ASML 3Q25

- Revenue down -2% q/q & up 1% y/y to €7.52B (below mid pt guidance); CY25 on track for 15% growth

- Implied CY26 will be flat to up; €32-€33B backlog exiting 3Q25; Near 100% coverage for CY26 (at flat growth)

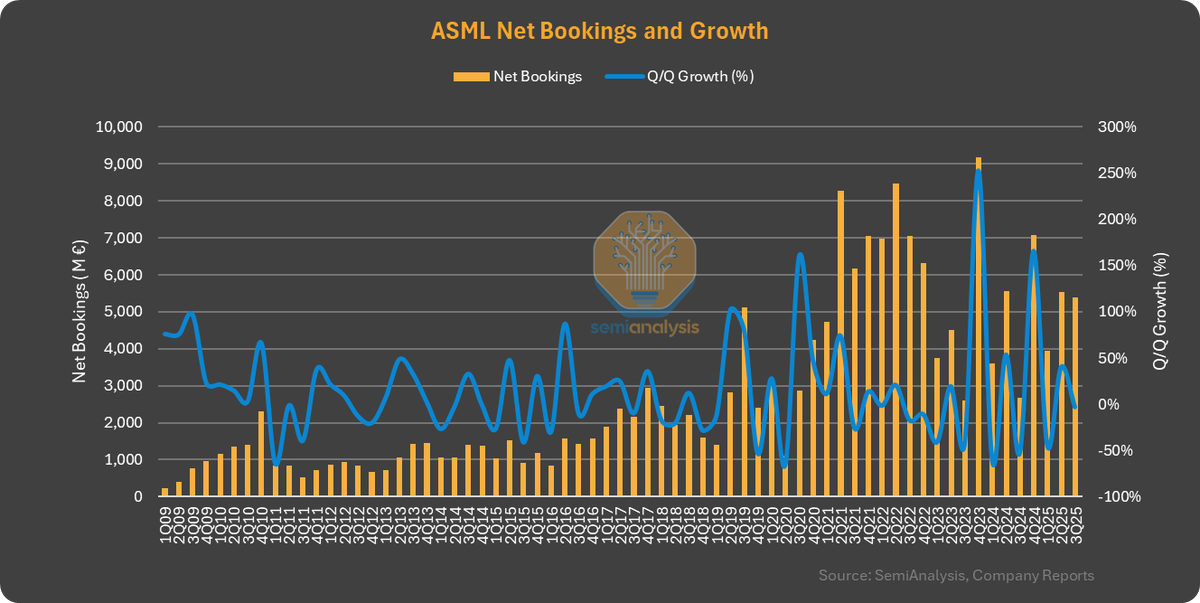

- Net bookings down -3% q/q but up 103% y/y to €5.4B; EUV booking up 57% q/q; DUV down -44%; Memory up 186% q/q

- Revenue down -2% q/q & up 1% y/y to €7.52B (below mid pt guidance); CY25 on track for 15% growth

- Implied CY26 will be flat to up; €32-€33B backlog exiting 3Q25; Near 100% coverage for CY26 (at flat growth)

- Net bookings down -3% q/q but up 103% y/y to €5.4B; EUV booking up 57% q/q; DUV down -44%; Memory up 186% q/q

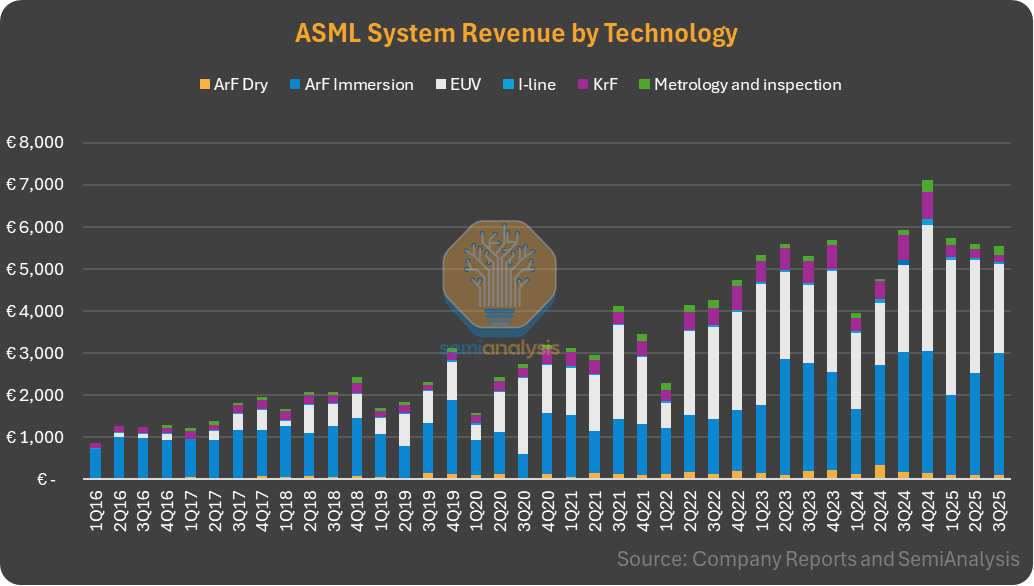

- EUV revenue down -21% q/q while DUV up 15%

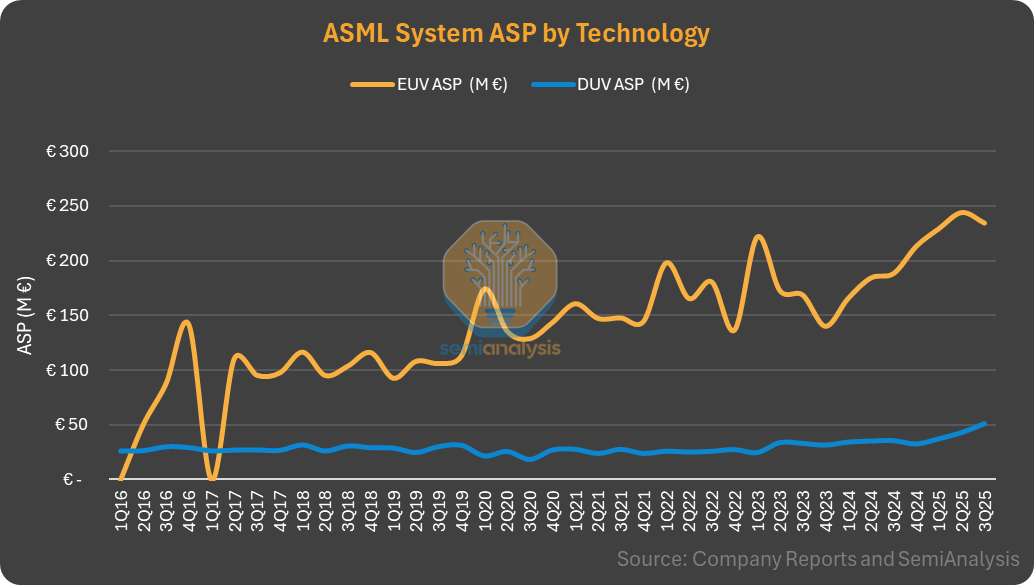

- EUV ASP down -4% q/q to €235M

- EUV system shipments down by 2 to 11

- 1 HNA rev rec in 3Q25

- Non-China DUV up 34% q/q

- EUV ASP down -4% q/q to €235M

- EUV system shipments down by 2 to 11

- 1 HNA rev rec in 3Q25

- Non-China DUV up 34% q/q

- 51.6% GM vs 50-52% guidance, likely driven by higher mix of 3800;

- 4Q25 revenue will grow 26% q/q & 3% y/y to €9.5B (mid pt); GM: 51-53%

- CY25: €32.5B rev (mid-pt of guidance) at >52% GM; CY26 will be flat to up; trends looking positive

- CY30 guidance of €44-€60B at 56-60% GM remains intact

- 4Q25 revenue will grow 26% q/q & 3% y/y to €9.5B (mid pt); GM: 51-53%

- CY25: €32.5B rev (mid-pt of guidance) at >52% GM; CY26 will be flat to up; trends looking positive

- CY30 guidance of €44-€60B at 56-60% GM remains intact

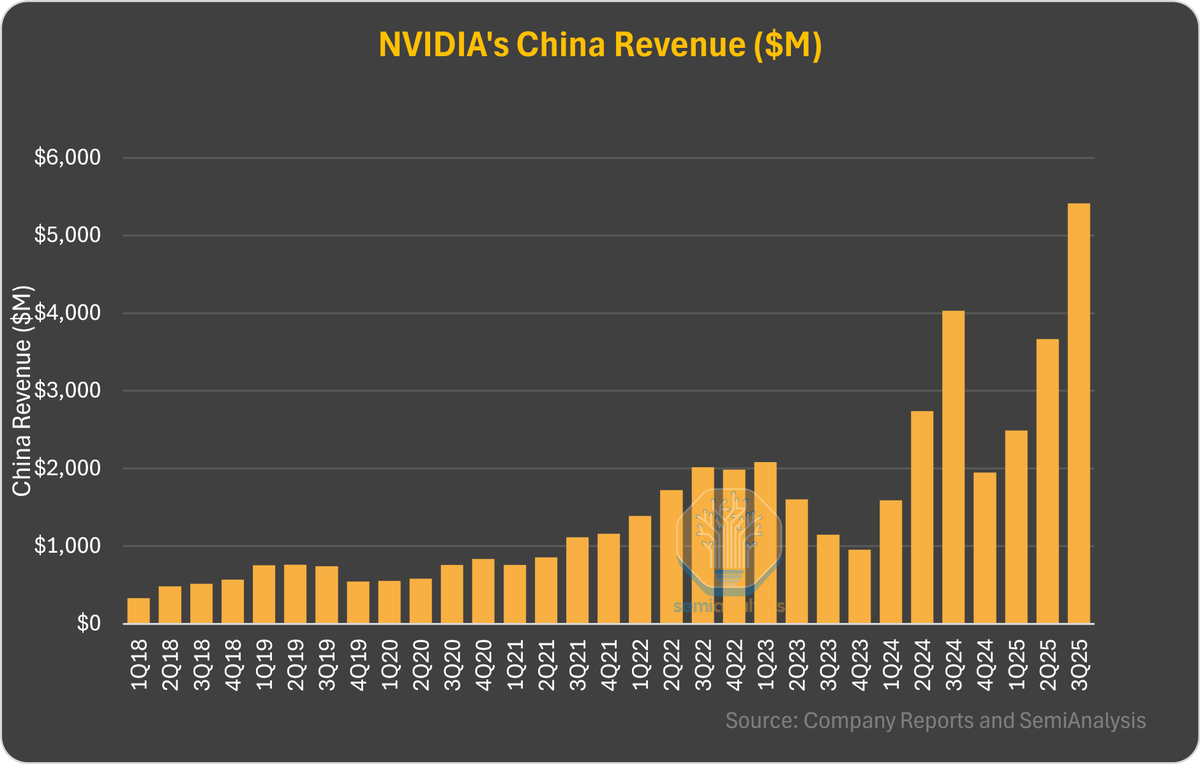

- China up 54% q/q after 3 quarters of -ve growth; But China will decelerate in 2026;

- Taiwan and Korea down q/q; US down -40% q/q; Japan down -80% q/q

- Taiwan and Korea down q/q; US down -40% q/q; Japan down -80% q/q

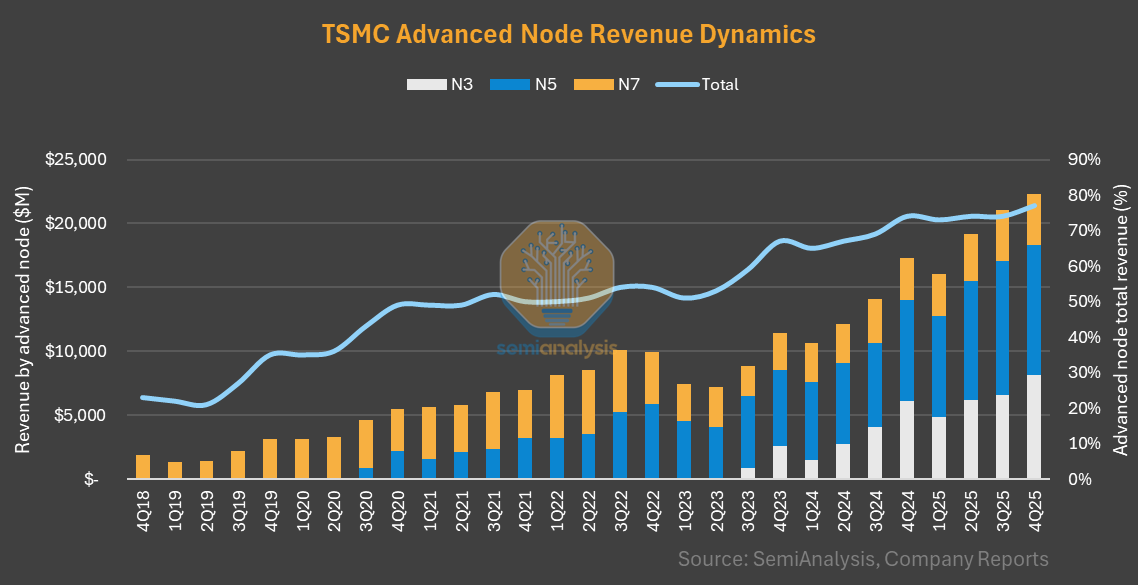

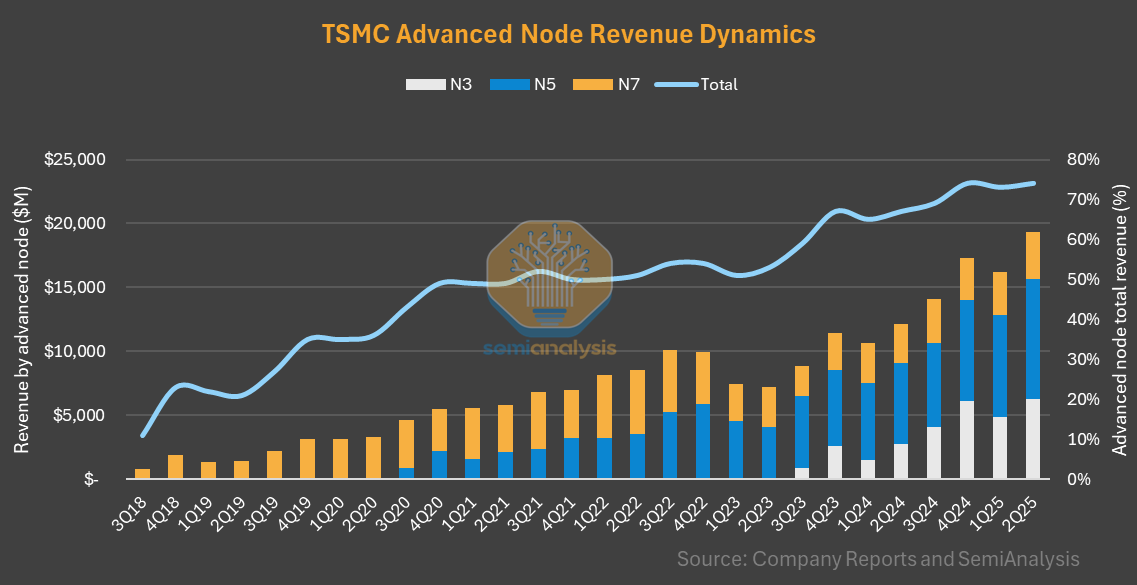

- Leading-edge logic a key driver in CY25; Memory strong too; CY26 to be driven by EUV with China DUV dragging down overall DUV

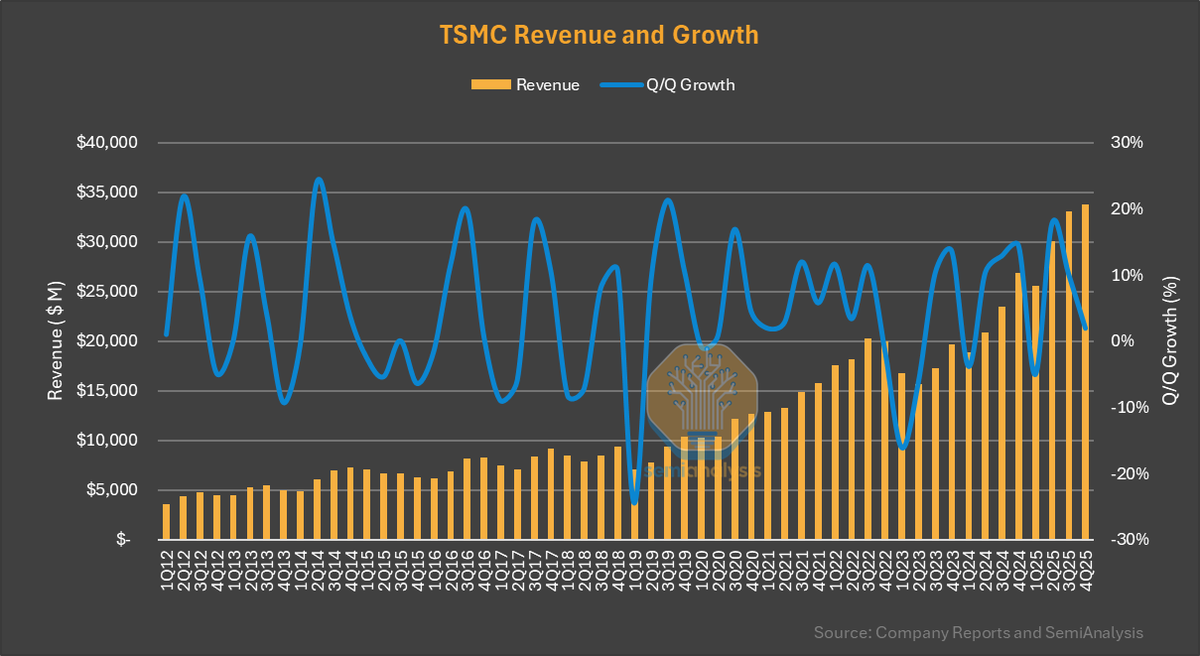

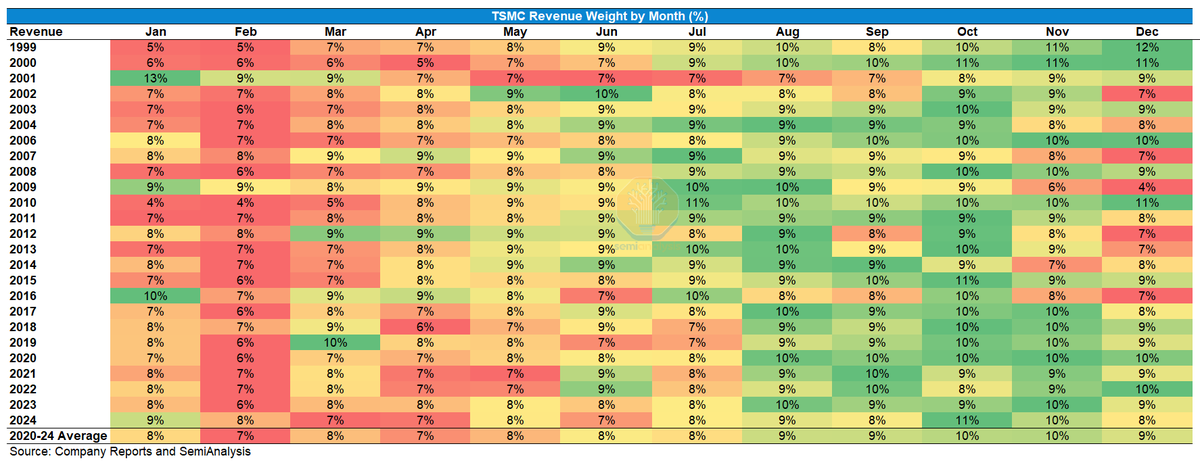

- ASML's logic revenue down -6% q/q while memory up 10%; its primary customer TSMC's revenue grew 10% q/q

- ASML's logic revenue down -6% q/q while memory up 10%; its primary customer TSMC's revenue grew 10% q/q

• • •

Missing some Tweet in this thread? You can try to

force a refresh