🚨 Breaking: Ripple + Immunefi Launch $200K “Attackathon” to Test XRPL Lending Protocol

Here’s what we know so far and why you should keep your eyes locked on this 👇🧵

Here’s what we know so far and why you should keep your eyes locked on this 👇🧵

🔍 Key Facts

•Ripple has teamed up with Immunefi to offer a $200,000 reward pool for white-hat hackers who can uncover vulnerabilities in the upcoming XRPL Lending Protocol.

•Ripple has teamed up with Immunefi to offer a $200,000 reward pool for white-hat hackers who can uncover vulnerabilities in the upcoming XRPL Lending Protocol.

The “attackathon” is structured in two phases:

• Education / prep period: October 13 → October 27, 2025 — participants will get tutorials, live sessions, and access to test environments.

• Active bug bounty period: October 27 → November 29, 2025 — that’s when the testing officially begins.

• Education / prep period: October 13 → October 27, 2025 — participants will get tutorials, live sessions, and access to test environments.

• Active bug bounty period: October 27 → November 29, 2025 — that’s when the testing officially begins.

If at least one valid bug is found, the full $200,000 will be distributed among winners. If no critical bugs are found, a fallback pool of $30,000 will be shared among contributors who submit useful insights.

The protocol is governed by XLS-66 and includes multiple primitives under scrutiny:

• Lending logic (liquidation, interest accrual)

• Vault interactions

• Permissioned domain logic

• Clawback / Deepfreeze mechanisms

• Administrative & access control vulnerabilities

• Lending logic (liquidation, interest accrual)

• Vault interactions

• Permissioned domain logic

• Clawback / Deepfreeze mechanisms

• Administrative & access control vulnerabilities

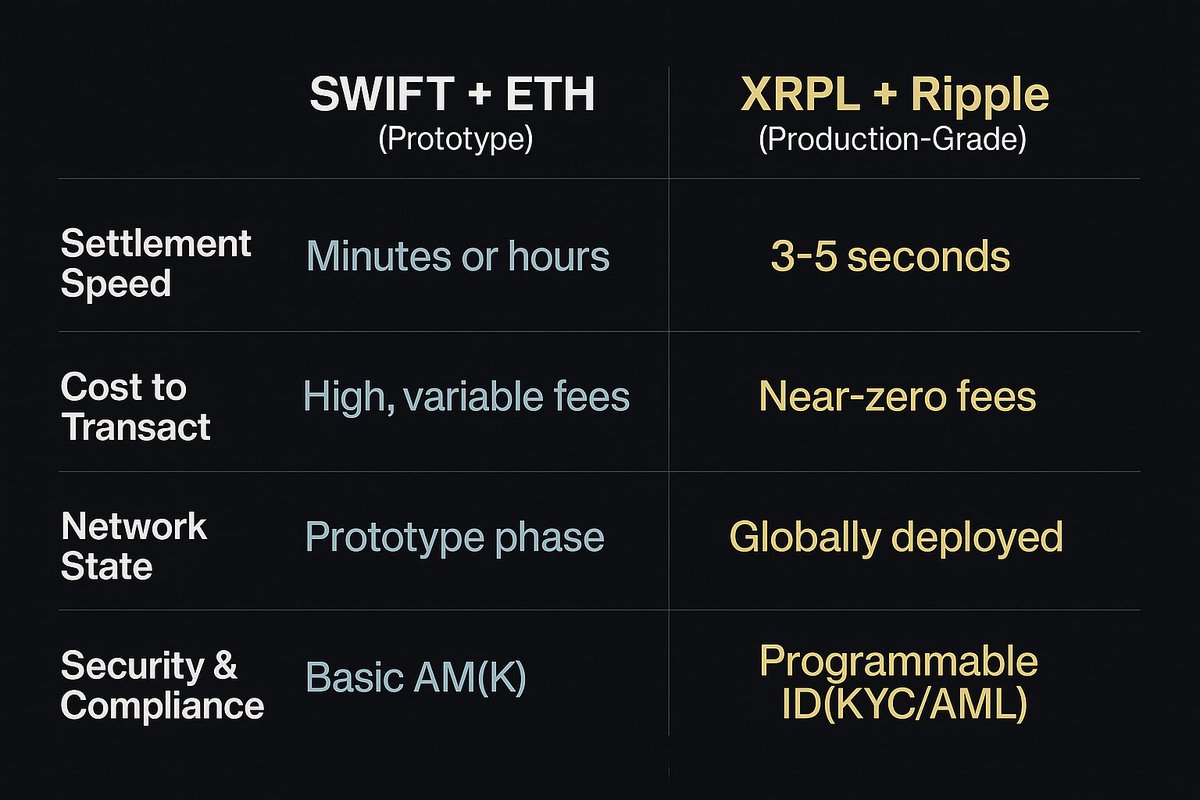

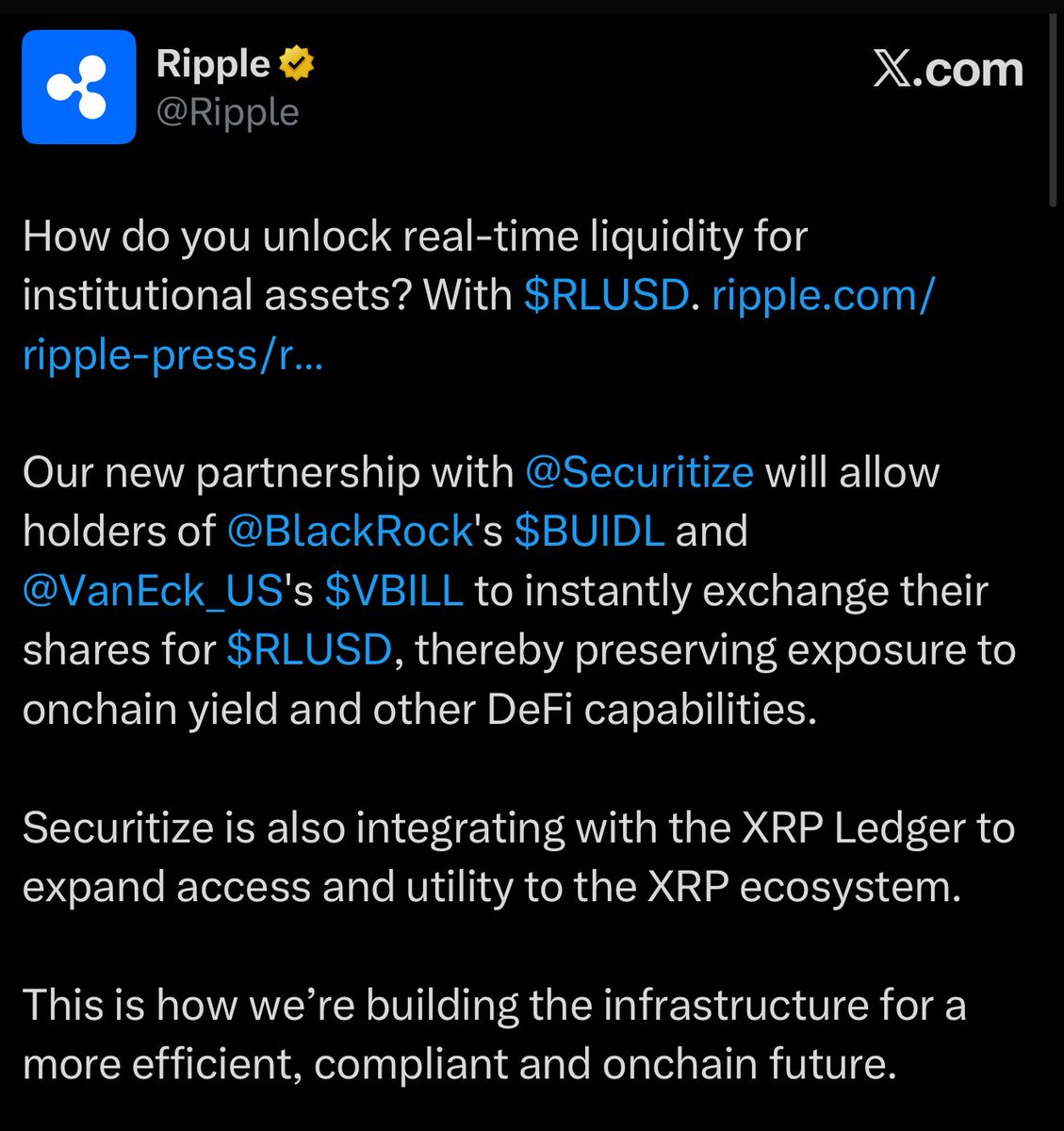

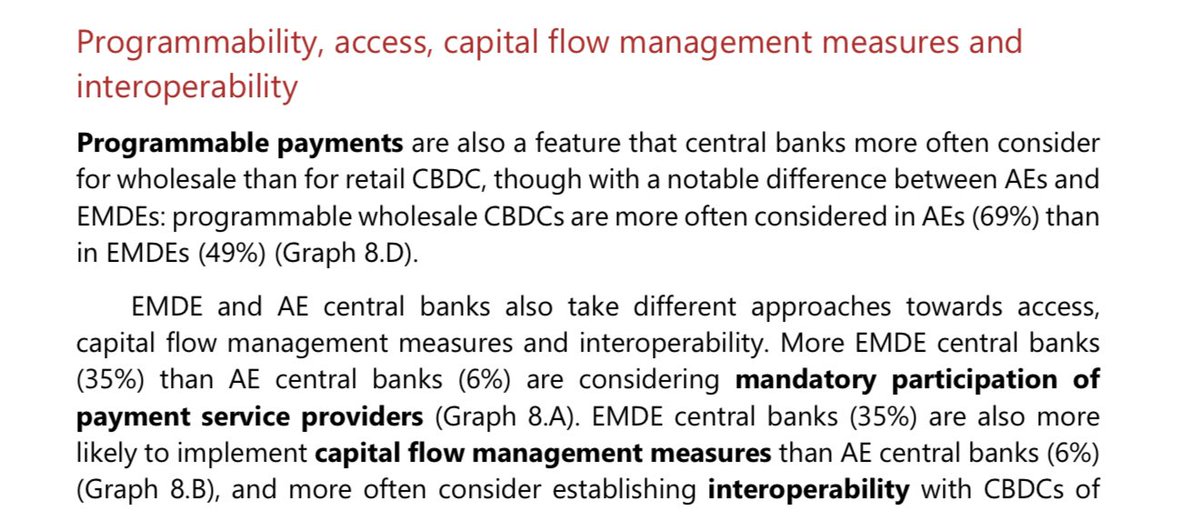

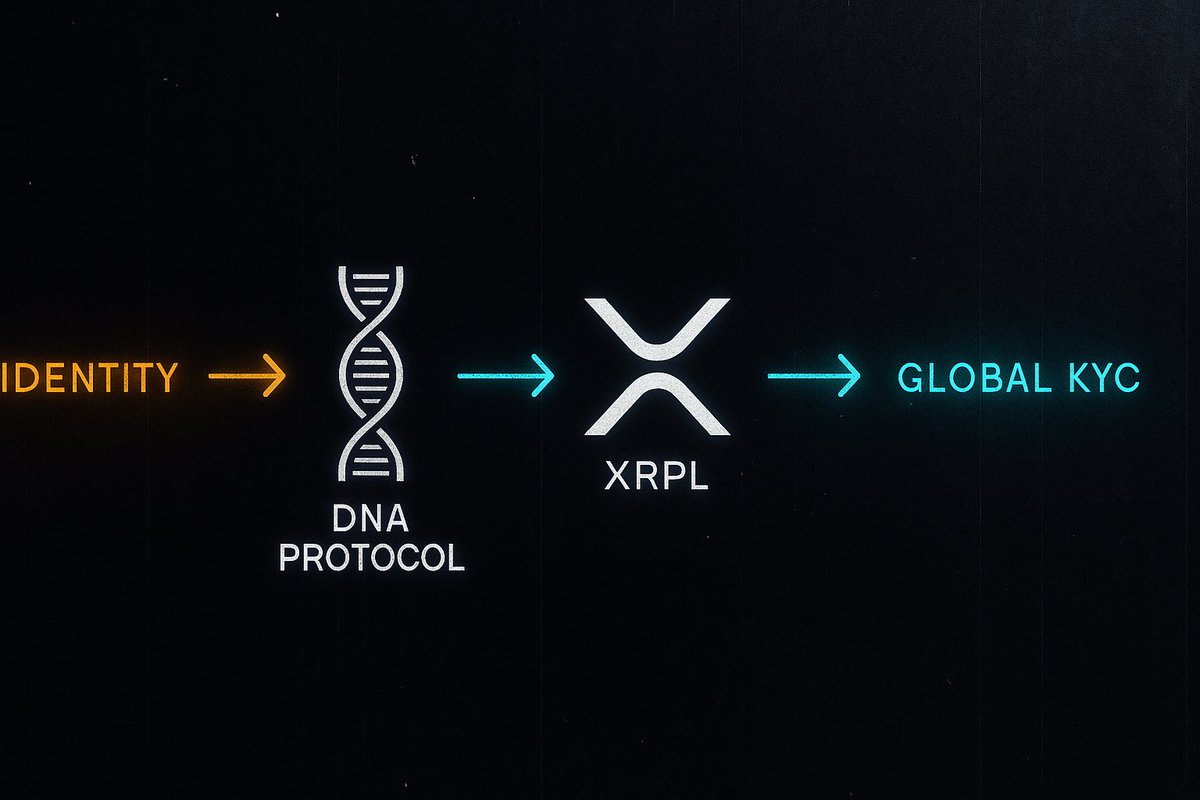

Ripple is designing uncollateralized, fixed-term lending built natively on XRPL (no smart contracts, no wrapped assets). Credit checks will happen off-chain, while funds, repayment terms, and contract enforcement happen on-chain.

For institutions needing collateralized loans, they’ll be able to build that layer via custodians or tri-party structures — bridging the demands of traditional finance with blockchain transparency.

The initiative is a proactive move by Ripple to harden the protocol before it’s deployed, reinforcing trust and security as XRPL pushes deeper into institutional DeFi.

🚀 Why This Matters

1.Security First Mindset

Many DeFi hacks happen because protocols skip or underinvest in prelaunch security. Ripple is signaling it wants to avoid that by inviting global scrutiny before money moves.

2.Institutional Infrastructure in Focus

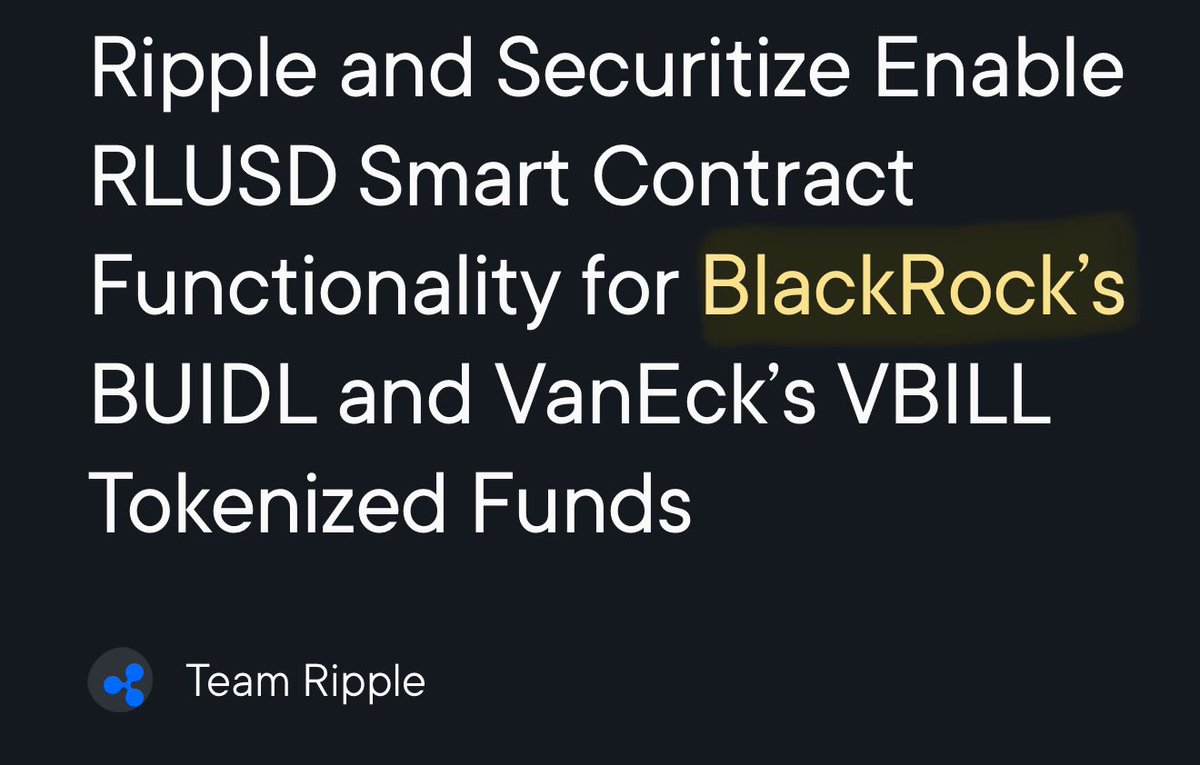

Native lending on XRPL is a big leap — if done right, it could attract traditional financial institutions that require resilience, auditability, and strong risk controls.

3.Catalyst for Developer & Community Activity

Attackathons like this activate the security community, bring attention to the protocol, and build confidence among ecosystems.

4.Narrative Reinforcement

This is not just a security initiative — it’s a statement of belief in XRPL’s DeFi future. When major protocols get battle-tested and survive, it’s a signal of durability.

1.Security First Mindset

Many DeFi hacks happen because protocols skip or underinvest in prelaunch security. Ripple is signaling it wants to avoid that by inviting global scrutiny before money moves.

2.Institutional Infrastructure in Focus

Native lending on XRPL is a big leap — if done right, it could attract traditional financial institutions that require resilience, auditability, and strong risk controls.

3.Catalyst for Developer & Community Activity

Attackathons like this activate the security community, bring attention to the protocol, and build confidence among ecosystems.

4.Narrative Reinforcement

This is not just a security initiative — it’s a statement of belief in XRPL’s DeFi future. When major protocols get battle-tested and survive, it’s a signal of durability.

👉 Want to follow every update, get insider take, and see analysis as it unfolds?

Follow me at

I’ll be live-sharing findings, risk assessments, and what this could mean for the next phase of XRP / XRPL.

Don’t miss out.t.me/alexanderthewh…

Follow me at

I’ll be live-sharing findings, risk assessments, and what this could mean for the next phase of XRP / XRPL.

Don’t miss out.t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh