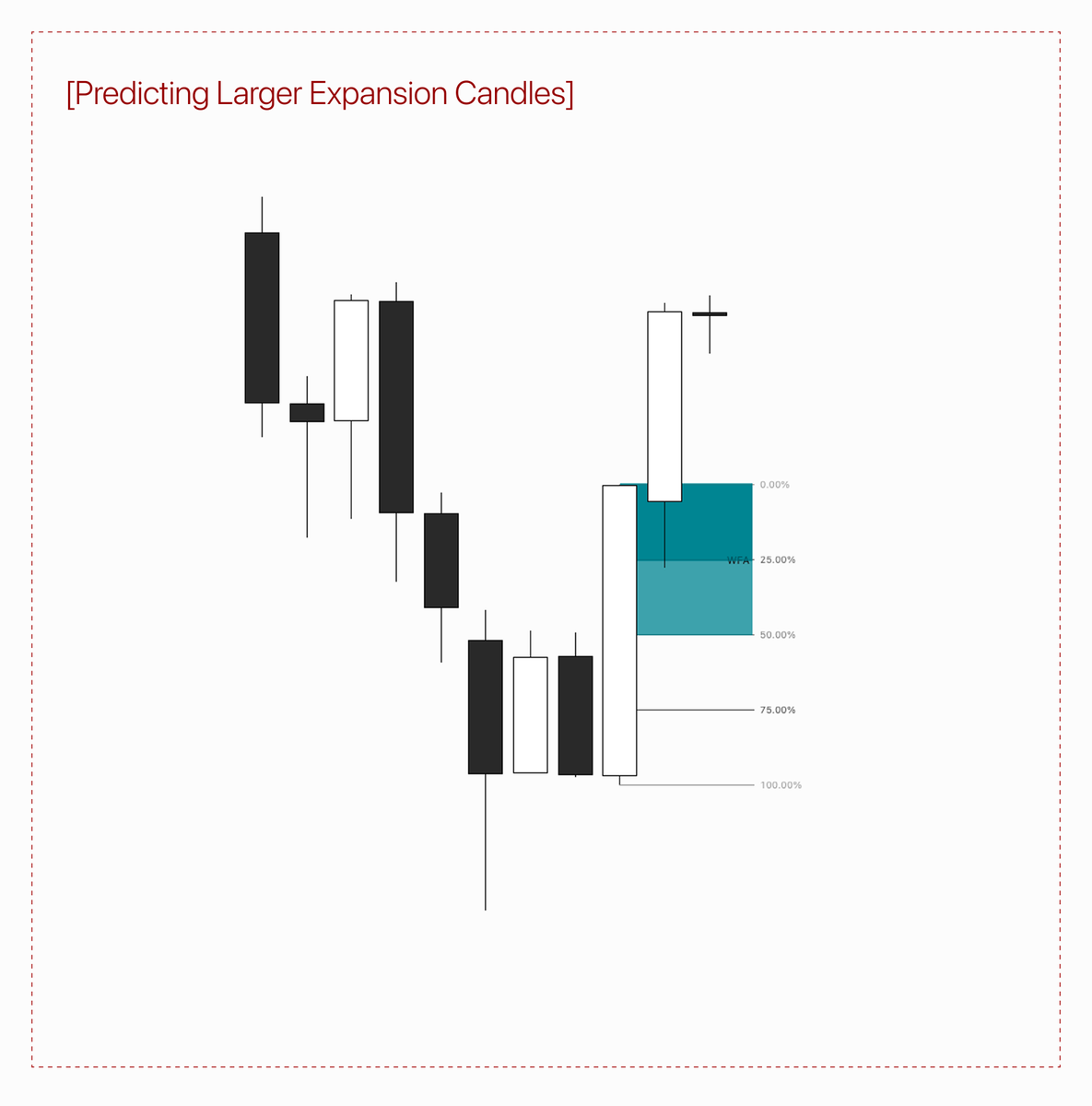

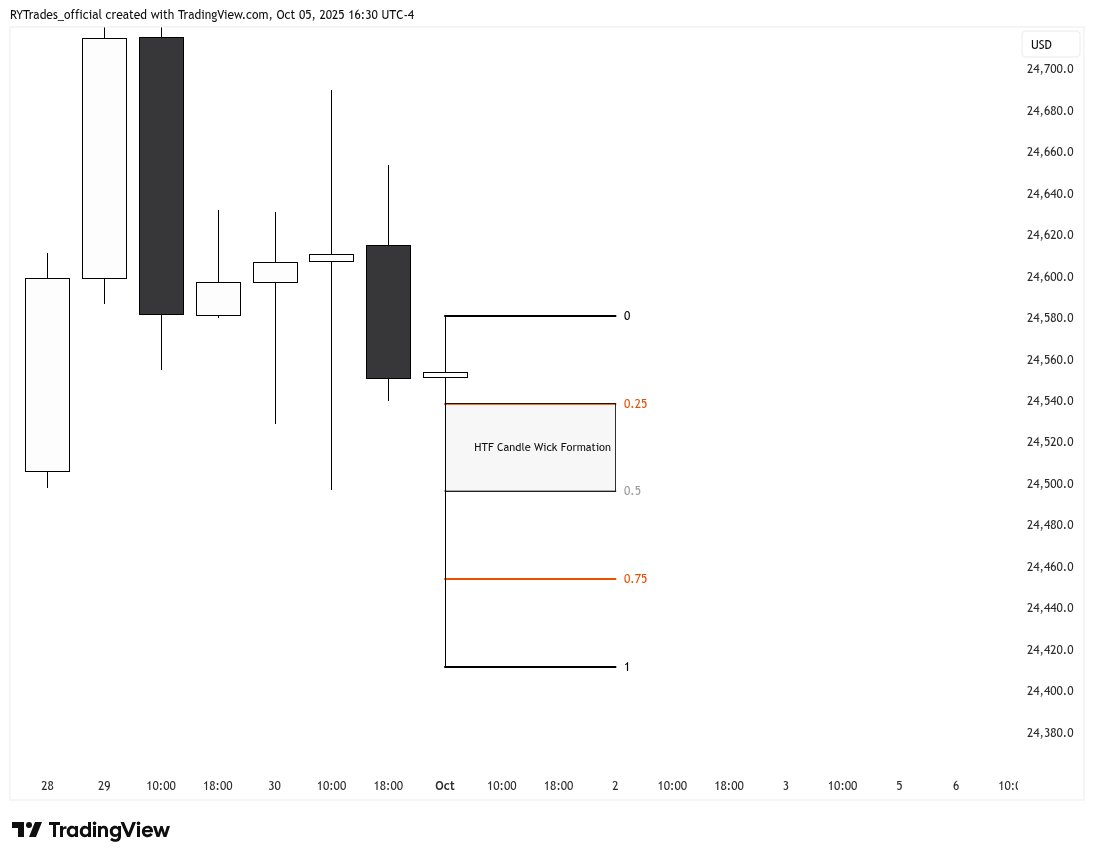

Every HTF candle has natural retracement zones

Every HTF candle has natural retracement zones

I first check the weekly chart and identify my potential direction for the week.

I first check the weekly chart and identify my potential direction for the week.

The first post I made was a post indicating that the low of the week was most likely in and an expansion is in play to the upside.

The first post I made was a post indicating that the low of the week was most likely in and an expansion is in play to the upside.

Using Ranges To Frame Expansions

Using Ranges To Frame Expansions

{Made the call in the Discord This morning}

{Made the call in the Discord This morning}

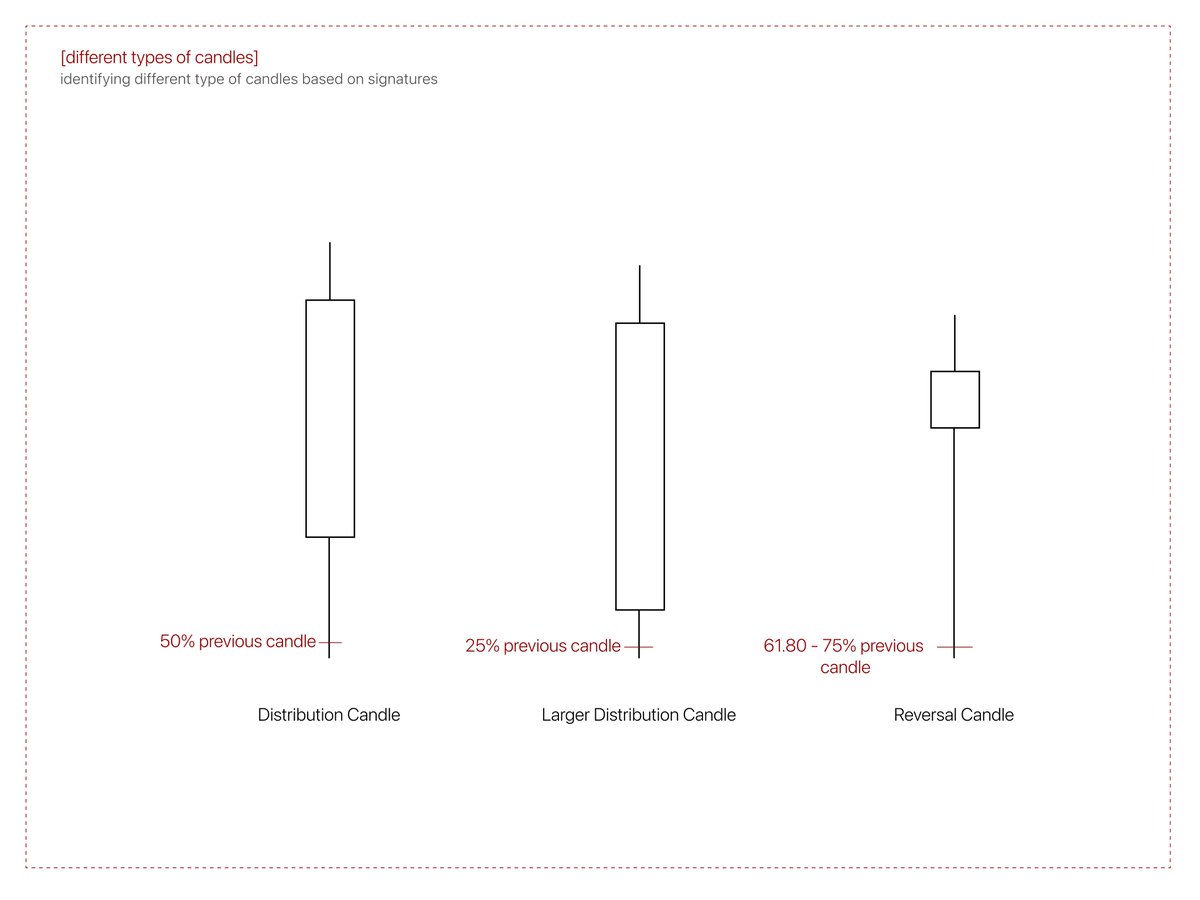

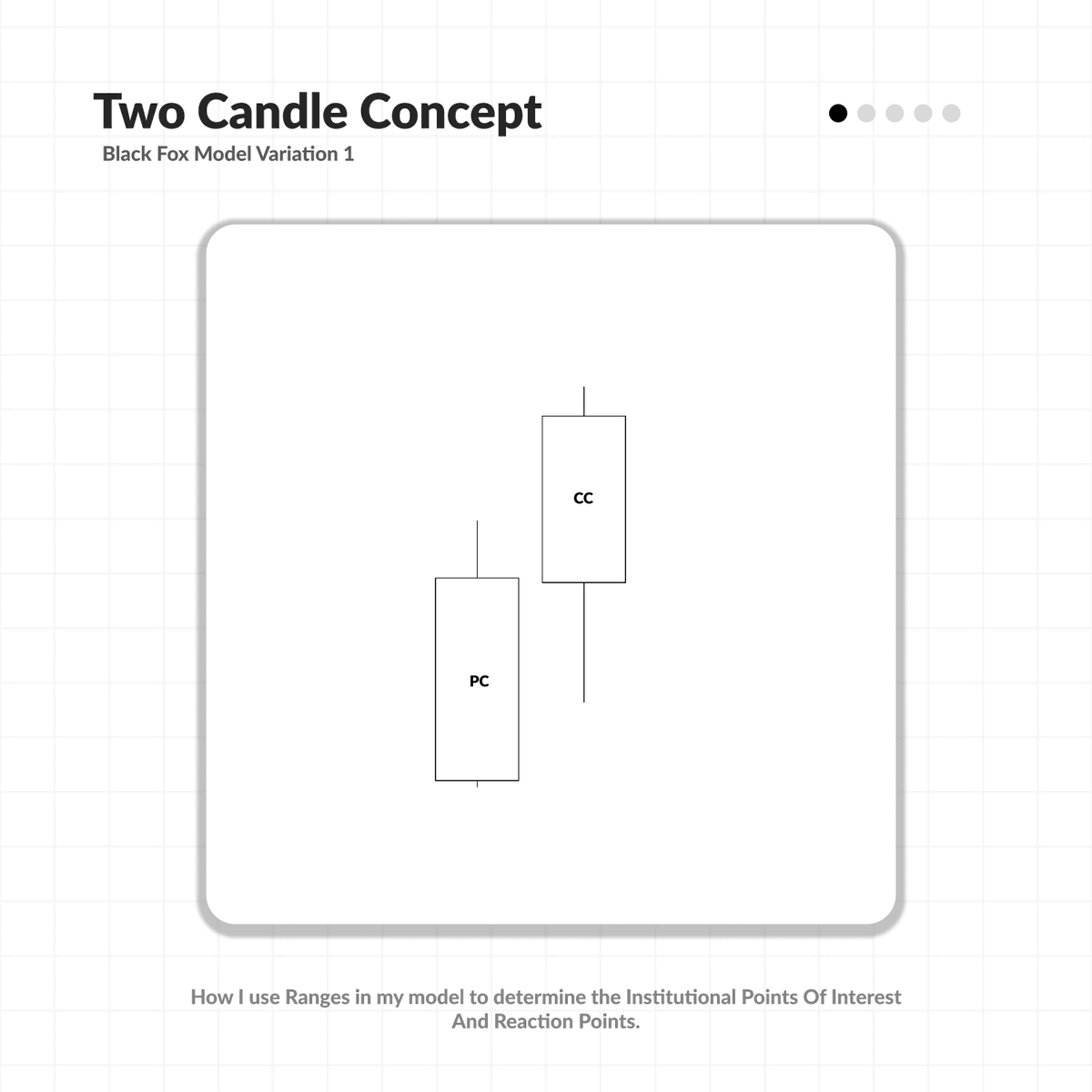

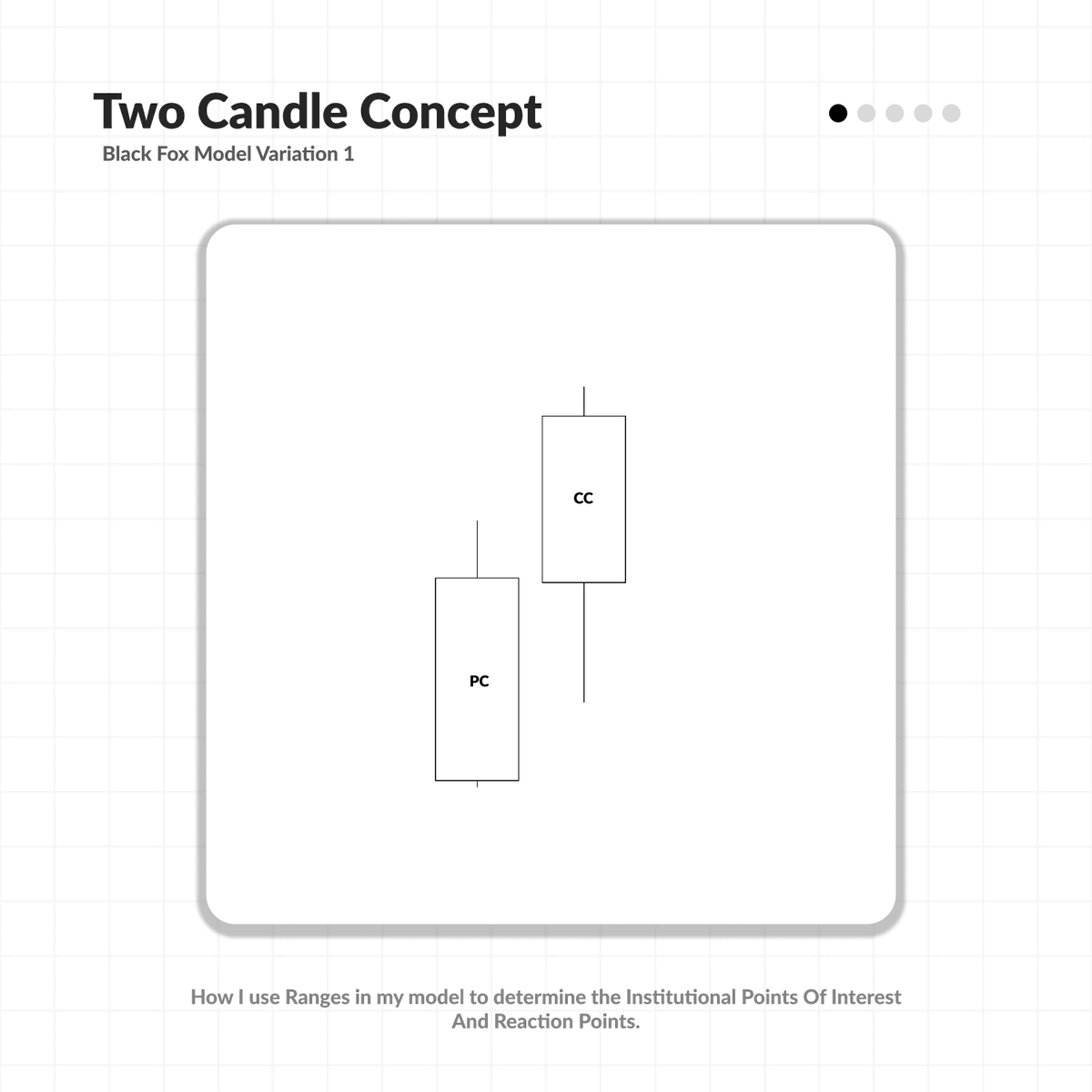

Defining Ranges:

Defining Ranges:

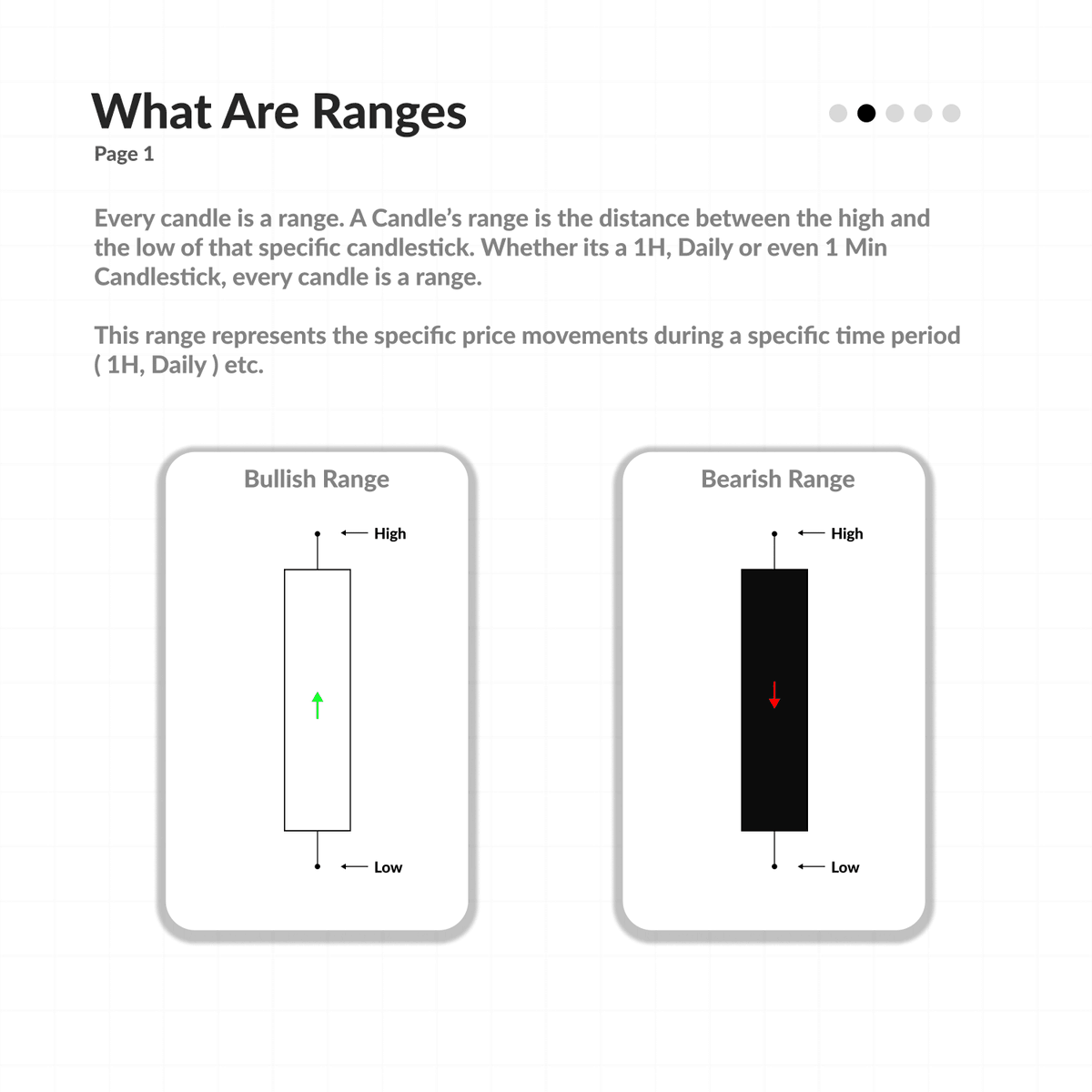

The first thing we need to know is what ranges are.

The first thing we need to know is what ranges are.

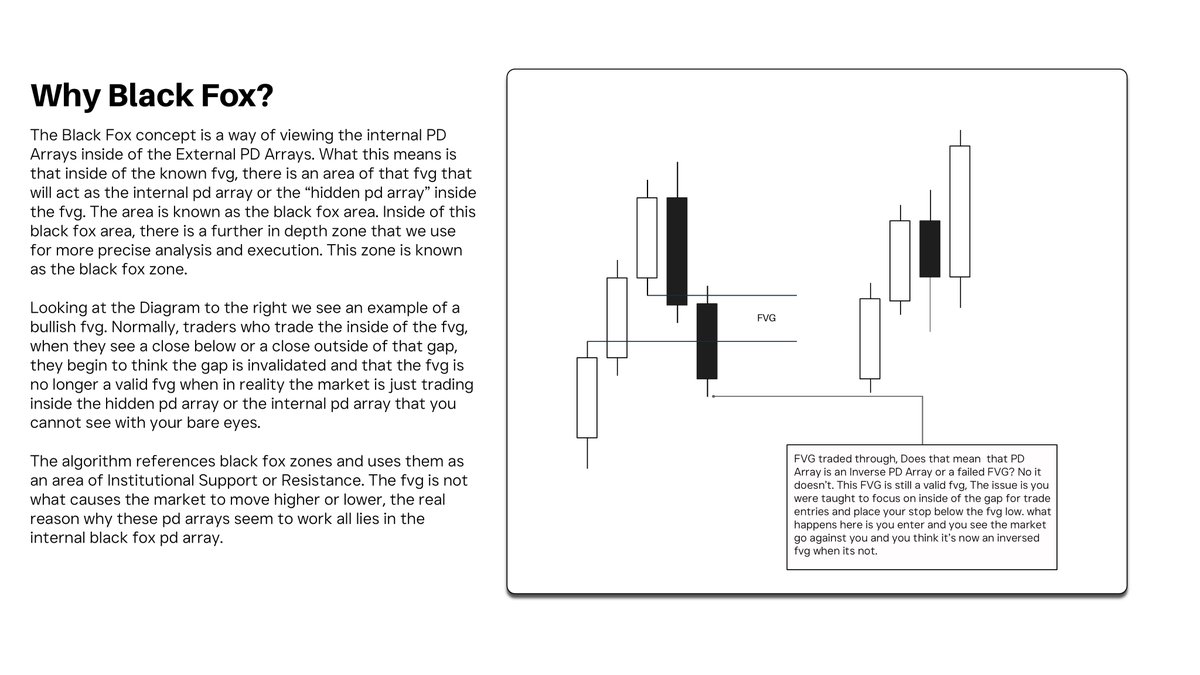

Why Black Fox? Black Fox gives you a view inside the PD Arrays that you cannot see with your bare eyes.

Why Black Fox? Black Fox gives you a view inside the PD Arrays that you cannot see with your bare eyes.

I discovered this model in my constant search for the logic behind the points of interests that I was using in my trading.

I discovered this model in my constant search for the logic behind the points of interests that I was using in my trading.

These are all the Topics We will be covering in this thread.

These are all the Topics We will be covering in this thread.

Table Of Contents:

Table Of Contents: